This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Low interest rates on bank FDs and post office small saving schemes has resulted in investors searching for higher yield fixed income options, including short term debt funds. One such investment option is available right now in the form of non-convertible debentures (NCDs) from SREI Infrastructure Finance Limited.

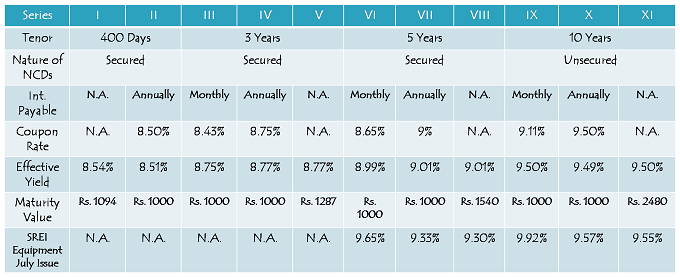

The issue opened on February 9, 2018 and is carrying a maximum of 9.50% per annum coupon rate. It will remain open for two more weeks to close on March 7, 2018. These NCDs are offering monthly, annually and cumulative interest payment options.

As we analyse it further, let us take a quick look at the salient features of this issue.

Size & Objective of the Issue – Base size of this issue is Rs. 200 crore, with a green-shoe option to retain an additional Rs. 1,800 crore, thus making it a Rs. 2,000 crore issue. The company plans to use at least 75% of the issue proceeds for its lending activities and to repay its existing loans and up to 25% of the proceeds for general corporate purposes.

Coupon Rate & Tenor of the Issue – The issue will carry a coupon rate of 9.50% p.a. payable on an annual or cumulative basis for a period of 10 years, 9% p.a. for a period of 5 years, 8.75% for 3 years and 8.50% for 400 days. For investors seeking regular income, monthly interest payment option is also available for a period of 3, 5 and 10 years. Though coupon rates will be lower with the monthly interest payment options, effective rates will be close to the coupon rates of annual interest payment options.

0.25% Additional Coupon for SREI Infra Shareholders, NCD Holders, Senior Citizens & Employees – Existing shareholders and NCD holders of SREI Infra, senior citizens aged more than 60 years of age and the employees of SREI Infra will be offered an additional coupon of 0.25% per annum. Record date for the payment of interest will be considered as the relevant date for these investors to be eligible for this additional rate of interest.

Minimum Investment – Investors are required to make a minimum investment of Rs. 10,000 i.e. ten NCDs of face value Rs. 1,000 each.

Categories of Investors & Allocation Ratio – The investors have been classified in the following four categories and each category will have the below mentioned percentage fixed in the allotment:

Category I – Institutional Investors – 20% of the issue i.e. Rs. 400 crore

Category II – Non-Institutional Investors – 10% of the issue i.e. Rs. 200 crore

Category III – Individual & HUF Investors – 60% of the issue i.e. Rs. 1,200 crore

Category IV – Trusts & Society Investors – 10% of the issue i.e. Rs. 200 crore

Allotment will be made on a first-come first-served basis, as well as on a date priority basis i.e. on the date of oversubscription, the allotment will be made on a proportionate basis to all the applicants of that day on which it gets oversubscribed.

NRIs Not Allowed – Non-Resident Indians (NRIs), foreign nationals and qualified foreign investors (QFIs) among others are not eligible to invest in this issue.

Credit Rating & Nature of NCDs – Rating agency Brickwork Ratings (BWR) has rated this issue as ‘AA+’. Debt instruments with such a rating are considered to have high degree of safety regarding timely payment of interest and principal. NCDs issued for 400 days, 3 years and 5 years are ‘Secured’ in nature and in case of any default on its payment of interest or principal, the bondholders will have the right on certain secured assets of SREI Infra. However, NCDs issued for 10 years are ‘Unsecured’ in nature.

Listing, Premature Withdrawal & Put/Call Option – These NCDs will be listed on both the stock exchanges i.e. Bombay Stock Exchange (BSE) as well as National Stock Exchange (NSE). The listing will take place within 12 working days after the issue gets closed. Though there is no option of a premature redemption, the investors can sell these bonds on the stock exchanges.

Demat Not Mandatory – Demat account is not mandatory to invest in these NCDs as the investors will have the option to apply for these NCDs in physical or certificate form as well.

TDS – Interest income earned is taxable with these NCDs and the investors are required to pay tax on the interest income as per their respective tax slabs. TDS @ 10% will be deducted if these NCDs are held in physical/certificate form and annual interest income is more than Rs. 5,000. NCDs held in demat mode will not attract any TDS.

Should you invest in SREI Infrastructure Finance NCDs?

Post the implementation of GST in July 2017, the government has reduced its rates from 28% to 18%, from 18% to 12% and from 12% to 5% on many of the items. Probably that is one of the primary reasons why GST tax collection has been below the government’s own estimates. Such shortfall in tax collection and lower than expected economic growth has put a lot of pressure on the government’s finances and thus resulted in a spike in bond yields. The benchmark 10-year G-Sec yield has jumped to 7.91% from a low of 6.1-6.2% post demonetisation.

In such a scenario, I would have liked SREI Infra to offer somewhat higher rate of interest in this issue. SREI Infra’s subsidiary, SREI Equipment Finance in its July issue offered relatively attractive rate of interest. Since then, bond yields have risen by at least 75 basis points. So, SREI Infra offering relatively lower rate of interest in a rising bond yield scenario has left me somewhat disappointed as an investor.

But, even the fixed deposit rates have been ruling at lower than satisfactory levels. In such a scenario, one should either wait for some other company to come out with its NCDs issue carrying relatively attractive rate of interest, or deploy money in short term deposits or short-term debt mutual funds. However, investors who do not want to wait for some other issue to invest their surplus money can consider investing in this issue.

Application Form – SREI Infra NCDs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in SREI Infra NCDs, you can reach us at +91-9811797407