This blog has been contributed by our guest blogger, Ms Snehil Gupta. She is leading the marketing & business development for CrediFiable (https://credifiable.com)

Investing is putting your money at work so that it grows in value over time and generates returns for you. You should not confuse investing with savings. You save when you simply put aside a part of your income in a safe place so that it is almost risk-free such as money in your saving bank account. Your money hardly grows in value over time when you just save. On the other-hand investing is committing your money to a financial product such as mutual fund or bond or direct stock, so that your money is exposed to some amount of risk in exchange of higher expected returns.

Understanding Risk & Return on Investment

In a very layman’s definition, return on investment is the amount by which the value of your original money changes. When the sum of your invested money increases, you have positive returns and when your sum of money decreases then you have earned negative returns.

Risk is defined as probability of deviation of the actual returns from the expected returns on your invested money. What this means is that if you put your money in a risky investment then there is a chance that you may lose some or even all your initial investment. There is also a chance that your investment grows in value and you stand to gain much higher returns than the traditional risk-free financial instruments.

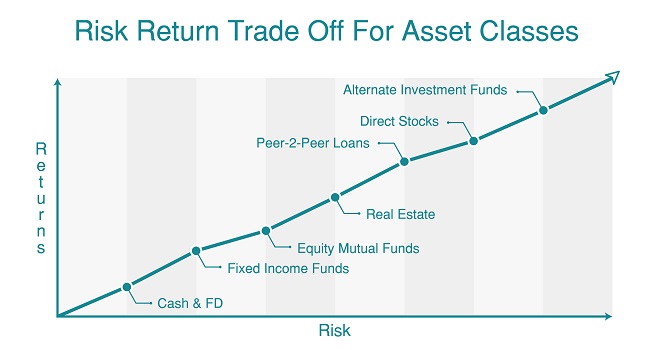

There is a principle of risk-return trade-off, as per which, as the risk potential increases the likely return on investment also go-up. Thus, if you invest money in a riskier small start-up you are likely to gain higher returns in contrast to investing in relatively safer large-cap equity mutual fund. Money invested in a start-up company may grow up to 3X or even higher in value. A large-cap equity mutual fund typically gives compounded annual return of 15% – 20% over 3 – 5 years of time. But if the start-up fails, you may lose all your initial investment. Whereas money invested in a large-cap equity mutual fund will not become zero but continue to grow albeit at a slower rate even in a bear-market.

How Time Impacts Risk and Return?

Time has an important role to play in expecting return on your investment. Under the concept of Time Value of Money, a Rupee today is worth more than a rupee tomorrow.

One of the reasons behind this is the inflation which leads to decrease in the “real-value” of your money over time. If your money does not increase by an amount at least greater than inflation, then it may be better to rather spend it today. For example, say you can buy 5 apples today for Rs.100 and a year later because of inflation you need to spend Rs.105 to buy the same 5 apples. But your money has increased only to Rs.103 over one year. Now it makes more sense to use your Rs.100 to buy 5 apples today instead of less than 5 apples after a year with Rs.103.

Another reason behind decrease in the worth of money with time is the concept of opportunity cost. So, if you choose to invest money in say equity mutual fund, you are forsaking the interest you will earn on this money if kept in a bank account or as an FD.

There are two takeaways here:

- Whenever you invest, it is important to start early. The earlier your start, your money is worth more than what it will be later.

- It is essential for you to invest your money, if not then inflation will eat away all your savings. Gradually over time your money will lose its purchasing power. If you will recollect, a movie ticket was much easier on your pocket 5 years ago, than it is now.

Risk-Return Trade-Off for Different Asset Classes

Asset is something which generates money. For example, if you have a house from which you generate rental income, it becomes an asset. For a business, its’ factory is an asset because it is used for the manufacturing of goods sold. Likewise, a financial instrument is an asset because it increases the value of money over time. Hence you invest your money in a financial asset. Asset class is a group of financial instruments having similar characteristics and which are subject to same regulatory guidelines.

Asset class is fundamental in financial planning. An asset class has unique risk and return characteristics. Now, depending upon an investor’s risk preference his / her financial planner may allocate different sum of money to different asset classes.

Types of Asset Classes

Mainly asset class are of 5 types with different degree of associated risk and rewards with each asset class. Let us look at the various asset classes available for you.

1. Cash

In all fairness cash is not an investment, but it is just an asset class. It is least risky but at the same time yields least returns as-well. But you must maintain an optimum amount of liquid cash either in the form of bank account savings or as a fixed income liquid mutual fund for transactions or any eventualities that may arise in future. Financial advisors suggest you to maintain 6 months’ equivalent of your expenses in form of cash or cash-equivalents.

2. Fixed Income

The most popular traditional investment vehicles in form of a Bank FD or small savings schemes offered by government are typical examples of Fixed Income asset class. A fixed income or a debt instrument is characterised with fixed repayment schedule over a fixed tenure. Of late, fixed income mutual funds which invest into corporate debt as well as government papers have started getting popular with retail investors. These carry higher risk than government schemes and offer better returns than them.

3. Equity

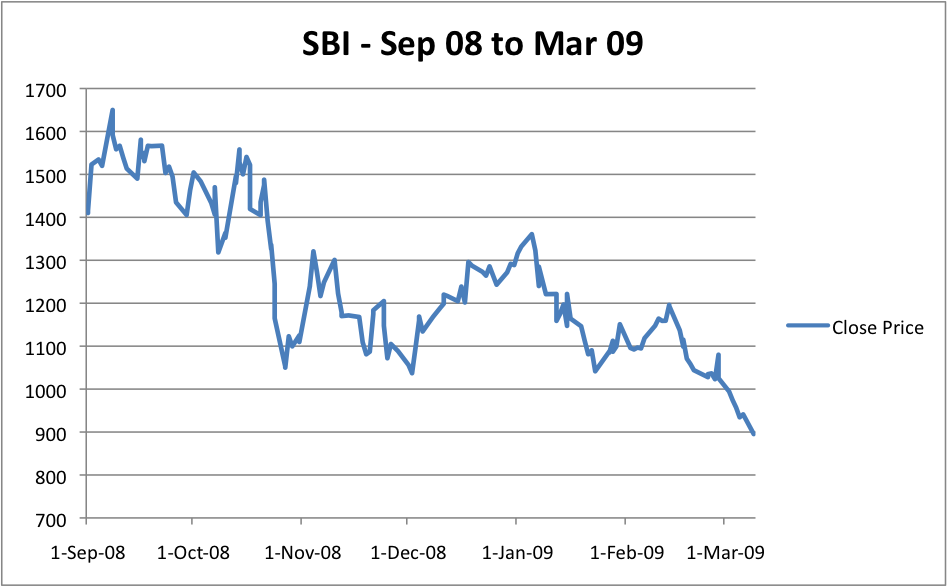

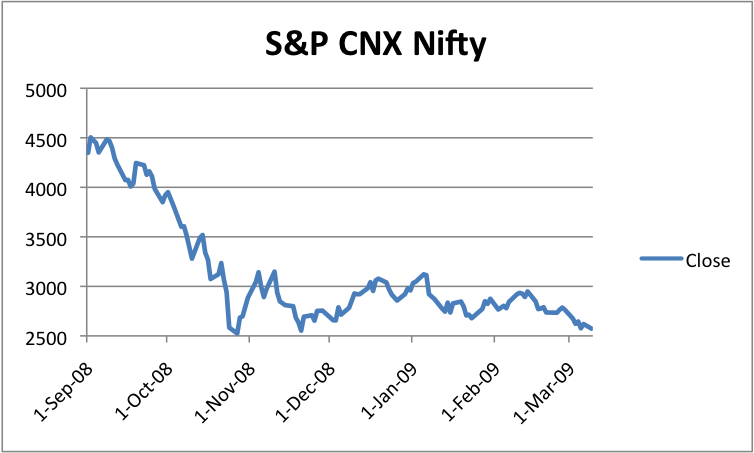

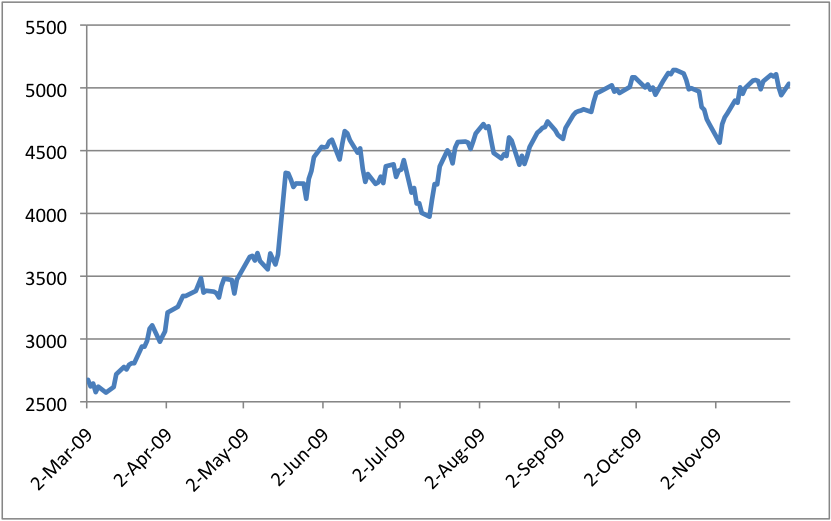

If you invest for a long term, then equity as an asset-class out-performs other asset classes. You can invest in equity by way of holding direct stock of companies or through the equity mutual funds. You should have sound knowledge of stock market to be able to successfully invest in direct stocks. Investing via the mutual fund route is simpler as they are managed by professional fund managers. Further, if chose to invest through the SIP mechanism you need not even worry about short volatility of the market. However, you must remember that equity is a risky asset in the short-term because of market movements. While there is a potential to gain higher return, you can also lose a lot of money without proper know-how.

4. Commodity

As Indians, we have been used to invest in gold, which is a typical commodity. Gold as an asset class has given rich dividends to its investors over long term. You can also invest and trade in other commodities such as metals, agricultural produce etc. through the commodity exchange. Commodity prices tend to have cyclical price pattern and you should equip yourself with required knowledge before investing. If you are not ready, better stay away.

If you just want to invest in gold as an asset class, then again you can take the easier route of investing through the Sovereign Gold Bond scheme as launched by Government of India or the Gold ETFs.

5. Real Estate

For long investor, have flocked to real estate as an asset class. You can invest either in commercial or residential real estate or a land parcel depending on the sum you want to invest. In the long run, real estate helps you multiply your investment but there are a few challenges associated with buying real estate. Clear titles, transaction cost and transparency are major hindrances you will face when buying. Even at the time of selling you would bear higher transaction cost than financial products. Moreover, you cannot sell your real estate investment in parts or even if you want to sell-off the entire asset then finding the right buyer at right price point may become a challenge. Real estate investment therefore, tend to be least liquid as compared to the others.

The Alternate Investment Asset Class

In addition to the above-mentioned traditional asset classes, you also have the option to diversify your portfolio with Alternate Investment Asset Classes. Let us look at few of the prominent Alternate Investment Asset Class in India.

The Alternate Investment Fund (AIF)

If you are an HNI (High Net Worth Individual) investor, you have the option to invest via Alternate Investment Funds (AIFs). These are privately pooled funds formed under the structure of trust permitting you to invest in higher risk bearing financial structures to earn superior returns. These funds have a dedicated fund manager to manage the pooled money and are typically closed ended funds. Through the AIFs you get a chance to invest start-ups, early-stage ventures, infrastructure or social ventures even if you don’t have professional knowledge of any of these sectors.

The Collectibles

Collectibles such as works of art, vintage cars, stamp collection and even race horses are another set of alternate asset class. Yet again, these are within the reach of ultra HNI and wealthy investors. One drawback of collectibles is that their market is not yet fully developed in India and is still illiquid. What this means is that while you may invest money in any of the collectibles, but it may not be possible to sell it for the right value at your desired time of sale. This is because there may be limited number of total buyers for such items and finding the right buyer at the time you want may not always be possible.

Game-Changer in Alternate Investment – P2P Loans

So far, alternate investment vehicles were meant only for the wealthy and affluent. With technology changing the entire financial services landscape, a new and genuine alternate investment asset class has come-up in the form of P2P loans. This asset class is within the reach of an average investor. You need not bring in millions of rupees to start investing in P2P loans.

P2P or Peer-to-Peer loans are online market places where an individual can borrow directly from another individual. When you become a lender on a P2P platform, you are investing your money which comes back to you every month with interest as EMI. You can earn anywhere between 14% – 25% depending on who you wish to lend money to. P2P loans are in-between debt and equity in terms of risk-reward metric. They have the characteristic fixed repayment schedule like a debt instrument but the risk associated with them is higher. Plus, you can diversify the risk by lending smaller amount to higher number of people. The distribution helps in limiting the default risk on the loan.

But you must note that the RBI regulations still do not cover the P2P loans. RBI has finalised its regulations but not yet brought them out. It had also published a consultation paper on P2P loans in 2016. Hence, before investing, you are advised to be aware about the risks associated with P2P business model.

You must choose your asset class keeping in mind your risk appetite. It is also advisable to consult a financial planner to assess your goals, investment horizon and then chalk out your investment strategy.