This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

If you trade in shares and unfortunately suffered any kind of loss while doing it in the previous financial year, FY 2016-17, then you should not miss the opportunity to carry it forward and set it off against your profits in the current financial year or any of the future financial years, up to eight years.

Actually, I came across one of my clients who had suffered a loss of around Rs. 1.72 lakh during FY 2015-16 and failed to file his ITR by 5th of August last financial year, the extended deadline for filing ITR for the previous assessment year. However, his fortunes turned favourable in the financial year ended March 31, 2017 and he made a decent profit of over Rs. 8 lakhs.

But, as he missed to file his ITR in a timely manner, he now cannot adjust his profits against his losses of previous assessment year and will have to pay around Rs. 53,000 as additional income tax which he could have easily saved by filing his ITR for FY 2015-16 on time.

This is one of the many silly mistakes which individuals make while filing their ITRs. Using wrong ITR form for filing your ITR could be one such mistake. So, here in this post, I would like to help our readers choose the right ITR form, applicable to them as per their source(s) of income.

Sources of Income

As we all must be aware, broadly there are five sources of income and the ITR form which we are supposed to fill depends on our sources of income. So, let’s quickly check these sources of income first.

I – Income from Salary

II – Income from House Property

III – Income from Other Sources

IV – Capital Gains

V – Income from Business or Profession

Which ITR form is for you?

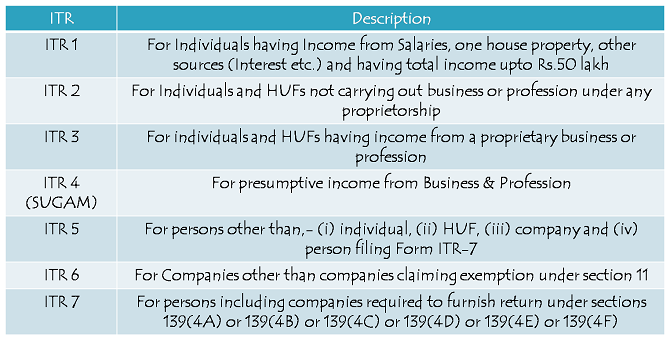

For individuals, the number of ITR forms have been reduced to only four this financial year – ITR 1, ITR 2, ITR 3 and ITR 4 (SUGAM), as against six in the previous financial year – ITR 1, ITR 2, ITR 2A, ITR 3, ITR 4 and ITR 4S (SUGAM).

Here you have the table suggesting applicability of ITR form as per your income from diverse sources:

ITR 1 – For Individuals having Income from Salary/Pension, one house property, other sources (interest etc.) and having total income upto Rs. 50 lakh

Though it is easy to understand from the language itself whether ITR 1 is applicable to you or not, I would like to mention here when it is not applicable to you. ITR 1 is not applicable to you in case:

* Your total income > Rs. 50 lakh

* You have more than one house property

* You have earned income from sale/purchase of any of your capital assets, like shares, mutual funds, ETFs, bonds, gold etc.

* You have income from any of your business activities or professional services

In all these cases, you need to fill either ITR 2 or ITR 3 or ITR 4 (SUGAM).

ITR 2 – For Individuals and HUFs not carrying out business or profession under any proprietorship

As against ITR 1, ITR 2 is applicable to you in case:

* You have income from more than one house property

* You have income from sale/purchase of any of your capital assets

* You have income as a partner of a partnership firm

* You earn any kind of foreign income

* You have agricultural income > Rs. 5,000

ITR 3 – For Individuals and HUFs having income from a proprietary business or profession

As against ITR 1 and ITR 2, ITR 3 is applicable to you if you earn income from any of your business activities or professional services, apart from any other source of income mentioned above.

ITR 4 (SUGAM) – For Presumptive Income from Business or Profession

ITR 4 (SUGAM) is applicable to you if you run your business on a presumptive income basis as per section 44AD & 44AE.

So, if you haven’t filed your ITR yet for the previous financial year, just do that as soon as possible as the deadline of 31st July is near and ITR filing is one such work which should ideally be done on time.

If you have any query regarding ITR filing for FY 2016-17 / AY 2017-18, please share it here, we will try to respond to it in a timely manner, or you can contact us on +91-9811797407 for any of your ITR filing related requirements.