This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

88% of India’s total labour force of 47.29 crore belongs to the unorganised sector, in which the workers do not have any formal provision of getting a regular pension payment on retirement. Moreover, due to increasing labour wages and better medical facilities, these people also face a risk of increasing longevity. So, this work force would require some kind of assured income guarantee to sustain itself in the coming years.

Launching Atal Pension Yojana (APY) from June 1, 2015

To encourage workers in the unorganised sector to voluntarily save for their retirement, the government of India will be launching a new scheme, called Atal Pension Yojana (APY), from 1st June, 2015. Finance Minister Arun Jaitley announced this scheme in his budget speech on February 28th.

This scheme will replace the UPA government’s Swavalamban Yojana – NPS Lite and will be administered by the Pension Fund Regulatory and Development Authority (PFRDA). The benefits of this scheme in terms of fixed pension will be guaranteed by the government and the government will also make contribution to these accounts on behalf of its subscribers.

Under this scheme, a subscriber would receive a minimum fixed pension of Rs. 1,000 per month and in multiples of Rs. 1,000 per month thereafter, up to a maximum of Rs. 5,000 per month, depending on the subscriber’s contribution, which itself would vary on the age of joining this scheme.

The minimum age of joining this scheme is 18 years and maximum age is 40 years. Pension payment will start at the age of 60 years. Therefore, minimum period of contribution by the subscriber under APY would be 20 years or more.

The Central Government would also co-contribute 50% of the subscriber’s contribution or Rs. 1000 per annum, whichever is lower, to each eligible subscriber account, for a period of 5 years, i.e., from 2015-16 to 2019-20, who join the NPS before 31st December, 2015 and who are not income tax payers. The existing subscribers of Swavalamban Scheme would be automatically migrated to APY, unless they opt out.

Who is eligible for Atal Pension Yojana?

Any Citizen of India, aged between 18 years and 40 years, who has his/her savings bank account opened and also possesses a mobile number, would be eligible to subscribe to this scheme.

Government Funding – Indian Government would provide (i) fixed pension guarantee for the subscribers; (ii) would co-contribute 50% of the subscriber contribution or Rs. 1,000 per annum, whichever is lower, to eligible subscribers; and (iii) would also reimburse the promotional and development activities including incentive to the contribution collection agencies to encourage people to join the APY.

Who is eligible for Government Co-Contribution in Atal Pension Yojana?

Subscribers of this scheme, who are not covered under any other statutory social security scheme and are not income tax payers, would be eligible for the government’s co-contribution of up to Rs. 1,000 per annum.

Social Security Schemes which are not eligible for Government Co-Contribution

- Employees’ Provident Fund (EPF) & Miscellaneous Provision Act, 1952

- The Coal Mines Provident Fund and Miscellaneous Provision Act, 1948

- Assam Tea PlantationProvident Fund and Miscellaneous Provision, 1955

- Seamens’ Provident Fund Act, 1966

- Jammu Kashmir Employees’ Provident Fund & Miscellaneous Provision Act, 1961

- Any other statutory social security scheme

Minimum/Maximum Pension Payable – This scheme will pay a minimum pension of Rs. 1,000 per month and a maximum pension of Rs. 5,000 per month, depending on the subscriber’s own contribution per month.

Minimum/Maximum Period of Contribution – As the minimum age of joining APY is 18 years and maximum age is 40 years, minimum period of contribution by the subscriber under this scheme would be 20 years and maximum period of contribution would be 42 years.

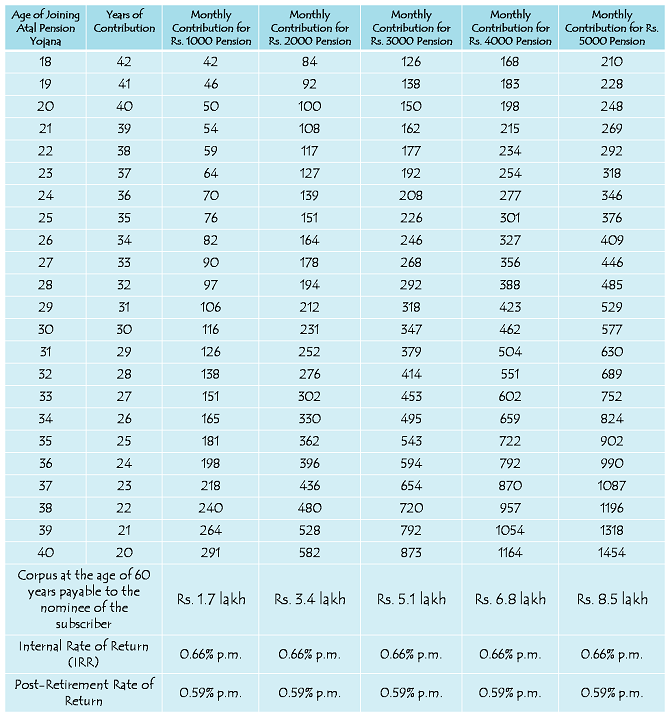

Atal Pension Yojana – Contribution Period, Contribution Levels, Fixed Monthly Pension and Return of Corpus to the Nominees of Subscribers

Internal Rate of Return (IRR) – Thanks to the government funding of Rs. 1,000 per annum per subscriber account for 5 years, your account would generate an IRR of approximately 0.66% per month or 8% per annum. This pension amount per month is fixed and the government has made it clear that if the actual returns on the pension contributions are higher than the assumed returns, such excess return will be credited to the subscribers’ accounts, resulting in enhanced pension payment to the subscribers.

Minimum Contribution – A subscriber aged 18 years will have to contribute a minimum of Rs. 42 per month in order to get Rs. 1,000 pension per month starting 60 years of age. For a 40 years old subscriber, his/her minimum contribution would be Rs. 291 per month. The contribution levels would vary and would be low if subscriber joins early and increase if he joins late.

Maximum Contribution – A subscriber aged 40 years will have to contribute Rs. 1,454 per month in order to get Rs. 5,000 pension per month starting 60 years of age. For a 18 years old subscriber, his/her contribution for Rs. 5,000 monthly pension would be Rs. 210 per month.

Can I increase or decrease my monthly contribution for higher or lower pension amount?

The subscribers can opt to decrease or increase pension amount during the course of accumulation phase, as per the available monthly pension amounts. However, the switching option shall be provided only once in a year during the month of April.

What will happen if sufficient amount is not maintained in the savings bank account for contribution on the due date?

Non-maintenance of required balance in the savings bank account for contribution on the specified date will be considered as default. Banks are required to collect additional amount for delayed payments, such amount will vary from minimum Re. 1 to Rs. 10 per month as shown below:

(i) Re. 1 per month for contribution upto Rs. 100 per month

(ii) Rs. 2 per month for contribution upto Rs. 101 to 500 per month

(iii) Rs. 5 per month for contribution between Rs. 501 to 1,000 per month

(iv) Rs. 10 per month for contribution beyond Rs. 1,001 per month.

Discontinuation of payments of contribution amount shall lead to following:

After 6 months account will be frozen.

After 12 months account will be deactivated.

After 24 months account will be closed.

Subscriber should ensure that the Bank account to be funded enough for auto debit of contribution amount. The fixed amount of interest/penalty will remain as part of the pension corpus of the subscriber.

Post-Retirement Rate of Return – Considering a retirement corpus of Rs. 1.7 lakh and monthly pension of Rs. 1,000, this scheme is going to generate a return of 0.59% per month or 7.1% per annum for its subscribers. I think this return is also on a lower side.

Nomination Facility – This scheme will also provide the nomination facility to its subscribers. In case of the subscriber’s death after attaining 60 years of age, the whole corpus generating the pension income to the subscriber would be returned back to the nominee of the subscriber. In case of untimely death of the subscriber before 60 years of age, the balance would be returned back to the nominee of the subscriber.

Where to open APY Accounts – You need to approach points of presence (PoPs) and aggregators under existing Swavalamban Scheme. These agencies would enrol you through architecture of National Pension System (NPS).

Points of Presence & Aggregators

Application Form – Here you have the links to the application form for subscribing to Atal Pension Yojana – Application Form in English – Application Form in Hindi

I think a subscriber should opt for a minimum monthly contribution of around Rs. 167 or so, which would make it approximately Rs. 2,000 annual contribution. 50% of Rs. 2,000 i.e. Rs. 1,000 would be contributed by the government as well. So, the subscriber will get the maximum benefit of government funding.

As mentioned above, the scheme would start from June 1, 2015. So, interested people will have to wait till then to open an account. If you have any other query regarding this scheme, please share it here.

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

KAB TAK MARKET ME ATAL PENSION YOJANA IYEGI

Ye yojana 1st June, 2015 ko launch hogi.

Sir, in your personal opinion, which scheme gives more benefits to common man (swavalamban or APY??) and also they didn’t mention earlier about removal of swavalamban until budget speech in 2015? wouldn’t they have to give more time to enroll peoples above 40 years and other subscribers in last days ……

Swavalamban is a market dependent scheme. Returns may be higher or lower but not assured. In APY, though the returns are lower, it is assured and pre-defined. Which one to consider better is all dependent on ones perception and risk appetite. With respect to giving more time to 40+ to enroll is a government’s decision which one can’t question and there might be some solid reason or logic behind government decision.

Hi Sir, thats a very informative article.thanks for easy explanation. I have a small doubt.. I see APY giving fixed pension but compared to swavalamban, returns are very less. So can we open New swavalamban account after June 1st, 2015??.

No. Swavalamban scheme ceases to exist post 1st Jun ’15.

sir meri mom ko abi 48 age hai agar mai mom ke swavalamban a/c open karta Hu abi kya vo a/c attal scheme me migration hota hai kya

Kyu ki swavalamban be max age hai 55 our attal scheme mai 40

Yes. It should migrate and merge with APY as per availabe publications on the scheme details of APY. In Swavalamban scheme entry age is between 18 to 60 and not 18 to 55.

Can I change name of nominee after oppening a APY account?

Yes, you can change your nominee after account opening.

& for how many years pension will be paid? that is from age 60 till what age will AYP subscriber get pension?

Under APY scheme, after attainment of 60 years pension will be paid till death of the subscriber. After which, the entire corpus will be paid/returned to the surviving nominee.

Thank you…

Hi, I was working in corporate and quit when i was 32 (2008) to pursue spiritual interest… at the time of working i had opened PF account which is still active. Post quitting my income is way below the IT slab. My question is whether i am eligible for AYP?

If you are still a member of EPS (i.e., holding pension scheme certificate under form 10C) of EPFO to avail pension after attainment of 50 years or 58 years then you are not eligible for APY. If not then you are eligible.

Thank you…

i have a NPS a/c holder

pls. convert APY.

I am Pondicherry. How i will be agent to APY and NPS. Before launch APY can i get PRAN card?

what is difference between NPS and APY ? What monthly contribution for NPS ?

Please in through the scheme details of both NPS and APY, you will come to know the difference.

NPS account is monthly starting 100 rs but APY is .monthly 1000 rs how to possible poor people .

APY mein minimum monthly contribution is Rs. 42 and not Rs. 1,000.

Where can I apply for APY scheme? Is it started now?

APY scheme will commence from 1st June 15. You can approach aggregator or POP-SP who are facilitating opening of NPS accounts after 01.06.15 to open APY account.

Yes. Your nominee will get the corpus. You can refer to the table published for APY scheme. As APY is pre-defined pension scheme, while joining APY itself you can decide how much pension you want at 60 years (between Rs.1K to 5K). Depending upon your age at entry, how much pension you want, your contribution amount varies, you have to make pre-defined contribution till 60 years of age. Even the corpus which accumulate in your pension account is pre-determined. So, your nominee will get the pre-defined corpus amount on your death.

My question was In The Atal Pension Yojana after attaining 60 years of age getting 1 year or less than 1 year pension if I died then what will be? will my nominee get total amount back?

In The Atal Pension Yojana after 60 years getting 1 year pension if I died then what will be? will I get total amount back?

You will not get anything because money/wealth of this physical world after your death may not be valid in eternal world (Heaven or Hell wherever you go). But, your nominee will get the complete 100% annuitized amount.

1 . Corpus at the age of 60 year payable to the nominee of the subscriber

Here i have some question

1 . curpus subscriber ke death pe hi milega ya ager wo alive hai 60 pe to milega ya nahi

2 . suppose subscriber death is on 55 corpus nominee to turant milega ya after 5 year

2 . private company me job krne wale iska account open krwa sakte hai ya nahi although unka TDS etc deduct hota hai

Rizwanji, ye scheme unorganised sector mein kaam karne waalon ke liye hai.

1. 21 saal baad jo corpus hoga, usi se hi to pension generate hogi. Corpus subscriber ki death pe uske nominee ko milega.

2. Subscriber ki death pe paisa mil jaayega, nominee ko 5 saal wait nahin karni padegi.

Interesting part of this migration of Swavalamban accounts to APY is how Swavalamban account holders who are above 40 years of age will be accommodated in APY and on what terms is a big question mark ? as they will have less than 20 years of contribution period to retirement age of 60 years.

I am 24 years. I want to enter in this scheme but have a query if i can’t continue till 60 years,what will be?

Account will be frozen unless revived. Every year charges will be deducted from the balance available till it becomes 0. Even then if any amount remains in the account on attaining 60 years then that will be returned or annuitized to provide pension.

Sir sawalambhan mein Jo plan hai vo bhi change ho jayega kya .kuki ushme pension limit 16000 hai

Swavalamban Yojana ke existing subscribers ko Atal Pension Yojana mein migrate karne ka provision hai, unless wo migrate na hone chahein.

Interesting part of this migration of Swavalamban accounts to APY is how Swavalamban account holders who are above 40 years of age will be accommodated in APY and on what terms is a big question mark ? as they will have less than 20 years of contribution period to retirement age of 60 years.

Dear Sir ,

Mene NPS me account Khulvaya he. or me har saal 1000 rs. contribution kar raha hu, sir muje kab tak Government Contribution milega, 2017 tak ya 2020 tak??.

or muje andajit kitani Pension Milengi Retirement ke bad?

NPS is not a pre-defined pension scheme. If you are in Swavalamban scheme then you will be migrated to APY and you will have to pay contribution as per new rules applicable to APY and accordingly your pension after 60 will be determined. Govt. contribution for Swavalamban is upto 2017 but we have to wait and see what govt. Stand will be on accounts migrated to APY.