This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Bharat 22 ETF – Allotment Status

Finance Minister in his budget speech had set Rs. 72,500 as the disinvestment target for the current fiscal year 2017-18. In order to meet this steep target, the government has decided to sell its stake in 22 of its holdings, by forming an altogether new index called “S&P BSE Bharat 22 Index”. As its name suggests, this index has been designed by the Bombay Stock Exchange (BSE) in consultation with the government. Unlike Nifty CPSE Index, which has all its constituents to be the CPSEs, Bharat 22 Index has CPSEs, PSUs and 3 private companies (L&T, ITC and Axis Bank) as its constituents.

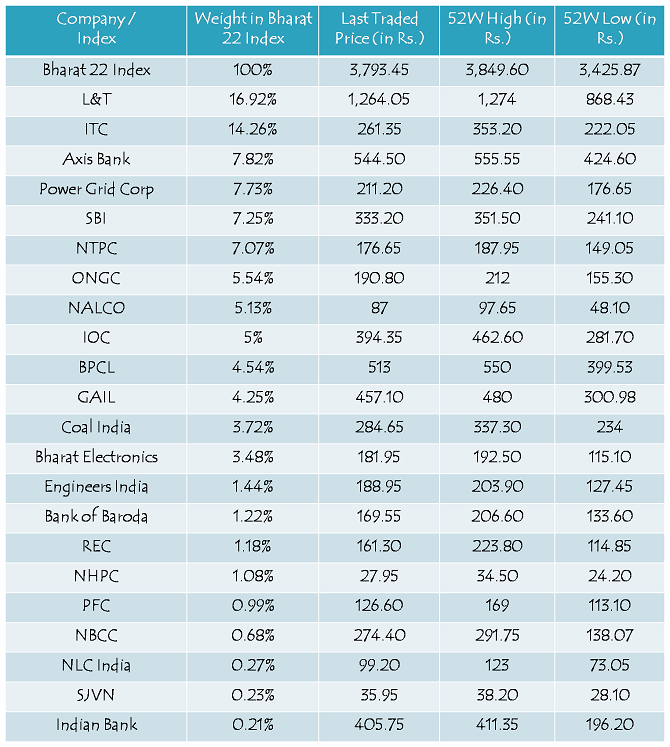

Here is the list of all its 22 constituents and their weightage in the index:

ICICI Prudential Bharat 22 ETF is an open-ended index scheme, to be listed on the stock exchanges in the form of an Exchange Traded Fund (ETF) tracking the S&P BSE Bharat 22 Index. This ETF has been launched by ICICI Prudential Asset Management Company and is named as Bharat 22 ETF.

Investment Objective – Bharat 22 ETF intends to generate returns that closely correspond to the total returns earned by the securities as represented by the Bharat 22 Index. However, the performance of the scheme may differ from that of Bharat 22 Index due to tracking error and also due to the scheme expenses.

NFO Opening & Closing Dates – This scheme will remain open for four days, only one day for the anchor investors i.e. November 14 and then three days for the non-anchor investors, including retail investors. For the non-anchor investors, it will open for subscription on November 15 and run for three days to close on November 17.

Reference Market Price/NAV – New Fund Offers, or popularly known as NFOs, normally get launched at Rs. 10 per unit as their NAV. This will not be the case with this scheme. During the NFO, each unit of this scheme will have a face value of Rs. 10 and will be issued at a premium, equal to the difference between the face value and the allotment price.

NAV of this scheme will be based on the Bharat 22 Index, and the allotment price would be approximately equal to 1/100th of Bharat 22 Index and calculated post adjusting the 3% discount offered by the government to Bharat 22 ETF for buying the underlying Bharat 22 Index shares.

3% Discount for All Investors – Investors making an investment during the offer period will be given a 3% discount on their investment. This 3% discount on the “Reference Market Price” of the underlying Bharat 22 Index shares will be offered to Bharat 22 ETF by the government of India.

Categories of Investors & Allocation Ratio

Anchor Investors – 25% of the total amount raised or 25% of Rs. 8,000 crore, whichever is higher, has been reserved for the anchor investors.

Retail Individual Investors (RIIs) – 25% of the total amount raised or 25% of Rs. 8,000 crore, whichever is higher, has been reserved for the retail individual investors also.

Qualified Institutional Buyers (QIBs) & Non-Institutional Investors (NIIs) – QIBs and NIIs too will have 25% of the issue reserved for each of their categories. In case of undersubscription in any or both of these categories of investors, unsubscribed portion will be allocated to the retail investors.

Target Amount to be Raised – The government has decided to raise Rs. 8,000 crore from this scheme. However, in case of oversubscription, the government would like to retain the whole of oversubscription in order to bridge its disinvestment target gap. So, it is highly likely that full allotment will be made to the retail individual investors.

Minimum/Maximum Investment Size – Retail individual investors can invest in the scheme with a minimum investment amount of Rs. 5,000. To remain a retail investor, the investment limit has been set at Rs. 2 lakhs.

Allotment & Listing – As per the offer document, investors will get the units allotted within 15 days from the closing date of the issue and listing on the stock exchanges will happen within 5 days from the date of allotment. However, like earlier CPSE ETF issues, I expect the allotment and listing to happen within 7-10 working days from the date the issue gets closed.

Demat Account Mandatory – As you cannot hold and trade ETFs in physical form, it is mandatory to have a demat account for you to invest in this scheme. Applications without relevant demat account details are liable to be rejected.

No Lock-In Period – As this ETF do not provide any tax benefit, there is no lock-in period for the non-anchor investors. Investors can sell their units whenever they want to do so.

Entry & Exit Load – There is no entry load to invest in this scheme and there is no exit load either as and when you decide to sell its units on the stock exchanges. You will be required to pay just your normal brokerage and other government taxes when you sell these units.

2.21% Dividend Yield – As per the BSE website, constituents of Bharat 22 Index are generating 2.21% dividend yield for its investors based on the dividends paid in the last one year. Though dividend yield is not a significant factor for me to invest in stocks or mutual funds/ETFs, I think this dividend yield of 2.21% is not too great for me to reconsider it for my portfolio.

20.28X PE Ratio – Price to earnings ratio (P/E Ratio) of Bharat 22 Index at present is ruling at around 20.28 times. If you consider Nifty to be trading at a P/E multiple of 26-27 times its trailing EPS, I think Bharat 22 Index is not too attractively valued considering most of its constituents are CPSEs or PSUs. You can only bank on their earnings recovery in order to expect a gradual rise in their share prices.

Should you invest in ICICI Prudential Bharat 22 ETF NFO?

Except 3% discount, there is nothing extraordinary in this ETF which attracts me to apply for it in this NFO. As most of its constituents are already trading close to their 52-week highs, you can consider this ETF to be trading close to its 52-week high. However, this should not be considered as anything negative for this ETF. If a stock is trading at or close to its all-time or 52-week highs, it doesn’t mean that it cannot go higher from those levels. Similarly, this ETF too has the potential to scale newer highs if its constituents continue rising as they have been in the last few months.

However, as most of these companies are CPSEs and PSUs, I think it is the government policies which are going to drive the share prices of these companies and thereby this ETF. Let us consider the decision taken by the government to recapitalise the public sector banks (PSBs) with Rs. 2.11 lakh crore worth of infusion over the next 2 years. Though it is a very positive measure announced by the government, but after all it is just an announcement and nothing concrete has taken place to actually strengthen these banks’ balance sheets and most importantly, this bank recap has done nothing to resolve the basic problems of PSBs – 1) extraordinary high levels of NPAs, and 2) poor level of accountability the managements of these public sector banks have shown over the past many years in which many of the private sector banks and NBFCs have flourished to higher levels over the opportunities lost by these PSBs.

Still, this announcement of bank recap has resulted in 36% returns in Nifty PSU Bank Index since Muhurat Trading on Diwali, from 2942.7 on October 19 to 4001.45 on November 10. What I want to say here is that if just an announcement of doing something good for the health of the public sector enterprises or overall economy can deliver such high returns in such a short period of time, then I think nobody has truly imagined the actual potential of these CPSEs and PSUs if the government honestly gets serious with its duty to run these companies professionally. If you trust the intentions and policy execution capabilities of the Modi government, then only this ETF is worth investing your money at these levels, or otherwise, go for the diversified equity mutual funds.