This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

New Post for FY 2016-17 – Post Office Small Savings Schemes – FY 2016-17 Interest Rates – PPF @ 8.10% & Sukanya Samriddhi Yojana @ 8.60%

The Finance Ministry on March 31st announced the applicable interest rates for all the Post Office Small Savings Schemes, including PPF, Sukanya Samriddhi Yojana and Senior Citizens Savings Scheme (SCSS). These rates would be applicable for the current financial year, 2015-2016 and have come into effect immediately from 1st April, 2015.

Positive Surprise for Small Savers

To make these schemes more attractive, the interest rate for Sukanya Samriddhi Yojana has been increased to 9.2% from 9.1% earlier and for Senior Citizens Savings Scheme, the rate has been hiked to 9.3% from 9.2% earlier. The interest rates on all other schemes have been left unchanged, including PPF which is going to earn 8.7% for you this financial year.

At a time when interest rates are falling sharply and the Government is putting considerable pressure on the RBI to lower down its policy rates, this move of keeping small savings rates higher/unchanged has left me stunned. I did not expect such a move from a government which seems to me a progressive government as far as its economic reforms are concerned.

If there is a scientific method of calculating interest rates on these small saving schemes, then I think the current rates have been fixed abnormally higher. In the last 12 months or so, the yields on Government Securities (G-Secs) have fallen from a high of around 9.1% to 7.65% recently. Though keeping interest rates higher has left me disappointed, this move by the government would make small savers & senior citizens happier, for at least one more year.

The increase of 0.10% interest rate on Sukanya Samriddhi Yojana (SSY) should encourage more and more investors and parents to join this scheme now. In fact, the interest rate differential of 0.50% between PPF and SSY would make some of the investors to contribute more towards SSY now.

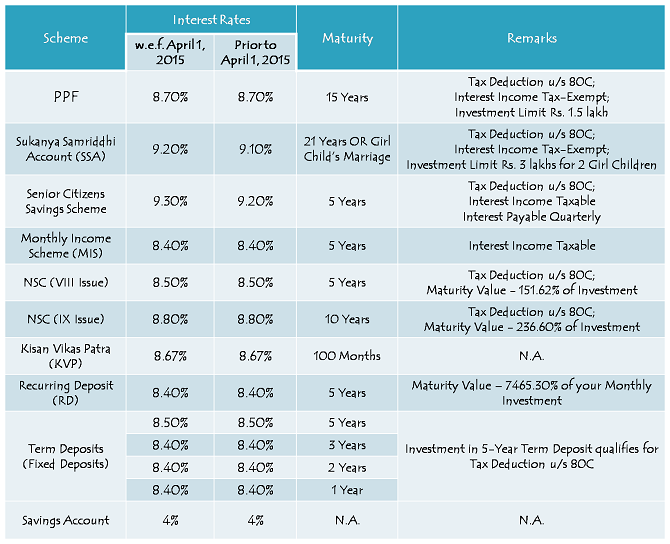

Here you have the table having all the small saving schemes with their applicable interest rates and tax benefits for the current financial year:

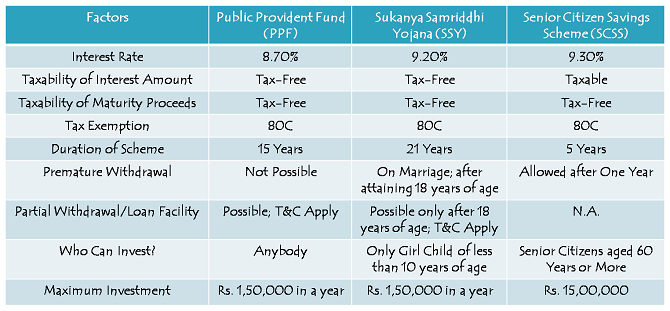

Public Provident Fund (PPF) – There has been no change in the interest rate offered by PPF, India’s most popular small savings scheme. PPF will earn you 8.70% for the current financial year as well. Interest rate will continue to remain tax-exempt on maturity and investment up to Rs. 1,50,000 will keep getting exemption under section 80C.

Sukanya Samriddhi Accounts (SSA) – Sukanya Samriddhi Yojana accounts will carry 9.20% for the current financial year, 2015-16. I was expecting the government to marginally reduce the rate here, say between 8.80% to 9%. But, in a surprise move, they have actually gone ahead and increased the rate to 9.20% from 9.10% till March 31st. I think the government’s move will increase the popularity of this scheme.

Moreover, like PPF, the interest earned will be tax-free on maturity and the investment amount up to Rs. 1,50,000 will get you tax deduction under section 80C.

PPF vs. Sukanya Samriddhi Yojana vs. Senior Citizen Savings Scheme

Senior Citizens Savings Scheme (SCSS) – Senior citizens will also feel happy about the changes announced by the Government as the interest rate on Senior Citizen Savings Scheme has also been increased by 0.10% to 9.30% from 9.20% earlier. Though your investment amount will get you deduction under section 80C, the interest earned is taxable and subject to TDS as well.

Post Office Monthly Income Scheme (POMIS) – Once quite popular with a terminal bonus of 10% and then 5%, Post Office Monthly Income Scheme is getting more and more unpopular these days. As against MIS, investors are getting attracted towards bank fixed deposits (FDs) these days as they get a higher rate of interest, better liquidity and quarterly interest payments. Interest rate has been kept unchanged at 8.40% for MIS.

National Savings Certificates (NSCs) – 5-year NSCs & 10-year NSCs will keep earning 8.50% and 8.80% respectively in the current financial year. Also, your investment will earn you tax exemption under section 80C.

Kisan Vikas Patra (KVP) – Your investment in KVP can double your money in 100 months, which makes its effective annual return to be 8.67% if held till maturity. Investment certificates in this scheme bear no name and can easily be transferred from one person to another.

Recurring Deposits (RDs)/Term Deposits (TDs) – Interest rates on recurring deposits and term deposits have also been kept unchanged at 8.40% for all tenures, except term deposit of 5 years tenure which will yield 8.50% per annum. 5-year term deposit with a lock-in clause will provide you tax deduction under section 80C.

Post Office Savings Account – Your savings account in a post office will continue to earn 4% annual interest and interest amount up to Rs. 10,000 will be tax exempt under section 80TTA.

At a time when banks are already struggling to keep their credit growth in double digits, I think keeping interest rates higher on these small savings schemes is not a wise move. It will make it really difficult for the banks to lower their deposit rates and hence there will be pressure on their net interest margins (NIMs) and profitability. I don’t know what exactly is the logic behind this move, but small savers will definitely benefit out of it. You should take full advantage of these high rates till the time the government realises its mistake.

Hi sir. If I deposited one thousand in a year and deposit same one thousand each for fourteen years how much my daughter’s gate after 21 year’s

Hi Harjeet,

Please check this post for maturity values – http://www.onemint.com/2015/04/03/sukanya-samriddhi-yojana-calculating-maturity-values-9-2-interest-rate-applicable-for-fy-2015-16/

Sir my daughter DOB..20/02/2007

Can she withdraw all amt after 20/02/2028 ?..

No Bhaskar, 21 years will be calculated from the account opening date and not from your daughter’s DoB.

Sir Maine apni baiti ka ssa mai a/c khulvaya hai baiti ku age 8 year hai

Mutual fund SIPs ? Sir Please elaborate

sir ji

mani pnb me pata kiya tha to wha par maneger ji bola ki ye hamari head office me hi khulega

Hi Suneshpal,

PNB ki sab branches ye account open nahin kar rahi. Aap kisi aur branch mein check keejiye, ya phir post office mein.

sir . i want to know about tax on interest of senior citizen scheme. if total interest income is less than income tax slab . then interest is tax free?

Yes Mr. Lalit, if total interest income is less than income tax slab, then you are not required to pay any tax.

Sir ,

I am college student and I want to deposit max. 500 per month till 3 yrs . Is there any scheme related to this ? And hw mch interest I wil get on this deposit..

Plz suggest me

Hi Ashi,

You may go with mutual fund SIPs with such an amount.

Sir,

I am newly married and would like to have some money in future.After all the payments i can save 1000, so with this amount is there any possibility for me to deposit, if so what is the deposit scheme and benefits??Thanks in advance in helping out..

Hi Tarun,

You should go for mutual fund SIPs with such an amount.

Sir, what is better!! Fd in bank or post office for five years!! Also Rd in bank or post office!!

Hi Pooja,

Rate of interest is the prime factor for deciding which is better.

Hallo. Sir my daughter is 10year old.if I open a ssy account for my daughter.how much amount I wihdraw in her 18year for his marriage.if I deposit 12000?per year

Hi Binay,

It is difficult to calculate it as it depends on your timing of deposits and annual rate of interest.

i would like to invest Rs.1070000/-

which one is better MIS or KVC and , please advise

Hi Mintu,

You cannot invest more than Rs. 4.50 lakh in MIS in a single name. MIS is for 5 years, as compared to KVP which is for 100 months. Rate of interest is 8.40% payable monthly with MIS, as against 8.67% payable on maturity with KVP. Rest you need to take a decision.

i would like to invest Rs.1070000/-

which one is better MIS or KVC, please advise

whether TDS on Recurring Deposits of post office is applicable for year 2015-2016?

Hi Nilesh,

Post Office Recurring Deposits (RDs) are exempt from TDS, even for FY 2015-16.

sir pl tell me that my douther age is 01 month 17 days upto till date so this policy i can take it.

Hi A B Sarkar,

It is an ongoing scheme and there is no last date as such for this scheme.

Dear Mr. Shiv Kukreja,

Can you please guide me ways and means how to do monthly remittance in Sukanya Sammridhi Account.

1 – Should I remit cash/cheque in the same post office where account is opened or any other near by post office in my SSA?

2 – Can I do a fund transfer through internet banking (NEFT)

3 – Can I remit cash or cheque in any bank authorised by India post in the Sukanya Samriddhi Account

Looking forward for your guidance..

Hi Mr. Arun,

1. You need to deposit cash/cheque in the same post office where account has been opened.

2. Post offices do not offer online fund transfer facility.

3. No, that is not possible.

It is better to get this account opened/transferred to a bank which is offering online transfer facility.

sir

can I deposit the amount for my daughter having girl child 2 yr of age.

but my daughter is living in USA.

Hi Dr. Jain,

NRIs/OCIs are not eligible for this scheme.

Hi sir mujhe meri beti ke liye palan samjhana h aap bataye sir ji

Sir, meri do betiya he to kya Mai suknya samrudhhi yojana me dono ke naam se account open kar sakti Hu.. Plz guide to me..

Hi Babita,

Agar aapki betiyon ki date of birth December 2, 2003 ya uske baad ki hai, to aap ye account unke naam pe open karwa sakti hain.

Yes you can.

Hello sir mujhe apni girl child ka samridhi karvana hai. Mera account hapur dist mai hai

Jagdishji, aap apne nazdeek ke kisi post office ya bank mein ye account khulwa sakte hain.

Sukanya Samriddhi Yojana is one of the best plan/ Offer suggested by Honourable PM Modi G for the girl child.Its best suit for all the medium as well as lower medium class public in India. Thanks………

Request : Please make Post office online , so that premium can be easily paid for the SSA. Banks are still not much more aware about this scheme.

Raman T

Thanks Mr. Raman for sharing your views & suggestions!