This article is written by Shiv Kukreja

Shriram Transport Finance Corporation will be launching the first public issue of Non-Convertible Debentures (NCDs) this financial year from July 26th. The issue size is Rs. 600 crore including a green-shoe option of Rs. 300 crore. The company plans to use the proceeds for various financing activities including lending and investments, to repay existing loans, for capital expenditures and other working capital requirements. The issue closes on August 10, 2012.

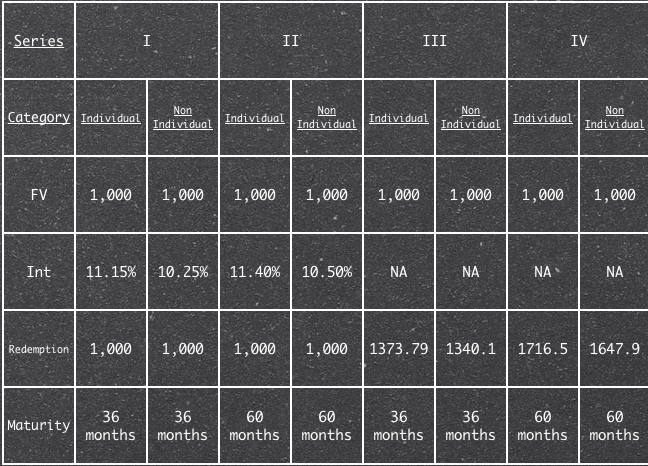

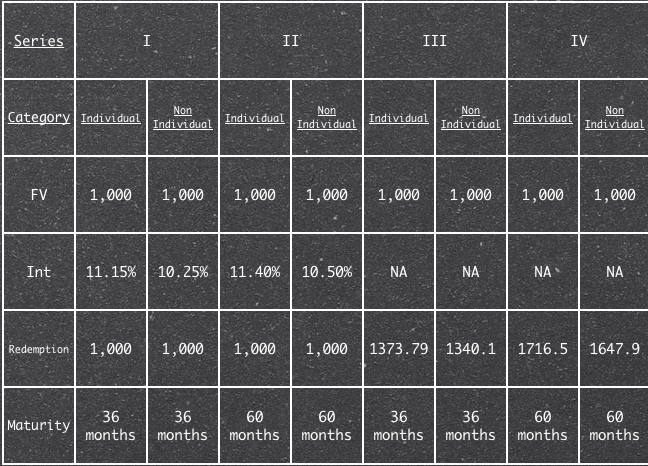

The bonds offer an annual coupon rate of 10.25% and 10.50% for a period of 36 months and 60 months respectively. What the company has done to make these NCDs attractive for the individual investors is that they will be offered an additional 0.90% p.a. making it an annual coupon rate of 11.15% and 11.40% respectively. This means even if an individual investor buys it from the secondary markets they are going to get 11.15% or 11.40%.

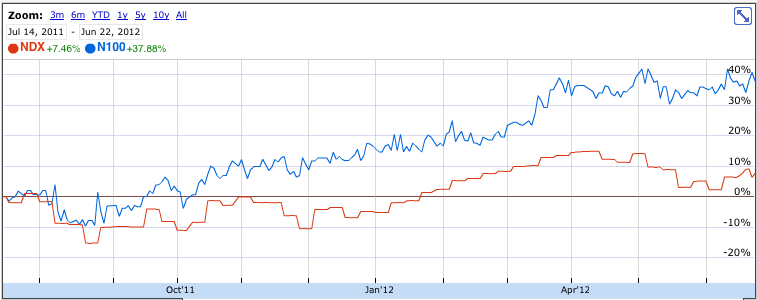

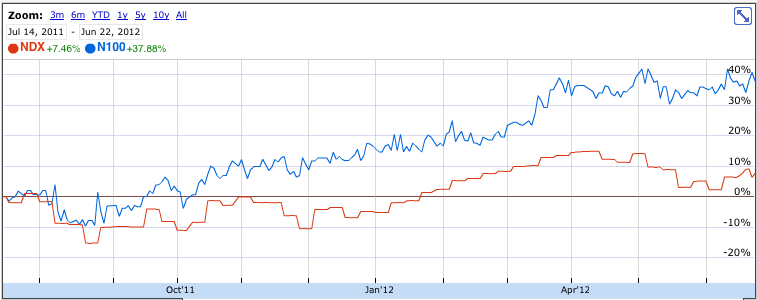

Many of you must have remembered that the company came with a similar kind of issue last year also. Bonds issued last year are currently yielding 11.07% under the 60 months reserved individual option and 12.23% under the 36 months reserved individual option. So, going by these yields, 11.40% and 11.15% is actually attractive for the individual investors.

The investors will have the option to get the interest either paid annually or at the end of the tenure along with the principal. Under the cumulative interest option, retail investors will get Rs. 1,716.15 after 5 years and Rs. 1,373.19 after 3 years for every Rs. 1,000 invested. For all other investors, these amounts stand at Rs. 1,647.90 and Rs. 1,340.10 respectively.

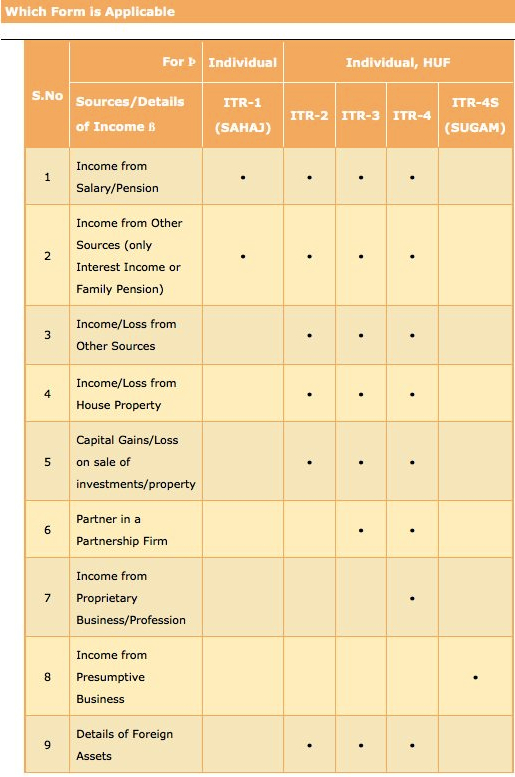

The interest earned would be taxable but the company will not deduct any TDS on it as is the case with all of the listed NCDs. The issue keeps a minimum investment requirement of Rs. 10,000 (or 10 bonds of face value Rs. 1,000) which seems reasonable from the small retail investors’ point of view.

These bonds will offer reasonable liquidity to the investors as they are going to list on both the stock exchanges – NSE and BSE. Unlike last year, the retail investors will have the option to apply these bonds in physical form also. All the remaining investors will have to subscribe these bonds compulsorily in demat form only.

40% of the issue is reserved for the Reserved Individual Category i.e. for the individual investors investing up to Rs. 5 lakhs and another 40% of the issue is reserved for the Non-Reserved Individual Category i.e. for the individual investors investing above Rs. 5 lakhs. 10% of the issue is reserved for the institutional investors and the remaining 10% is for the non-institutional investors. NRIs and foreign nationals among others are not eligible to invest in this issue.

A slew of NCD issues had hit the markets last year when companies like Shriram Transport, Shriram City Union Finance, Muthoot Finance, Manappuram Finance, Religare Finvest, India Infoline Investment Services etc. came with approximately ten such issues. I must tell you, except Shriram Transport NCDs, all other NCDs listed at a discount and that too at quite a deep discount of 5-8% in some cases. Many of them have still not been able to recover from those losses. They must be yielding higher than 13% even now.

But Shriram group is a quite stable group and the issue has been rated ‘AA/Stable’ by CRISIL and ‘AA+’ by CARE suggesting that these bonds are reasonably safe to invest. Unlike last year, there are no put/call options available either to the investors or to the company.