This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Stock markets have turned turbulent again. Every morning I turn on a business channel these days, I see a large number of red ticks and only a few green ticks. Markets have fallen back to the May 2014 levels when Modi government was voted to the power with high hopes of turning things around. While I think the government is working very hard to get things in order, things are taking a very long time to get back on track.

While analysts are pointing fingers towards China, Fed rate hike and tumbling crude oil prices, I think they are taking classes from Kejriwal i.e. blaming others for anything & everything, but not checking what is wrong within. I think Indian markets are not falling only because of China scare, but because the investors have lost hopes of any corporate earnings revival in the foreseeable future.

Moreover, sentiment has also turned negative with respect to the pace of reforms and policy actions. For this, I would like to thank the Congress leadership, for the role they have played in disrupting two consecutive sessions of parliament and blocking passage of some important bills like GST, Land Acquisition Bill, Real Estate Regulatory Bill etc.

But, I think they have no other option, but to do all this in order to survive for a few more months or years. As India is a democratic nation, we all have to bear such dramas year after year and the more they are able to successfully carry it out, the better are their chances for getting voted back to the power again. Chalo, chalta hai… aakhir India hai !!

But, whether markets go up or go down, a retail investor always gets stuck somewhere, either waiting for the markets to come down to make some investments or watching the markets fall like there is no tomorrow. It is easier to advise investors – “Buy when there is a panic and sell when there is a euphoria”, but it is very very difficult to follow it religiously. Small investors are never able to follow it and they do the exact opposite most of the times. That is why, most of them finally end up bearing losses, after which they stop investing in equities forever.

Equity Linked Savings Schemes (ELSS) – Tax Saving Mutual Funds u/s 80C

Tax saving season is gathering pace again. While service class people are required to submit their tax saving investment proofs in offices, others will also wake up soon to take such actions. Whenever the markets jump extraordinarily during a financial year, Equity Linked Savings Schemes, or popularly known as ELSS, become the investors’ favourite investment instrument for tax saving under section 80C.

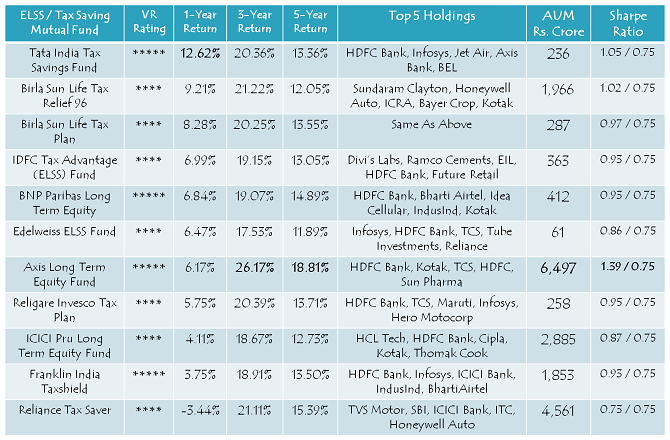

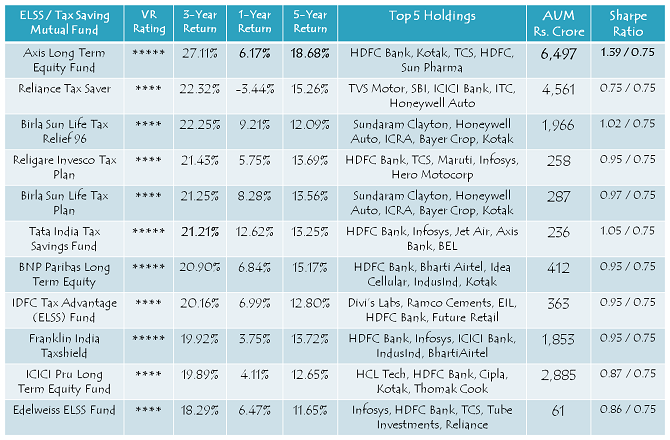

For the last two years or so, investors have been putting a lot of money in these ELSS schemes, but the returns have remained moderately below their expectations. In the three tables below, you can check the best performing ELSS schemes for a period of 1 year, 3 years and 5 years, starting from January 3, 2011 to December 31, 2015.

Best Performing ELSS from January 1, 2015 to December 31, 2015

Best Performing ELSS from January 1, 2013 to December 31, 2015

Best Performing ELSS from January 1, 2011 to December 31, 2015

Personally, I feel these equity linked saving schemes (ELSS) are the best investments to save tax under section 80C. But, conservative investors should prefer PPF, NSC or tax saving fixed deposits (FDs) over these schemes as these funds can have considerably high volatility over your investment period and if any of your financial goals hinge on the returns generated by these funds, you could be fairly disappointed with their returns.

Also, the schemes taken up here in the tables above are not the only good schemes to invest in, there are around 30 more ELSS schemes from which you can pick two or three schemes which suit your investment objectives. You can consult your investment/tax advisor for making such investments.

Please share your views about your investment experience in equity mutual funds and whether you make investments in these funds or not for your tax saving. I think it would be a great topic of discussion here.