This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

I had covered Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) a few weeks ago, but there were still a few things which were not clear at that time. In order to cover all missing links and provide some updated information, I thought of covering the FAQs provided on the government’s Jan Suraksha website.

So, here you have the FAQs covering PMJJBY:

Q1. What is the nature of the scheme, Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)?

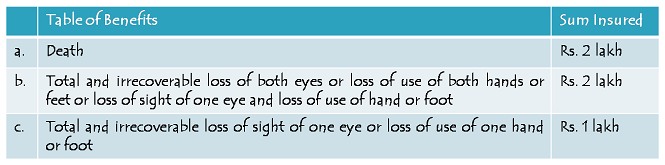

The scheme is a Term Insurance Scheme with a life cover of Rs. 2 lakhs for one year. It is renewable every year, offering life insurance cover for death due to any reason.

Q2. What are the benefits under the scheme and how much is the premium?

Rs. 2 lakhs is payable on a subscriber’s death due to any reason. The premium payable is Rs. 330 per annum per subscriber.

Q3. How the premium is to be paid?

The premium will be deducted from the account holder’s savings bank account through ‘auto debit’ facility in one installment, as per the option to be given on enrolment. Members may also give one-time mandate for auto-debit every year till the scheme is in force, subject to re-calibration that may be deemed necessary on review of experience of the scheme from year to year.

Q4. Who is eligible to subscribe? Can I enrol myself with two or more different banks?

All savings bank account holders in the age 18 to 50 years in participating banks will be entitled to join. In case of multiple saving bank accounts held by an individual in one or different banks, the person would be eligible to join the scheme through one savings bank account only.

Q5. Will this cover be in addition to cover under any other insurance scheme the subscriber may be covered under?

Yes, this cover of Rs. 2 lakhs will be in addition to your existing life insurance cover(s). So, in case of any mishappening, you will get the insurance claims under all your policies, including PMJJBY.

Q6. If the subscriber survives the policy period, what would be the Surrender Value or the Maturity Benefits?

As it is a term insurance plan, there will be no surrender value or maturity value payable under this policy. This policy is similar to a car insurance policy, in which nothing gets paid to you if your car doesn’t meet any accident or you do not make any such claim.

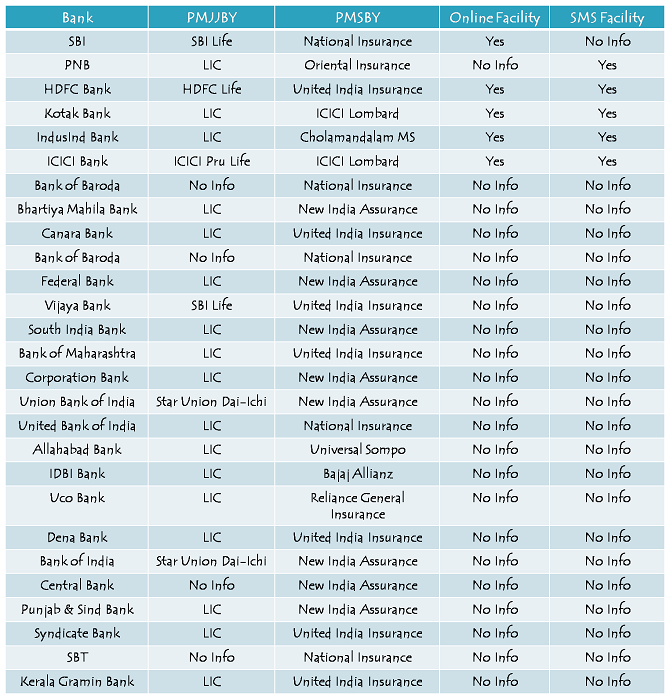

Q7. Who will offer / administer the scheme?

The scheme would be offered / administered through LIC and other Life Insurance companies in collaboration with participating banks. Participating banks will be free to engage any such life insurance company for implementing the scheme for their subscribers.

Q8. What is the enrolment period and modality?

Initially on launch for the cover period from 1st June 2015 to 31st May 2016 subscribers are expected to enroll and give their auto-debit option by 31st May 2015, extendable up to 31st August 2015. Enrolment subsequent to this date will be possible prospectively on payment of full annual payment and submission of a self-certificate of good health. Subscribers who wish to continue beyond the first year will be expected to give their consent for auto-debit before each successive May 31st for successive years. Delayed renewal subsequent to this date will be possible on payment of full annual premium and submission of a self-certificate of good health.

Q9. Can eligible individuals who fail to join the scheme in the initial year join in subsequent years?

Yes, on payment of premium through auto-debit and submission of a self-certificate of good health. New eligible entrants in future years can also join accordingly.

Q10. Can individuals who leave the scheme rejoin?

Individuals who exit the scheme at any point may re-join the scheme in future years by paying the annual premium and submitting a self declaration of good health.

Q11. Who would be the Master policy holder for the scheme?

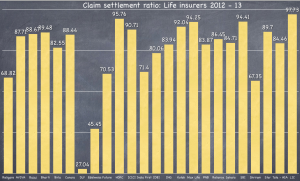

Participating Banks will be the Master policy holders. A simple and subscriber friendly administration & claim settlement process shall be finalized by LIC / chosen insurance company in consultation with the participating bank.

Q12. When can the assurance on life of the member terminate?

The assurance on the life of the member shall terminate / be restricted accordingly on any of the following events:

(i) On attaining age 55 years (age near birth day), subject to annual renewal up to that date (entry, however, will not be possible beyond the age of 50 years).

(ii) Closure of account with the Bank or insufficiency of balance to keep the insurance in force.

(iii) In case a member is covered through more than one account and premium is received by LIC / insurance company inadvertently, insurance cover will be restricted to Rs. 2 Lakh and the premium shall be liable to be forfeited.

Q13. What will be the role of the insurance company and the Bank?

(i) The scheme will be administered by LIC or any other Life Insurance company which is willing to offer such a product in partnership with a bank / banks.

(ii) It will be the responsibility of the participating bank to recover the appropriate annual premium in one installment, as per the option, from the account holders on or before the due date through ‘auto-debit’ process and transfer the amount due to the insurance company.

(iii) Enrollment form / Auto-debit authorization / Consent cum Declaration form in the prescribed proforma, as required, shall be obtained and retained by the participating bank. In case of claim, LIC / insurance company may seek submission of the same. LIC / Insurance Company also reserve the right to call for these documents at any point of time.

Q14. How would the premium be appropriated?

1. Insurance Premium to LIC /other insurance company: Rs.289/- per annum per member;

2. Reimbursement of Expenses to BC/Micro/Corporate/Agent : Rs.30/- per annum per member;

3. Reimbursement of Administrative expenses to participating Bank: Rs.11/- per annum per member.

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Participating Banks & Insurance Companies servicing PMJJBY & PMSBY

If you find any relevant info missing in these FAQs or have any of your queries regarding this scheme, please share it here.

I know that this is a very big issue for a large number of retail investors whether they know it or not. I say that because Colin is actually in the minority in the sense that he is aware of the fact that he doesn’t know how to calculate the return of an insurance policy. The vast majority of people who own insurance policies don’t know how to calculate the returns, or if they know the mechanics of it, are not aware of the actual numbers they should use, and that is a bigger issue than the calculation itself.

How do you calculate the return on an insurance policy?

At very basic level, there are two numbers you have which are how much premium you pay every year, and what is the final amount you are expected to get. You use these two numbers to get the rate of return on your investment.

This is very simple if you don’t want to understand the maths behind this (which you probably don’t need either). Go to this annuity calculator, and click on “Rate”. After that enter the values as follows:

The system will calculate a rate of return for you after you enter these three values and this is the rate of return of your insurance policy, and if you are entering actual numbers from your policy, I would expect them to be in the mid to lower single digit range because that is generally what most insurance policies return.

Which numbers to use in the return calculation of your insurance policy?

This is often the harder part where the brochures and tables that you are shown often have little stars on them with subtle disclaimers that confuse the issue and make it hard to decide which numbers to use.

Every insurance policy that provides returns will either have a guaranteed and variable return, or just variable return or just guaranteed return.

If you just have guaranteed return then use that to see how much is the rate of return.

If you have only variable or a mix of variable and guaranteed then carefully go through the documents to ascertain where the distinction is and you will have to input one or more numbers to account for the assumptions they are making at various return points, and see what the policy is likely to net you in different projected scenarios. Even then, please appreciate that these are projections and may not come to realize at all if the insurance company doesn’t make as much money as they hoped they’d make.

This is definitely the harder part of calculating returns and requires some judgment calls and also the understanding that all you have is assumptions and there is no guarantee that any of this may come to pass.

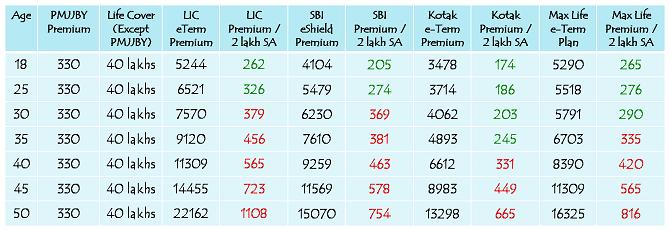

How to measure the returns against a term plan?

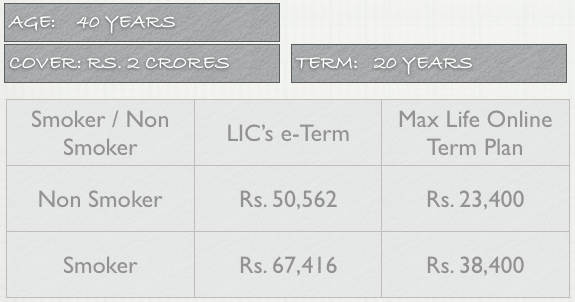

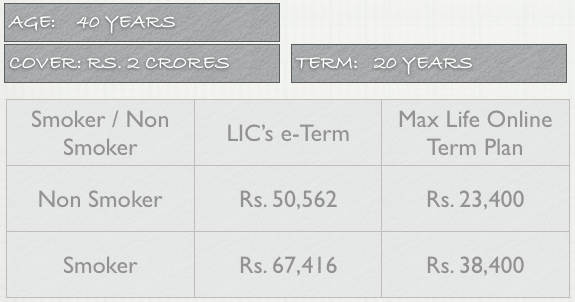

Once you have calculated returns or have some general idea of what those returns might be, go to the website of any life insurance company and get an estimate of what an equivalent pure term plan will cost you. Now, deduct that amount from your premium and see how much money you save, and if you invested that in a simple bank fixed deposit how much money you’d make. In most cases, you will find that this combination is better than whatever policy you currently own.

If you have insurance policies, and have never done this exercise then I’d highly recommend doing it and getting a sense of how much you are paying for the insurance, and whether you can substitute that with a term plan and the remaining money in a fixed deposit or a mutual fund.