This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

ICICI Securities IPO Review – Should You Invest or Not @ Rs. 519-520?

ICICI Securities Limited, a wholly-owned subsidiary of ICICI Bank, is entering the primary markets with its initial public offer (IPO) of 7.72 crore shares worth Rs. 4,017 crore. The offer would constitute 23.98% of the company’s post-offer paid-up equity share capital. Price band of the IPO is in a very narrow range of Rs. 519-520 a share and no discount has been offered by the company to the retail investors.

The issue is getting opened for subscription from Thursday, March 22 and will remain open for three business days to close on March 26. This IPO is a 100% offer for sale (OFS) by its promoter ICICI Bank and hence ICICI Securities will not get any money out of this IPO for its further expansion.

Here are some other salient features of this IPO:

Only 10% Issue is for Retail Investors – Only 10% of the issue size, excluding the portion reserved for the ICICI Bank shareholders, is reserved for the retail individual investors (RIIs) i.e. approximately 73.38 lakh shares out of total 7.72 crore shares on offer. 15% of the issue is reserved for the non-institutional investors (NIIs) and the remaining 75% shares will be allocated to the qualified institutional buyers (QIBs).

Bid Lot Size & Minimum Investment – Investors need to bid for a minimum of 28 shares and in multiples of 28 shares thereafter. So, a retail investor would be required to invest a minimum of Rs. 14,560 at the upper end of the price band and Rs. 14,532 at the lower end of the price band.

Maximum Investment – Individual investors investing up to Rs. 2 lakh are categorised as retail individual investors (RIIs). As a retail investor, you can apply for a maximum of 13 lots of 28 shares in this IPO i.e. a maximum investment of Rs. 1,89,280.

Objective of the Issue – As the entire issue proceeds will go to ICICI Bank, being the promoter of the company, the primary objective of the offer for ICICI Securities is to enhance its visibility and brand image by getting listed on the stock exchanges.

Listing – The shares of the company will get listed on both the stock exchanges i.e. National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) within 6 working days after the issue gets closed on 26th March. Here are the important dates after the issue gets closed:

Finalisation of Basis of Allotment – On or about April 2, 2018

Initiation of Refunds – On or about April 3, 2018

Credit of equity shares to investors’ demat accounts – On or about April 4, 2018

Commencement of Trading on the NSE/BSE – On or about April 5, 2018

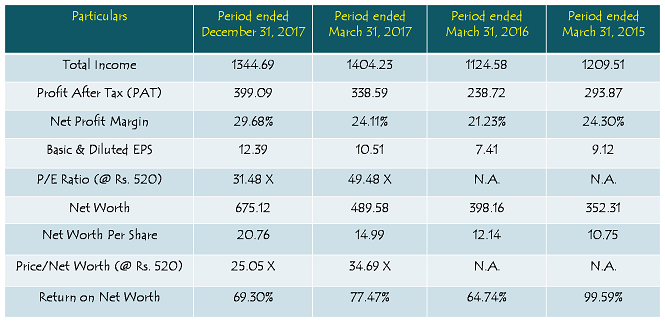

Financials of ICICI Securities

Note: Figures are in Rs. Crore, except per share data & percentage figures

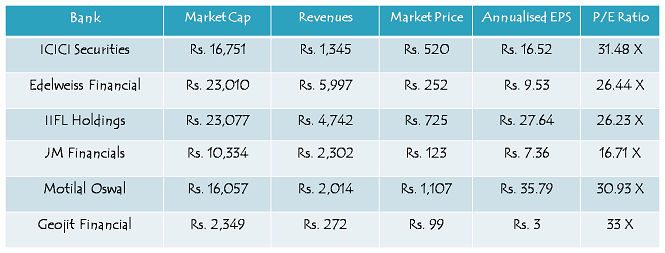

Peer Comparison

Note: Market Caps and Market Prices are dated March 20, 2018. EPS have been annualised taking 9-month EPS as on December 31, 2017.

Upcoming IPO Ambani Organics IPO and Ambani Organics IPO Allotment Status

OBJECTIVE OF THE AMBANI ORGANICS IPO:

Ambani Organics IPO comprises a Fresh Issue by the Company and an Offer for Sale by the Selling Shareholder. The Company will not receive any proceeds of the Offer for Sale by the Selling Shareholder.

The Objects of the Fresh Issue is to raise funds for:

Funding Long-Term Working Capital Requirement; and

Funding expenditure for General Corporate Purposes

ISSUE DETAILS OF AMBANI ORGANICS IPO:

Issue Open: Jul 6, 2018

Issue Close: Jul 10, 2018

Issue Type: Fixed Price Issue IPO

Issue Size:1,368,000 Equity Shares of Rs 10 aggregating up to Rs 9.03 Cr

Face Value: Rs 10 Per Equity Share

Issue Price: Rs 66 Per Equity Share

Market Lot: 2000 Shares

Minimum Order Quantity: 2000 Shares

Listing At: NSE SME

More @ http://www.sharpcareerfinancialupdates.in/investment-updates-sharpcareerfinancialupdates/upcoming-ipo-ambani-organics-ipo-and-ambani-organics-ipo-allotment-status/

Upcoming IPO HDFC AMC IPO and HDFC AMC IPO Allotment Status

HDFC AMC IPO:

According to the draft papers, the proposed HDFC AMC IPO offers up to 2.54 crore equity shares of the fund house through an offer for sale of 85.92 lakh shares by HDFC and up to 1.68 crore shares by Standard Life.

HDFC AMC IPO comprises a net offer of up to 2.21 crore equity shares for public, a reservation of up to 3.20 lakh shares for purchase by eligible HDFC AMC employees.

HDFC AMC IPO, 24 lakh shares have been reserved for eligible HDFC shareholders.

After Reliance Nippon Life AMC HDFC AMC become the second AMC to hit the market with total asset under the management of more than Rs 3 Lakh core at the end of March.

3. Objective of the HDFC AMC IPO:

Objectives of the HDFC AMC IPO are listed below.

• The objects of the Offer are to achieve the benefits of listing the Equity Shares on the Stock Exchanges

• Second objective is to carry out the sale of Equity Shares offered for sale by the Selling Shareholders.

• The Company expects that the listing of its Equity Shares will enhance its visibility and brand image, and will provide a public market for Equity Shares in India.

• The Company will not receive any proceeds from the Offer and all the proceeds from the Offer will be received by the Selling Shareholders, in proportion to the Equity Shares offered by the respective Selling Shareholders as part of the Offer.

More @ http://www.sharpcareerfinancialupdates.in/investment-updates-sharpcareerfinancialupdates/upcoming-ipo-hdfc-amc-ipo-and-hdfc-amc-ipo-allotment-status/

Upcoming IPO Jakharia Fabric IPO and IPO Allotment Status

Objective of the Jakharia Fabric IPO:

There are three objective of the Jakharia Fabric IPO. They are

• Part finances the setting up of processing unit through M/s. Jakharia Industries at Tarapur, MIDC.

• Funding Expenditure for General Corporate Purposes.

• Listing of company Equity Shares on the SME Exchange, would provide liquidity to shareholders, enhance our visibility and better brand name.

Issue Details of Jakharia Fabric IPO:

• Issue Open: Jun 29, 2018

• Issue Close: Jul 3, 2018

• Issue Type: Fixed Price Issue IPO

• Issue Size: 1,092,000 Equity Shares of Rs 10 aggregating up to Rs 19.66 Cr

• Face Value: Rs 10 Per Equity Share

• Issue Price: Rs 180 Per Equity Share

• Market Lot: 800 Shares

• Minimum Order Quantity: 800 Shares

• Listing At: NSE SME

More @ http://www.sharpcareerfinancialupdates.in/investment-updates-sharpcareerfinancialupdates/upcoming-ipo-jakharia-fabric-ipo-and-ipo-allotment-status/

Upcoming IPO Bright Solar IPO and IPO Allotment Status

OBJECTIVE OF THE BRIGHT SOLAR IPO:

There is Four Objective of the Bright Solar IPO. They are listed below:

? Acquisition of Land, its Registration, Stamping and other charges

? Working Capital

? General Corporate Purpose

? Issue Expenses.

ISSUE DETAILS OF BRIGHT SOLAR IPO:

? Issue Open: Jun 26, 2018

? Issue Close: Jun 29, 2018

? Issue Type: Fixed Price Issue IPO

? Issue Size:5,400,000 Equity Shares of Rs 10 aggregating up to Rs 19.44 Cr

? Face Value: Rs 10 Per Equity Share

? Issue Price: Rs 36 Per Equity Share

? Market Lot: 3000 Shares

? Minimum Order Quantity: 3000 Shares

? Listing At: NSE SME

? Retail Allocation: 50%

More @ http://www.sharpcareerfinancialupdates.in/investment-updates-sharpcareerfinancialupdates/upcoming-ipo-bright-solar-ipo-and-ipo-allotment-status/

E2E NETWORKS IPO-UPCOMING IPO 2018

OBJECTIVE OF THE E2E NETWORKS IPO:

There are two objective of the IPO. They are listed below.

Working Capital requirements

General Corporate Purposes

ISSUE DETAILS OF E2E NETWORKS IPO:

Issue Open: May 3, 2018

Issue Close: May 7, 2018

Issue Type: Fixed Price Issue IPO

Issue Size:3,858,000 Equity Shares of Rs 10 aggregating up to Rs 21.99 Cr

Face Value: Rs 10 Per Equity Share

Issue Price: Rs 57 Per Equity Share

Market Lot: 2000 Shares

Minimum Order Quantity: 2000 Shares

Listing At: NSE SME

More @ http://www.sharpcareerfinancialupdates.in/investment-updates/e2e-networks-ipo-upcoming-ipo-2018/

Shiv, waiting for your views. 🙂