This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Budget 2016 has got presented in the Parliament today and I would like to highlight the key announcements here on this forum for a further discussion and deep understanding:

* Global Slowdown – Global growth has slowed down from 3.4% in 2014 to 3.1% in 2015.

* Indian Growth Strong – India is a ‘bright spot’ amidst a slowing global economy. The World Economic Forum has said that India’s growth is ‘extraordinarily high’. The growth of GDP has now accelerated to 7.6%.

* Inflation in Control – CPI inflation has come down to 5.4%, providing big relief to the public.

* Drastic Fall in Current Account Deficit – The Current Account deficit has declined from $18.4 billion in the first half of last year to $14.4 billion this year. It is projected to be 1.4% of GDP at the end of this year.

* New Health Insurance Scheme – A health insurance scheme which protects one-third of India’s population against hospitalisation expenditure is also being announced.

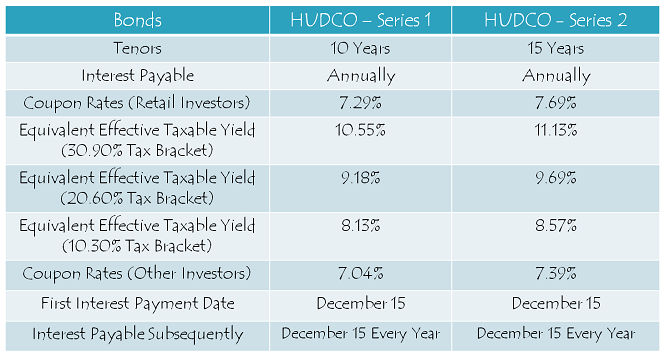

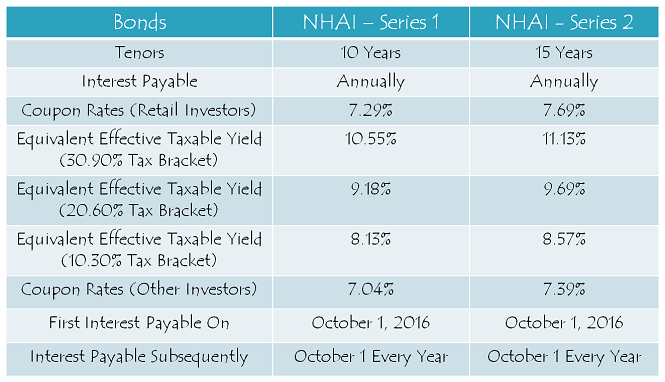

* Tax-Free Infrastructure Bonds – To augment infrastructure spending further, Government will permit mobilisation of additional finances to the extent of Rs. 31,300 crore by NHAI, PFC, REC, IREDA, NABARD and Inland Water Authority through raising of Bonds during 2016-17.

* Retail Investment in G-Secs – To improve greater retail participation in Government securities, RBI will facilitate their participation in the primary and secondary markets through stock exchanges and access to NDS-OM trading platform.

* Boost to Commodities Market – New derivative products will be developed by SEBI in the Commodity Derivatives market.

* Bank Recapitalisation – To support the Banks in these efforts as well as to support credit growth, I have proposed an allocation of Rs. 25,000 crore in BE 2016-17 towards recapitalisation of Public Sector Banks.

* PSU Bank Transformation – The process of transformation of IDBI Bank has already started. Government will take it forward and also consider the option of reducing its stake to below 50%.

* Listing of General Insurance CPSEs – Public shareholding in Government-owned companies is a means of ensuring higher levels of transparency and accountability. To promote this objective, the general insurance companies owned by the Government will be listed in the stock exchanges.

* Fiscal Deficit Targets – The fiscal deficit in RE 2015-16 and BE 2016-17 have been retained at 3.9% and 3.5% of GDP respectively. While doing so, I have ensured that the development agenda has not been compromised.

Relief to small tax payers:

Rebate u/s 87A Raised from Rs. 2,000 to Rs. 5,000 – In order to lessen tax burden on individuals with income not exceeding Rs. 5 lakhs, I propose to raise the ceiling of tax rebate under section 87A from Rs. 2,000 to Rs. 5,000. There are 2 crore tax payers in this category who will get a relief of Rs. 3,000 in their tax liability.

Deduction u/s 80GG Raised from Rs. 24,000 to Rs. 60,000 – The people who do not have any house of their own and also do not get any house rent allowance (HRA) from any employer today get a deduction of Rs. 24,000 per annum from their income to compensate them for the rent they pay. I propose to increase the limit of deduction in respect of rent paid under section 80GG from Rs. 24,000 per annum to Rs. 60,000 per annum, which should provide relief to those who live in rented houses.

Measures to boost growth and employment generation:

Cut in tax rates for new manufacturing companies – The new manufacturing companies which are incorporated on or after 1.3.2016 are proposed to be given an option to be taxed at 25% + surcharge and cess provided they do not claim profit linked or investment linked deductions and do not avail of investment allowance and accelerated depreciation.

Cut in corporate tax rates for small enterprises with up to Rs. 5 crore turnover – I also propose to lower the corporate income tax rate for the next financial year of relatively small enterprises i.e companies with turnover not exceeding Rs. 5 crore (in the financial year ending March 2015), to 29% plus surcharge and cess.

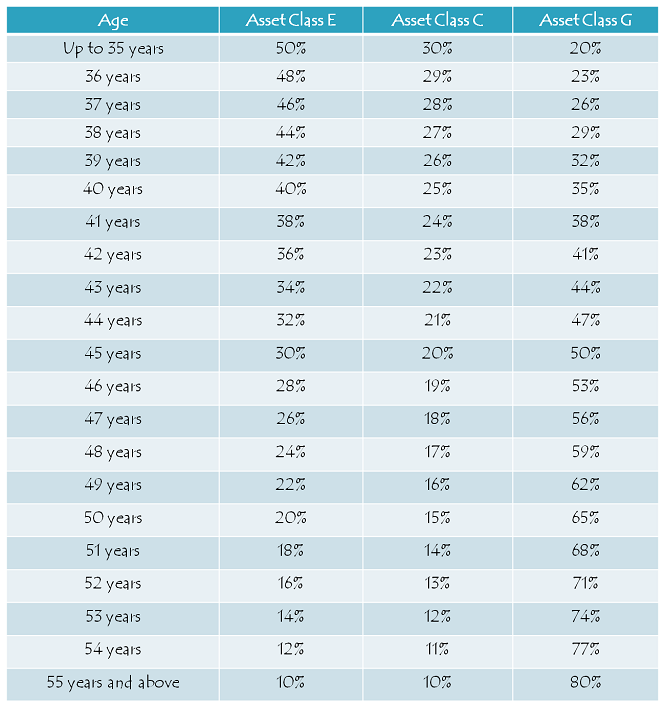

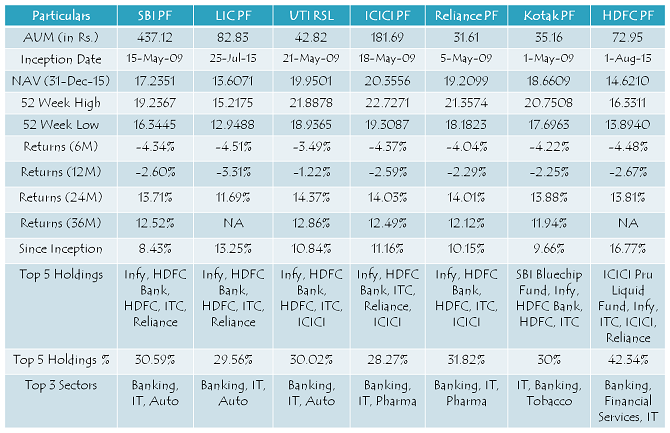

Measures for moving towards a pensioned society:

NPS Withdrawal Partially Tax Exempt Now – I propose to make withdrawal up to 40% of the corpus at the time of retirement tax exempt in the case of National Pension Scheme (NPS).

EPF Withdrawal Partially Taxable Now – In case of superannuation funds and recognized provident funds, including EPF, the same norm of 40% of corpus to be tax free will apply in respect of corpus created out of contributions made after 1.4.2016.

Annuity to Legal Heir Tax Exempt – Further, the annuity fund which goes to the legal heir after the death of pensioner will not be taxable in all three cases. Also, we are proposing a monetary limit for contribution of employer in recognized Provident and Superannuation Fund of Rs. 1.5 lakh per annum for taking tax benefit.

NPS/EPF Annuity Service Tax Exempt – I propose to exempt from service tax the Annuity services provided by the National Pension System (NPS) and Services provided by EPFO to employees.

Service Tax on Annuity Policies Reduced – I also propose to reduce service tax on Single premium Annuity (Insurance) Policies from 3.5% to 1.4% of the premium paid in certain cases.

Measures for promoting affordable housing:

Tax Incentives to First Time Home Buyers – For the ‘first – home buyers’, I propose to give deduction for additional interest of Rs. 50,000 per annum for loans up to Rs. 35 lakh sanctioned during the next financial year, provided the value of the house does not exceed Rs. 50 lakh.

Boost to REITs – I propose that any distribution made out of income of SPV to the REITs and INVITs having specified shareholding will not be subjected to Dividend Distribution Tax (DDT).

Additional resource mobilization for agriculture, rural economy and clean environment:

10% DDT on Rs. 10 Lakh Dividend Income – I propose that in addition to DDT paid by the companies, tax at the rate of 10% of gross amount of dividend will be payable by the recipients, that is, individuals, HUFs and firms receiving dividend in excess of Rs. 10 lakh per annum.

Hike in Surcharge from 12% to 15% – I also propose to raise the surcharge from 12% to 15% on persons, other than companies, firms and cooperative societies having income above Rs. 1 crore.

TCS of 1% on Cars & Luxury Goods – I also propose to collect tax at source at the rate of 1% on purchase of luxury cars exceeding value of Rs. 10 lakh and purchase of goods and services in cash exceeding Rs. 2 lakh.

Hike in STT on ‘Options’ – Rate of Securities Transaction tax (STT) in case of ‘Options’ is proposed to be increased from 0.017% to 0.05%.

Hike in Service Tax from 14.5% to 15% – I propose to impose a Cess, called the Krishi Kalyan Cess, @ 0.5% on all taxable services, proceeds of which would be exclusively used for financing initiatives relating to improvement of agriculture and welfare of farmers. The Cess will come into force with effect from 1st June 2016.

1% Infastructure Cess on Small Cars, 2.5% on Diesel Cars & 4% on Big Cars & SUVs – The pollution and traffic situation in Indian cities is a matter of concern. I propose to levy an infrastructure cess, of 1% on small petrol, LPG, CNG cars, 2.5% on diesel cars of certain capacity and 4% on other higher engine capacity vehicles and SUVs.

Hike in Excise Duty on Jewellery – I also propose to impose an excise duty of ‘1% without input tax credit or 12.5% with input tax credit’ on articles of jewellery.

There has been no change in the tax slab rates and tax deductions u/s 80C, 80D etc. So, no material change would be there as far as individual taxation is concerned. Some people would be disappointed about the EPF withdrawal getting taxable, but I think it was required to have a uniformity between EPF and NPS. So, I think it is a good move.

Moreover, as feared earlier, I think the budget did not have any major negatives in the form of long term capital gain (LTCG) tax on equity transactions or increasing the LTCG holding period to 3 years or a 2% hike in Service Tax. Finance Minister Mr. Arun Jaitley has tried to make a balance between the government’s financial constraints and the task of improving the growth momentum. Going forward, much will depend on the global economic conditions and how fast the government is able to push economic reforms.

Are you satisfied with Budget 2016? What could have been done to make it a good budget for you? Please share your thoughts about it here. If you need any clarification regarding any of the proposals, please let me know and I’ll try my best to answer it as soon as possible.