This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Demonetisation has resulted in a flood of liquidity in the Indian banking system and nobody is able to decide when to channelise such excess liquidity in a scenario where there is no demand for money for any new project and even for the existing ones. Banks and lending institutions are struggling to find takers for their loans as the prospective borrowers are also struggling to see any light at the end of this long and uncertain tunnel. But, as we know all bad times end with good times, this period of bad time will also pass away very soon.

Amidst this uncertainty, Reliance Home Finance Limited, a subsidiary of ADAG group’s Reliance Capital Limited, is coming out with its issue of non-convertible debentures (NCDs) from today. The company is offering interest rates in the range of 8.90% to 9.40% to the individual investors, for an investment period of 3 to 15 years.

The company plans to raise Rs. 3,500 crore in this issue and it is scheduled to close on January 6, 2017.

Here are some of the salient features of this issue:

Size & Objective of the Issue – The company plans to raise Rs. 3,500 crore from this issue, including the green shoe option of Rs. 2,500 crore. The company plans to use at least 75% of the issue proceeds for its lending and financing activities and to repay interest and principal of its existing borrowings and a maximum of 25% of the issue proceeds for other general corporate purposes.

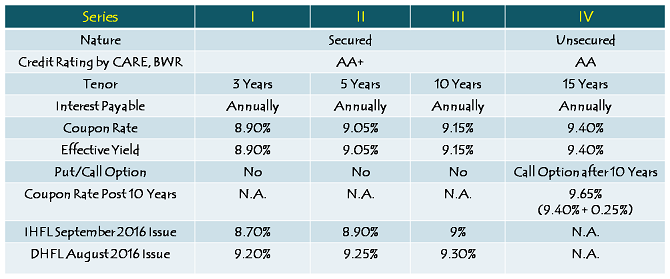

Coupon Rate & Tenor of the Issue – The issue will carry a coupon rate of 8.90% p.a. for a period of 3 years (36 months), 9.05% p.a. for 5 years (60 months), 9.15% p.a. for 10 years (120 months) and 9.40% p.a. for 15 years (180 months). Interest will be paid on an annual basis and there is no option to get interest on a monthly or cumulative basis.

Call Option – It should be noted here that RHFL will have the right to call back Series IV NCDs at the end of 10 years from the date of issuance. The company will primarily do so if interest rates fall from here and it is able to raise money cheaply 10 years from now. However, if the company decides not to exercise its call option, then it will pay an additional 0.25% to the investors over and above the annual rate of 9.40% i.e. 9.65% after 10 years from its issue date.

Premature Withdrawal, Put Option – Investors in these NCDs will have no right to surrender these bonds back to the company for premature redemption as there is no ‘Put’ option embedded with these NCDs. However, if taken in demat form, the investors can always sell these NCDs on the Bombay Stock Exchange (BSE) or National Stock Exchange (NSE).

Categories of Investors & Allocation Ratio – The investors have been classified in the following four categories and each category will have the below mentioned percentage fixed in the allotment:

Category I – Qualified Institutional Bidders (QIBs) – 30% of the issue i.e. Rs. 1,050 crore

Category II – Non-Institutional Investors (NIIs) – 10% of the issue i.e. Rs. 350 crore

Category III – High Net Worth Individuals (HNIs) including HUFs – 30% of the issue is reserved i.e. Rs. 1,050 crore

Category IV – Resident Indian Individuals including HUFs – 30% of the issue is reserved i.e. Rs. 1,050 crore

Allotment on First-Come First-Served (FCFS) Basis – Subject to the allocation ratio, allotment will be made on a first-come first-served basis, as well as on a date priority basis i.e. on the date of oversubscription, the allotment will be made on a proportionate basis to all the applicants of that day on which it gets oversubscribed.

NRIs Not Allowed – Non-Resident Indians (NRIs), foreign nationals and qualified foreign investors (QFIs) among others are not eligible to invest in this issue.

Credit Rating & Nature of NCDs – CARE and Brickwork Ratings have rated the ‘Secured’ NCDs of this issue as ‘AA+’ with a ‘Stable’ outlook. ‘AA+’ rated debt instruments are considered to be highly safe from credit default point of view. Series I, II and III NCDs are ‘Secured’ in nature for which the investors will carry a right on certain assets of RHFL in case of any major financial trouble for the company. However, Series IV NCDs are ‘Unsecured’ in nature and have been rated ‘AA’ by these credit rating agencies.

To compensate the investors of Unsecured NCDs, RHFL is offering a marginally higher rate of interest i.e. 0.25% additional coupon rate, over and above 9.15% for 10 years with Secured NCDs.

Listing – These NCDs will be listed on both the stock exchanges i.e. NSE as well as BSE. The listing will take place within 12 working days from the date the issue gets closed.

Demat, Physical Application – Investors can apply for these NCDs either in demat form or physical or certificate form as it is not mandatory to have a demat account to invest in these NCDs.

TDS – Interest income earned is taxable with these NCDs and the investors are required to pay tax on the interest income as per their respective tax slabs. TDS @ 10% will be deducted if these NCDs are held in physical/certificate form and annual interest income is more than Rs. 5,000. NCDs held in demat mode will not attract any TDS.

Should you invest in Reliance Home Finance Limited (RHFL) NCDs?

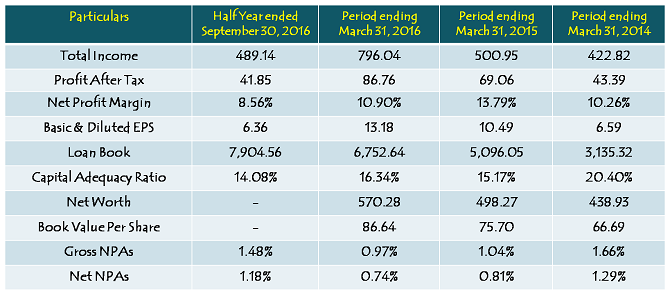

Note: Figures are in Rs. Crore, except per share data & percentage figures

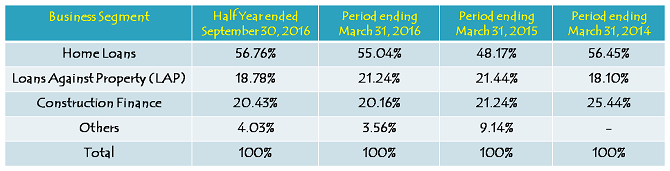

With the entry of so many big and small players, housing finance space has become very competitive now and Reliance Home Finance has not been a very prominent name in this space. The company itself knows it and that is why it does not focus on low margin home loans segment. Rather it focuses on loan against property (LAP) and construction finance and that too, primarily to that segment of borrowers who do not get loans easily from big and rather conservative players like HDFC, LIC Housing Finance etc.

With demonetisation, it is widely expected that real estate industry will have a really tough time for a period of 6-12 months at least. A considerable slowdown in this market will have a really bad impact on the real estate finance companies, especially companies like Reliance Home Finance which are focusing on self-employed borrowers and miscellaneous segments of our real estate market.

However, with dwindling fixed income investment options and volatile interest rate scenario, investors are finding 9%+ interest rate options to be attractive. Investors, who are not in the 20-30% tax bracket and/or those who want to remain invested in these NCDs for a medium to long term period, can consider investing in these NCDs. Investors, who seek listing gains or capital appreciation due to an expected fall in interest rates going forward, should avoid these NCDs as I think there is a very limited scope of any such outcome.

Application Form – Reliance Home Finance NCDs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in Reliance Home Finance Limited (RHFL) NCDs, you can reach us at +91-9811797407

Sir,

For all NCDs eg DHFL, India Bulls, Reliance etc…Is the tax deducted at source on the interest paid?

Reliance Home Finance (RHFL) NCDs have got listed on the BSE & the NSE today i.e. 6th January –

Here are the BSE and the NSE codes for the same:

8.90% 3-year NCDs – Annual Interest – BSE Code – 935904, NSE Code – N2

9.05% 5-year NCDs – Annual Interest – BSE Code – 935908, NSE Code – N4

9.15% 10-year NCDs – Annual Interest – BSE Code – 935912, NSE Code – N6

9.40% 15-year NCDs – Annual Interest – BSE Code – 935916, NSE Code – N8

Deemed date of allotment has been fixed as January 3, 2016. Annual interest will be paid on January 3rd every year.

Thanks Shiv. However, I don’t see units in my ICICIDirect demand account yet. Any idea when those will be reflected?

script code please shiv

hi Shiv, could you please publish your views on SREI NCD opening on 3rd Jan?

Now You can Withdraw Rs 4,500 Per day from ATM: RBI Relaxed norm

More info@ https://www.moneydial.com/blogs/now-you-can-withdraw-rs-4500-per-day-from-atm-rbi-relaxed-norm/

10 facts about BHIM App launched by PM Modi

https://www.moneydial.com/blogs/10-facts-about-bhim-app-launched-by-pm-modi/