This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

The Finance Ministry on March 31st announced the applicable interest rates for all the Post Office Small Savings Schemes, including PPF, Sukanya Samriddhi Yojana (SSY) and Senior Citizens Savings Scheme (SCSS). Except for SCSS and SSY, the government has kept all other interest rates unchanged, including 8.7% for its most popular scheme, PPF.

To encourage more and more people to get the Sukanya Samriddhi Account (SSA) opened, the Government has decided to ride against the tide and has increased its interest rate to 9.20% from 9.10% earlier, an increase of 0.10%.

As the interest rate on Sukanya Samriddhi Yojana is subject to a revision every financial year, this rate of 9.2% will remain applicable only for the current financial year, 2015-16 and will be further revised in March 2016 for the next financial year, 2016-17.

But, this move of keeping its interest rate higher makes me feel that the Modi Government will continue to keep its interest rate higher going forward as well. I think, like the current financial year, they will try to keep a differential of approximately 0.50% between PPF and Sukanya Samridhi Yojana.

I had posted an article last month in which maturity values were calculated with 9.1% rate of interest throughout its tenure of 21 years. But, as the interest rate has been updated to 9.2% and as most of the investors are yet to open this account, I thought there is a need to have a new post having maturity values calculated as per the new rate of 9.2%.

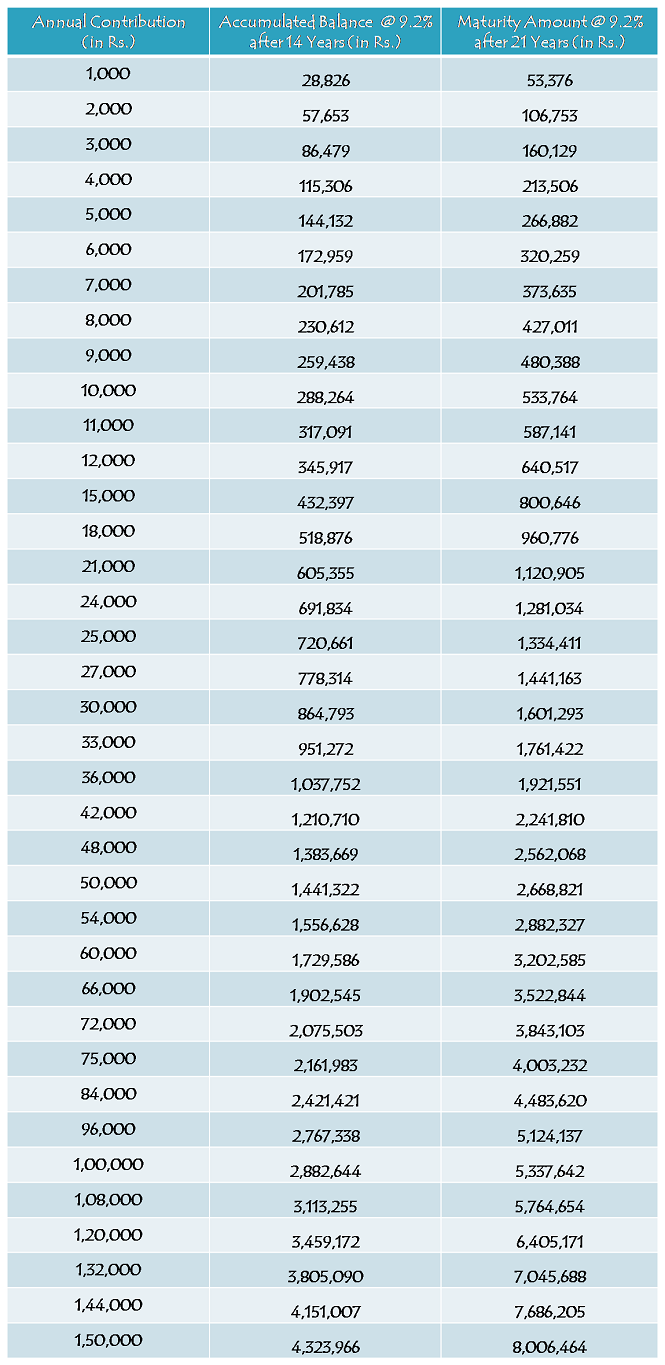

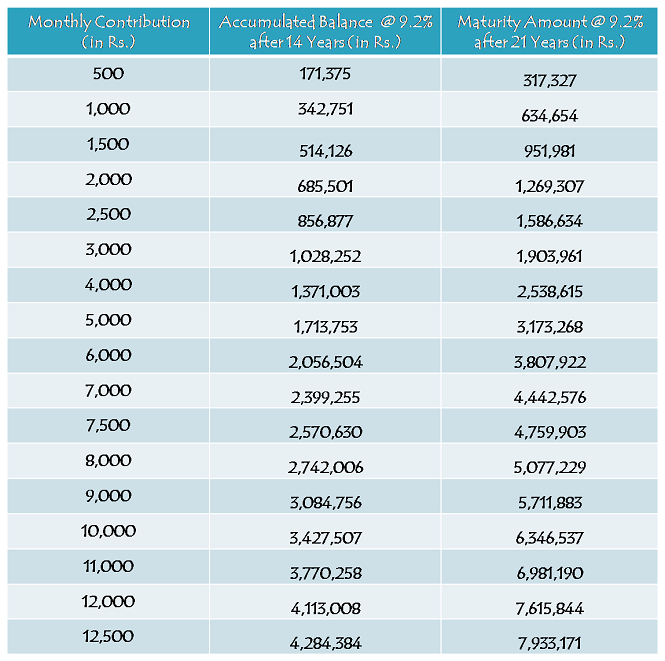

So, here you have the tables in which maturity values are given as per your annual contributions as well as monthly contributions:

Yearly Contribution Table

Monthly Contribution Table

As different investors will have have different amounts and different timings of their deposits, it is natural that their maturity values will also be different. So, these maturity values are only indicative based on certain assumptions and here you have those assumptions:

* Rate of Interest has been assumed to remain 9.2% for all these 21 years.

* Yearly contributions have been assumed to be made on April 1 every year i.e. the beginning of the financial year.

* Monthly contributions have been assumed to be made on 1st day of every month.

* Although it is not mandatory, a fixed amount of yearly/monthly contribution has been assumed.

* It is also assumed that no withdrawal is made throughout these 21 years.

As people are looking for more and more information about this scheme, I would like to again highlight the main features of this scheme here:

Who can open this account? – Parents or a legal guardian of a girl child up to the age of 10 years, can open this account in the name of the girl child. So, if your daughter is born on or after December 2, 2003, you can get this account opened for her in a post office or an authorised bank branch.

Which documents are required to open this account? – You need birth certificate of the girl child, along with the identity proof, residence proof and two photographs of the parents/legal guardian, to open an account under this scheme. You can approach any post office or a branch of any of the authorised banks to get this account opened.

9.2% Tax-Free Rate of Interest for FY 2015-16 – As mentioned above, this scheme will carry 9.2% rate of interest for the current financial year and it was 9.1% for the previous financial year. Similarly, interest rate will be revised every year in March and will be applicable for the applicable financial year afterwards.

Scheme Matures in 21 years or on Girl’s Marriage, whichever is earlier – The scheme gets matured on completion of 21 years from the date of opening of the account or as the girl child gets married, whichever is earlier. Please note that the girl attaining the age of 21 years has no relevance to maturity period of this scheme.

Deposit for 14 years only – You need to deposit a minimum of Rs. 1,000 and a maximum of Rs. 1,50,000 only for the first 14 years, after which you are not required to deposit any amount. Your account will keep earning the applicable interest rate for the remaining 7 years or till it gets matured on your daughter’s marriage.

NRI/OCI Investment – It is still not clear whether Non-Resident Indians (NRIs) or Overseas Citizens of India (OCI) are allowed to open an account under this scheme or not. But, as it is not allowed with most of the post office small saving schemes, I think the government will not allow them to invest in this scheme either. I’ll update this post as soon as I get any information regarding the same.

Partial Withdrawal – It is allowed to withdraw 50% of the balance for higher education as the girl child attains the age of 18 years. Except for this period, it is not allowed to withdraw any amount during the whole tenure of this scheme.

Nomination Facility – Nomination facility is not there with this scheme. In an unfortunate event of the death of the girl child, the balance amount will be paid to the parents/ legal guardian of the girl child and the account will be closed immediately.

You can check all the features of this scheme from this post – Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

You can also check the updated list of banks and download the application form to open an account from this post – Sukanya Samriddhi Yojana – Updated list of Authorised Banks to Open an Account, Specimen Application Form & Passbook. If you have any query or something related to all these posts, please share it here.

Sir , meri beti ki dob 02-05-2005 hai mujhe kitan time tak payment karna hoga .

Hi Akhilesh,

Aapko 14 years tak pay karna hoga, yaani 2029 tak.

sir hamara betike SUKANYA ACOUNT OPEN kardiyahi DATE (01-03-2015) hum abse 164000/-14YEARS,keliye kethna amount MONTHLEY pay karna hi PLEASE ANSWERME SIR (hamara beti- D/B=15-4-2005 DEEPIKA)

Hi Somesh,

Aapki query clear nahin hai.

sir hamara betike SUKANYA ACOUNT OPEN kardiyahi DATE (01-03-2015) hum abse 164000/-14YEARS,keliye kethna amount MONTHLEY pay karna hi PLEASE ANSWERME SIR (hamara beti- D/B=15-4-2005 DEEPIKA)

SAR MAA PAPAKI SUKANYA ACOUNT OPEN CHESAAM DATE (01-03-2015) MEMU IPPATINUNDI 164000/-14YEARS,LO PAY CHEYALA LEKAPOTE MONTHLEY ? KATTALI PLEASE ANSWERME SIR (MA PAPA- D/B=15-4-2005 DEEPIKA)

Consider account opened at the age of 9yr. And marriage happens at the age of 21yr. Then Maturity period came even before 14yr installments completion. Plese clarify for above scenario, till what age installments need to be continued and when it will be matured.

Hi Rajni,

Girl child can withdraw the whole balance & close the account as & when she gets married, even before completion of 14 years from the account opening date.

Meri beti ki dob 15-03-2015 hai main isibmonth say account khulwaungi so btayie benefit kita hoga….mujhe pay kitna karna padega 14 years tak

Hi Priya,

Aap is scheme mein Rs. 1,000 se Rs. 1.50 lakh tak ek financial year mein deposit karwa sakte ho. Maturity amount aapke contribution pe depend karega.

Sir my daughter with her daughter is settled in US but both were born in INDIA. I want to know a girl child who was born in INDIA and currently living in US can open Sukanya Samriddhi Yojana. Please reply.

Hi Mr. Ramesh,

NRIs are not eligible for this scheme.

DEAR SIR,

MERI DAUGHTER KI D.O.B 02-06-2013 HAI , MAINE USKA SSY ACCOUNT OPEN KIYA HUA H , SIR MAI MONTHLY 2000 RUPEE DEPOSIT KARATA HU, TO HAME AFTER 21 YEAR KITNA AMOUNT MILEGA

OR SIR, MAI BAHAR JOB KARTA HU TO HAR MAHINE DEPOSIT NHI KAR PATA ,LEKIN 2YA 3 MAHINE KE BAD PURA 2YA 3 MAHINE KA EK SATH DEPOSIT KAR DETA HU TO SIR ESA KARNE SE INTREST TO KAM NAHI MILEGA………. PLEASE SIR REPLY

Hi Amit,

Aap jab paise deposit karenge, interest usi date/month se calculate hoga. Jitna late deposit karenge, interest utna kam earn kar payenge. Maturity amount ke liye upar pasted table check keejiye.

sir one que. more , sir agr meri beti ki shadi 2030 m ho jati hai, to tab beti ke marriage ke pahle (7 days ) piase mil jaye gye ya bad m mile gye with thanks mukesh

Paise shaadi se pehle nikaal sakte hain.

Today I opened ssa for my daughter Lovely. I want to know that do I have to deposit a fix amount for each year? Can I deposit 30000 first year, 20k in 2nd year…like this unfixed sequence? One more question.. Can I deposit the total 30k(on a certain year) in any unfix sequence like 10k+5k+7k+8k in anytime throughout that year?

Yes Subhash, you can do both these things.

Sir can u pls help me to know that on completion of 18 yrs of girl age can she herself withdraw the money or parents have any role while withdrawing the money like joint account in which both must b agreed. Situation may arise when girl may follow a way wrong or right a different issue but what if she misled her life by this ammount. Like conflict view on marriage or marriage without parent agreement or run away marriage. On first it may look like orthodox view but when parent save pie by pie and give their whole effort in bringing up child’s then they will surely think .Thanks in advance.

Hi Niraj,

This account is for your girl child and she will have complete authority on this account as she attains 18 years of age. After that, she can use this account as she likes. You will have no say in operation of this account after that.

kya SSY acct transfer ho sakta hei???

Yes Madhu, SSY account is transferable.

sir,

meri beti ka date of birth 2014 last me hua hai our mene rs 1000 yearly

ka a/c open kiya hai to muche 18 year ke me kitna minega with intrest ke sath

sir plz reply me thanks

Sorry Mr. Sanjay, it is not possible for us to do such calculations.

If somebodys daughter is 07 yrs old so he has to pay the premium for next 7 yrs till she is 14 yrs or one has to pay full 14 yrs till she is 21 and further one can leave the amt for more 7 yrs till she is 28 if he wants.

One has to deposit amount for complete 14 years, till 21 years of your daughter’s age in your case. The account will get matured as your daughter gets married or as she turns 28, whichever is earlier.

Sir kya iska premium payment net banking se ho sakta hai. Meri job transferable hai. Pls mention all the payment modes.

Hi Narsingh,

Online transfer facility has not been introduced as yet by the banks. But, it will be introduced by the banks in future.

Sir,

Meri beti 4 years ki hai aur mujhe uski marriage uske 21 years per karni hai. If main ssy a/c aaj open karwata hu to mujhe kitni maturity milegi.

Hi Anoop,

Maturity value aapke contribution, timing of contributions aur rate of interest pe depend karegi.

Sir mere ek beti h uski dob 12/3/2007 h uska mene ac khulva diya h muje kab tak jama karvana padega or ye pese muje kab vapis milenge plz sir meri help kare

Hi Pinku,

Aapko 14 saal paise deposit karne honge aur beti ki shaadi hone pe aapki beti paise withdraw kar sakti hai.

Dear Mr. Shiv Kukreja,

I have two daughters having date of birth 31.01.2006 and 28.08.2008 respectively. As per your report, I can open two separate account for both children with max. permissible limit will be Rs 150000/- per year per child. Ok…. Now, My query is : Is it tax free at the time of maturity or withdraw @ 50% of the balance for higher education or marriage ?

Regards

(S P Yadav)

Hi Mr. Yadav,

Withdrawal would be tax-free on both the occasions.

Hi. This is Virendra. I am looking for a term plan with option for waiver of premium in case of permanent disability. I have chosen Kotak Preferred ETerm Plan, which has this option, and which has more than 90% Claim Settlement Ratio in FY 2013-14. Kindly suggest whether it is good as other options like ICICI iProtect, HDFC Click 2 Protect, SBI eshield, Max Life Insurance, etc. don’t have this option, which I think is must while taking term insurance. I have heard a lot about HDFC plan, but it doesn’t have waiver of premium in case of Permanent Disability.

Also, whether i should take 2 policies of 50 lakhs each or only 1 policy of 1 crore, and if 2 policies, then from same company or two different companies.

Thanks and regards

Virendra

Sorry Mr. Virendra, we do not entertain such individual queries here on this forum.

Thanks for the reply to my previous query, still a small doubt, What is the timeframe for and account to get inactive, is it if I forget to pay in any month it will get deactivated or is it in a period of one year If I don’t pay any amount it will get deactivated.

Non-deposit of money in a financial year is the trigger for making it inactive.