This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

2016 so far has seen a good amount of volatility in all the major financial markets in the world. The main cause of this volatility has been China. After having many years of high GDP growth, Chinese economy is taking a breather. How long this slowdown would last, it is something which only God can answer. In these uncertain times, risk averse investors want safety of their hard earned money and tax efficiency of their investments. Tax Free Bonds fulfil both of these requirements.

To satisfy our hunger for tax-free bonds, IRFC will join the company of NABARD from Thursday, March 10th. The issue will remain open for just 3 days to get closed on March 14. This is the shortest period of time a company has decided to keep its issue open even before it actually opens. It seems the merchant bankers are confident enough to get the required subscription numbers within a day or two, and we all know that they are right in their calculations.

Here are the salient features of IRFC Tranche II of Tax Free Bonds:

Size of the Issue – Indian Railways has been spending a huge amount on expanding its network and upgrading its existing infrastructure. IRFC is one of the sources through which Indian Railways gets its required funds for such high expenditure. IRFC has already raised Rs. 7,050 crore in the current financial year by issuing these tax-free bonds. To partly meet its funds requirements, IRFC will raise another Rs. 2,450 crore in this issue.

Rating of the Issue – CRISIL, ICRA and CARE have assigned ‘AAA’ rating to this issue and consider it to be the safest from timely payment of its debt obligations, including interest and principal investment. Moreover, these bonds are ‘Secured’ in nature and certain fixed assets of the company will be charged equivalent to the outstanding amount of the bonds.

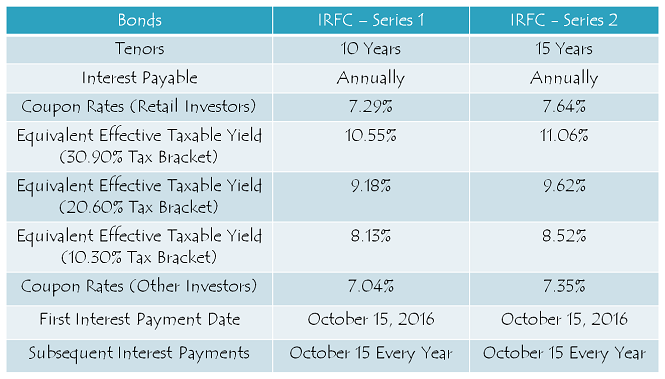

Coupon Rates on Offer – IRFC is offering yearly interest rate of 7.29% for its 10-year option and 7.64% for the 15-year option to the retail investors investing less than or equal to Rs. 10 lakh. These rates exactly match the rates offered by NABARD in its issue which is getting launched today.

For the non-retail investors, coupon rates will be lower by 25 basis points (or 0.25%) for the 10-year option at 7.04% and 29 basis points (or 0.29%) for the 15-year option at 7.35%.

NRI/FPI/QFI Investment Allowed – This issue will try to quench the thirst of some Non-Resident Indians (NRIs), Foreign Portfolio Investors (FPIs) and Qualified Foreign Investors (QFIs) as they have been allowed to invest in this issue either on a repatriation basis or a non-repatriation basis.

Investor Categories & Allocation Ratio – As compared to the earlier issues, this issue has a higher percentage allocation of 60% for the retail investors and as compared to the NABARD issue, a slightly higher percentage allocation of 15% for the high networth investors.

As always, the investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 10% of the issue is reserved i.e. Rs. 245 crore

Category II – Non-Institutional Investors (NIIs) – 15% of the issue is reserved i.e. Rs. 367.50 crore

Category III – High Net Worth Individuals including HUFs – 15% of the issue is reserved i.e. Rs. 367.50 crore

Category IV – Resident Indian Individuals including HUFs – 60% of the issue is reserved i.e. Rs. 1,470 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first served (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

Listing & Allotment – IRFC has decided to get these bonds listed on both the stock exchanges i.e. on the National Stock Exchange (NSE) as well as on the Bombay Stock Exchange (BSE). The bonds will get allotted and listed within 12 working days from the closing date of the issue.

Demat Account Not Mandatory – It is not mandatory to have a demat account to apply for these bonds. Investors have the option to subscribe to these bonds in physical form also. Whether you apply for these bonds in demat or physical form, the interest payment will still get credited to your bank account through ECS.

Also, even if you get these bonds allotted in an electronic form and sometime in future you decide to close your demat account, you will have the option to get them rematerialized in physical/certificate form.

No Lock-In Period – These tax-free bonds are freely tradable and do not carry any lock-in period. The investors may sell them at the market price whenever they want after these bonds get listed on the NSE and BSE.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – IRFC will make its first interest payment on October 15 this year. Subsequent interest payments will also be made on October 15 every year.

Should you invest in this issue?

For a large number of retail investors, tax-free bonds have remained their favourite investment option for all these years since they first got allowed to be issued in 2011-12. As the finance ministry has decided to end this channel of fund raising for all these big and reliable government companies in the infrastructure financing or development space, we all have been very disappointed.

But, there is nothing we can do about it. The only thing we can do is to utilise these last couple of opportunities to subscribe to these bonds and just hope for the government to reintroduce these bonds again in the next year’s budget. Till then, risk-averse investors should subscribe to these bonds and other investors should invest their money in good mutual funds for infrastructure development to gather pace through a different funding channel.

Application Form for IRFC & NABARD Tax Free Bonds – Resident Indians and NRIs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in IRFC or NABARD tax-free bonds, you can contact/whatsapp me at +919811797407 or mail me at skukreja@investitude.co.in

Sir,

Can we get 100 % allocation in IRFC retail for day 1 closing.

Very high probability of 100% allotment for Day 1 applicants.

What is the cut off time of the day? 5 pm or midnight?

Cut Off time is 5 p.m.

Don’t know what is the difference between “bid details” and “demand schedule”. The numbers don’t match.

http://www.bseindia.com/markets/publicIssues/DisplayIPO.aspx?id=1076&type=DPI&idtype=1&status=L&IPONo=1152&startdt=3%2f10%2f2016

You should focus on the Demand Schedule.

What is the correct issue size of IRFC 2450 crores or 5000 crores? Earlier post says 2450 crores, whereas bse link shows total of 5000 crores.

It is not Rs. 5,000 crore, it is Rs. 500 crore. Total issue size is Rs. 2,450 crore.

True..decimal error..

Surprise! IRFC retail portion is already oversubscribed 1.34 times at 1 pm today and NABARD issue is still not fully subscribed.

1.34 times subscription is misleading, it is based on Rs. 500 crore base issue size, whereas actual issue size is Rs. 2,450 crore.

It shows subscription of 4147147 against the size of 3000000. Hence 1.38 times. The number of 3000000 does not make sense.

http://www.bseindia.com/markets/publicIssues/BSEcumu_demand.aspx?ID=1076

I think their base is 500 crores. Hence 60% of it is 300 crores. Anyway it does not match with 60% of 2450 crores which is 1470 crores.

what is the expected listing price of 7.64% IRFC TFB

It should list between Rs. 1,010 and Rs. 1,020.

can i expect listing price of 1050 looking to subscription from other category e.g. banks etc.??

Good start means chances of 100% allotment?

I think there would be 100% allotment against Day 1 applications and probably Day 2 as well.

How response to IRFC bond..?my

Internet speed is very slow..

Hi PS,

It is subscribed by Rs. 326.79 crore in the retail category at 12:27 p.m.

84% subscribed in Cat 4. Not sure if Day 1 will get 100% allocation.

And NABARD has hardly moved to 76%.

correction… 84 is based on issue size of 500 crores…

so numbers are not very good…or really good if you want 100% allocation

That’s right nn!

http://economictimes.indiatimes.com/markets/bonds/irfc-tax-free-bonds-subscribed-fully-in-first-hour-nabard-issue-too-a-big-hit/articleshow/51339182.cms

This is a complete non-sense. They write articles and sensationalise it without having knowledge about it. Issue is of Rs. 2,450 crore and they are saying it got oversubscribed within an hour considering the base issue size of Rs. 500 crore only. Half knowledge is dangerous most of the times.

Shiv Ji can you give us the link for the status.

Here you have the BSE link – http://www.bseindia.com/markets/publicIssues/BSEcumu_demand.aspx?ID=1076

And this why they are called Presstitutes.

Hi Shiv

Any idea what has been the retail subscription rate for NABARD on day 1 ?

Can we expect 100% allotment if we have invested on day 1 ?

Regards

Girish

Yes Mr. Joshi, all Day 1 applicants will get 100% allotment.

good start isn’t it shiv

Not a good start I would say.

Dear Shiv Kukreja ji,

Thank you for valuable guidence.

Always on Time Updates.

Tax Free Bond investments helps in my retirement.

I Appreciate your cooperation.

God Bless You.

Thank you PS for your kind words!

Thanks a ton Shiv for your blog. It is helping us to take right decision.

Thanks Pankaj!

would be highly elated with such high allotment % ….

One request , Can u make a post on all the TFB issued in FY 2015-16 w.r.t. the date of allotment and their payment of interest dates, the way you made for the previous yrs..

Also i would like to thank you from the bottom of my heart for sharing such an invaluable source of knowledge of financial tips for many readers like us and responding to each and every comment with due dedication and devotion. May this blog grow by leap and bounds….

Thanks Aashish! 🙂

I’ll soon do a post covering all relevant details about this year’s tax-free bonds.

Hi Shiv,

Appreciate for sharing this detailed article and prompt responses. If I miss this golden opportunity in investing these tax free bonds (as I have missed earlier and just applied for NABARD yesterday), are there any chances in investing in the same after they have been listed in NSE/BSE thru my demat account (without worrying about these deadlines). If so will that investment still better than a current highest paid bank FD of around 8% for individuals who are in 30% tax bracket. Please respond. Thanks.

Hi Shankar,

Yes, it is definitely possible to buy/sell these bonds in the secondary markets. These bonds are way superior to the fixed deposits, post office schemes (except PPF) from tax efficiency point of view for the investors in the 30% tax bracket.

Hi Shiv, what’s the expected allocation for application on day 1 for IRFC on 10th March?

Can one expect 100% allocation?

Hi SG,

I think one should get 90-100% allotment.

Yes Shiv. I also feel chances of 80-100% considering that a portion of Nabard still to be subscribed. Once again Big Thanks to you for this forum which focusses on TFB so much and your analysis on each issue. Most of the time you was spot on.Not sure when we can expect another TFB season.

Thank you Mr.Shiv Kukreja. Have been following your forum since 2013. Helped me during my retirement. Appreciate your contribution

Thanks Christy!

Thanks a lot George for your motivation and contribution to this forum! 🙂

Hi Shiv,

Thanks for the updates, hope to get 100% allocation in Retail category.

Hi Nagarajan,

Let’s hope for 100% allotment.

Looking at the subscription figures and the rate at which retail category in NABARD spiked after 4pm i.e. after refunds, looks like the retail category of Rs. 1,470 crores in IRFC might take place with a 60-65 % allotment.

Any thoughts Shiv…

Hi Ashish,

I don’t think IRFC issue will have such a high subscription to have only 60-65% allotment. I think it should fall in the range of Rs. 1,200 crore to Rs. 1,600 crore. So, 90-100% allotment for the retail investors who apply for it on the first day.

would be highly elated with such high allotment % ….

One request , Can u make a post on all the TFB issued in FY 2015-16 w.r.t. the date of allotment and their payment of interest dates, the way you made for the previous yrs..

Also i would like to thank you from the bottom of my heart for sharing such an invaluable source of knowledge of financial tips for many readers like us and responding to each and every comment with due dedication and devotion. May this blog grow by leap and bounds….

would be highly elated with such high allotment % ….

One request , Can u make a post on all the TFB’s issued in FY 2015-16 w.r.t. the date of allotment and their payment of interest dates, the way you made for the previous yrs..

Also i would like to thank you from the bottom of my heart for parting such an invaluable source of knowledge of financial tips for many readers like us and responding to each and every comment with due dedication and devotion. May this blog grow by leap and bounds….

Thanks Aashish for your kind words! 🙂

I’ll soon do a post on all the tax-free bonds issued during 2015-16.

Hi Shiv, Any more TFB issues coming up this year? Thanks.

Hi Shiv, thanks for the article. Any idea about NHAI refunds. Want to use it for IRFC. Also, any expected allocation. Suppose if i apply for 3 lacs. Expected lot that i get in retail category.

TIA

Hi Vinit,

NHAI refund process has started, you’ll get soon get your refund amount credited in your bank account. You can expect allotment of around 88% i.e. Rs. 2,64,000 or 264 bonds of Rs. 1,000 each.

Thanks for the response Shiv, one more thing please. If i don’t get the refund of NHAI by tomorrow, then i will be applying for IRFC for whatever amount i have as of now. Is it possible to again submit the request for some more amount on 11th?

Hi Vinit,

That is something you need to check with your broker. I think broking companies do not allow online submission of multiple applications. However, you can submit multiple applications in physical form.

Thanks Shiv. Any idea when are we likely to get HUDCO Refund back. Could be of use in IRFC TFB’s.

You are welcome Mr. Joshi! HUDCO refunds are expected by Friday or Monday morning.

Thanks Shiv for this post.

You are welcome KS!