This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Mahindra & Mahindra Financial Services Limited, working & popularly known as Mahindra Finance, is launching its issue of non-convertible debentures (NCDs) from the coming Monday i.e. July 10th. The company is offering interest rates in the range of 7.86% to 8.05% for a period of 7 years to 15 years. The company plans to raise Rs. 2,000 crore from this issue and use it primarily for further lending and refinancing of its existing loans.

The issue is scheduled to close on July 28, however the company is free to close it much earlier if it gets the desired subscription well before that. These NCDs are ‘AAA’ rated, so many institutional investors and/or risk-averse investors would like not to miss this opportunity.

As we analyse it further, let us take a quick look at the salient features of this issue:

Size & Objective of the Issue – Base size of this issue is Rs. 250 crore, with a green-shoe option to retain an additional Rs. 1,750 crore, thus making it a Rs. 2,000 crore issue. The company plans to use at least 75% of the issue proceeds for its lending activities, to refinance its existing loans and for long-term working capital and up to 25% of the proceeds for general corporate purposes.

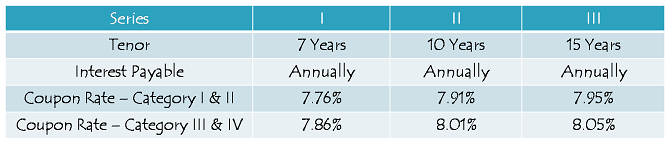

Coupon Rate & Tenor of the Issue – The issue will carry a coupon rate of 7.86% p.a. for a period of 7 years, 8.01% p.a. for 10 years and 8.05% for 15 years. There are no options for monthly or cumulative interest payments.

For Category I and Category II investors, these NCDs will carry 0.10% lower rate of interest.

Minimum Investment – Investors are required to subscribe to at least ten units of these NCDs, thus making it a minimum investment of Rs. 10,000.

Categories of Investors & Allocation Ratio – The investors have been classified in the following three categories and each category will have the below mentioned percentage fixed in the allotment:

Category I – Institutional Investors – 20% of the issue i.e. Rs. 400 crore

Category II – Non-Institutional Investors – 10% of the issue i.e. Rs. 200 crore

Category III – High Net-Worth Individuals (HNIs) & HUFs – 35% of the issue i.e. Rs. 700 crore

Category IV – Retail Individual Investors – 35% of the issue i.e. Rs. 700 crore

Allotment will be made on a first-come first-served basis, as well as on a date priority basis i.e. on the date of oversubscription, the allotment will be made on a proportionate basis to all the applicants of that day on which the issue gets oversubscribed.

NRIs Not Allowed – Non-Resident Indians (NRIs), foreign nationals and qualified foreign investors (QFIs) among others are not eligible to invest in this issue.

Credit Rating – Rating agencies, India Ratings (IND) and Brickwork Ratings (BWR) have rated this issue as ‘AAA’ with a ‘Stable ‘ outlook. Debt instruments with such a rating are considered to have the highest degree of safety regarding timely payment of interest and principal.

Unsecured NCDs – These NCDs are ‘Unsecured’ in nature i.e. in case of any default on its payment of interest or principal, the bondholders will not have any right on any of the assets of Mahindra Finance.

Listing, Premature Withdrawal & Put Option – These NCDs will get listed only on the Bombay Stock Exchange (BSE) and the listing will take place within 12 working days from the issue closure date. Moreover, there is no option with the bondholders for a premature redemption back to the company. In order to encash their investments, they need to sell these bonds on the stock exchange once they get listed.

Call Option – The company will have the option to call Series III of these NCDs at the end of the 10th year from the issuance date. The investors will not be compensated in any way for such an action.

Demat Not Mandatory – Demat account is not mandatory to invest in these NCDs as the investors will have the option to apply for these NCDs in physical or certificate form as well.

TDS – Interest income earned on these NCDs is taxable and the investors are required to pay tax on it as per the respective tax slabs they fall into. TDS @ 10% will be deducted if these NCDs are held in physical/certificate form and annual interest income is more than Rs. 5,000. NCDs held in demat mode will not attract any TDS.

Should you invest in Mahindra Finance NCDs?

Despite having a ‘AAA’ rating, I find no compelling reason for me to invest in such NCDs, except only two reasons – the liquidity comfort you get with the listed NCDs and longer tenors of the issue in case the interest rates drop further in the medium to long term.

But, even these two factors are not attractive enough for me to invest my money in this issue. The interest rates the company is offering are extremely unattractive to me. In fact, they are very close to most of the Post Office Small Saving Schemes. PPF is fetching 7.8% tax-free interest rate, while NSCs carry 7.8% taxable interest rate. While these are the instruments which any class of investor can invest in, other instruments which are meant for specific categories of investors offer even higher rate of interest. While Senior Citizen Savings Scheme carries 8.3% rate of interest, Sukanya Samriddhi Yojana offers even higher rate of interest of 8.4%, and that too tax-free.

Post Office Small Saving Schemes are more or less 100% safe and therefore the investors don’t require any kind of credit rating for their investments. Low liquidity and no scope of capital appreciation are the two reasons which stop me to invest in most of these post office small saving schemes.

Finally, if you want some alternative to bank fixed deposits (FDs), would like to play 100% safe as far as your capital is concerned and trust the management of the Mahindra group, then only I think these NCDs are meant for you. Otherwise, just give this issue a pass and invest your money in some better opportunities elsewhere.

Application Form – Mahindra Finance NCDs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in Mahindra Finance NCDs, you can reach us on +91-9811797407

I want interest certificate of my holding bonds for F. Y 2017-18. ISIN NO. :- INE774D08LU6. Please send me on my above mail ID.

Any upcoming ncds

Mahindra Finance NCDs got listed on the BSE today – http://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20170726-11

Here are the details of the same:

7.86% 7-year NCDs – BSE Code – 936040 – CMP – Not yet traded

8.01% 10-year NCDs – BSE Code – 936044 – CMP – Rs. 988

8.05% 15-year NCDs – BSE Code – 936048 – CMP – Rs. 985

Is it allowed for NRIs to purchase these NCDs from secondary market

Nice information thank you for sharing good information with us.

I don’t get the logic of why M&M chose to came out with this public issue! If they wanted to diversify their long-term funding profile by tapping the retail segment, they should have at least offered a decent coupon, instead of being so overly aggressive with the rates. Otherwise, they could have simply raised this much via private placements to institutions & HNI’s.

Mahindra Finance has decided to preclose its NCDs issue today i.e. July 14, as against its scheduled closing date of July 28.

Day 4 (July 13) Subscription Figures:

Category I – Rs. 50 crore as against Rs. 400 crore reserved – 0.13 times

Category II – Rs. 1.36 crore as against Rs. 200 crore reserved – 0.01 times

Category III – Rs. 911.96 crore as against Rs. 700 crore reserved – 1.30 times

Category IV – Rs. 214.61 crore as against Rs. 700 crore reserved – 0.31 times

Total Subscription – Rs. 1177.93 crore as against total issue size of Rs. 2,000 crore – 0.59 times

today’s latest subscription status of mahindra Finance Ncd and details of srei equipment Ncd dear Shiv

srei is offering .15% additional rate to its existing shareholders so if I buy one Share of are I Finance tommorow

then should I get this benefit dear Shiv

sorry srei Ncd details please Shiv

srei equipment Ipo details please

today’s latest subscription

Day 3 (July 12) Subscription Figures:

Category I – No bids placed as against Rs. 400 crore reserved – 0 times

Category II – Rs. 1.16 crore as against Rs. 200 crore reserved – 0.01 times

Category III – Rs. 151.56 crore as against Rs. 700 crore reserved – 0.22 times

Category IV – Rs. 131.60 crore as against Rs. 700 crore reserved – 0.19 times

Total Subscription – Rs. 284.32 crore as against total issue size of Rs. 2,000 crore – 0.14 times

latest subscription figures please

today’s subscription figures please shiv

Day 1 (July 10) Subscription Figures:

Category I – No bids placed as against Rs. 400 crore reserved – 0 times

Category II – Rs. 1.04 crore as against Rs. 200 crore reserved – 0.01 times

Category III – Rs. 0.96 crore as against Rs. 700 crore reserved – 0.00 times

Category IV – Rs. 35.98 crore as against Rs. 700 crore reserved – 0.05 times

Total Subscription – Rs. 37.98 crore as against total issue size of Rs. 2,000 crore – 0.02 times

today’s subscription figures please

Shiv – As always, thanks for the candid and logical advice. Had these been secured and offered a cumulative option, then I would have gone for these, but in it’s current state- it does not make sense.

Thanks Bobby!

I think if the company is good, Secured & Unsecured don’t matter much to me. As far as interest payment is concerned, I prefer regular payment of interest with private companies and cumulative option with PSUs.