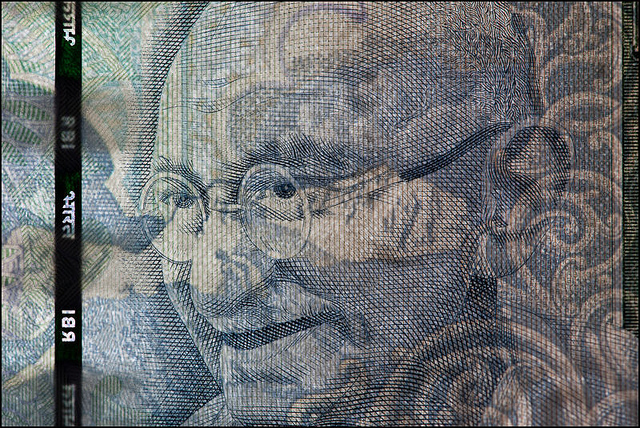

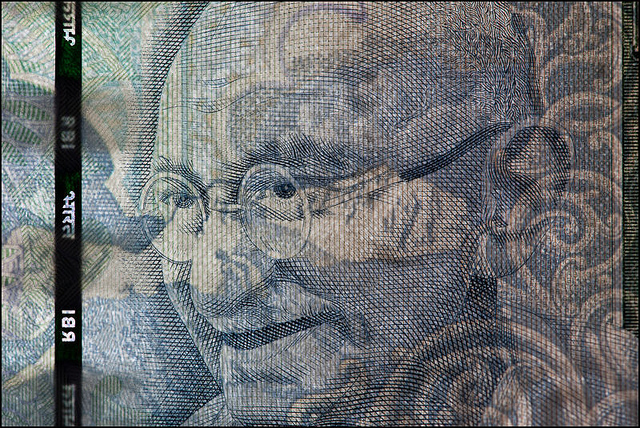

The RBI Governor, Dr. Raghuram Rajan has brought up the subject of full convertibility of Rupee again recently, and it will be interesting to see what steps he takes to make it happen in the future.

Capital account convertibility of the Rupee means the ability to convert INR into any foreign currency, and the foreign currency back to the Rupee at any time without any restriction on the amount at the market rates.

The obvious benefit of capital account convertibility is that it makes it easier for foreign investors to invest in your country as currency movement has no barriers, and they are assured that they will be able to take their money back to their country when the need is warranted.

The big drawback is that if a large number of investors decide to take out their money from the country at the same time then the local currency crashes. This is what happened in the Asian financial crisis when the currencies of Indonesia, Thailand and South Korea took a big hit, and needed support from the IMF to rescue them.

India has taken steady steps to full convertibility, and steps aimed at NRIs are the most visible with a lot of concessions made in the NRE and NRO accounts in the recent past.

Although full convertibility is sometimes given a shade of nationalistic pride by the media, and since only a handful of countries in the world have currencies that are fully convertible (most of them advanced economies), perhaps it is a matter of pride, but more importantly, it is the ability to access deep capital markets that can be used for investing into infrastructure or other projects that makes full capital account convertibility a desirable thing.

The other big benefit is the ability to settle India’s trade in INR as opposed to a foreign currency which is how almost all of it is done today.

I feel that full convertibility is not a ‘short number of years’ away as the RBI governor stated some time ago, but more likely many number of years away because of the situation the Indian economy is currently in, and in general the power it gives foreign investors over your exchange rate. Even our much bigger neighbor hasn’t been able to adapt a fully convertible Yuan despite their impressive reserves, and much better economic indicators.