This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Markets are often driven by sentiment and there is a slump in the real estate market these days due to negative sentiment. There is a drastic fall in the number of sale-purchase transactions which has resulted in an overdue price correction and squeezed the liquidity from this market. The same liquidity seems to be flowing now to equity and debt markets. Such high levels of liquidity flows have resulted in stock markets and bond prices to touch their 52-week highs.

Encouraged by super demand for two back to back NCD issues of DHFL, SREI Infrastructure Finance Limited is coming out with its issue of non-convertible debentures (NCDs) from this Wednesday, September 7. The issue is scheduled to remain open for three weeks to get closed on September 28.

Size & Objective of the Issue – Base size of this issue is Rs. 250 crore, with the green-shoe option to retain an additional Rs. 750 crore, making it a Rs. 1,000 crore issue. The company plans to use at least 75% of the issue proceeds for its lending activities and to repay its existing loans and up to 25% of the proceeds for general corporate purposes.

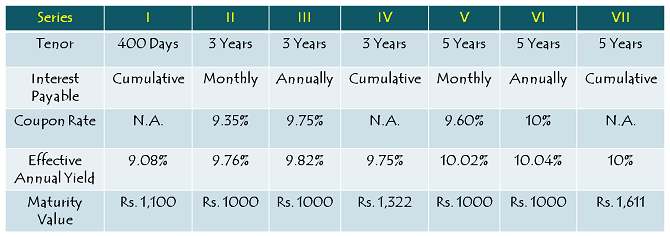

Coupon Rate & Tenor of the Issue – The issue will carry coupon rate of 9.35% p.a. payable monthly and 9.75% p.a. payable annually or cumulative for a period of 3 years (36 months) and 9.60% p.a. payable monthly and 10% p.a. payable annually or cumulative for a period of 5 years (60 months). There is one more option of 400 days which offers an effective annual yield of 9.08%.

Minimum Investment – Investors need to apply for a minimum of ten bonds in this issue with face value Rs. 1,000 each i.e. a minimum investment of Rs. 10,000.

Categories of Investors & Allocation Ratio – The investors have been classified in the following three categories and each category will have the below mentioned percentage fixed in the allotment:

Category I – Institutional Investors – 20% of the issue i.e. Rs. 200 crore

Category II – Non-Institutional Investors – 20% of the issue i.e. Rs. 200 crore

Category III – Individual & HUF Investors – 60% of the issue i.e. Rs. 600 crore

Allotment will be made on a first-come first-served basis, as well as on a date priority basis i.e. on the date of oversubscription, the allotment will be made on a proportionate basis to all the applicants of that day on which it gets oversubscribed.

NRIs Not Allowed – Non-Resident Indians (NRIs), foreign nationals and qualified foreign investors (QFIs) among others are not eligible to invest in this issue.

Credit Rating & Nature of NCDs – Brickwork Ratings has rated this issue as ‘AA+’. Debt instruments with such a rating are considered to have high degree of safety regarding timely payment of interest and principal. Moreover, these NCDs are ‘Secured’ in nature i.e. in case of any default on its payment of interest or principal, the bondholders will have the right on certain secured assets of SREI Infra.

Listing, Premature Withdrawal & Put/Call Option – These NCDs will be listed on both the stock exchanges i.e. Bombay Stock Exchange (BSE) as well as National Stock Exchange (NSE). The listing will take place within 12 working days after the issue gets closed. Though there is no option of a premature redemption, the investors can sell these bonds on the stock exchanges if NCDs are held in demat form.

Demat Not Mandatory – Demat account is not mandatory to invest in these NCDs as the investors have the option to apply for these NCDs in physical or certificate form as well.

TDS – Interest income earned is taxable with these NCDs and the investors are required to pay tax on the interest income as per their respective tax slabs. TDS @ 10% will be deducted if these NCDs are held in physical/certificate form and annual interest income is more than Rs. 5,000. NCDs held in demat mode will not attract any TDS.

Should you invest in these NCDs?

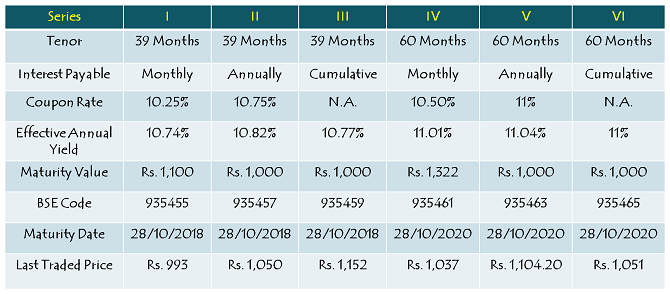

SREI Infra had its last NCD issue in July 2015. Below pasted is the table having issue details, BSE scrip codes and last traded prices of those NCDs.

SREI Infra NCDs always carry low volumes and that is why it is very difficult to calculate its relevant yield to maturity (YTM) for the interested investors. But, If I were to invest in SREI Infra’s NCDs, I would have bought them from the secondary markets as I think it is possible to invest in these NCDs at a YTM between 10.50% and 11.50%. Its current issue offers coupon rates between 9.35% and 10% which are not attractive for me to invest. However, conservative investors, who are not liable to pay any tax or fall in the 10% tax bracket or who trust SREI Infra’s management, can consider investing in these NCDs.

Application Form – SREI Infra NCDs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in SREI Infra NCDs, you can reach us at +91-9811797407

respected Dr Kukreja

Please see your reply to Vanita on 7-9-16 where you say, looking at the subscription figures big/smart investors are preferring DHFL over Srei.

Did you ever ponder before expressing out this verdict, is not something

like ‘BHED CHAH’ in hindi proverb.And Bheds are bhed that every one knows.

Secondly you have mentioned the subscription figures dubious intentionally so a to a discourage the customers from buying the srei ncd. srei ncd basically was subscribed

for receiving Rs 250/ cr from public and if get excess than the cap was Rs1000/ cr.Upto 9/9/16 they have recd Rs343.45cr as against Re250/cr as per your report dated 9/9/16.SERI needed Re250/cr as per criterion.

Then how did you dare make a comparison of the subscription with the cap amount Re 1000/cr.they needed Re250/cr and have recd Re343.45cr

My earnest request to you is to study the matter deeply and then try to help the innocent persons sincerely w/o any grudge against any co.srei has got a very high response from public and may get Re1000/cr before time.

warm regards

shiv charan sharma

Hi Mr. Sharma,

I have no grudge against SREI Infra and I am in no way linked to DHFL or Indiabulls Housing Finance or any other company analysed. I have expressed my unbiased views in the post above, based on my knowledge and whatever experience I have. You have full right to disagree with my views and you are most welcome to express your views here. But, you need to be careful while choosing your words. Thanks!

Day 3 (September 9) Subscription Figures:

Category I – Rs. 1.1 lakh as against Rs. 200 crore reserved

Category II – Rs. 8.13 crore as against Rs. 200 crore reserved – 0.04 times

Category III – Rs. 163.05 crore as against Rs. 600 crore reserved – 0.27 times

Total Subscription – Rs. 171.18 crore as against total issue size of Rs. 1,000 crore – 0.17 times

HPL Electric & Power Ltd IPO

More info@ https://www.moneydial.com/hpl-electric-power-ltd-ipo/

HPL Electric & Power Ltd IPO

More info @ https://www.moneydial.com/hpl-electric-power-ltd-ipo/

Srei Infrastructure Finance ltd (SREI) – Non- Convertible Debentures (NCD)

More info @ https://www.moneydial.com/srei-infrastructure-finance-ltd-srei-non-convertible-debentures-ncd/

Day 2 (September 8) Subscription Figures:

Category I – Rs. 70,000 as against Rs. 200 crore reserved

Category II – Rs. 7.51 crore as against Rs. 200 crore reserved – 0.04 times

Category III – Rs. 145.10 crore as against Rs. 600 crore reserved – 0.24 times

Total Subscription – Rs. 152.62 crore as against total issue size of Rs. 1,000 crore – 0.15 times

Thanks Shiv sir.I just feel Dewan is shady..like a Mallya. Its not a Tata or Godrej .

Any pointers or tips on how to learn analysis of a stock / company so as to take a decision to invest or not.Pls share.

Hi Vanita,

Stock analysis requires deep understanding of financials and valuations. Tips don’t always work. Read some books on stock analysis, create a dummy portfolio to begin with and start investing small-small money in the companies your understand.

SHREI applications forms are not available with Karvy. They are down loading from Net and filling up details of bank is difficult for want of space. Wher can I get a printed form? Can anyone help me.

Hi Shekar,

Here you have the link to download the pre-printed forms (Broker Code – 155929):

http://edelweisspartners.com/formprinting/IPO_Entry_Form.aspx

Hello dear shiv, from where do u find this subscription details? Kindly provide the link and can i expect any kind of listing gain from this issue.

Thanks Sir for the reply.I guess the smart investors are right but I don’t know why I find it difficult to put my trust in the Dewan name.I don’t think they are reliable ,principled or safe company/ institution. That’s why I let the opportunity go by.And am now mulling over whether to put some money in Srei.

Hi Vanita,

I understand that it is difficult to trust a brand which you have never dealt with or whose product/service you have never used. But, basing your trust just in the brand name doesn’t make sense either. If that is the case, I would never eat anything from Haldiram. However, if you have analysed the company/management properly, then you should trust your analysis and nothing else.

Respected shiv Kukreja I got information via SMS from KSBL about10%

issue please tell me if I invest 250ooo.00(two lakh fifty thousand haw

much amount we shell gate after five years .Is this offer garented according SEBI

Also, SEBI never provides any kind of guarantee to such offers.

Respected shiv Kukreja I got infrmation via SMS from KSBL about10%

issue please tell me if I invest 250ooo.00(two lakh fifty thousand haw

much amount we shell gate after five years .Is this offer garented according SEBI

Hi Asim,

Please check the 1st table above for SREI’s maturity values.

Hello Sir,

Is DHFL a better NCD to invest in than SREI?

Hi Vanita,

Looking at the subscription figures, it seems big/smart investors are preferring DHFL over SREI. So, I think it is safe to assume DHFL’s NCDs are better investment than SREI’s NCDs.

Day 1 (September 7) Subscription Figures:

Category I – Rs. 70,000 as against Rs. 200 crore reserved

Category II – Rs. 7.22 crore as against Rs. 200 crore reserved – 0.04 times

Category III – Rs. 117.48 crore as against Rs. 600 crore reserved – 0.20 times

Total Subscription – Rs. 124.71 crore as against total issue size of Rs. 1,000 crore – 0.12 times

Thanks for the info Shiv.

Thanks Ikjot!

Very poor response to NCD..why is so shiv??

Seems investors are still scared of the infrastructure sector. In the past as well, investors have avoided SREI’s debt paper.

Hi Shiv,

Thanks for the info, Can we have today’s subscription figures please.

Hi Ikjot,

Bidding is still going on, will update it after 5 p.m.

Sir,

suppose i invested 10,000.00 how many i get after maturity.

Hi Ankit,

You will get Rs. 11,000 with Series I, Rs. 13,220 with Series IV and Rs. 16,110 with Series VII. Check the maturity values in the table above.

Sir, Thanks for keeping us updated on SREI NCD. As my only earnings are from Deposits, NCDs etc I keep looking at these issues and have difficulty in understanding this term YTM.

Pls tell me, if my assumptons are right to buy a NCD.

NCD IPO price: 1000

RoI : 10% annual

Listed/current price : 1100

Next int payment date: 31.03.2017

If I have to buy this NCD from secondary market today, need to shell out 1100+brokerage ie., 1150 (approx) So I paid 150/ more than principle while I get 100 in next 6mnths, since interest payment by march2017 >> implies it fetches 200/ if weighed on yearly basis.

so, 200 – 150 = +50/ for me in this transaction. Hence I can buy this instrument (assuming it got good rating for safety etc)

Dear Shiv,

1. What is your opinion about trustworthiness of this company and rating given by only one rating agency

2. How are the financials of this company

Thanks

Hi TCB,

1. Though it seems SREI’s management is dedicated, I don’t think they are dynamic. Had this issue been rated by more than one rating agency, then I think it would been rated ‘AA’, like its last issue.

2. Financials of the company are not great, but expected to improve going forward.

I must say, your posts are in-depth informative, specially, like your secondary market analysis on bonds.

Thanks Debashree!

will try to buy from secondary market. Dear shiv and more NCD coming near by ??

Hi Abhinav,

Indiabulls Housing Finance NCD issue is also expected this month. Lets see when it decides to launch it.

Thank you for details on this upcoming IPO. Like your addition of last year’s NCD by SREI for comparison. Those NCDs from July 2015 have appreciated a lot, now trading at 1104.20 (5-year, 11% annual). For this NCD, YTM is 7.86%. So, I would rather subscribe to the latest IPO which yields 10% annually (5-year, 1000 rupees) and save on the brokerage.

Thanks Kris!

I don’t think Rs. 1104.20 is a reliable price to interpret its intrinsic value. As I write, there is a buyer for these NCDs at Rs. 1,047 and a seller at Rs. 1,090. If I compare Rs. 1,104.20 with Rs. 1,051 of the cumulative option, then in no way Rs. 1,104.20 price is justified. Price of the yearly interest option must be less than the price of the cumulative option by at least 4-5%. Considering this price anomaly, I don’t think your way of comparing these two NCDs is correct.

Thanks Shiv, I used the number 1104.20 from your table above under “Last Traded Price”. Also, it is difficult to get a good feel for price actions since bond trading volume is low and the spread between bid and ask is wide. Hopefully soon we will have a robust bond market that should remove the anomaly you mentioned.

Sreiv ncd issue is CLOSED?

No, SREI issue is still open.