This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

After a gap of almost three years when the Modi government took over in May 2014 and the markets went euphoric about reforms and economic recovery, Indian stock markets have breached their previous highs and there are no signs of any fatigue in this rally so far.

However, investors are nervous to invest in stocks or mutual funds at these levels. Many of them carry a view that markets are overheated right now and there is a bubble building up which could burst anytime in the near future. So, they are either waiting for the markets to have a healthy correction, or seeking newer avenues to park their money lying idle in their bank accounts.

InvIT (or Infrastructure Investment Trust) from IRB Infrastructure could be one such avenue investors are looking for. IRB has launched the IPO of its InvIT fund and as it is first of its kind, there is a big curiosity among individual investors about how it works and what is the return they can expect out of it.

What are InvITs and where your money will be invested?

Structurally, InvITs are similar to Mutual Funds, as they would have a trustee, a sponsor, an investment manager and a project manager. However, InvITs are practically similar to ETFs or Exchange Traded Funds. Like ETFs, InvITs will also get listed and traded on the stock exchanges and the investors will be allotted units of the same against their investments. InvITs are investors’ pooled investments in infrastructure projects.

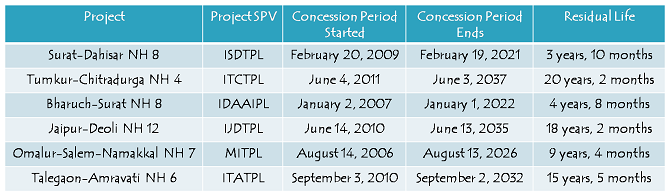

While other InvITs might have a different structure, IRB’s InvIT will function as a Special Purpose Vehicle (SPV) and will have a bundle of six operational toll-collecting road projects of IRB covering 3,635 lane kms of highways across five Indian states – Maharashtra, Gujarat, Rajasthan, Karnataka and Tamil Nadu.

Issue Details of IRB InvIT

Price Band – IRB has fixed its price band to be Rs. 100-102 per unit.

Minimum Investment – Investors are required to apply for a minimum of 10,000 units of this fund i.e. Rs. 10,20,000 or Rs. 10.20 lakh.

Trading Lot Size – These units will trade in the lots of 5,000 units.

Size & Objective of the Issue – IRB InvIT plans to raise Rs. 4,300 crore via a fresh issue of its units, and its existing investors will sell additional 3.48 crore units in the price band of Rs. 100-102. There will also be a greenshoe option of up to 25% of the issue size. These proceeds will be utilised to pay off high cost debt of each of these Project SPVs. Average cost of debt for these SPVs is around 10.75% and this IPO will reduce their debt burden and interest cost substantially.

Allocation to Individual Investors – 25% of the issue size is reserved for the non-institutional investors. Rest 75% is for the institutional investors, including FPIs, insurance companies, mutual funds etc.

Anchor Investors – InvIT on Tuesday finalised allocation of approximately 20.53 crore units to the anchor investors @ Rs. 102 per unit for Rs. 2,094.47 crore. Some of these anchor investors include Government of Singapore, Monetary Authority of Singapore, Platinum International Fund, Platinum Asia Fund, BNP Paribas Arbitrage, Birla Sun Life Trustee Company, HDFC Standard Life Insurance, Schroder Asian Asset Income Fund, Deutsche Global Infrastructure Fund.

Listing – These units will get listed on both the stock exchanges i.e. National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) within 12 working days after the issue gets closed on 5th May.

Sources of Return for Investors

Dividend Income – The InvIT Regulations provide that not less than 90% of net distributable cash flows of each Project SPV are required to be distributed to the Trust in proportion of its holding in each of the Project SPVs. Further, not less than 90% of net distributable cash flows of the Trust shall be distributed to the Unitholders. Although such distributions are required to be declared and made not less than once every six months in every financial year, InvIT’s management wants to distribute it once every quarter.

Dividend yield is expected to be in the range of 10-12% based on the estimates made by the management and some of the analysts. Such cash flows as dividend would be tax-free for the investors.

Capital Appreciation – Though you should not expect equity kind of capital appreciation or volatility in returns with this fund, it is quite possible to have capital gains/losses in case of high/low demand for these units, especially from the institutional investors.

Tax Treatment of InvIT Investments

Dividend Income distributed by the Trust is exempt in the hands of the unitholders.

Long Term Capital Gains (LTCG) would be applicable if the units are held for more than 3 years and it would be exempt from tax provided STT has been paid on sale of such units.

Short Term Capital Gains (STCG) would be applicable if the units are sold before completion of 3 years and it would be calculated at 15% provided STT has been paid on sale of such units.

Interest Income paid, if any, would be taxable in the hands of the unitholders.

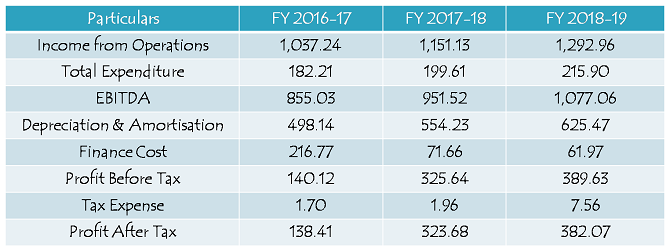

Projected Financials of IRB’s InvIT Projects

(Note: All figures in Rs. Crore)

Should you invest in IRB’s InvIT IPO at Rs. 100-102?

Firstly, investing in this IPO depends on your profile as an investor. It is not for those investors who have only Rs. 15-20 lakh or even less to invest across all their financial holdings. As it is widely recommended not to put all your eggs in one basket, you should strictly avoid investing a major portion of your savings in this fund. To invest in this kind of fund, you either need to have a complete understanding of how this fund would generate returns for you and what are the risks involved in it, or you should have a portfolio of assets worth at least Rs. 1 crore or so in order to diversify your investments. In other words, it is strictly not for the risk averse investors and also for those who have limited sources of income.

Secondly, despite of the fact that it is a first of such kind of funds and returns are uncertain with it, institutional investors are gung ho about this fund. Anchor investors have already put in a big chunk of money in it on Tuesday, and more such big investors are in a queue to lap it up during this IPO period. Liquidity could be one such reason for this kind of demand, but at the same time it seems that they are not ignoring its fundamentals as well.

As the dividend received from this fund is tax-exempt for the institutional investors, a lot of interest is there from the foreign portfolio investors (FPIs), pension funds, retirement funds, insurance companies and even domestic mutual funds. While Birla Sun Life Mutual Fund has invested in this fund as an Anchor Investor for some of its hybrid funds, Birla Sun Life Insurance and HDFC Standard Life Insurance have also invested in it.

Such a high interest from these institutional investors makes me believe that this kind of interest would be there post its listing as well, which could fetch its IPO investors a decent premium on their investments.

Moreover, in today’s scenario in which interest rates have bottomed out for a foreseeable period of time and bond yields have started moving up in a gradual manner, it seems it would be a dull period going forward for the conservative investors looking for healthy returns out of fixed deposits, debt funds, NCDs/tax-free bonds etc. If interest rates keep going up in this manner, market-linked debt investments would either earn a low single digit or even negative returns for you in the next 6-12 months. In such a scenario, 10%+ returns with a favourable tax treatment would look quite superior in comparison.

As there are a few positives with this fund, there are some negatives as well. Firstly, the projected financials in the table above are based on certain assumptions, like expected traffic volume, toll rates, operation and maintenance costs, amortization, debt repayments etc. which reflects current expectations and views regarding future events. Some unfavourable events might result in lower than expected revenues or higher than expected expenditures. Cash flow visibility is not so reliable in such cases.

Moreover, some unfavourable tax treatment or any major policy change might substantially hamper toll revenues of these projects. This is a big risk as far as investment returns are concerned.

All in all, if you have confidence in the management of IRB Infra and its InvIT fund and also in the fundamentals of the Indian economy and its growth story, and if you think the current government would lead India out of its past regulatory problems and environmental issues, then you should definitely invest in this IPO. However, if you think otherwise, that infrastructure projects will keep struggling the way they have been in the past 8-10 years, and the government will not be able to resolve the structural issues these infrastructure projects have been facing for all these years, then you should completely avoid this IPO.

I expect a strong institutional appetite for this fund and that should result in a healthy listing gain for it. If the sentiment remains buoyant, short term investors would do well to book profits on listing. Medium to long term investors should keep a close eye on its fundamentals. Any negative deviation from its projected financials should be analysed critically and appropriate action should be taken.

Very nice post. it’s Really helpful

Shoud i hold the invit funds units ? It is below cost price? When & what should we expect dividand from Trust? Minimum 10% (of issue prise 102) is expected? pl .advise what to do ? I have got allotment of my all 3 applications.

Hi Shiv can you clarify what would happen to investment in irb invit when irb has to return those projects to govt and stop collecting toll as they are authorised to collect toll for certain piriod only regards

It is trading at below 102 (issue price).

Can buy as lot size is 5000 (=5L) compared to 10L during IPO.

Hi Shiva,

Any idea/opinion on India Grid InvIt IPO please?

it closes in 2 days, so if possible, kindly suggest at the soonest pls.

Thanks,

Warm Regards,

Niraj

Better to buy in secondary market.

Hi Niraj,

Here is the link to the IndiGrid InvIT IPO review – http://www.onemint.com/2017/05/19/india-grid-trust-invit-ipo-review-subscribe-or-not-rs-98-100/

Hi Shiv,

So since this IPO got oversubscribed, were the shares allotted by lottery system, since I do not see any shares in my demat account, and release of funds in my saving account.

Regards,

PP

Hi PP,

Yes, the units of IRB InvIT have been allotted on a lottery basis to the individual investors.

Hi Shiv,

Expecting Post on India Grid InvIT.

Hi Rohit,

Here is the link to the IndiGrid InvIT IPO review – http://www.onemint.com/2017/05/19/india-grid-trust-invit-ipo-review-subscribe-or-not-rs-98-100/

Dear Shiv,

If a project is under BOT (Build, Operate, Transfer) contract, will the trust get any amount on Transferring the project to the Government on expiry of the contract ? If not, from where will the trust get money to invest in other projects in future, as ‘toll’ is the only source of revenue for the trust and 90% of the revenue is to be regularly distributed as dividend to unit holders ?

Thanks

Hi TCB,

The trust could raise money by issuing fresh units of the same InvIT fund and acquire more projects from its parent IRB Infra.

What will happen after full tenure of these six toll which is nearly sixteen years.

Whether my prime investment amount I would get back or not

Hi Dinesh,

The trust plans to keep adding more road projects on a regular basis, like debt funds do in case of NCDs & bonds.

Thank you Shiv for the information but can you tell me how to apply to this IRB invit IPO because I cant find it anywhere not even in my sharekhan account

Hi Vishal,

You need to invest in it through your bank’s ASBA facility.

Thank you Mr. Shiv, as always for your insights. I am retired & have invested 75% of my retirement savings in Tax Free Bonds, a sizable portion of which I have purchased from the open market @18%-20% premium. In view if your above comments as above on not putting all eggs in one basket, I am having my doubts. But then, the current administration’s policies have closed most doors for senior citizens & retirees. Your advice will be appreciated!

Hi Mr. S.K.,

I think we are lucky to have our investments here in India. I think there are only a few countries where you get high interest rates on savings schemes and bank accounts, and even higher for senior citizens & retirees. However, you are right that investment options have gone down very rapidly in the last 3-4 years. But, you cannot do anything about it, you will have to live with it. At present, nothing seems better than long-term diversified equity mutual funds, and that puts no burden on government finances.

Please express your views on the fact that 75% of my retirement investment is in Tax Free Bonds.

Dear SK

Since you already invested 75% in TFB that too paying high premium it is not worth exiting if you were not to get premium higher than paid. Most of the TFB are with minimum risk as good as FD. But being Sr. Citizen you could have diversified between TFB , Debt funds, Post office saving and Bank FDs. The advantage of FD is , you can reinvest if the inyerest rate were to go up. In case of TFB the price will depend on market interest rate if you were to liquidate at some point of time. This is my view. Shiv can correct if he feels.

Thank you, Mr. George for responding. I am 59 & in the 20% tax bracket. Yes, 75% of my retirement corpus is invested in TFBs in view of the declining trend in Bank FD Rates & wanted to safeguard/fix at least the TFB Coupon Rate for the coming years. Remaining 25% corpus has been invested in Bank FDs & Liquid Funds. Even MF DEBT Dynamic Bond funds are giving negative to Zero returns during the past few months. What would you say/suggest a better plan of action?

I understand your situation. I have investments in all the instruments that I hsve mentioned. I have purchased TFB on offer rate and some them traded and moved to Gilt funds when interest rate was good. I was only feeling that paying premium and holding TFB means you are only getting YTM of 6% which is not attractive. If the interest rate were to change in next 2 to 3 years the premium of these bonds comes down and for any reason you have to sell these bonds you will get less money which is a risk. Considering this I would have expected you to lock 50% in TFD and remaining in Fd for 1 or 2 years in current rate. Govt promised to give 8% interest for Sr. Citizens for next 10 years. Ypu can also invest some in 8%Govt of India taxable bonds paying coupon once in 6 months. Effectively you get 8.1% yield per annum.with 20% tax you still get 6.45% yield and the duration is 6 years only. I will not suggest investing in any debt bond at current market. GOI bonds have a better safety period and easy to acquire.

Thank you, Mr. George for your valuable advice. Appreciate it a lot. Guess got carried away by the hype created during the TFB issues & the low allotment. Higher TAX outgo was also instrumental in influencing my decision, along with the falling FD Rates & of course a desire for stability in an era of limited investment opportunities.

Had invested in ICICI PRU LONG TERM DEBT FUND (Dynamic Bond Fund) since past 2 months & have being seeing negative or Zero returns. Should I switch to Liquid Find instead?

Hi S.K.,

Had you invested 75% of your savings in Tax-Free Bonds at the time of their IPOs, it would have made a perfect sense. Among TFBs, debt funds, FDs and post office savings schemes, TFBs are the best investments for me. But, I think 75% exposure to TFBs is on a higher side. For me, it should be at least 50% in equity mutual funds in the post demonetisation period.

Sir, would it be advisable to sell some quantity of my TFB portfolio?

Hi S.K.,

I don’t think it is a good time to sell TFBs. You should use events like demonetisation or economic slowdowns when interest rates touch their lowest levels to book profits in these bonds.

Hi

I agree with Shiv , no point in selling for loss. But comsidering that 75% is locked in TFB paying premium , my approach will be to exit 25% in a staggered manner when good price is available covering cost interest for the period held and the transaction charges. You can park this money in liquid fund for short term and switch to Equity mf at right time or invest in 6 years taxable 2003 bond paying 8% if you dont want any risk.

Thank you both Mr. George & Mr. Shiv. Currently, market prices of bonds are almost equal to my Avetage PURCHASE PRICE. Do ypu feel that Interest Rates will go up in the near term? It will be possible to exit TFBs only if Interest were to fall. What are your gut feelings about the next 6-12 months Interest Rate Scenario?

Hi S.K.,

I think interest rates should remain in a range of 6.3% to 7.3% in the next 12 months or so, nothing dramatic should happen here in the absence of any major event.

Thanks Shiv for the post.

As always its very informative.

How can we roughly calculate Dividend Yield would be in the Range of 10-12% ?

Profit is Rs 382 Crores(FY19), And Total Size of InvIT is around Rs 5300 crores, which is 7.2%. I guess, there are some Buy Back concept which will raise its yield to 10-12%, can u please roughly share your understanding on this aspect.

Thanks Rohit!

10-12% dividend yield is estimated based on the “projected cash flow” on the basis of estimated growth in traffic and inflation-linked increase in toll charges.

Shiv – As always, many thanks for the prudent advice. Could you also share your views on the upcoming HUDCO IPO?

Thanks Bobby!

I’ll review the HUDCO IPO either today evening or tomorrow.