This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Prime Minister Mr. Narendra Modi launched three new social security schemes under his government’s Jan Suraksha initiative during his visit to Kolkata on May 9. As most of us know by now, these schemes are – Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY) and Atal Pension Yojana (APY).

People are keen to know more about these schemes and how to get themselves enrolled/subscribed to get insurance coverage in case of death or disability. Though banks are also aggressive & keen in attracting their customers to subscribe to these schemes, many people are still clueless how to get themselves enrolled and whether banks are providing online subscription facility or not.

Customers of banks, like Kotak Mahindra Bank, HDFC Bank, ICICI Bank, IndusInd Bank and SBI, can subscribe to PMJJBY and PMSBY in any of the following manners:

* Visiting a bank branch nearest to your place, filling the Consent-cum Declaration Form & depositing in the branch itself

* Through Netbanking by filling the online form

* Sending an SMS to the number provided by your bank

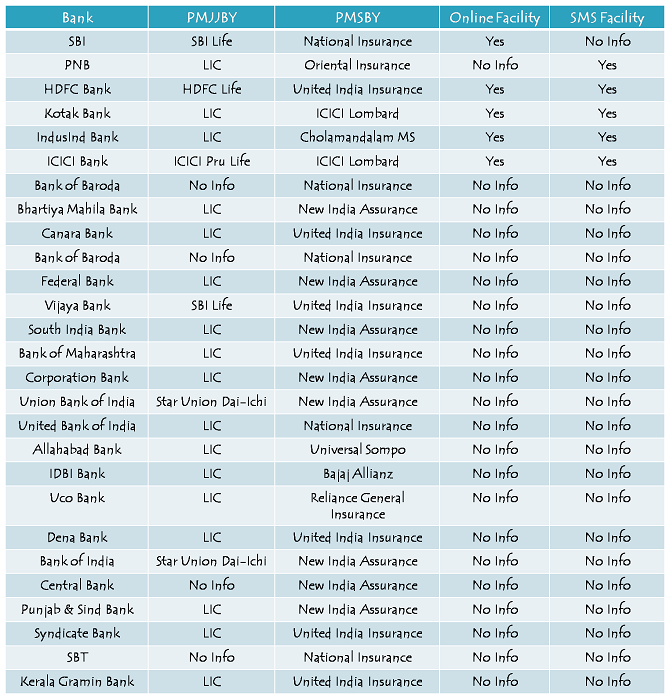

I have tried to compile a list of participating banks which have tied up with different insurance companies for providing life insurance and accidental death & disability insurance to their interested customers. Here you have the list of banks along with their partner insurance companies and whether they are providing the online and/or SMS facility to their customers or not:

LIC affiliated Banks for PMJJBY – PNB, Kotak Mahindra Bank, IndusInd Bank, Bhartiya Mahila Bank, Canara Bank, Federal Bank, South India Bank, Bank of Maharshtra, Corporation Bank, United Bank of India, Allahabad Bank, IDBI Bank, Uco Bank, Dena Bank, Punjab & Sind Bank, Syndicate Bank and Kerala Gramin Bank.

Banks affiliated with SBI Life for PMJJBY – State Bank of India (SBI) and Vijaya Bank.

Banks affiliated with New India Assurance for PMSBY – Bhartiya Mahila Bank, Federal Bank, South India Bank, Corporation Bank, Union Bank of India, Bank of India, Central Bank and Punjab & Sind Bank.

Banks affiliated with United India Insurance for PMSBY – HDFC Bank, Canara Bank, Vijaya Bank, Bank of Maharashtra, Dena Bank, Syndicate Bank and Kerala Gramin Bank.

Banks affiliated with National Insurance for PMSBY – State Bank of India (SBI), Bank of Baroda, United Bank of India and State Bank of Travancore (SBT).

Banks affiliated with Oriental Insurance for PMSBY – PNB.

Banks affiliated with ICICI Lombard for PMSBY – Kotak Mahindra Bank and ICICI Bank.

I will try to update this list as & when I get info about more banks joining these schemes. You may visit the respective websites of these banks to download their application forms for getting yourself enrolled. In case you need to get yourself updated with the terms of any of these schemes, here you have the links to our previous posts in which we covered these schemes:

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) – Form in English – Form in Hindi

Pradhan Mantri Suraksha Bima Yojana (PMSBY) – Form in English – Form in Hindi

Atal Pension Yojana (APY) – Form in English – Form in Hindi

If you have any query regarding any of these schemes, please share it share and I will try to respond to it as soon as possible.

Thanks a lot for the information. It is helpful 🙂

You are welcome!

Sir

As u told that there is no service tax on PMJJBY and PMSBY schemes.

But in my Area one branch of BANK OF MAHARASHTRA is saying that this branch is situated in service tax area so service tax is applicable here on both schemes.

They are asking for 330+31=371 & 12+2=14 for both the schemes respectively.

Kindly confirm me it is ok or not….

Thank u…

Hi Mr. Manjeet,

You need not pay any service tax on these premiums. These schemes have been exempted from service tax by our Finance Minister Mr. Arun Jaitley – http://www.cbec.gov.in/ub1516/do-ltr-jstru1-post-budget.pdf

Please inform me with which Insurance company Punjab National Bank tie up for PMSBY Scheme?

Punjab National Bank (PNB) has tied up with The Oriental Insurance Company Limited for Pradhan Mantri Suraksha Bima Yojana (PMSBY).

HDFC has not started Atal Pension Yojana yet….i am not sure how do i register for it.

Hi Rohan,

Please check this link, it has the list of POP-SP – https://npscra.nsdl.co.in/pop-sp.php

how to activate SMS based service in Hdfc bank pls tell me the SMS format

“SMS PMSBY Y to 5676712” – Be careful, by sending this SMS, you will be enrolled to this scheme i.e. PMSBY. Do it only if you want to subscribe to it.

Sir kindly tell me two things about PMJJBY and PMSBY that is there any service tax we need to pay to any govt. Or private bank for both or any of the schemes?

2nd is, can a tax payer avail these insurance policies?

Kindly assist.

Sir kindly tell me two things about PMJJBY and PMSBY that is there any service tax we need to pay to any govt. Or private bank for both or any of the schemes.

2nd is can a tax payer avail these insurance policies.

Kindly assist.

Hi Manjeet,

1. Service Tax is not applicable to these two schemes.

2. Yes, anybody can avail these schemes, even if you are a tax payer or not.

Pl.check with your Bank.If you are already insured with any insurance policy,you will no t covered under this scheme.You will loose your bank premium.

Hi,

If you have enrolled yourself to PMJJBY and PMSBY with any of your banks, only then you cannot subscribe to these schemes again. But, in case your have bought any other insurance schemes, then you can definitely subscribe to PMJJBY and/or PMSBY.

Hi, Has anyone applied for PMJJBY & PMSBY via State Bank Of India or State Bank Of Mysore website[i.e online mode]? If yes, is there a provision to enter a nominee name as I could not locate it ?

Please share info and steps.

Thanks

– Kunal

Hi Kunal,

I think it is available on the SBI’s netbanking platform. Nominee name provision will also be there while enrolling for these schemes.

dear sir…will u help us to know that is there both type of account has been included by this policy :- saving/current.

and if we have account in any co oprative bank then can we get its benifits.

Hi Shobhit,

I don’t think current accounts can be linked to these schemes. Also, an account in a co-operative bank can be linked to these schemes.

Are persons with existing diseases such as critical illness covered under these scheme? What is the way to undergo medical examination ?

Hi Kumar,

These schemes do not cover medical treatments for critical illnesses etc. These schemes cover death and/or accidental disability/death.

I mean to ask Are persons suffering from critical illness are eligible to enroll for life insurance under this scheme? What is medically fitness criteria? Under normal circumstances, private life insurance company does not provide life insurance to person with critical illness or they may increase the premium. What is the eligibility under this scheme for such person.

Thanks,

-Kumar

Hi Shiv,

Any idea if HDFC is / going to offer SBJJBY. I do not see them offering now.

Thanks

Amit

Hi Amit,

I think HDFC should offer PMJJBY. Even I do not have confirmed info about the same. I’ll share it here as & when I have info about it.

same question i also have..

how to go for it in HDFC BANK?

I have a account in SBI,when I tried to enroll online ,I got a message that I am not eligible for the scheme??.why?

Hi Pratima,

I am not sure why it declined your subscription, but if you are more than 50 years old, then you are not eligible for PMJJBY. If you are not 50, then you need to check it with the bank.

I am more than fifty,but another friend of mine who is also more than 50,has done it.In fact she has done in two schemes,one where you pay 12? and another where you pay 300.She has done at HDFC bank

You and your friend, if not 70 or more, are eligible for PMSBY. But, none of you is eligible for PMJJBY. I think your friend’s application should also get rejected for PMJJBY.

How many years paid for this

If you are 50 years or younger, then you can continue with PMJJBY till 55 years of age. With PMSBY, you can avail the benefits till 70 years of age.

Bank of Baroda —-PMSBY—-National Insurance

Thanks Rocky for providing this info!

Heloo sir I am tex payer . I have no pension scheme till now .Age 35

Which is better pension scheme for me nps or apy

can I subscribe both

plz tell

Hi Rajkumar,

Yes, you can subscribe to both NPS as well as APY. Which scheme is better for you, it depends on your requirements. Overall, I think NPS is better than APY.

I do insurance in PMJJBY

What will happen if someone has enrolled for both the insurance plans i.e. PMJJY and PMSBY? If someone dies in accident, would the nominee get the benefits of both schemes, i.e. 2L for PMJJY and 2L for PMSBY = 4L

Hi Kshitij,

Yes, if someone dies in an accident, the nominee would get Rs. 4 lakhs.

Dear Sir,

I am unable to locate the mentioned PMO form for Insurance on HDFC Bank website.

Pls help me find the form for online submission and guide ..

Regards

Hi Aditya,

It is still not available on HDFC Bank’s net banking platform, but the bank will introduce it by May 25th. Kotak Mahindra Bank has already made it available for subscription.

Thanks Shiv as usual your information is life saving(:)) ICICI has made it as easy as an SMS.

You are welcome Harinee! It feels nice to see private sector banks taking active part in such schemes and making it easier for their customers to subscribe to them. I don’t know when public sector banks will improve their efficiency.