This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

The Finance Ministry on March 31st announced the applicable interest rates for all the Post Office Small Savings Schemes, including PPF, Sukanya Samriddhi Yojana (SSY) and Senior Citizens Savings Scheme (SCSS). Except for SCSS and SSY, the government has kept all other interest rates unchanged, including 8.7% for its most popular scheme, PPF.

To encourage more and more people to get the Sukanya Samriddhi Account (SSA) opened, the Government has decided to ride against the tide and has increased its interest rate to 9.20% from 9.10% earlier, an increase of 0.10%.

As the interest rate on Sukanya Samriddhi Yojana is subject to a revision every financial year, this rate of 9.2% will remain applicable only for the current financial year, 2015-16 and will be further revised in March 2016 for the next financial year, 2016-17.

But, this move of keeping its interest rate higher makes me feel that the Modi Government will continue to keep its interest rate higher going forward as well. I think, like the current financial year, they will try to keep a differential of approximately 0.50% between PPF and Sukanya Samridhi Yojana.

I had posted an article last month in which maturity values were calculated with 9.1% rate of interest throughout its tenure of 21 years. But, as the interest rate has been updated to 9.2% and as most of the investors are yet to open this account, I thought there is a need to have a new post having maturity values calculated as per the new rate of 9.2%.

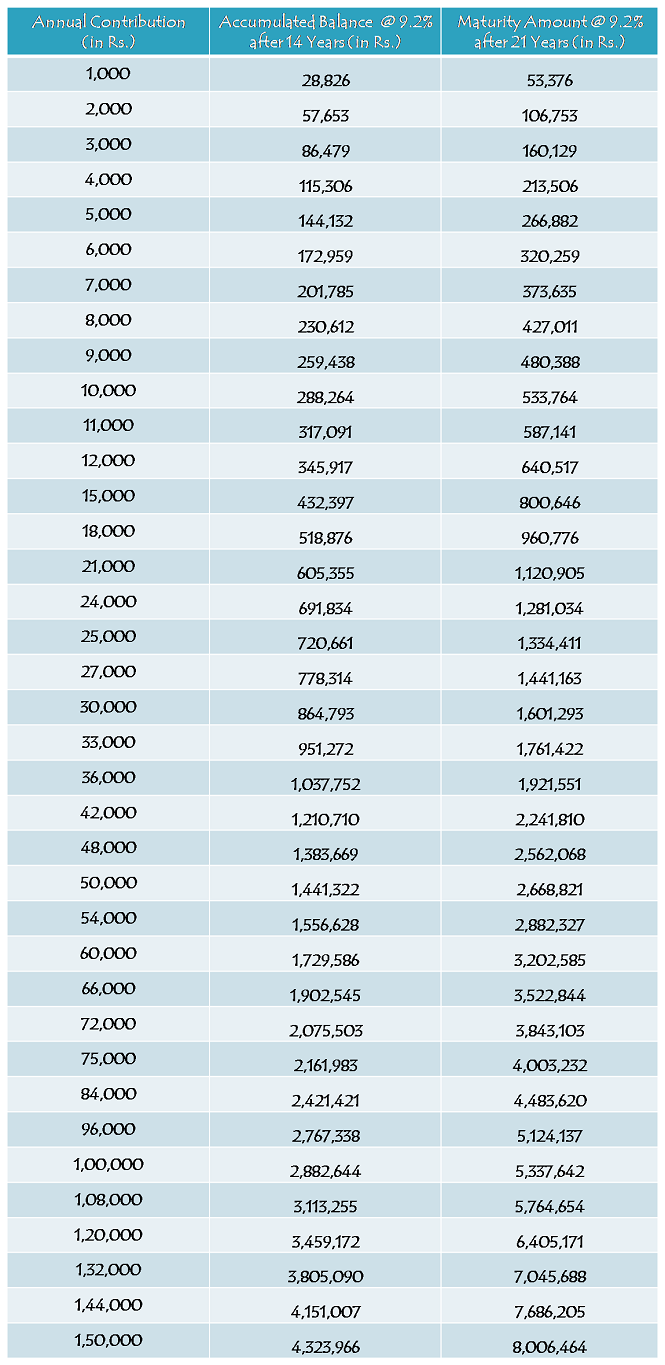

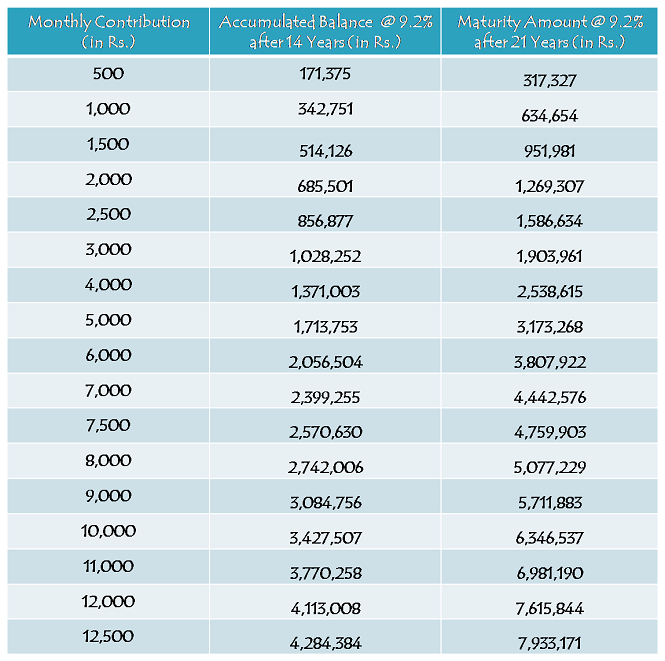

So, here you have the tables in which maturity values are given as per your annual contributions as well as monthly contributions:

Yearly Contribution Table

Monthly Contribution Table

As different investors will have have different amounts and different timings of their deposits, it is natural that their maturity values will also be different. So, these maturity values are only indicative based on certain assumptions and here you have those assumptions:

* Rate of Interest has been assumed to remain 9.2% for all these 21 years.

* Yearly contributions have been assumed to be made on April 1 every year i.e. the beginning of the financial year.

* Monthly contributions have been assumed to be made on 1st day of every month.

* Although it is not mandatory, a fixed amount of yearly/monthly contribution has been assumed.

* It is also assumed that no withdrawal is made throughout these 21 years.

As people are looking for more and more information about this scheme, I would like to again highlight the main features of this scheme here:

Who can open this account? – Parents or a legal guardian of a girl child up to the age of 10 years, can open this account in the name of the girl child. So, if your daughter is born on or after December 2, 2003, you can get this account opened for her in a post office or an authorised bank branch.

Which documents are required to open this account? – You need birth certificate of the girl child, along with the identity proof, residence proof and two photographs of the parents/legal guardian, to open an account under this scheme. You can approach any post office or a branch of any of the authorised banks to get this account opened.

9.2% Tax-Free Rate of Interest for FY 2015-16 – As mentioned above, this scheme will carry 9.2% rate of interest for the current financial year and it was 9.1% for the previous financial year. Similarly, interest rate will be revised every year in March and will be applicable for the applicable financial year afterwards.

Scheme Matures in 21 years or on Girl’s Marriage, whichever is earlier – The scheme gets matured on completion of 21 years from the date of opening of the account or as the girl child gets married, whichever is earlier. Please note that the girl attaining the age of 21 years has no relevance to maturity period of this scheme.

Deposit for 14 years only – You need to deposit a minimum of Rs. 1,000 and a maximum of Rs. 1,50,000 only for the first 14 years, after which you are not required to deposit any amount. Your account will keep earning the applicable interest rate for the remaining 7 years or till it gets matured on your daughter’s marriage.

NRI/OCI Investment – It is still not clear whether Non-Resident Indians (NRIs) or Overseas Citizens of India (OCI) are allowed to open an account under this scheme or not. But, as it is not allowed with most of the post office small saving schemes, I think the government will not allow them to invest in this scheme either. I’ll update this post as soon as I get any information regarding the same.

Partial Withdrawal – It is allowed to withdraw 50% of the balance for higher education as the girl child attains the age of 18 years. Except for this period, it is not allowed to withdraw any amount during the whole tenure of this scheme.

Nomination Facility – Nomination facility is not there with this scheme. In an unfortunate event of the death of the girl child, the balance amount will be paid to the parents/ legal guardian of the girl child and the account will be closed immediately.

You can check all the features of this scheme from this post – Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

You can also check the updated list of banks and download the application form to open an account from this post – Sukanya Samriddhi Yojana – Updated list of Authorised Banks to Open an Account, Specimen Application Form & Passbook. If you have any query or something related to all these posts, please share it here.

Hi sir,

please reply me

my daughter is now 9 years old… if we started to pay 24000/- per year, how much money we can get after completion of her 21 age?

Hi Naveen,

This scheme is for 21 years from the account opening date. You cannot withdraw it as your daughter attains 21 years of age, unless she is getting married on 21. For maturity values as per your contribution, please check the tables above.

Sir

meri betiko ab sirf one month hua hai kya main us keliye sukanya samridhi accounts khol sathahoon.agar main per month 2500 rupay diposit karunga meri betiko 21 sal bad kitne amount mil jayenge

Yes Rabindra, aap apni beti ke liye ye account khol sakte hain. Maturity value ke liye upar pasted table check keejiye.

Sir,

21 sal ke bad Amount beti ko milega ya father ko aur agar 14 sal se pahale Amont jama karna band karde ya 2-3 sal jama kiya bad me nahi bhara ya father ki death ho jaye to kya hoga please batane ka kast kare

Hi Amar,

1. 21 saal ke baad maturity amount beti ko milega.

2. 14 saal tak har saal paisa na jama hone pe account inactive ho jaayega. Account activate karne ke liye Rs. 50 har saal penalty pay karni hogi.

3. Father ki death hone pe account close kiya ja sakta hai. Agar beti ya legal guardian chahen to account continue kar sakte hain.

Sir ,

I hav opened SSY for my dau i m depositing 1000 per month can we deposited more in the end of the year fr ex 12000 wil b our scch amt but at the end of year can we deposit another 8000 so her yearly contrubtion wil b 20000 wat wil her final refund is it possible in this schme pls reply me

Yes, it is possible to deposit some extra amount in a lump sum payment.

Sir,

Mujhe ek cheez confirm karni h sukanya yojna mei ki baki sab kuch theek h but after modi sarkar aur kisi aur ki sarkar banti h to kya ye yojna continued rahegi aur rate of interest wahi rahega ya bhut kam bhi ho skta h..

i mean modi sarkar k baad kisi aur ki sarkar banti h to ye scheme discontinued b ho skti h ki nhi…..

21 year baad meturity amount wahi hoga……jo chart pe abi h…??????????

Hi Mr. Dev,

1. Ye main nahin bata sakta ki next government is scheme ko continue rakhegi ya band kar degi.

2. Is scheme mein rate of interest har saal April 1 ko change hoga, jo ki 9.20% se kam bhi ho sakta hai aur zyaada bhi.

3. 21 saal baad jo maturity amount milega, wo definitely table mein diye gaye amount se different hoga. Table mein di hui figures 9.20% rate of interest ke according hain.

kya system Hindi spot nahi karta?

Dear Sir,

Meri beti june me 2 saal ki ho jaaygi … main sbi bank me form bharne gai thi par unko puri tarah se is sceem ke baare me nhi pata hai to mujhe kuch ajeeb laga maine jo pada hai main uske hisaab se main unko kaha ki mere monthly 2500 ka karna chati hu pur unhone kaha ki start kate waqt aapko 1000 hi krna padega phir baad me karte rehan to iska kya mtalab hua merko kya karna padega main chati hu ki maturity ke baad mujhe 15 lck wala amunt mile meri beti ko jis se uska future acha ho plz suggest kya pehla amunt jo hoga wahi har baar dena hoga …

Hi Nidhi,

Aap Rs. 1,000 se account open karwa leejiye. Account open hone ke baad aap har maheene Rs. 2,500 jama kar sakti ho. Zaroori nahin ki aapko har maheene Rs. 2,500 jama karana hi hoga, aap kam ya zyaada bhi jama kar sakti ho, aur saal mein kam se kam ek baat aur zyaada se zyaada jitni marzi baar jama kar sakti ho.

Hello my dear sir

After open account continue deposit 1000 every years .but in case of I can’t deposit. Can my daughter any interest or any profit.

Hi Raaz,

Aapko ye account maintain karne ke liye har saal Rs. 1,000 deposit karna zaroori hai. Agar kisi saal aap Rs. 1,000 deposit nahin kar paate, to ye account inactive ho jaayega and aapko next year Rs. 50 penalty ke saath amount deposit karna hoga.

sir ,

if 2 years bad hum nehe deposit karpate tab ,keya hoga?

Mr. Dey,

This account is similar to a PPF account. In case nothing is deposited in a financial year, the account becomes inactive and there is a penalty of Rs. 50 per year to make it active again.

Sir ,

Agar deposit karte karte father ka death ho jata he tab ,my daughter ko maturity amount kab melegi?

Hi Mr. Dey,

In case of the depositor’s death, the girl child’s legal guardians can continue with this scheme, if they desire to do so. In case nobody is willing to continue with the contributions, the girl child could close this account and withdraw the balance.

I have a 6 mnths old female child. If i start now for 10000 per year for 2 to 3 years and then after can i increase amount gradually per year.

for example 12000,13000,20000,30000 etc then after.

Yes Pritam, you can increase your contribution in the desired manner.

Sir,

Indian Bank, UBI Bank, Central Bank mein hai Ki Nahi ?

Pinkuji, ye aapko in banks mein ja ke pata karna hoga.

Hi Sir,

Under Nomination Facility- If the an unfortunate event of the death of the Parents.

Will the girl child get the complete plan amount?

Pls advise.

Hi Ravi,

The girl will get the balance amount plus interest and not the full maturity amount.

sir, merit beti 7 saal ki h 10000 per year Kansas maturity Lorna hoga

Hi Ankur,

Agar aap har saal Rs. 10,000 deposit karte hain to maturity pe aapko Rs. 5,33,764 mil sakta hai @ 9.20% per annum.

Whether TDs will be applicable on maturity value of sukanya scheme

No Neelam, there is no tax payable on the maturity amount as it is completely tax-free.

SIR,

MAI AGAR ONE TIME RS. 1,00,000 DEPOSIT KAR SAKTA HU KYA

TO MUJE MATURITY KE WAQT KITANA AMOUNT MELEGA

SIR,

MAI AGAR ONE TIME RS. 1,00,000 DEPOSIT KAR SAKTA HU KYA

TO MUJE MATURITY KE WAQT KITANA AMOUNT MILEGA

Agar aap har saal Rs. 1,00,000 deposit karte hain to maturity pe aapko Rs. 53,37,642 mil sakta hai @ 9.20% per annum.

10 saal ki beti honewali hai 3000 / month jama karenge to kitna rupya milega aur agar beti ki saadi 21 warsh me ho jaati hai to kitna milega aur kab milega vistar se batane ki kripa karen.

Sangeetaji, 21 saal mein shaadi hone pe kitna milega, ye to main calculate nahin kar paaonga. But, 14 saal baad agar shaadi hoti hai, to aapko Rs. 10,28,252 milega as per the table above.

Sir, i have one RD a/c running at 9 % with approx 2 lakh rupees. It

will mature in oct 2016 with value 4 lakh. EMI is 11000 pm. Since RD

interest is going to be chargeable from june, is it advisable to close

RD and deposit amount in Sukanya samriddhi a/c ?.or

should i keep RD going and open fresh SSA .What do you suggest?

I am confused as FD rates have also gone down.

Hi Vishwa,

I think SSA/PPF accounts are much better investments as compared to FDs or RDs. So, it is always better to switch to SSA/PPF/Equity SIPs as compared to FDs/RDs.

Thanks for the info Sir. In any case i am opening SSA a/c for my daughter.She is 1 year old now. I was just wondering i should keep RD going as its interest will be around 50k at maturity and will be TAX chargeable and i can invest separately for SSA a/c as well.

Sir how many years I will deposit the amount.which year I get the amount at least 19 to 20 lakhs.that for which amount I will deposit monthly or yearly, for collect that amount.my daughter 2 years old.this mail I sended u sir.

Hi Suman,

You need to deposit money for 14 years from the account opening date. Rs. 19-20 lakh ke liye aap monthly/yearly kitna paisa deposit karoge? Maturity amount aapko account khulne se 21 saal baad ya beti ki shaadi hone pe milega, whichever is earlier.