This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Shriram Transport Finance Company Limited (STFC) is launching its public issue of non-convertible debentures (NCDs) from tomorrow, July 2, 2014. This will be the first public issue by the company in the current financial year and the same will remain open for three weeks to close on July 22, 2014.

Though the base size of this issue is Rs. 500 crore, the company has filed the draft shelf prospectus for Rs. 3,000 crore. So, even if the company gets a demand of more than Rs. 500 crore for these NCDs, it will retain the oversubscribed portion to the tune of Rs. 3,000 crore.

Here are some of the features of the issue worth considering:

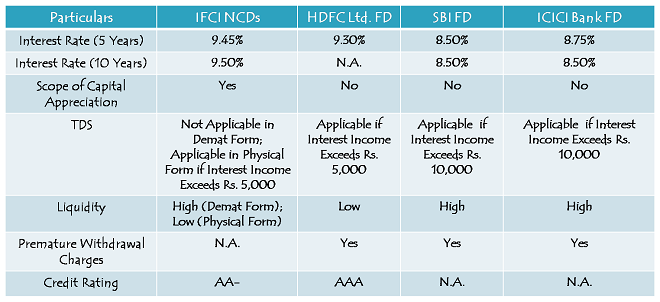

Credit Rating of the Issue – CRISIL has given a rating of ‘AA’ to the issue with a ‘Stable’ outlook, whereas CARE has assigned a rating of ‘AA+’, which is a notch above the rating of the NCD issue of ECL Finance. Moreover, this issue is ‘Secured’ in nature, unlike the ECL Finance issue which was ‘Unsecured’.

Categories of Investors & Allocation Ratio – The investors have been classified in the following four categories and each category will have the below mentioned percentage fixed in the allotment:

Category I – Institutional Investors – 10% of the issue is reserved

Category II – Non-Institutional Investors – 10% of the issue is reserved

Category III – HNI Individual & HUF Investors investing more than Rs. 5 lakh – 30% of the issue is reserved

Category IV – Retail Individual & HUF Investors investing Rs. 5 lakh or below – 50% of the issue is reserved

Allotment will be made on a first-come first-served (FCFS) basis.

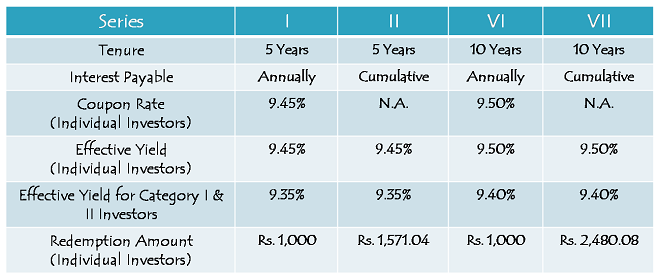

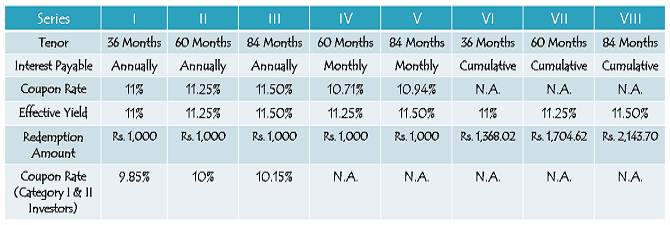

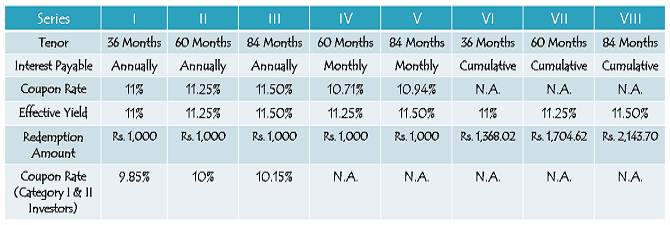

Coupon Rate & Tenor of the Issue – Individual investors, including HNIs, will be incentivised to invest in the issue with the company offering them an additional coupon of 1.15% to 1.35% over and above the base coupon rates applicable for the non-individual investors. These NCDs will be issued for a period of 36 months, 60 months and 84 months.

For 36 months, 60 months and 84 months, the individual investors will earn 11%, 11.25% and 11.50% per annum respectively. Apart from the annual and cumulative interest payment options, this time around the company has decided to offer monthly interest option as well. But, the monthly interest payment option will not be there with the 36 months maturity period.

Additional Coupon for Senior Citizens – Like some of the fixed deposits, senior citizens will get an additional interest rate of 0.25% p.a., but only the first allottees. If any of the senior citizen investors buys these NCDs through secondary markets post the initial public offer, he/she will not be entitled to this additional 0.25%. For monthly interest payment option, this rate would be 0.23% extra. For Series VI, VII and VIII, senior citizens will get Rs. 1,377.29, 1,723.87 and 2,177.70 respectively at the end of the tenure.

Minimum Application Size – STFC has fixed Rs. 10,000 as the minimum amount to invest in this issue. So, if you want to invest in this issue, you need to apply for a minimum of ten NCDs worth Rs. 1,000 each.

NRIs Not Allowed – Non-Resident Indians (NRIs), foreign portfolio investors (FPIs) and qualified foreign investors (QFIs) among others are not eligible to invest in this issue.

Demat/Physical Option – Investors can apply for these NCDs either in physical form or demat form, whichever they are comfortable with, except for Series IV and Series V NCDs i.e. NCDs which offer to pay monthly interest. Series IV and Series V NCDs will be allotted compulsorily in the demat form.

Taxability & TDS – As these are not tax-free debentures, the investors will be liable to pay tax on the interest income as per their individual tax brackets. Also, though the interest income is taxable, NCDs taken in demat form will not attract any TDS.

Listing, Lock-In Period – These NCDs will get listed on both the stock exchanges i.e. Bombay Stock Exchange (BSE) as well as National Stock Exchange (NSE) and the listing will take place within 12 working days after the issue gets closed.

Also, there is no lock-in period with these NCDs i.e. as and when these NCDs get allotted, the investors can sell their holdings on any of the exchanges whenever they want.

Conclusion

As compared to the NCD issue of ECL Finance which offered an effective annualised interest rate of 12.68%, the effective interest rate of 11.25% for 60 months seems a bit unattractive to me, despite of the fact that Shriram Transport Finance is a big company and quite superior fundamentally and even as these NCDs are ‘Secured’ in nature.

Having said that, STFC is a good company fundamentally. All those investors who could not invest in the past NCD issues and are willing to park their money for long periods of 36 months to 84 months can consider investing in this issue. These NCDs are way superior than company NCDs in terms of liquidity, safety and returns.

If I were to park my money in this issue, I would have opted for a tenure of 60 months with the monthly interest payment option or for a tenure of 60 months with the annual interest payment option.

Application Form of Shriram Transport Finance NCDs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in STFC NCDs, you can reach me at +91-9811797407