This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

I have already posted three articles for Sukanya Samriddhi Yojana and the queries regarding this scheme are not showing any signs of tiredness. People have been asking all kind of queries regarding various features of this scheme and sharing all kind of experiences here on these posts. The biggest problem they are facing is to find out which bank branches are opening this account and accepting deposits from the general public. Banks are showing their inability to open these accounts as they do not have any clue about the account opening process.

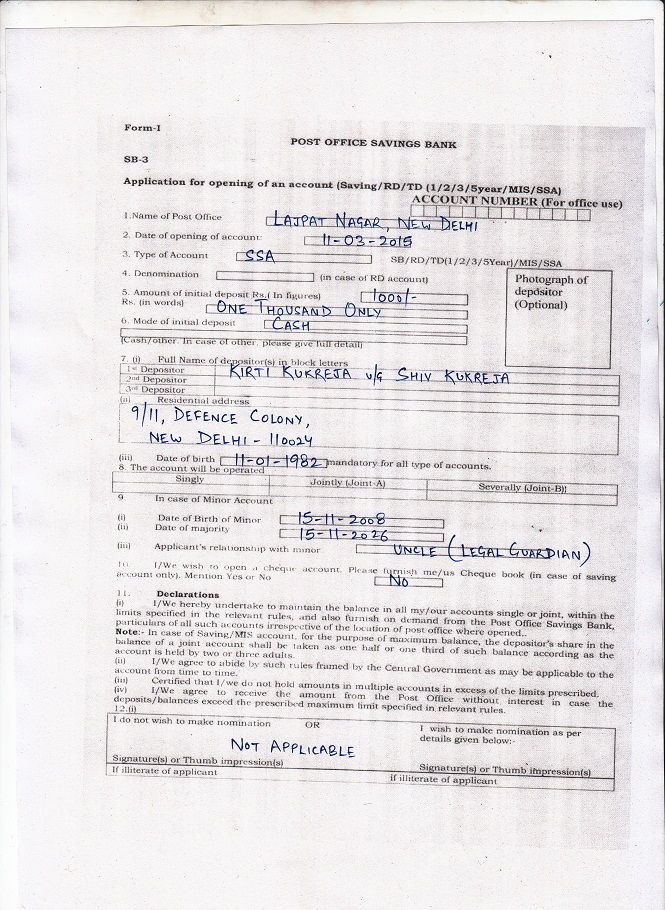

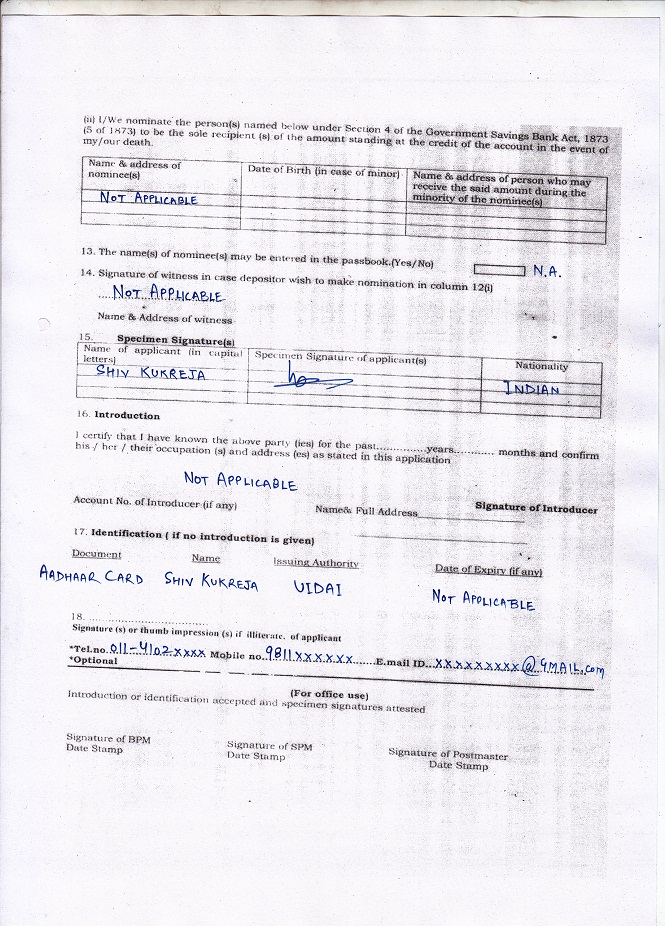

I also got a few comments in which people wanted me to post a duly filled application form so that they can also easily fill the application form for themselves. So, here you have the sample of a duly filled application form:

The application form is fairly simple and you can fill it in less than two minutes. Also, I have filled this application form to the best of my knowledge. So, if any of you find any discrepancy in it, please point it out to me and I’ll rectify it as soon as possible.

Please don’t forget to carry the necessary documents to open this account, which are as under:

* Birth Certificate of the Girl Child

* Identity Proof or Aadhaar Card of the Parent/Legal Guardian

* Residence Proof or Aadhaar Card of the Parent/Legal Guardian

* 2 Photographs of the Depositor/Parent/Legal Guardian

Much has already been mentioned about this scheme in my earlier posts, so I’ll wrap it up here. If you have any query regarding this scheme or any of its features, please let me know.

Application Form for Sukanya Samriddhi Yojana

List of authorised commercial banks where you can get this account opened

Calculating Maturity Value of SSA

Sir, namaste

Mera question..

1. Ssa 21 year ki bad maturity kisko milega-

Gairl ko eaa parent ko?

2. Agar girl chaild 18 year pure hone ki pahele pita mata ki morgiki khilap sadi karlete hai to is ssa ka kia hoga? Maturity milega kob or kise milega?

3. Agar girl chaild 18 year pure hone ki bad sadi karlete ho to kia deposit band karna parega and maturity kab milega?

Namaste,

1. Maturity amount girl child ko milega.

2. 18 saal se pehle shaadi illegal hai, isliye maturity amount 18 saal ke baad hi milega.

3. Shaadi hone pe hi saara amount girl child ko mil jaayega.

sir, is possible ssa account in sbi

Yes, SBI will provide all services as & when it starts opening these accounts.

sir

form me photo kiska lagana hai.

kya har mahine kam jayada rupees jama kar sakte hain

Form mein photo parents/legal guardian ka lagana hai. Har mahine paisa deposit karna zaroori nahin hai. Har saal paisa deposit karna zaroori hai, amount upar neeche ho sakta hai.

sir

child name u/g father name me

u/g ka kya meaning hai

and

dob 01.01.2007 hai to

date of majority kya hogi

u/g means Under Guardian. Date of Majority will be 01.01.2025.

Sir,

We have four children (3 girls n 1 boy). Please suggest me

1.If im opens 3 accounts in ssy for my 3 daughters from 2015 in my name, then can i open 2 ppf accounts for me and my husband name each?

2.How much amount i can get as maturity in ppf if i invest 150000/yearly after 15 years, when i withdraw partial amount for my children education after 10 years?

Thanks

Hi Nithya,

1. You can open a maximum of 2 SSY accounts for 2 of your daughters. It is not allowed to open 3 SSY accounts unless you have twins or triplets.

2. I won’t be able to help you in this calculation as PPF interest rate varies every year.

Thanks for the reply Sir

You are welcome!

sir

agar dob 01.01.2007 hai to

date of maturity kitni hogi

31.12.2027

first depositer me kuska naam likhna hai

Girl Child u/g Parents/Legal Guardian.

sir

apke dwara bhare hue form me

dob 15.11.2008 hai

and dom 15.11.2026 kaise hue

It is the “Date of Majority” and not the “Date of Maturity”.

Dear Sir

in ssa date of birth child ki likhni hai ya parent ki

Both, child as well as parents.

Sir,

In case if both account holder and depositor died than who will get the total amount. for example if my daughter and me died than who will get the fund.

Hi Narendra,

In that case, your legal heir(s) will get the balance amount.

Agar mai yearly pament kar rha hu aur agar 13y ke bad agar meri beti ka dath ho jata h to mathurity milega ke nhi.aur milega to kiss condition pe plz sir

Hi Rohit,

Maturity amount aapko mil jaayega without any condition.

Shiv,

Is there any penalty if we are not able to pay any money during any financial year in this account ?

Raj

Hi Raj,

Yes, it is Rs. 50 per financial year.

Dear Shiv ,

My Daughter is currently 9 year old right now , Can she claim the complete amount once she turned up to 21 year old ? or after 21’yr from today date ( once she turned to 29yr ) ?

If She can claims at 21 year age ,means we will be able to pay only for 12 year ?

Hi Vikas,

Your daughter can withdraw the balance amount whenever she gets married or when she turns 29 (after 21 years from the date of opening this account), whichever is earlier.

Hi sir,

My name is deepali.. I gt married in d year 2015 at goa.. But due to some dicuments problems not able to get my marriage certificate yet.. So my name have not yet changed.. N my babys birth was at mumbai in 2017.. N she is having her dads name in her birth certificate..

So is dr any problem if i applied for this scheme as my name is differnt and still not have marriage certificate??

Whether this account can be opened in the name of adopted girl child ?

Yes, you can.

Hello shiv,

Got few questions. let me ask one by one .

One of my daughter is 9 yrs old, how many years i need to pay the deposits ?

my other daughter is just 5 months old what her calculation ?

Regards

Raj M Palani

Hi Raj,

You need to pay for 14 years for both of your daughters.

Thanks for reply sir,

I just wanted to know in case of mishappening or death, who will be the beneficiary/ owner of amount deposited in this scheme?

And this account is opened with joint names with father or mother account?

Girl child would be the owner/beneficiary of this account in case of an unfortunate event with the parents/legal guardian. In case something happens to the girl child, parents/legal guardian would get the balance amount. Moreover, father or mother cannot be a joint applicant.

Sir,

my single query is that is there any nominee facility in this scheme, can father or mother can be nominee of child?

No, nomination facility is not there.

Great work Sir. No need to find anything else if I have the printout of your blog post. Thank you so much for this great work.

sir ,

i want to know documents required for sukanya samriddhi yojana are attested by notry

REPLY

No, it is not required to get your documents notarised.

sir , i want to know documents required for sukanya samriddhi yojana are attested by notry