This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

RBI on March 11 issued a Circular to the authorised commercial banks to start observing the rules and regulations of Sukanya Samriddhi Yojana as per the Government of India Notification dated December 2, 2014. This circular has been marked to the Chairman & Managing Directors (CMDs) and Managing Directors (MDs) of some of the commercial banks operating in India.

These banks include most of the public sector banks, including State Bank of India (SBI), Bank of Baroda (BoB) and Punjab National Bank (PNB) and a few private sector banks also, including Axis Bank and ICICI Bank.

RBI has instructed these banks to approach Central Account Section, Reserve Bank of India, Nagpur for necessary arrangements to report Sukanya Samriddhi Account transactions with immediate effect. I think it means the RBI wants these banks to start opening accounts under this scheme without any further delays and the subscribers will not have to wait more to open their accounts. They can now approach these authorised banks to open an account.

Though it is still not clear if only these banks would act as the agency banks to open accounts under this scheme or some other banks would also join in, but it seems the following 28 banks would definitely be among all those banks authorised to open Sukanya Samriddhi Accounts (SSA).

Updated List of Banks to Open Sukanya Samriddhi Yojana Accounts

- State Bank of India (SBI)

- State Bank of Patiala (SBP)

- State Bank of Bikaner & Jaipur (SBBJ)

- State Bank of Travancore (SBT)

- State Bank of Hyderabad (SBH)

- State Bank of Mysore (SBM)

- Allahabad Bank

- Andhra Bank

- Axis Bank

- Bank of Baroda (BoB)

- Bank of India (BoI) – Branches; Contact – 022-40919191 / 1800 220 229

- Bank of Maharashtra (BoM)

- Canara Bank

- Central Bank of India (CBI)

- Corporation Bank

- Dena Bank

- ICICI Bank

- IDBI Bank

- Indian Bank

- Indian Overseas Bank (IOB)

- Oriental Bank of Commerce (OBC)

- Punjab National Bank (PNB) – Website Link; Contact – 011-25744370

- Punjab & Sind Bank (PSB)

- Syndicate Bank

- UCO Bank

- Union Bank of India

- United Bank of India

- Vijaya Bank

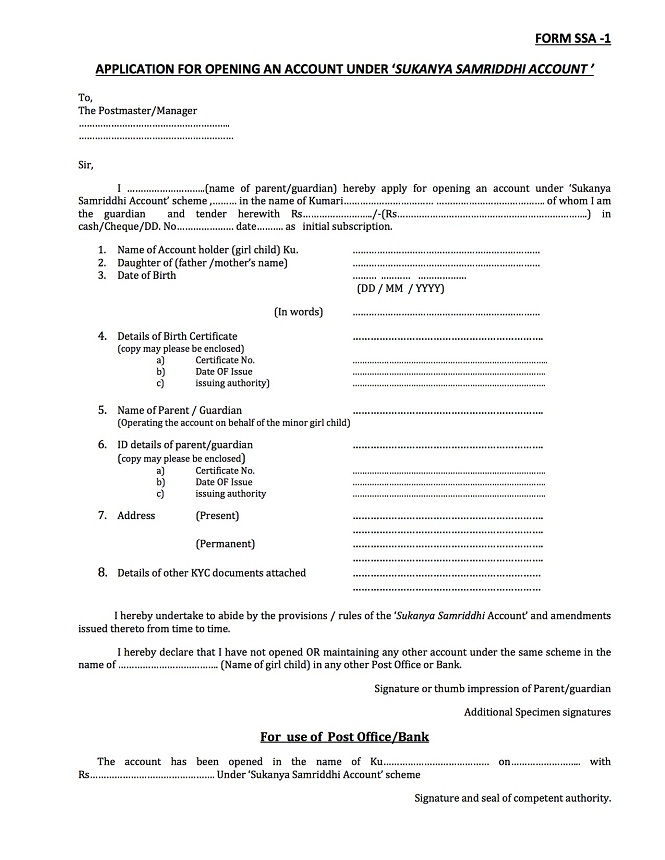

RBI also issued a specimen of application form and the passbook for opening an account under this scheme. Unlike the post office application form, this application form would be applicable just for this scheme only.

Here you have the specimen of the application form which the authorised banks/post offices will be using for opening Sukanya Samriddhi Accounts – Application Form

Also, here you have the specimen of the passbook which the authorised banks/post offices will be issuing to the parents/legal guardian of the girl child – Passbook

You can also refer to the following posts for the complete details about this scheme:

Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

Sukanya Samriddhi Yojana – Application Form & List of Banks to Open an Account

Sukanya Samriddhi Yojana – Calculating Maturity Value after 21 Years

Sukanya Samriddhi Yojana – Sample Filled Application Form

If any of you have anything to share or ask about this scheme, please let us know.

Hello Sir,

Sir m Uttam Nagar New Delhi se hoo.Meri 1year 4 months ki ek beti h.Abi humare yahan ye account kisi b bank m ni khul rahe h.main PNB ya Allahbad bank m ye account khulwana chahti hoo but abi wahan ni khul rahe .To kya aap mujhe bata skte h ki kabse ye account bank m khulenge.Aur please mujhe ye b pata karna h ki iske liye kya kya documents chahiye.

Hi Neha,

Ye account khulwaane ke liye aapko apni beti ka birth certificate, apna id & address proof aur 2 photographs chahiye. Banks kab se ye account kholenge, iski information aapko banks se hi milegi.

hi shiv

i want to open a SSY account pls clarify that can i deposit different anmmount in ssy account per month or any fix ammount,

what about 80c & 80ccc in ssy account.

can u give the list of banks for SSY account in bhopal

thanx in advance

Hi Nafees,

1. You can deposit any amount, subject to a minimum of Rs. 1,000 and a maximum of Rs. 1,50,000.

2. You’ll get exemption u/s. 80C.

3. I don’t have the desired list of banks in Bhopal.

Hello Sir,

What will happen if the girl becomes NRI at the time of maturity? Will she get the maturity amount without any hassles? Please clarify.

Thaks in advance.

Hi,

It is still not clear what will happen in such cases. You’ll have to wait some more time to get further clarity in this regards.

Can I withdrawal the deposit amount in between

Your daughter could withdraw 50% of the balance amount as she completes 18 years of age and 100% of the balance amount as she gets married.

SSY KA LAST DATE KAB TAK HAI

SSY account khulwane ki koi last date nahin hai.

Dear Sir,

I have one daughter 2 year old was born in Saudi arabia & having Consulate General, Jeddah Birth certificate where she doesn’t carry citizenship. (In Gulf countries cant get citizenship even you born there). She might been held Indian citizenship, not NRI/NRE status, but recently SBI bank was refused to open PPF account for her because she was born abroad.

I am working in Saudi Arabia, now I want to open SSY account for her, can it possible. Also tomorrow If I moved back to India & settled there permanently, It still she not omit from NRE & avail the facility to open any government scheme account in India.

Hi Sunil,

It is still not clear whether NRIs or Indians living abroad are allowed to invest in this scheme or not. You’ll have to wait some more time for further clarification.

Thanks Mr. Shiv for reply….hope keep in touch if you have update on this

Dear sir I am village person in village post office,rs nobody knows abt this scheme we ready to open this account BT we dont know the procedures and documentation pls give a information to village post offices .thanks regards .Gangadhar.M

Hi Gangadhar,

The government will provide the necessary information soon to all the left out post offices/banks.

Hii

Can you please tell me is this possible to increase the amount after opening the account.. It means afterwards 2 years possible to increase the monthly paying amount?…

It is not required to fund this account on a monthly basis. You need to deposit money in this account only once a year. However, you can deposit money more than once also and there is no such limit on the money to be deposited. You can increase or decrease the amount to be deposited.

Hi shiv,

I m going to open an account for ssy in post can u clear me that if i m open an account with rs. 1000/- and can i decrease and increase figure amount in financial year. Like i m paying 20000 in 1st financial year and then 2nd financial year i can deposit 5000 in a year can its possible?

Thnx pradeep

Yes Pradeep, it is allowed to change the deposit amount every financial year. Minimum deposit amount is Rs. 1,000.

Dear shiv,

My daughter is just 5 months old. If i deposit rs 4k every month, please tell me the maturity value at 21 yrs?

Hi Ambica,

Please check this post – http://www.onemint.com/2015/03/09/sukanya-samriddhi-yojana-calculating-maturity-value-after-21-years/

It has the maturity value tables in which you will find the answer to your query.

I m Vinod

i have open my child new account for post office but online transaction problem link for sbi bank with any banks

and give me full information SSY sachem please

Hi Vinod,

Your Query is not clear.

hi dear,

plz share me , can i open my 2yr old daughter a/c in ssy scheme , and if i m start with rs.1000 per month and after a yr i wish to pay more than rs.1000 per month . than how is it possible and than how we know how much i m getting the age of 21yr.

thaking you

abhishek garg

8802153341

Hi,

1. Yes, you can open this account in your daughter’s name.

2. You can increase your contribution in the subsequent years.

3. It is not possible to calculate a precise maturity amount as your contribution will vary every year along with the rate of interest.

Sir

State run banks r not even made arrangements regarding the scheme. I enquired in IOB. They r clueless about the scheme. Is this the same situation with all the state run banks?

Hi Prakash,

Yes, it is like that in almost all these banks.

Hello sir

south Delhi M kha kis bank m ssy account khol skte h …. kon se bank m ssy start ho gyi h ..south delhi m .

Hi Meenakshi,

As of now, I don’t have this information.

If we oped this account in ICICI bank, at a later stage can we transfer this account into other bank.

pls clear.

Yes, you can do that.

Hi Shiv, Can you please provide the date when can banks start opening account.

Hi,

I’ll do that as soon as I get some info about it.

Would you be aware of whether the scheme is eligible for a Person of Indian Origin? Can their NRI guardian create an account?

I have been to the RBI website which has the circular and other application forms, but could not find any information on residency rules.

No, it is still not clear.

is NRIs holding Indian passport eligible to apply for their daughters (Indian Nationality)

It is still not clear, but it is highly unlikely that NRIs would be eligible for this scheme.

I just spoke to Indian Overseas Bank in Kerala, they are still not aware of such scheme, however they said will wait for circular to come. When would these procedures get completed at various bank branches? 2months ON since the scheme announced and banks still clueless.

Only God knows!

Mr shiv.. .you r not 100% sure. How bank will know about the scheme.. ..govt should made clear about the scheme to the banks also

I agree that the government should take some proactive steps for the banks to quickly start opening these accounts.