This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

We all want to save taxes. We all invest to save taxes. Some invest in PPF, some in ELSS, some in NSC, some invest in 5-year bank fixed deposits. But, we all know the maximum investment limit for saving tax under section 80C is Rs. 1,50,000. So, we all want to save more tax, over and above 80C. But, there are only a limited number of investment options which provide tax exemption other than 80C. One of those options is NPS – National Pension System.

Introduced in Budget 2015, your contribution in NPS can save you tax of up to Rs. 15,450, if you are in the highest tax bracket of 30%. NPS provides an additional deduction of Rs. 50,000 from your taxable income. Interested? Read on.

So, let’s start our journey to know more about this tax saving investment avenue and see whether it truly makes sense to invest in it or it is better to pay tax and invest in mutual funds to earn higher tax-free returns.

How to open an NPS account?

Online Account – There are 2 ways to open an NPS account online – one, directly through NPS Trust’s website and two, through an intermediary, like your bank, ICICI Direct, HDFC Securities etc.

Offline Mode – You can also approach a POS (Point of Service) and get this account opened.

Documents Required – PAN card copy, address proof copy, 2 passport-size photographs, investment cheque and Duly Filled Subscriber Registration Form.

Exclusive Tax Benefit u/s 80CCD (1B)

If you decide to invest in NPS, you can avail a tax exemption of Rs. 50,000 from your taxable income. As the minimum investment requirement is Rs. 6,000, you can contribute any amount between Rs. 6,000 and Rs. 50,000 to save tax.

Which Account is eligible for Rs. 50,000 Deduction – Tier I or Tier II? – Your contribution to Tier I account is eligible for up to Rs. 50,000 tax deduction u/s 80CCD (1B). Tier II account does not entitle you to any tax deduction.

Minimum/Maximum Annual Contribution – As per the NPS rules, you need to contribute at least Rs. 6,000 in this account in a financial year. However, you can do so in multiple instalments and minimum contribution in a single contribution is Rs. 500.

However, there is no upper limit on your contribution to NPS. You can contribute any amount to your NPS account. But, as far as tax benefit is concerned, you can have only up to Rs. 50,000 in tax deduction.

Six/Seven Pension Fund Managers – These are the pension fund managers (PFMs) which are managing the subscribers’ money in NPS at present.

- HDFC Pension Management Company

- LIC Pension Fund

- ICICI Prudential Pension Fund

- Kotak Mahindra Pension Fund

- Reliance Pension Fund

- SBI Pension Fund

- UTI Retirement Solutions

Seven Annuity Service Providers – These are the insurance companies which would provide you pension as you retire at 60 years of age.

- Life Insurance Corporation of India (LIC)

- SBI Life Insurance

- ICICI Prudential Life Insurance

- Bajaj Allianz Life Insurance

- Star-Daichi Life Insurance

- Reliance Life Insurance

- HDFC Standard Life Insurance

Where your money gets Invested? – Your NPS contribution will get invested in Equity (E), Government Securities (G) or Corporate Debt Securities (C) either as per your own choice (Active Choice) or as per your age (Auto Choice).

Active Choice – Under “Active Choice”, you can have your money invested in these three asset classes as per your own choice. You can allocate your money among these three asset classes (E, G or C), but there is a cap of 50% for Equity (E) investment allocation.

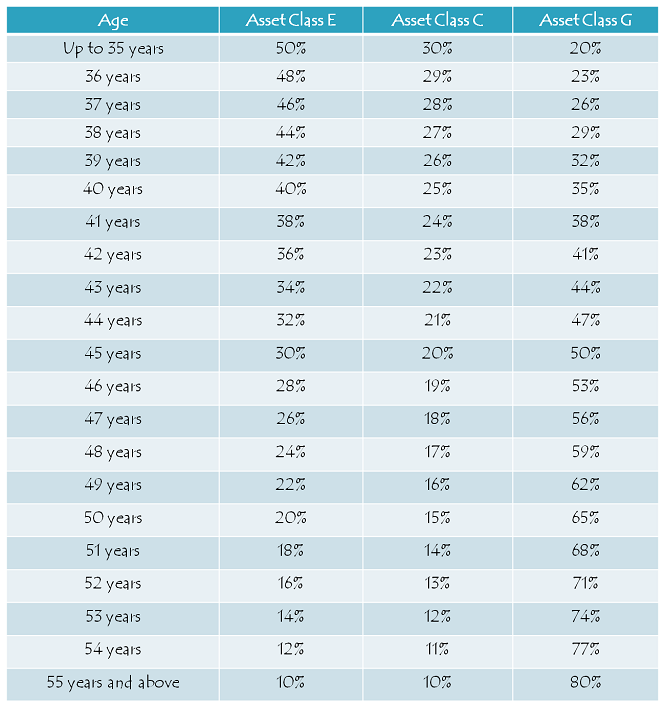

Auto Choice – Under “Auto Choice”, your money gets invested based on your age i.e. the higher your age as the subscriber, the lower would be the allocation for Equity.

Returns – As NPS is completely market driven, there is no guaranteed/defined return in this pension scheme. Returns get accumulated throughout its tenure and get paid as annuity or lump sum benefit on maturity.

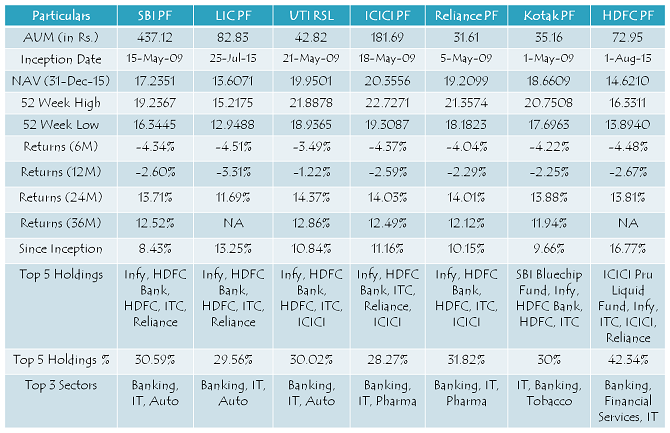

Historical Equity Returns of NPS (Returns as on 31st December, 2015)

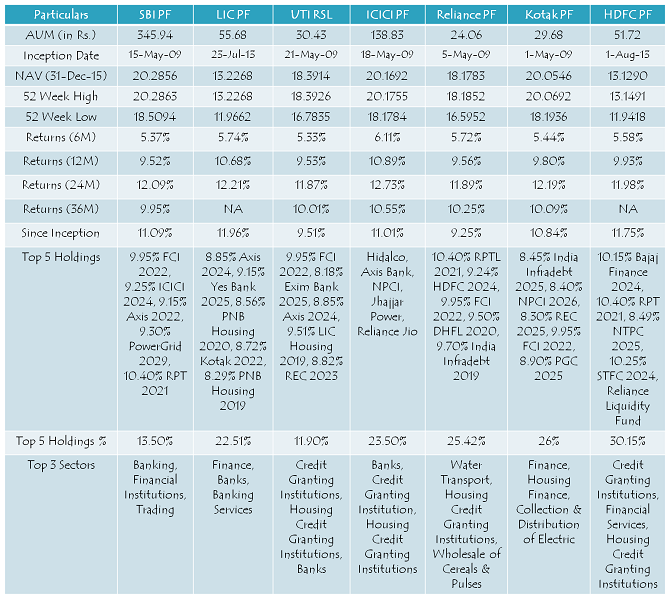

Historical Corporate Debt Returns of NPS (Returns as on 31st December, 2015)

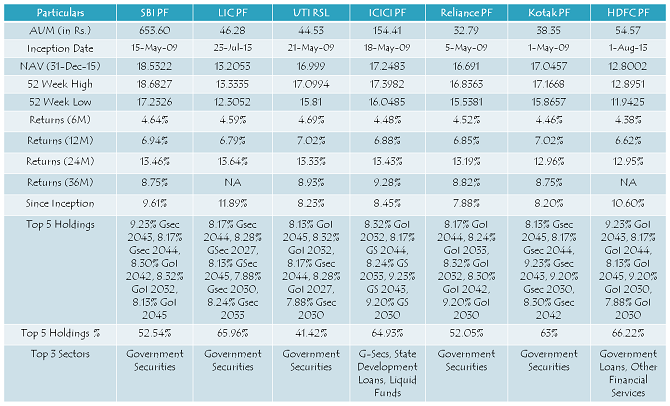

Historical Government Securities Returns of NPS (Returns as on 31st December, 2015)

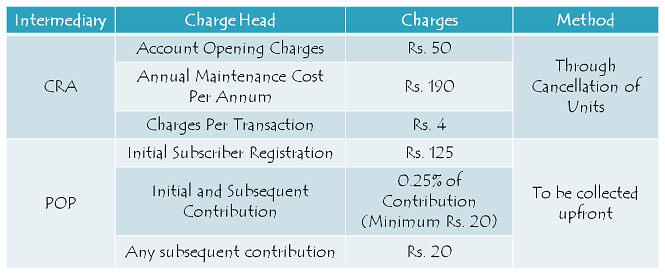

Charges – This account attracts a processing charge of 0.25% of your contribution amount, subject to a minimum charge of Rs. 20, plus service tax as applicable. So, if you contribute Rs. 6,000, then Rs. 20 + service tax will be the charges. In case your contribution is Rs. 50,000, then a charge of Rs. 125 + service tax will be deducted from your account.

Exit – As you turn 60, you will be required to use at least 40% (maximum 100%) of your accumulated savings to buy a life annuity from an insurance company. Rest 60% or less, you can withdraw as lump sum amount. If you decide to exit before 60 years of age, you will have to buy an annuity with 80% of your accumulated savings, rest 20% amount you can withdraw as the lump sum benefit. Both, annuity income as well as the lump sum withdrawal, will be taxable.

In case of death before 60 years of age, entire pension corpus will be paid to the nominee of the subscriber.

Should you invest in NPS?

Please check this post – Should you invest in NPS Post Budget 2016?

Also, if you think I have missed to cover any important aspect(s) of NPS, then please share it here, I’ll try to include it in the post above.

1. If LIC premium paid by Wife by Cheque and policy under her name. Can Husband claim deduction u/s 80C from his ITR?

2. If LIC premium paid by Wife by CASH and policy under her name. Can Husband claim deduction u/s 80C from his ITR?

Note:- Wife is a House wife or not claim LIC deduction from her ITR.

i am govt. employee since 2001 & under old pension scheme under GPF. Can open NPS account and avail 50000 rs. rebate in 80ccd(1B). PLEASE CLARIFY.

sir my ppf invedtment is 150000.

my employe deduction in nps id 117000.

can i take 200000 lac tax benifit.

ppf 150000.employee contribution 117000. can i take benifit of 50000 of 80ccd 1b

hi

my query is about wrong entry in my NPS Account.

Actually in my NPS account there was two time entry for same month and it happen for two month. what is procedure to correct it.

Hello Shiv, Can you please describe the details about u/s80ccd(2) & u/s80cce for NPS.

Dear Sir

My question to you is, I am a teacher in a gov. Added school and there’s a 50000 plus deduction towards nps tire 1. So when i file returns can put this deduction under 80CCD(1) and the reaming 1.5 Lks so total 2Lks.

Kindly guide me about the same

sir, i am a central government employee under nps. I invested 160000 rs ( in ppf, pli and lic), and 110000 in nps which is 10 percentage of my gross salary. Now i want to know that can i avail additional tax benefit of 50000 rs under 80ccd1b in 110000 rs from nps.

please suggest me.

Regards

How can I know that how much money my nps account have please tell me..

My query is about Swavalamban Scheme

I have read somewhere that contribution has no upper limit

Secondly i am depositing money 12000/- per year from last 3 years, but till date i do not know about the status of my contribution.

I am having PRAN No.

Where do i check the status.

Kindly help me.

whether we can transfer money from pnb thro net banking as pnb is not included for making payment.

whether we can transfer money from pnb gmail.comthro net banki

sir i am bank employee since 1999 having pension option.now my query is that can i open NPS for which i can get income tax deduction under 80 cc(d). please clarify

Dear Mr. Shiv,

can you please clear, that a private sector employee can open NPS account individually to avail additional benefit Rs.50000/- u/s 80ccd who is already a member of EPF.

I am working as Sr. Manager in a private limited company and also a member of EPF, 12% my contribution and 12% employer contibutes. Now I have consumed 150000/- u/s 80c and 25000 u/s 80D, can I eligible to invest individually in NPS to get additional benefit u/s 80ccd(1), 80ccD(2) and how much should I invest?

please advice

regards

Kuljeet Singh

I would like to invest in NPS at the age of 57+.What is my option after 60 years with tax.Kindly explain

i am in state gov job..and 10% of gross salary is already deducted at source to nps account.

i want to deposit more 50000 beyond 1.5lakh savings..

how should i proceed ?

i am bank employee and my own contribution(emloyee contribution) to tier-I is 60000/- which is contribution through my salary and i have invested rs.1.5 lakh in 80cc beside this 60000/-.can i claim tax benefit of rs.50000/- out of this 60000/- under sec 80ccd(1b) or i will have to invest additional 50000/- to avail tax benefit of 50000/- under 80 ccd(1b).please guide me.

Dear Sir,

i am haryana state govt. employee & joined in govt. job in dec. 2008. govt. deduct 10%of (basic+da) from my salary which is around 5200 rs. per month & deposit in my NPS account tier-1 . 1 had invested 150000(one lack fifty thousand) in ppf account in may 2017. pl. guide can i consider nps amount 5200×12=62400 out of which 50000 rs. under 80CCD(1B ) or i have to deposit 50000 additional to take rebate under 80ccd(1b).

Regards

Rajiv Gupta

9416338855

Sir,

I am a Central Government Employee, joined after 01-04-2004, thus falls in NPS. Deduction in Tier-1 account is approx Rs. 65,000/- . If I deposit in PPF a/c Rs. 1,50,000/- then will I be eligible to claim Rs. 50,000/- as deduction in 80CCD(1B) out of that Rs. 65,000/- deposited in Tier-1 account.

My date of birth is 9th Feb 1945

Can I join this fund for the benefit of income tax under 80(CCD(1b)