This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at shivskukreja@gmail.com

Here are some other important dates as the issue gets closed on July 27:

Finalisation of Basis of Allotment – On or about August 1, 2018

Initiation of Refunds – On or about August 2, 2018

Credit of equity shares to investors’ demat accounts – On or about August 3, 2018

Commencement of Trading on the NSE/BSE – On or about August 6, 2018

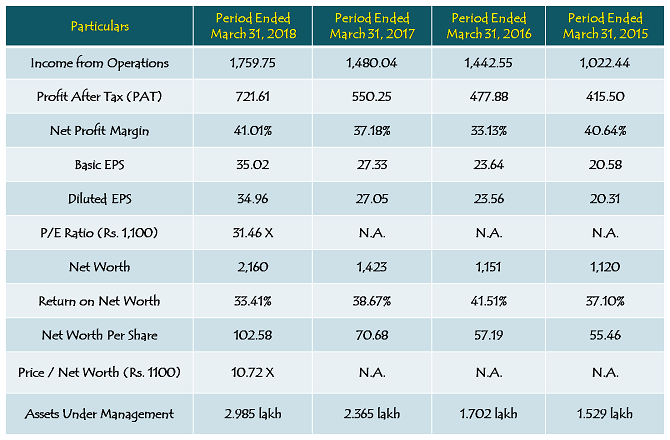

Financials of HDFC AMC

(Note: Figures are in Rs. Crore, except per share data & percentage figures)

Should you invest in HDFC AMC IPO or Not @ Rs. 1,100?

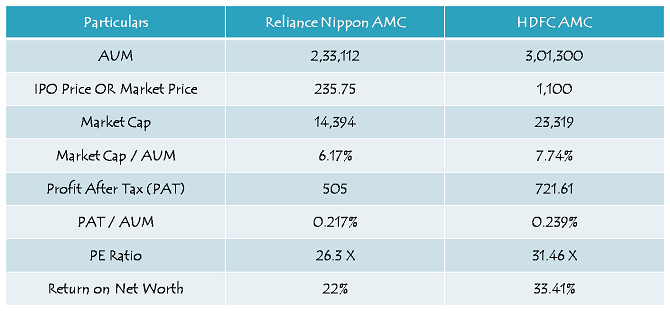

Reliance Nippon Asset Management Ltd. (RNAM) is currently the only asset management company listed on the stock exchanges. Its IPO came in the last week of October 2017 at a price of Rs. 252 a share. It touched a high of Rs. 335 on January 16, 2018, a low of Rs. 205.35 on June 1, 2018 and is currently trading at Rs. 235.75. At Rs. 235.75 a share, the company has a market cap of Rs. 14,394 crore and its price/earnings (P/E) ratio currently stands at 26.3 times. The company generates an RoE of 22% for its shareholders.

In comparison, HDFC AMC IPO is priced at Rs. 1,100 a share. At this price, the company will have a market cap of Rs. 23,319 crore and P/E ratio of 31.46 times based on its trailing twelve months EPS. The company generates an RoE of 33.41% for its shareholders. Also, HDFC AMC is the industry leader in equity-oriented funds, having 51% of its AUM in equities as against 42% industry average. Having 51% of its AUM in equities helps HDFC AMC earn higher management fee for managing these funds. Such high profitability and focus on garnering investors’ money for its high margin schemes justify its rich valuations vis-a-vis Reliance AMC, based solely on the fundamentals attributes of both the companies.

However, the biggest factor, that makes investors avoid investing in ADAG group companies, is the quality of their management and the legacy of their actions that have led to the downfall of many of their group companies and the resulting destruction in shareholders wealth.

On the other hand, the biggest factor, that differentiates HDFC group companies from their respective industry peers and command a premium in valuations, is the quality of their management and the legacy of their actions that have resulted in a phenomenal growth of all its group companies and the resulting healthy growth in shareholders wealth.

Despite of a poor performance of many of its schemes in the last 2-3 years, I expect HDFC AMC to keep growing its business at a healthy pace and maintain its leadership in equity oriented schemes for a long period of time. At Rs. 1,100 a share, I have a view that HDFC AMC is fairly valued, but still leaves a scope of money to be made on listing, and also due to long term sustainable growth in business and profitability.

For many of us, HDFC’s year on year consistent growth of 20%+ has been a matter of a case study. So, if 20% is a magical number for the HDFC group companies, then I would expect a 20% listing gain here too with this HDFC group company.

Currently all Asset Management companies (AMCs) are seeing huge inflow of money and as a result they are also getting huge profits. This is primary driven by good performance of the stock market. In the near future, if there is correction in the market, then you would see a lot of money flowing out of mutual funds but the fixed cost of all Asset Management companies will stay the same. So they will go in the red hence I would be cautious in investing HDFC AMC at anypoint. Best is to consult a financial advisor and take a holistic approach. We can help and you can contact us here – http://www.mnpartners.in/

I am watching on youu tube and reading a lot of things about – Parag parikh long term equity fund

Can you please let me know if this fund would be suitable for 5K SIP for 5 to 7 years time horizon.

How is this fund house? Are there any cons of Parag parikh long term equity fund scheme?

I invest in SBI blue chip direct and AB sunlife front-line equity direct funds. The current SIP in both funds is 10K each.

Please help me on the question.

Hi, I want to invest in Kotak Standard Multicap Fund – Direct Plan (G)

This SIP will be for 10,000 per month. I already invest in SBI Blue chip fund from last 5 years with SIP of 10,000 per month. I am 27 years old now and want to buy house in 10 yrs.

Please guide me if this Kotak fund is fine or can you suggest a Multi Cap fund for a goal of 10 years. Thank you!

With the stellar IPO performance, the HDFC AMC reported a 25% growth in net profits on YOY basis for quarter ended in June 18. HDFC AMC operates as a joint venture of HDFC and SLI. The asset management company currently stands among the top AMCs in India. A continuous growth and some acquisitions such as Morgan Stanley MF as well as Zurich India are the major contributors for the company’s flourishing performance. The company reports robust EPS of Rs. 34.04 along with an exceptionally high P/E ratio of 51.72x for TTM basis. The stock seems to be a potential one for long term investment.

Visit https://www.niveza.in/stock-news/free-stock-market-tips/stop-read-before-you-invest-in-stock-market-tips for FREE share market tips or Search Google for Niveza FREE Share Market Tips today

Hi, I want to buy “ICICI Pru Heart / Cancer Protect” to protect me and my spouse. Can you please help me in terms of if I can go ahead. This is specifically for cancer cover.

I already have term and critical illness insurance and this is just another step to protect my family.

Appreciate if you can help or suggest any other cancer plan. Thanks.

i am beginner in this can you guide me where to invest my money?

i want also invest in sites could you inform me its secure method for investment?

Hi,

I was to invest in the below two funds. I can invest 5,000 in each fund. So total 10,000/month. My goal is to generate 10 Lakh corpus in next 7 years. I am a new investor. Please help with the question.

1. HDFC Short Term Debt Fund

2. Franklin India Ultra Short Bond Fund

If you’re investment tenure is 7 years, you can very well invest in Equity funds instead of Debt funds. Invest in some good quality Aggressive Hybrid funds.

Sir,

My comment is awaiting moderation since July 28.

And the software is not allowing me to retype .

Its not accepting.

Hello,when one applies for the IPO,there are categories

1) HDFC shareholders

2)HDFC employee

3)HCFC general

Does this mean that out of the 35% reserved for retail application ….it will be further subdivided into these categories and preference will be given to shareholders and employees ?

I have subscribed to the IPO, but mostly I will not get an allotment. Why is it so that I am mostly not getting any allotment.? I have subscribed through ASBA.

https://www.wealthpedia.in/best-platforms-for-investing-in-direct-mutual-funds-in-india/

Hello, when one applies for the ipo..

There are different categories..

1) Hdfc shareholders

2) Hdfc employee

3) Hdfc general

Does this mean that out of the 35% that is reserved for retail application.,it will be further subdivided into these categories and preference will be given to employee and shareholders?

I note that there is a reserved category for existing HDFC share holders. Any idea how to avail that ?

YES bank ASBA application doesnot have any such category.

It is possible through SBI’s ASBA!

Hi Vish,

Have you been able to subscribe to it through SBI’s ASBA facility?

Yes, I did.. 2 minimum bids in 2 categories.