One of the most common questions I get is about children insurance plans, and usually the comment is accompanied with the name of a plan and a request to review it. I am not too familiar with child insurance plans, and the problem with following this approach is that I don’t know if there are plans better than the ones I have looked at. I thought it would be good if there were one page with child insurance plans, and I was a bit surprised to see that no one has already done that.

So I started by creating my own list of child insurance plans.

There are several child insurance plans in India, and I have created this list of every child insurance plan that I came across.

I think you can divide them into the following different categories:

1. No different than a normal plan: There are a few plans that some insurers have labeled as child insurance plans but which are totally indistinguishable from any other policy they offer.

2. Child is the insured: In these type of plans, the insurance is on the child, and I can’t understand why companies are offering such plans. What is the point on offering insurance on children?

3. Health insurance for children: These plans provide health insurance for children, and though not many parents think about medical or health insurance for children, these can be useful at times. I used to have one of these plans in my own childhood and it was a good because it came handy when I got an appendix operation in my college.

4. Parent is the insured: These are like term plans and pay up on the demise of a parent. These are of two types – they either pay the whole amount at the time of the death, or wait till the child becomes a major and then pays them.

5. Money-back plans: These are the most common type of child insurance plans where you pay a premium for a number of years and then the insurance company pays you back at set time periods. In children plans you usually get this amount when the child is 18 years old or some other milestone like that.

I have tried to list all the child insurance plans that I could find and took their description from the website itself. The idea was to see the whole list at one place and then narrow down ones that you find interesting to review further in later posts.

If you know a plan that’s missing from this list please let me know and I will update the post. If you want some parameters added then you can leave a comment and I’ll try to see if I can get that added on this post itself.

| Insurer | Name of the Policy | Features | ||||||||||||||||||||

| National Insurance Company Limited | Amartya Siksha Yojana Policy

|

The policy is basically intended for covering expenses to be incurred after happening of the accidental contingency to the insured parent/guardian of the insured student child for continuation of the insured students education in respect of the covered course till completion of the course.

The Policy will also cover the first admission fees but will excluded Donation /Capitation Fees if any.

|

||||||||||||||||||||

| National Insurance Company Limited | Vidyarthi – Mediclaim for students | VIDYARTHI-Mediclaim for Students is a unique policy designed to provide Health and Personal accident cover to the students. It also provides for continuation of insured students education in case of death or permanent total disablement of the guardian due to accident.

Parents/Legal Guardian of individual student in any Registered Educational Institution affiliated to any State Board, Council, University and AICTE or any other Govt. Statutory Authority, within the territory of India may take this policy. The Educational Institutions may also take a Group Policy covering named students enrolled with them. |

||||||||||||||||||||

| Future Generali | Future Generali Flexible Money Back | Key Features:

|

||||||||||||||||||||

| Future Generali | Future Generali Select Insurance Plan – Child Insurance Plan | Key Features

Â

|

||||||||||||||||||||

| LIC India | Jeevan Anurag | LIC’s Jeevan ANURAG is a with profits plan specifically designed to take care of the educational needs of children. The plan can be taken by a parent on his or her own life. Benefits under the plan are payable at prespecified durations irrespective of whether the Life Assured survives to the end of the policy term or dies during the term of the policy. In addition, this plan also provides for an immediate payment of Basic Sum Assured amount on death of the Life Assured during the term of the policy

Assured Benefit

|

||||||||||||||||||||

| LIC | Komal Jeevan | This is a Children’s Money Back Plan that provides financial protection against death during the term of plan with periodic payments on survival at specified durations. This plan can be purchased by any of the parent or grand parent for a child aged 0 to 10 years.

|

||||||||||||||||||||

| LIC | Children’s Deferred Endowment Assurance Plan – Vesting at 21 | This is an Endowment Assurance plan designed to enable a parent or a legal guardian or any near relative of the child (called proposer) to provide insurance cover on the life of the child (called life assured). The plan has two stages, one covering the period from the date of commencement of policy to the Deferred Date (called deferment period) and the other covering the period from the Deferred Date to the date of maturity. The insurance cover on the child’s life starts from the Deferred Date and is available during the latter period.

The Deferred Date in case of Plan No 41 is the policy anniversary date coinciding with or next following the date on which the child completes 21 years of age.

|

||||||||||||||||||||

| LIC | Marriage Endowment Or Educational Annuity Plan | Product summary: This is an Endowment Assurance plan that provides for benefits on or from the selected maturity date to meet the Marriage/Educational expenses of the named child. Premiums: Bonuses:

|

||||||||||||||||||||

| LIC | Jeevan Kishore | Product summary: This is an Endowment Assurance Plan available for children of less than 12 years of age. The policy may be purchased by any of the parent/grand parent. Commencement of risk cover: Premiums: Bonuses: Â |

||||||||||||||||||||

| LIC | Jeevan Chhaya | Product summary: This is an Endowment Assurance plan that provides financial protection against death throughout the term of the plan. Besides payment of Sum Assured immediately on death, one-fourth of Sum Assured is payable at the end of each of last four years of policy term whether the life assured dies or survives the term of the policy. Premiums: Bonuses: Â |

||||||||||||||||||||

| LIC | Child Career Plan | This plan is specially designed to meet the increasing educational and other needs of growing children. It provides the risk cover on the life of child not only during the policy term but also during the extended term (i.e. 7 years after the expiry of policy term). A number of Survival benefits are payable on surviving by the life assured to the end of the specified durations.

|

||||||||||||||||||||

| LIC | Jeevan Ankur | LIC’s Jeevan Ankur is a conventional with profits plan, specially designed to meet the educational and other needs of your child. If you are the parent of a child aged upto 17 years, LIC’s Jeevan Ankur is the most suitable insurance plan for you which ensures that your responsibilities are met whether you survive or not and without depending on anyone else.

The risk cover under this plan will be on your life as a parent and the named child shall be the nominee under the plan. The policy term shall be based on the age at maturity of the child.

|

||||||||||||||||||||

| AEGON Religare | AEGON Religare Educare Plus Insurance Plan | AEGON Religare’s Educare Plus Insurance Plan provides you with lump sum payouts during the last four policy years so that recurring college fees are never a hassle!

|

||||||||||||||||||||

| AEGON Religare | AEGON Religare Rising Star Insurance Plan |

|

||||||||||||||||||||

| Aviva | Aviva Family Income Builder

|

Benefits That I Will Receive Guaranteed Income for self:Â Pay annual premium every year for 12 years and get Double the annual premium every year from 13th to 24th year. Guaranteed Income for family in case of your death:Â If death occurs after the first policy year, an amount equal to Double the Annual Premium is guaranteed as annual payouts for family from 13th to 24th year, if all due premiums were paid till death. Future premiums are not required to be paid by the family. If death occurs during the first policy year, an amount equal to the Annual Premium is guaranteed as annual payouts for family from 13th to 24th year, if all due premiums were paid till death. Future premiums are not required to be paid by the family. |

||||||||||||||||||||

| Aviva | Aviva Young Scholar Advantage

|

Death Benefit:

Rider Benefit:

Loyalty Additions:

Maturity Benefit:

|

||||||||||||||||||||

| Aviva | Aviva Young Scholar Secure

|

Death Benefit:

Upon death, Life cover is paid to the nominee (beneficiary) and the policy continues with all benefits intact. Any installment already paid by us will not be deducted from the death benefit. All future installments of Tuition Fee Support, College Admission Fund & Higher Education Reserve will be paid on the scheduled dates Additional benefits as detailed below will also be paid if the corresponding riders are opted for: – Aviva Term plus rider Sum Assured is also payable on death if this rider has been opted for – An additional sum equal to ADB Rider Sum Assured would be payable, if ADB Rider has been opted and death is due to an accident. – Aviva Dread Diseases rider Sum Assured is paid on contracting any of the 18 critical illnesses covered or on suffering Permanent Total Disability (PTD) due to illness or accident, while the policy continues with Death Benefit intact. The said benefits are applicable only if the policy is inforce as on date of evantuality Guaranteed Education Support Benefit: This plan provides guaranteed Tuition fee support, College Admission Fund and Higher Education Reserve irrespective of you being there or not. Please click here for further details on payout pattern. If you would like to understand the benefits using an Illustration please click here |

||||||||||||||||||||

| Birla Sun Life Insurance | BSLI Bachat Child Plan | Once you have chosen your premium amount, you receive a series of benefits as follows:

1. You will get a life cover for the financial security of your family.

|

||||||||||||||||||||

| Birla Sun Life Insurance | BSLI Classic Child Plan | You choose the Savings Date that suits your financial goals for your child. 2. Your Policy Term will be the Savings Date + 20 years. 3. You choose the Basic Premium you want to pay every year. 4. You will receive Basic Sum Assured which is the minimum death benefit payable on the demise of the primary life insured. The Basic Sum Assured is automatically determined as your Basic Premium multiplied by: • ​The higher of 10 or the number of years to maturity divided by 2, for entry ages below 45; or • The higher of 7 or the number of years to maturity divided by 4, for entry ages 45 and above 5. You have an option to choose an Enhanced Sum Assured and increase the financial security for your child’s future. With this option you can choose any amount of additional life cover over and above the Basic Sum Assured at a nominal cost. 6. You have an option to choose from our range of riders and customise your family’s future financial security.

|

||||||||||||||||||||

| Birla Sun Life Insurance | BSLI Dream Child Plan | You choose the Guaranteed Savings Date that suits your objectives. Your Guaranteed Savings Date is the policy anniversary when your child’s attained age is from 18 to 27 years, subject to a minimum of 10 policy years. 2. Your Policy Term will be your Guaranteed Savings Date + 20 years. 3. You decide the Basic Premium you want to pay every year. 4. You will receive Basic Sum Assured which is the minimum death benefit payable on the demise of the primary life insured. The Basic Sum Assured is automatically determined as your Basic Premium multiplied by: • The higher of 10 or the number of years to maturity divided by 2, for entry ages below 45; or • The higher of 7 or the number of years to maturity divided by 4, for entry ages 45 and above 5. You have an option to choose an Enhanced Sum Assured to increase the financial security for your loved ones. With this option you can choose any amount of additional life cover over and above the Basic Sum Assured at a nominal cost. 6. You have an option to choose from our range of riders to further customize the financial security of your loved ones.

|

||||||||||||||||||||

| Canara HSBC Life | Canara HSBC Oriental Bank of Commerce Life Insurance Future Smart Plan | Our Future Smart Plan is a unit linked child plan that provides long-term investment opportunity to build a bright future for your child. Its comprehensive insurance cover (Sum Assured on death and Premium Funding on death or disability) ensures that your plan for your child’s future continues unaffected, in any unfortunate event.

|

||||||||||||||||||||

| Edelweiss Tokio Life | Edelweiss Tokio Life – Education | This is a non participating guaranteed endowment Plan.

The comprehensive death benefit pays not only a lump sum amount to your family, but also waives future policy premiums, thereby protecting the maturity value that you had planned for your child. In addition to all this, the plan also offers a monthly benefit to take care of your child’s needs in the years before graduation.

|

||||||||||||||||||||

| HDFC Life | HDFC SL YoungStar Super II

|

In case of your unfortunate demise or critical illness, we will pay the greater of Sum Assured (less partial withdrawals) or Fund Value to your child (Beneficiary). The policy will terminate. We will pay 100% of all the future regular premiums to the Beneficiary as and when due, on an annual basis. Please refer to the sales brochure for details.

|

||||||||||||||||||||

| HDFC Life | HDFC SL YoungStar Super Premium

|

The Triple Insurance Benefit helps you secure your child’s immediate and future needs. In case of your unfortunate demise or critical illness, we will pay the Sum Assured to your child (Beneficiary). Your family need not pay any further premiums. With Save -n- Gain benefit ,we will pay 50% of all the original regular premiums towards your policy and 50% of the premiums will be paid to the Beneficiary as and when due, on an annual basis. Any Death Benefit or Critical Illness cover terminates immediately.

|

||||||||||||||||||||

| ICICI Prudential Life Insurance | ICICI Pru Smart Kid RP | This plan guarantees educational benefits to your child. It provides you with two options to receive those benefits. | ||||||||||||||||||||

| ICICI Prudential Life Insurance | ICICI Pru Smart Kid Premier | You need to choose the premium amount, sum assured, coverage option, premium payment option, premium payment mode, policy term and portfolio strategy for your policy.

After deducting the premium allocation charges, the balance amount will be invested in the portfolio strategy of your choice. At maturity, the Fund Value including Top up Fund Value, if any, shall become payable. Alternatively, the Settlement Option can be chosen. In the unfortunate event of death of the parent (Life Assured) during the term of the policy, the Company shall pay the full Sum Assured and shall also waive all the future premiums payable under the policy while continuing the allocation of units as if the premiums are being paid. However, if the joint life option is chosen, the death benefit shall become payable on death of either of the parents, whichever is earlier. The maturity benefit shall become payable on the date of maturity. |

||||||||||||||||||||

| IDBI Federal Life Insurance Co Limited | Childsurance | Pay premiums for a limited period or for the entire term of the plan – Pay additional top-up premiums whenever you want. Grow wealth faster and get tax benefits Choose how your money is invested from a wide choice of investment options, based on your return expectations and risk tolerance – Choice of wide range of fund options, with varying levels of risk and return Choose your investment strategy – Manage your investments as per your choice with complete flexibility or Boosters to help your savings grow faster – Receive Guaranteed Loyalty Additions** at the end of specific terms as a reward for making long-term investments

|

||||||||||||||||||||

| ING Life | ING Aashirvaad | Guarantee 1:- Guaranteed Maturity Benefit (GMB) with flexible payout options ING Aashirvad guarantees the target amount you have aimed for your child and offers flexible options to receive your maturity payout that will take care of your child’s key financial needs.

Guarantee 2:-

|

||||||||||||||||||||

| ING Life | Creating Life Child Protection Plan: A Children Life Insurance Policy |

|

||||||||||||||||||||

| ING Life | Creating Life Money Back Plan-Financial planning for children |

|

||||||||||||||||||||

| Kotak Life | Kotak Child Advantage Plan | Save up for your children’s education or marriage through the Kotak Child Advantage Plan – a savings-cum-life-insurance plan. Not only can you accumulate money for your children, you also protect them from unfortunate financial consequences as a result of eventualities like an untimely death of the parent.

|

||||||||||||||||||||

| Kotak Life | Kotak Headstart Child Assure

|

Your regular investments made with this plan will provide you with a planned corpus upon the maturity of the plan, ensuring that the cost of education will never be a deterrent to fulfilling your children’s dreams.

Secure the well-being of your family through triple protection In the unfortunate event of a parent’s death, Kotak Life Insurance helps lessen the financial burden the child might face by providing the benefit of triple protection as follows:

|

||||||||||||||||||||

| Kotak Life | Kotak Child Edu Plan |

|

||||||||||||||||||||

| Kotak Life | Kotak Child Future Plan |

|

||||||||||||||||||||

| Max Life Insurance | Shikhsha Plus II |

Immediate Family Support:100% of applicable Sum Assured is paid immediately in the event of death ofLife Assured. This ensures that the child doesn’t have to depend on anybody else in your absence. University Education Pool:Upon policy maturity, the prevailing Fund Value is paid out to take care of higher education expenses of your child. It is calculated as (Accumulated Units x prevailing NAV). University Education Support:In the event of death of Life Assured, all future premiums are funded by us to boost the University Fund corpus and protect the child’s dreams of studying in an university of his/her choice. School Fee Support:10% of Sum assured will be paid immediately along with Immediate Family support. From the next policy anniversary following the date of death, 10% of the base sum assured will be paid on each policy anniversary to provide for school expenses subject to a maximum of 100% of the base sum assured but not beyond the original term of policy. Talent Enhancement Withdrawal:To encourage and nurture your child’s special talents, you can withdraw a specified amount from your Fund Value to assist talent enhancement.

|

||||||||||||||||||||

| Max Life Insurance | Max Life College Plan |

Key Features:Living and maturity benefit:The total payout is 120% of Sum Assured. There are guaranteed cash backs every year from child’s age 18 to 21.

|

||||||||||||||||||||

| PNB Metlife | PNB MetLife offers ‘Met Bhavishya’ – a guaranteed money back plan that pays out funds to help you meet the education and career milestones of your children. With this plan, the Life Insured is that of the parent. The plan also has inbuilt guaranteed additions to add value to the policy over its term.

There are two options to choose from and fixed term benefits, periodic additions & terminal additions are payable based on the option that you select. The policy is suitable for parents with children between the ages 0-12 and parents in the age group of 20-50 years old. |

|||||||||||||||||||||

| PNB Metlife | Met Smart Child | Today, your role in your child’s life extends from being a provider to a nurturer, a mentor and a friend. You are a part of your child’s dreams and rising aspirations – the one responsible to ensure that your child gets what they aspire for. This decision requires you to plan and be prepared for tomorrow. Our specially designed plans take care of the ever changing requirements of your child, be it the rising education cost, financial planning for his extracurricular developments or marriage. We understand each of your roles and participate with you to realize your child’s every dream. | ||||||||||||||||||||

| PNB Metlife | Met Junior Endowment | PNB MetLife offers ‘Met Junior’ – a flexible endowment plan that combines savings and security. Your children’s well-being is your highest priority. So we offer a plan which offers both timely and efficient “Return on Investment”. All with a guarantee.

Met Junior is available in both participating (UIN:117N010V01) as well as non-participating versions(UIN:117N005V01). |

||||||||||||||||||||

| PNB Metlife | Met Junior Money Back | PNB MetLife offers ‘Met Junior Money Back’ – a money back plan that combines savings and security. Your child’s well-being is your highest priority. So we offer you a money back plan which provides guaranteed periodic survival benefits at the end of 5, 10 & 15 years, along with guaranteed growth of your savings.Â

A plan which offers both timely and efficient “return on investment” with payouts at different milestones. |

||||||||||||||||||||

| Reliance Life Insurance | Reliance Child Plan | As a parent, it is only natural to dream of a smooth and blissful life for your child. Which is exactly why you need to secure your child’s tomorrow, today.

Reliance Child Plan helps you save systematically so that you can give your child the much-needed financial security in the future. Simply put, Reliance Child Plan gives you the freedom to enjoy every moment with your child today, without worrying about his/her tomorrow.

|

||||||||||||||||||||

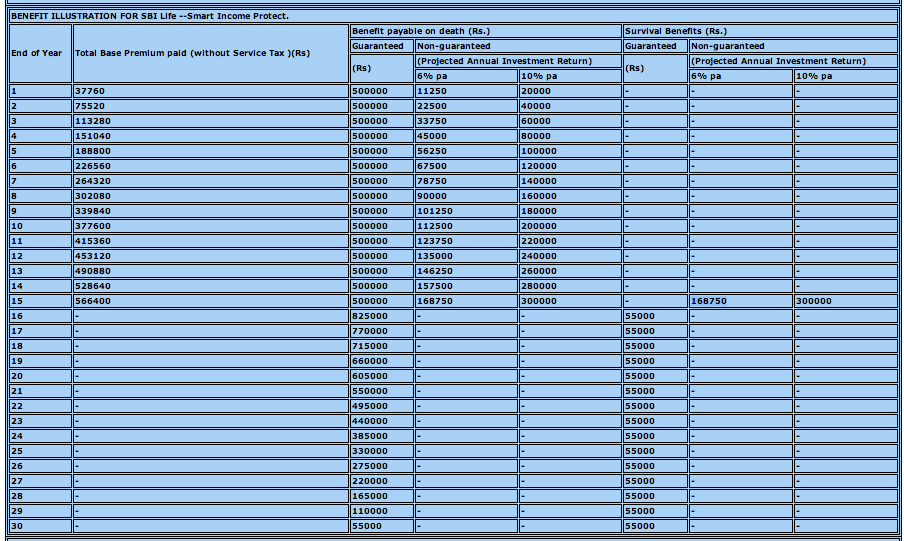

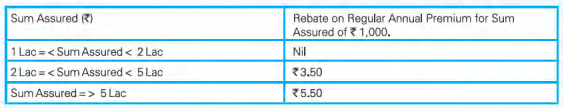

| SBI Life Insurance | SBI Life – Scholar II | A traditional participating plan, SBI Life – Scholar II has guaranteed benefits which are payable at the regular intervals during the term of the policy. In an unfortunate event, your nominee would receive full sum assured along with vested bonus, plus regular guaranteed survival benefit. Key Features: • Twin benefit of saving for your child’s education and securing a bright future despite the uncertainties of life. Full risk cover throughout the policy term irrespective of payment of survival benefits installments. Option to receive the installments in lump sum at the due date of first installment of Survival benefit. Rebate for Female lives and High Sum Assured. 15 days Free Look Period. |

||||||||||||||||||||

| SBI Life Insurance | SBI Life – Smart Scholar |

|

||||||||||||||||||||

| Tata AIA Life Insurance | Tata AIA Life Insurance United Ujjwal Bhawishya Supreme |

|

||||||||||||||||||||

| Tata AIA Life Insurance |

Security Net (Inbuilt Waiver of Premium Benefit# + Family Income Benefit)

|

|||||||||||||||||||||

| Â Tata AIA Life Insurance | TATA AIA Life StarKid |

|

||||||||||||||||||||

| Â Tata AIA Life Insurance | TATA AIA Life Assure Career Builder |

Key Features

|

||||||||||||||||||||

| Â Tata AIA Life Insurance | TATA AIA Life Assure Educare |

|

||||||||||||||||||||

| Â Tata AIA Life Insurance | TATA AIA Life Assure 21 Years Money Saver Plan |

*Â In case the policy has been in force for 10 years; |

||||||||||||||||||||