This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Muthoot Finance Limited will be the next company to come out with its issue of non-convertible debentures (NCDs) this month from September 17th. This issue will be the fourth issue from the company’s shelf in just over one year’s time.

Muthoot collected Rs. 1,413 crore through its previous three issues – Rs. 693 crore from Series I, Rs. 460 crore from Series II and Rs. 260 crore from Series III. The size of this NCD issue is Rs. 500 crore including a green-shoe option of Rs. 250 crore.

The company plans to use the proceeds for various financing activities including lending and investments, to repay existing loans, for capital expenditures and other working capital requirements.

About Muthoot Finance Limited

Muthoot Finance Limited, a flagship company of the Muthoot group, is primarily into the gold financing business which constitutes 99% of its total advances. It is also the largest gold loan company in India. Muthoot started its lending business in 2001 after getting RBI’s registration to function as an NBFC and currently it has a network of 3,780 branches all over India. The company till date has no major plans to diversify its business from gold loans to any other streams of financing.

Financials of the company

During the year ended March 31, 2012, the loan book of the company stood at Rs. 21,338 crore as against Rs. 11,682 crore during the year ended March 31, 2011, an increase of approximately 83%. Assets under management (AUM) stood at 26,707 crore in FY12 vs. 18,152 crore in FY11.

Muthoot reported revenues of Rs. 4,549 crore in FY12 as against Rs.2,316 crore in FY11, a jump of almost 96%. Net profit of the company increased by a massive 81% from 494 crore in FY11 to 892 crore in FY12.

Gross NPAs and Net NPAs of the company stood at 0.56% and 0.57% respectively as on March 31, 2012 as against 0.29% and 0.33% respectively as on March 31, 2011. Debt Equity Ratio of the company stands at 6.63 times before this issue and will result in 6.80 times after this issue.

Here is the link to check the latest audited financial results of the company ending March 31, 2012.

About the NCD Issue

This issue has seen a cut of 1.50% or 1.25% per annum in its interest rates across the board vis-a-vis its last two issues which the company came out with during December 2011 and March 2012 respectively. I do not understand the rationale behind this massive rate cut as the fundamentals of the company or the fortunes of the gold loan business have only deteriorated since then, as the Reserve Bank of India (RBI) has become stricter with the gold financing norms. Competition from the banks and other gold financing companies has also increased quite considerably.

I think the reason for this cut could only be attributed to the fact that during the previous two issues, the investors were not in a mood to invest any money in Muthoot NCDs after a severe beating all the listed NCDs suffered last year. Also, during that period, there was a flood of tax-free bonds and tax saving infrastructure bonds, which was keeping all the investors busy and ignorant to the Muthoot NCDs. In fact the company had decided to extend the closing date of its last issue from March 17th to April 9th and still the issue closed undersubscribed after remaining open for 39 days from March 2nd. So, I think the rate cut is not justifiable.

Here is the link to check the list of all previous Muthoot Finance NCD issues.

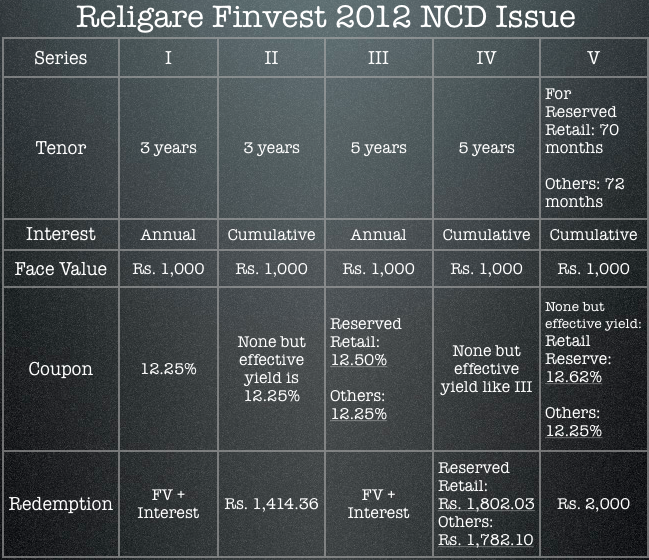

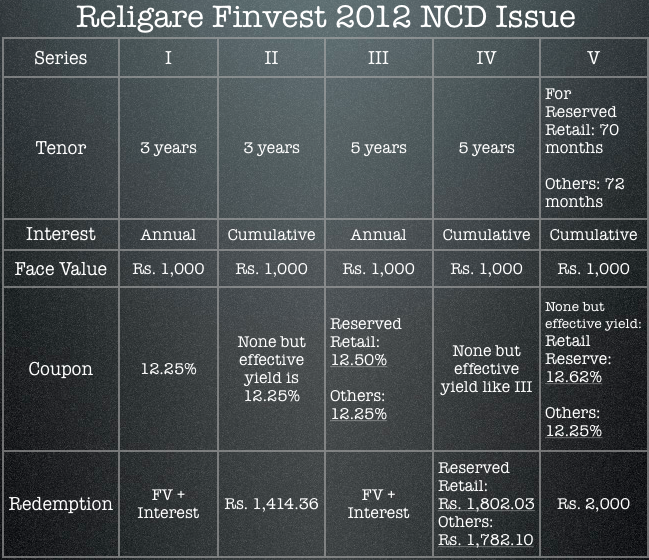

Though Muthoot’s loan portfolio has only one component in the form of gold loans but as far as the interest rates and maturity periods are concerned, the company always offer a bucketful of options. This year also they have many options – 2 Year NCDs, 3 Year NCDs, 5 Year NCDs and 6 Year NCDs offering 11.50%, 11.75%, 12% and 12.25% per annum respectively. “Option V†this year offers to double your money in 6 years, which was 5.5 years in the last two issues. Religare Finvest NCDs are promising to do the same for you in 70 months i.e. 5 years and 10 months, 2 months earlier than Muthoot. There is an option of monthly interest also but that is there only in the 5 year option with 11.75% p.a. rate of interest.

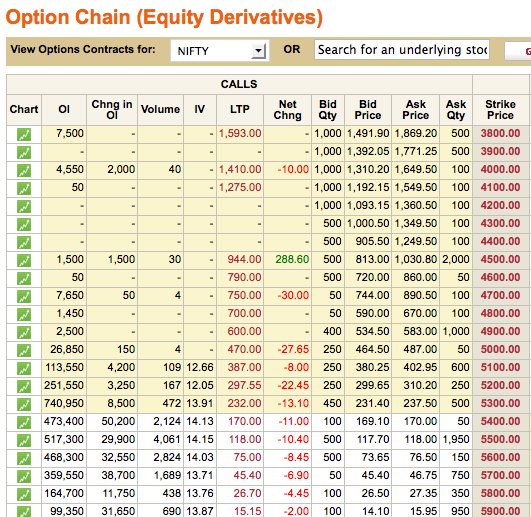

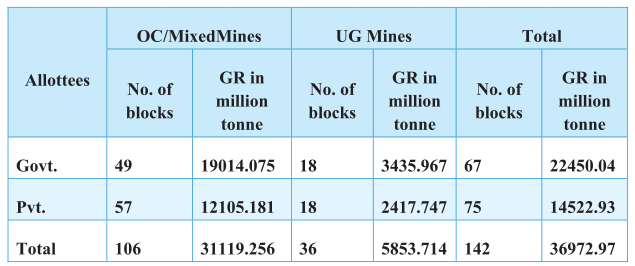

| Option | I | II | III | IV | V |

| Tenor | 2 Years | 3 Years | 5 Years | 5 Years | 6 Years |

| Coupon – 2012 | 11.50% | 11.75% | 11.75% | 12% | 12.25% |

| Interest Payment Frequency | Annual | Annual | Monthly | Annual | Cumulative |

| Redemption Amount | Rs. 1000 | Rs. 1000 | Rs. 1000 | Rs. 1000 | Rs. 2000 |

| Coupon FY2011 – I | 12% | 12.25% | N.A. | 12.25% | N.A. |

| Coupon FY2011 – II | 13% | 13.25% | N.A. | 13.25% | 13.43% |

| Coupin FY2011 – III | 13% | 13.25% | N.A. | 13.25% | 13.43% |

| Market Price FY2011 – I | Rs. 1000 | Rs. 980.2 | N.A. | Rs. 965.8 | N.A. |

| Market Price FY2011 – II | Rs. 1076.8 | Rs. 1067 | N.A. | Rs. 1080 | Rs. 1091 |

| Market Price FY2011 – III | Rs. 1036 | Rs. 1053 | N.A. | Rs. 1050 | Rs. 1058 |

* Tenor for 2nd and 3rd issue in FY 2011 under Option V was 5.5 years instead of 6 years.

** Interest Payment Dates: Issue I – September 14 every year, Issue II – January 18 every year, Issue III – April 18 every year

*** Data as on September 13, 2012

The interest earned will be taxable as per the tax slab of the investor but the company will not deduct any TDS on the NCDs taken in the demat form. The company has decided to keep the minimum investment requirement of Rs.10,000 (or 10 bonds of face value Rs. 1,000) which is on a higher side as compared to Rs. 5,000 which was there with the NCD issues of IIFFL and Shriram City Union Finance Limited (SCUF).

50% of the issue is reserved for the retail investors i.e. for individual or HUF investors investing up to Rs. 5 lakhs, 35% of the issue is reserved for the non-institutional investors and HNIs and the remaining 15% of the issue is reserved for the institutional investors. Again, NRIs and foreign nationals among others are not eligible to invest in this issue. The allotment will be made on a “first-come-first-served†basis.

These bonds will also list on both the stock exchanges – NSE and BSE. Investors will have the option to apply these bonds in physical form also except the “Option V†bonds which are available only in the demat mode. The issue has been rated ‘AA-/Stable’ by CRISIL and ‘[ICRA] AA-(Stable)’ by ICRA.

Performance of the bonds issued last year

Most of the NCDs issued by Muthoot during January and April this year, offering 13% coupon or more, are still trading at a yield of 13% or more. NCDs with coupon 13% for 2 years in the second issue last year are trading at Rs. 1076.80, yielding 13.53% and NCDs with coupon 13.25% for 3 years in the same issue are trading at Rs. 1067, yielding 14.17%. You can check the prices of last year’s NCDs in the pasted table here.

I have a view that it is the most unattractive issue of this financial year. With other issuers offering better rates than Muthoot and its previous issues quoting at a yield of 13% plus, I find no single reason for me or for any of my family members or clients to invest in this NCD issue of Muthoot Finance. The issue gets closed on October 5, 2012.

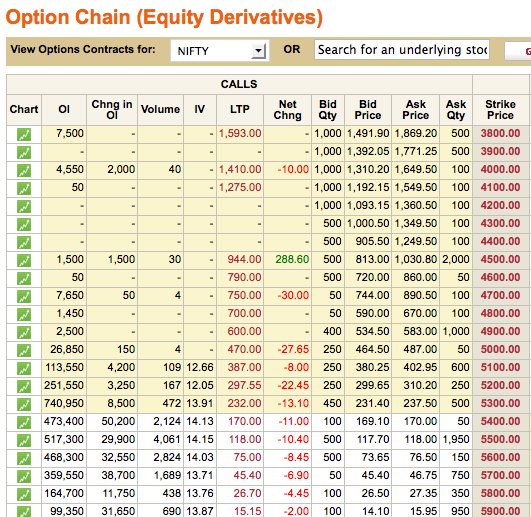

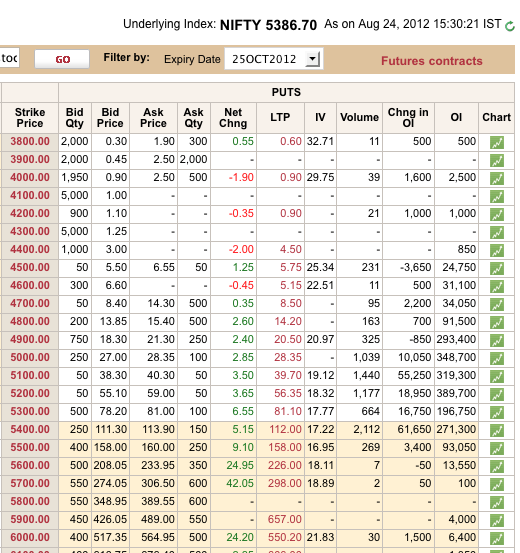

Now almost all the companies, which issued their NCDs last year, have offered their first round of NCDs this year again. Only one out of all these issues, NCD issue of Shriram Transport Finance, has got listed and that is currently trading at a marginal discount to its issue price. It would be very interesting to observe how these NCDs list after RBI comes out with its monetary policy on 17th of this month. If we see a rate cut from RBI this time around, then there should be a rise in the prices of all the listed NCDs and bonds. Let’s see what RBI does after a very long awaited diesel price hike has happened.