This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Pradhan Mantri Suraksha Bima Yojana (PMSBY) and Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) are getting launched from June 1st, 2015. So, if you have not already subscribed to these schemes, you need to quickly take a decision now as only four working days are left for you to do so.

As the deadline approaches, many of you must be having some last minute queries regarding these schemes. So, I thought of covering the FAQs provided on the government’s Jan Suraksha website.

Here you have the FAQs covering PMSBY:

Q1. What is the nature of the scheme, Pradhan Mantri Suraksha Bima Yojana?

The scheme is a personal accident insurance scheme of up to Rs. 2 lakhs for one year. It offers protection against death or disability due to an accident and renewable every year.

Q2. How much is the premium and what are the benefits under the scheme?

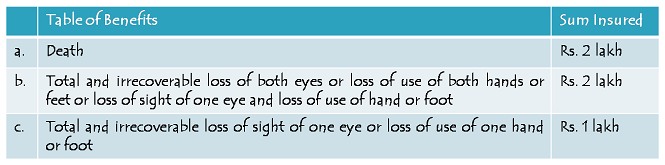

Premium payable is Rs. 12 per annum per subscriber. The benefits are as follows:

Q3. How the premium is to be paid? Do I need to pay the premium every year or is there any auto debit facility?

The premium will be deducted from the account holder’s savings bank account through ‘auto debit’ facility in one installment, as per the option to be given on enrolment. Members may also give one-time mandate for auto-debit every year till the scheme is in force.

Q4. Who is eligible to subscribe? Can I enrol myself with two or more different banks?

All savings bank account holders aged 18 to 70 years in participating banks will be entitled to join. In case of multiple saving bank accounts held by an individual in one or different banks, the person would be eligible to join the scheme through one savings bank account only.

Q6. Who will offer / administer the scheme?

The scheme would be offered / administered through the public sector general insurance companies (PSGICs) and other general insurance companies in collaboration with participating banks. Participating banks will be free to engage any such general insurance company for implementing the scheme for their subscribers.

Q6. What is the enrolment period and modality?

Coverage period would be from 1st June, 2015 to 31st May, 2016. Subscribers should enroll and give their auto-debit option by 31st May, 2015. The enrol period is extendable up to 31st August, 2015. Subscribers who wish to continue beyond the first year will be expected to give their consent for auto-debit before each successive May 31st for successive years. Delayed renewal subsequent to this date may be possible on payment of full annual premium, subject to conditions that may be laid down.

Q7. Can eligible individuals who fail to join the scheme in the initial year join in subsequent years?

Yes, on payment of premium through auto-debit. New eligible entrants in future years can also join accordingly.

Q8. Can individuals who leave the scheme rejoin?

Individuals who exit the scheme at any point may re-join the scheme in future years by paying the annual premium, subject to conditions that may be laid down.

Q9. Who would be the Master policy holder for the scheme?

Participating Banks will be the Master policy holders. A simple and subscriber friendly administration & claim settlement process shall be finalized by PSGICs / chosen insurance company in consultation with the participating bank.

Q10. When can the accident cover assurance terminate?

The accident cover of the member shall terminate / be restricted accordingly on any of the following events:

(i) On attaining age 70 years (age neared birth day).

(ii) Closure of account with the Bank or insufficiency of balance to keep the insurance in force.

(iii) In case a member is covered through more than one account and premium is received by the insurance company inadvertently, insurance cover will be restricted to one account and the premium shall be liable to be forfeited.

Q11. What will be the role of the insurance company and the Bank?

(i) The scheme will be administered by PSGICs or any other General Insurance company which is willing to offer such a product in partnership with a bank / banks.

(ii) It will be the responsibility of the participating bank to recover the appropriate annual premium in one installment, as per the option, from the account holders on or before the due date through ‘auto-debit’ process and transfer the amount due to the insurance company.

(iii) Enrollment form / Auto-debit authorization / Consent cum Declaration form in the prescribed proforma shall be obtained, as required, and retained by the participating bank. In case of claim, PSGIC / insurance company may seek submission of the same. PSGIC / Insurance Company also reserve the right to call for these documents at any point of time.

Q12. How would the premium be appropriated?

(i) Insurance Premium to PSGIC / other insurance company: Rs.10/- per annum per member;

(ii) Reimbursement of Expenses to BC/Micro/Corporate/Agent : Rs.1/- per annum per member;

(iii) Reimbursement of Administrative expenses to participating Bank: Rs.1/- per annum per member.

Q13. Will this cover be in addition to cover under any other insurance scheme the subscriber may be covered under?

Yes, this cover of up to Rs. 2 lakhs will be in addition to your existing accidental insurance cover(s). So, in case of any mishappening, you will get the insurance claims under all your policies, including PMSBY.

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

Participating Banks & Insurance Companies servicing PMJJBY & PMSBY

If you find any relevant info missing in these FAQs or have any of your queries regarding this scheme, please share it here.

I wanna know my nominee of pmjby

My account no is 015305300012043

I want to change name of nominee in PMSBY, PMJJBY and APY. So please update me the procedure for change the same.

sir please suggest me what is the online procedure of registration in PMSBY?

You need to contact nearest bank having saving account.