This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

New Post for FY 2016-17 – Post Office Small Savings Schemes – FY 2016-17 Interest Rates – PPF @ 8.10% & Sukanya Samriddhi Yojana @ 8.60%

The Finance Ministry on March 31st announced the applicable interest rates for all the Post Office Small Savings Schemes, including PPF, Sukanya Samriddhi Yojana and Senior Citizens Savings Scheme (SCSS). These rates would be applicable for the current financial year, 2015-2016 and have come into effect immediately from 1st April, 2015.

Positive Surprise for Small Savers

To make these schemes more attractive, the interest rate for Sukanya Samriddhi Yojana has been increased to 9.2% from 9.1% earlier and for Senior Citizens Savings Scheme, the rate has been hiked to 9.3% from 9.2% earlier. The interest rates on all other schemes have been left unchanged, including PPF which is going to earn 8.7% for you this financial year.

At a time when interest rates are falling sharply and the Government is putting considerable pressure on the RBI to lower down its policy rates, this move of keeping small savings rates higher/unchanged has left me stunned. I did not expect such a move from a government which seems to me a progressive government as far as its economic reforms are concerned.

If there is a scientific method of calculating interest rates on these small saving schemes, then I think the current rates have been fixed abnormally higher. In the last 12 months or so, the yields on Government Securities (G-Secs) have fallen from a high of around 9.1% to 7.65% recently. Though keeping interest rates higher has left me disappointed, this move by the government would make small savers & senior citizens happier, for at least one more year.

The increase of 0.10% interest rate on Sukanya Samriddhi Yojana (SSY) should encourage more and more investors and parents to join this scheme now. In fact, the interest rate differential of 0.50% between PPF and SSY would make some of the investors to contribute more towards SSY now.

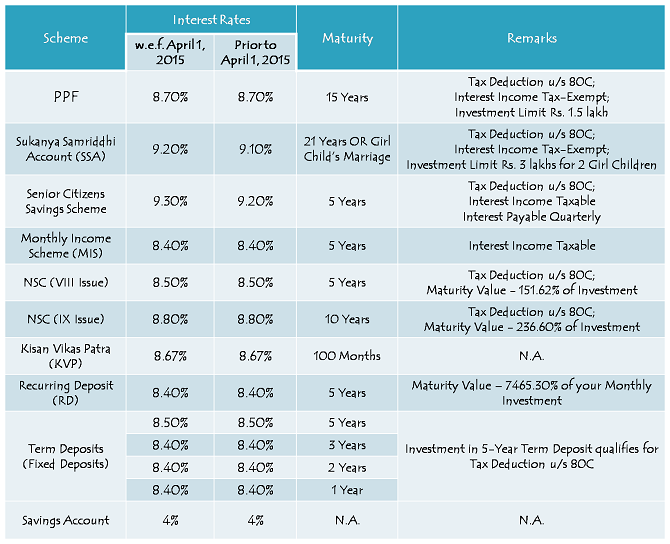

Here you have the table having all the small saving schemes with their applicable interest rates and tax benefits for the current financial year:

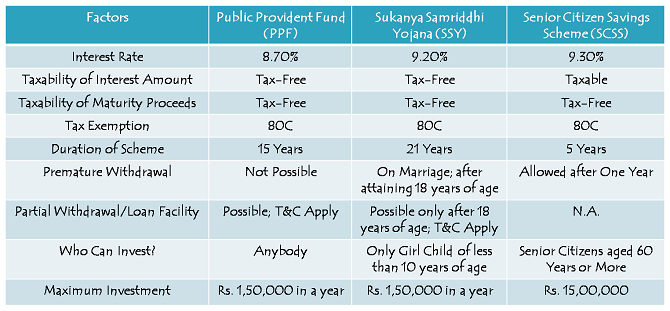

Public Provident Fund (PPF) – There has been no change in the interest rate offered by PPF, India’s most popular small savings scheme. PPF will earn you 8.70% for the current financial year as well. Interest rate will continue to remain tax-exempt on maturity and investment up to Rs. 1,50,000 will keep getting exemption under section 80C.

Sukanya Samriddhi Accounts (SSA) – Sukanya Samriddhi Yojana accounts will carry 9.20% for the current financial year, 2015-16. I was expecting the government to marginally reduce the rate here, say between 8.80% to 9%. But, in a surprise move, they have actually gone ahead and increased the rate to 9.20% from 9.10% till March 31st. I think the government’s move will increase the popularity of this scheme.

Moreover, like PPF, the interest earned will be tax-free on maturity and the investment amount up to Rs. 1,50,000 will get you tax deduction under section 80C.

PPF vs. Sukanya Samriddhi Yojana vs. Senior Citizen Savings Scheme

Senior Citizens Savings Scheme (SCSS) – Senior citizens will also feel happy about the changes announced by the Government as the interest rate on Senior Citizen Savings Scheme has also been increased by 0.10% to 9.30% from 9.20% earlier. Though your investment amount will get you deduction under section 80C, the interest earned is taxable and subject to TDS as well.

Post Office Monthly Income Scheme (POMIS) – Once quite popular with a terminal bonus of 10% and then 5%, Post Office Monthly Income Scheme is getting more and more unpopular these days. As against MIS, investors are getting attracted towards bank fixed deposits (FDs) these days as they get a higher rate of interest, better liquidity and quarterly interest payments. Interest rate has been kept unchanged at 8.40% for MIS.

National Savings Certificates (NSCs) – 5-year NSCs & 10-year NSCs will keep earning 8.50% and 8.80% respectively in the current financial year. Also, your investment will earn you tax exemption under section 80C.

Kisan Vikas Patra (KVP) – Your investment in KVP can double your money in 100 months, which makes its effective annual return to be 8.67% if held till maturity. Investment certificates in this scheme bear no name and can easily be transferred from one person to another.

Recurring Deposits (RDs)/Term Deposits (TDs) – Interest rates on recurring deposits and term deposits have also been kept unchanged at 8.40% for all tenures, except term deposit of 5 years tenure which will yield 8.50% per annum. 5-year term deposit with a lock-in clause will provide you tax deduction under section 80C.

Post Office Savings Account – Your savings account in a post office will continue to earn 4% annual interest and interest amount up to Rs. 10,000 will be tax exempt under section 80TTA.

At a time when banks are already struggling to keep their credit growth in double digits, I think keeping interest rates higher on these small savings schemes is not a wise move. It will make it really difficult for the banks to lower their deposit rates and hence there will be pressure on their net interest margins (NIMs) and profitability. I don’t know what exactly is the logic behind this move, but small savers will definitely benefit out of it. You should take full advantage of these high rates till the time the government realises its mistake.

HI

Is it not possible to withdraw the amount at the time of education at the age of 16 /18 years of child in SSY?

Yes Rajneesh, you can withdraw 50% of the balance amount as the girl child turns 18.

Whether Post office Recurring deposit accounts will also attract TDS provisions with effect from 1st June 2015?

No Shriram, Post Office RD accounts have been exempt from the new TDS rules.

Abhi intrestrate% kya hai. Our intrestrate uper niche bhi ho sakta hai.kya.

SSY ka current interest rate 9.20% hai aur ye increase/decrease ho sakta hai.

Sir,

i want to invest around 10 lakh for lomg term,as bank FD rate now gives lower interest rate,therefore where should i invest like KVP,NSC or post office term deposit.

Regards,

partha

i have good business ideas , my whatsapp number is ( 7014287798)

Sir mai sukanya samriddhi yojana ke bare me janana chahata hu. Callculation bhi

Bataiye Suresh, kya poochna chahte hain?

Best rd scheme monthly 5000 in five yrs large intest schme

i have one boy, 3 years old. i want to know the saving schemes with high interest and safety in Indian Postal Service for him. kindly guide me for the above.

Hi B.Gomathi,

I think PPF is the best small savings investment for a boy in post office.

sir… i can save Rs. 1000-2000 per month from my salery.Which one schemes best for me & tell me Also its banefits. …plz reply

Hi Mohit,

Every investor has his/her own risk profile and financial goals. You also should invest your money as per your risk profile and financial goals. If you can take risk and have long term financial goals, then investing in equity mutual funds is a good option. If you don’t want to take risk, then Sukanya Samriddhi Yojana (SSY) & PPF are good schemes to invest.

Sir can an NRI invest in post office schemes in India.Please Reply.

No Mr. Bajaj, NRIs cannot invest in post office small saving schemes.

Bhaailog pls help.mi mujhe fixed deposit karna hai 1 lakh ka Jodouble hue kaunsa scheme aacha hogaa aurr kyaa calcuation hogaa aur scheme ka naam kya h pls tell mi

Hi Nicky,

Post Office ke Kisan Vikas Patra (KVP) mein invest karne pe aapki investment 100 months mein double ho jaayegi.

Sir Namaste mai anjali meri daughter 5month ki hai Mai 2000 ka monthly jama karungi tu 21 year me kitna maturity hoga plz reply me

Hi Anjali,

Rs. 2,000 monthly deposit karne pe aapko 21 saal baad approx. Rs. 12,69,307 milega @ 9.20% per annum – http://www.onemint.com/2015/04/03/sukanya-samriddhi-yojana-calculating-maturity-values-9-2-interest-rate-applicable-for-fy-2015-16/

hello sir meri do beti hain 3year n 6year me is yojna me kkitne saal tak paise deposit karoo or kitne year hone par mujhe sara amount milega

Sir aap apna no. De skte h.

Hi sir jankari leni hai agar ek hazar mahina dalte hai to kya amount milega bitya ko date of birth hai 7/1/2006

Hi Chandan,

Rs. 1,000 mahina daalne pe aapko 21 saal baad approx. Rs. 634,654 milega @ 9.20% per annum – http://www.onemint.com/2015/04/03/sukanya-samriddhi-yojana-calculating-maturity-values-9-2-interest-rate-applicable-for-fy-2015-16/

Sir, mai ye jankari chahiye yadi hum 12000 ek sath deposit kare to in par intrest @ 12000 par milega ya 1000 per month ke hisab se milega bcoz mai chahata hu k 12000 ek sath deposit karu plz tell me ne milta haito hum 1000 per month deposit kare

Thanks!

(J P Singh)

09411951964

Jitendraji, agar aap Rs. 12,000 ek baar mein jama karte hain, to aapko poore Rs. 12,000 pe interest milega.

Hello,

Is it possible to open SSA account in two different location by two different people with same name with one year difference. Dad and Uncle, Dad or Mom. If no, How it is possible for them to check. Even PAN no ll be different. What are consequences if we open account and found later.

Amit,

I would not like to respond to such queries.

Sir.

July 2010 me r.d. per kitne % tha.

Hi Yatendra,

Hamare paas 2010 RD ka data nahin hai.

Sukanya Samriddhi Yojana is one of the best plan/ Offer suggested by Honourable PM Modi G for the girl child.Its best suit for all the medium as well as lower medium class public in India. Thanks………

Request : Please make Post office online , so that premium can be easily paid for the SSA. Banks are still not much more aware about this scheme

Thanks Mr. Tiwari for sharing your views. I agree that post offices should provide online facilities and be made more efficient.

dear sir,

is it possible the following ?:-

1)i want to transfer my SSA from Post Office to Allahabad Bank.

2)i want to balance check by any other post office.

3)i want to check my balance at a glance by using mobile or any other option. if it is possible than what is the process ?

Hi Satya,

1. Possible

2. Not Possible

3. Not Possible

Start one year RD in post office by agents for bissnessmen

Sir.

Meri beti ka date of birth -18.05.2009 ka hai . our mai 2000/. Thousands/ month deposit karta hu to 21 years ke bad kitna milega.??

Hi Mukesh,

Please check this post for maturity values – http://www.onemint.com/2015/04/03/sukanya-samriddhi-yojana-calculating-maturity-values-9-2-interest-rate-applicable-for-fy-2015-16/

sir,

How many senior citizen account opened in calender month

Hi Sudhir,

Your query is not clear to me.