This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

General Insurance Corporation of India (GIC Re), 99.99% subsidiary of the Government of India and India’s largest re-insurance company, is all set to enter the primary markets with its initial public offer (IPO) of Rs. 11,176 crore. The issue is getting opened for subscription today and will remain open for three days to close on October 13. This IPO is a mix of fresh issue of 1.72 crore equity shares by the company and an offer for sale (OFS) of 10.75 crore equity shares by the Government of India.

The company has fixed its price band in the range of Rs. 855-912 a share and in order to attract the retail investors, Rs. 45 a share discount has been offered by the company. The offer would constitute 14.22% of the company’s post-offer paid-up equity share capital.

Here are some of the salient features of this issue:

Size of the Issue – This IPO is a combination of an offer for sale (OFS) of 10.75 crore shares by the Government of India and a fresh issue of 1.72 crore shares. This makes it a Rs. 11,176 crore IPO at the upper end of the price band of Rs. 912.

Price Band – GIC Re has fixed its IPO price band to be between Rs. 855-912 a share and the company has decided to offer a discount of Rs. 45 a share to the retail investors and its eligible employees.

Retail Allocation – 35% of the issue has been reserved for the retail individual investors (RIIs), 15% for the non-institutional investors (NIIs) and the remaining 50% shares will be allocated to the qualified institutional buyers (QIBs).

Rs. 45 a share discount for Retail Investors & Employees – The company has decided to offer a discount of Rs. 45 a share to the retail individual investors and its eligible employees.

Reservation for Employees – The company has decided to keep its shares worth Rs. 11.68 crore reserved exclusively for its employees.

Bid Lot Size & Minimum Investment – Investors need to bid for a minimum of 16 shares in this offer and in multiples of 16 shares thereafter. So, a retail investor would be required to invest a minimum of Rs. 13,872 at the upper end of the price band and Rs. 12,960 at the lower end of the price band.

Maximum Investment – Individual investors investing up to Rs. 2 lakh are categorised as retail individual investors (RIIs). As a retail investor, you can apply for a maximum of 14 lots of 16 shares each @ Rs. 867 a share i.e. a maximum investment of Rs. 1,94,208. At Rs. 810 per share, you can apply for a maximum of 15 lots of 16 shares, thus making it Rs. 1,94,400.

Listing – The shares of the company will get listed on both the stock exchanges i.e. National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) within 6 working days after the issue gets closed on October 13th. Its shares are expected to get listed on October 25th.

Here are some other important dates as the issue gets closed on October 13:

Finalisation of Basis of Allotment – On or about October 18, 2017

Initiation of Refunds – On or about October 23, 2017

Credit of equity shares to investors’ demat accounts – On or about October 24, 2017

Commencement of Trading on the NSE/BSE – On or about October 25, 2017

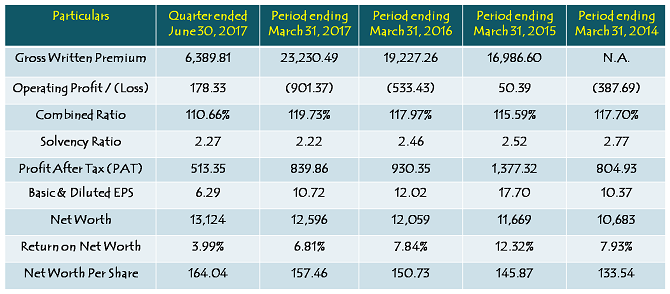

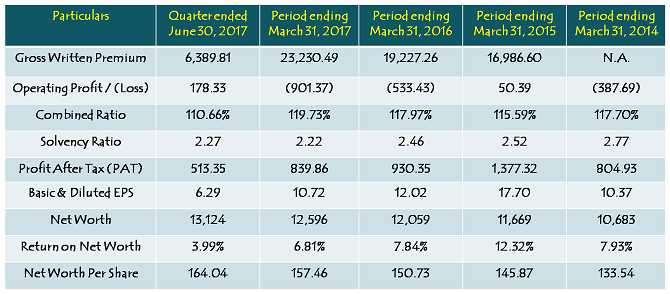

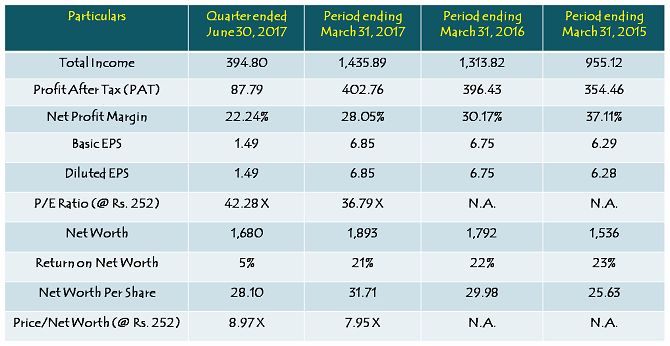

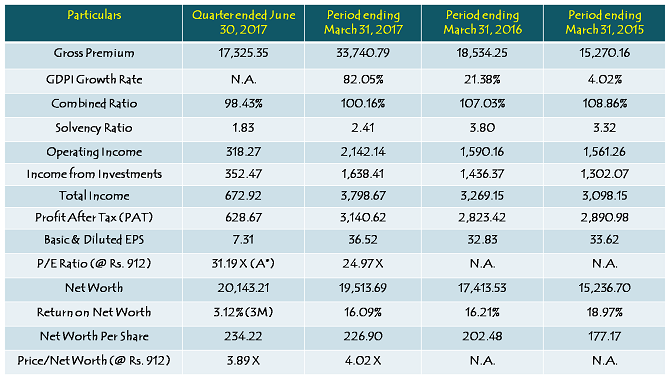

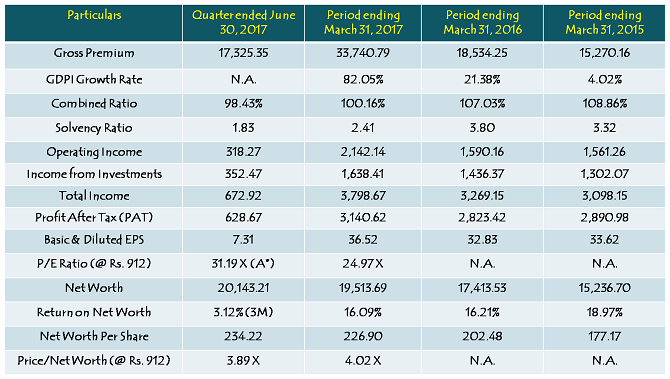

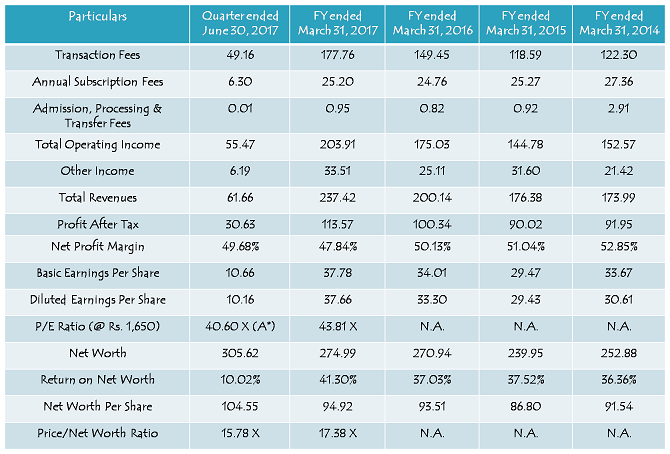

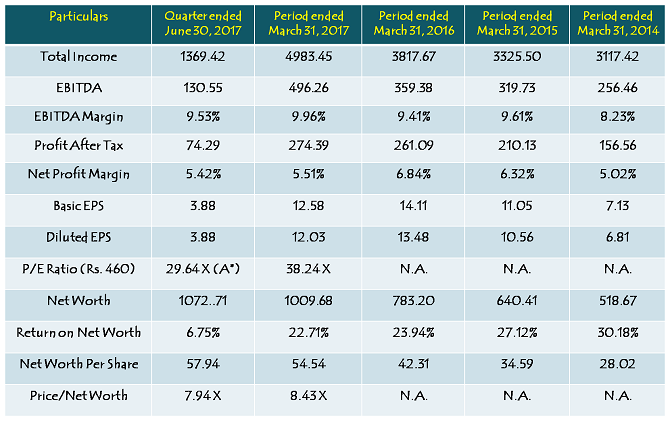

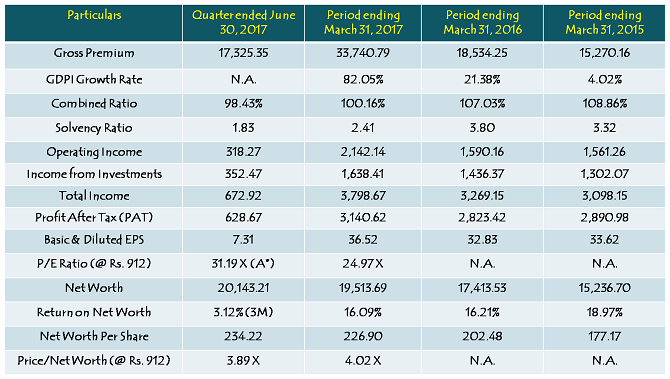

Financials of GIC Re

(Note: Figures are in Rs. Crore, except per share data & percentage figures)

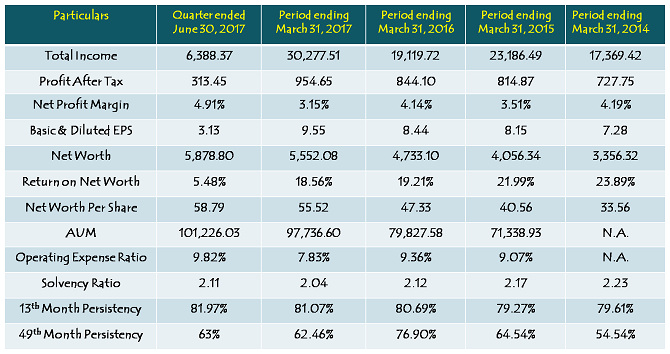

During financial year 2016-17, GIC reported an operating income of Rs. 2,142 crore, investment income of Rs. 1,638 crore and profit after tax (PAT) of Rs. 3,141 crore, as against Rs. 1,590 crore, Rs. 1,436 crore and 2,823 crore respectively in the previous financial year, registering a growth of 34.72%, 14.07% and 11.26% respectively. The company could manage to deliver such a big jump of 34.72% in its operating income last year, all thanks to an unusually high jump in its gross premium last year, which in turn was the result of the launch of Pradhan Mantri Crop Insurance Scheme.

Is such a high growth sustainable? It doesn’t seem so, as the company has reported a muted set of numbers in the first quarter of the current financial year and the recent slowdown in the Indian economy would make it even tougher for the company to avoid a degrowth in its operating revenues and profitability in the current financial year.

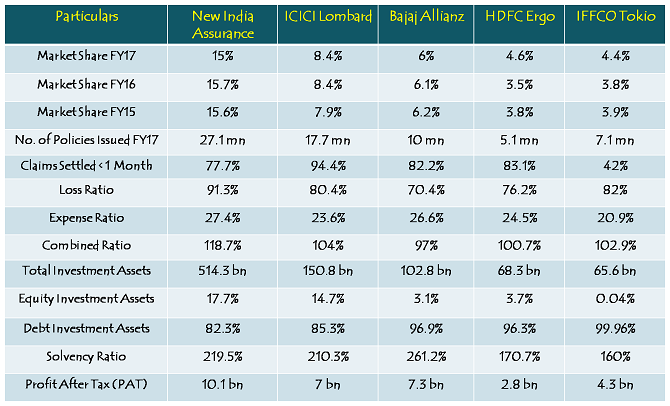

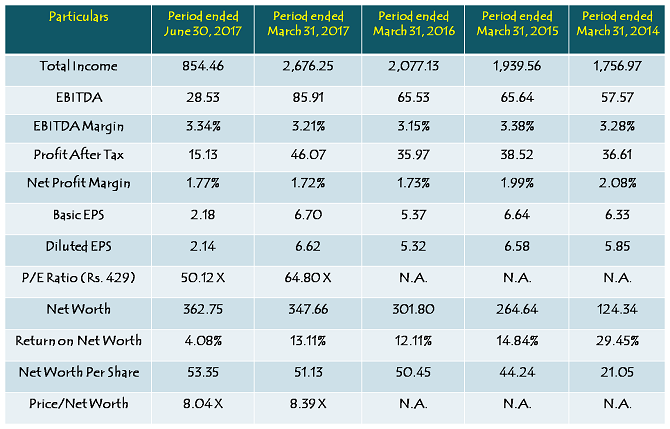

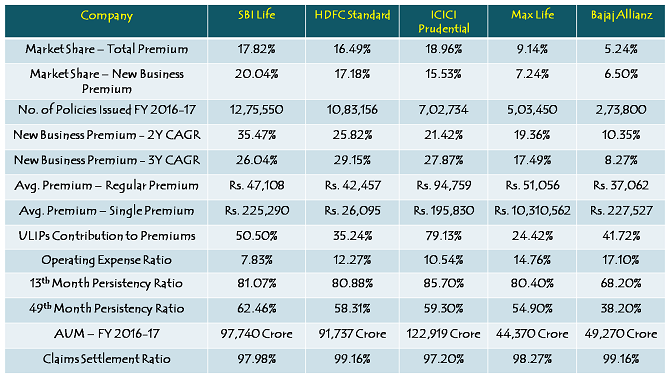

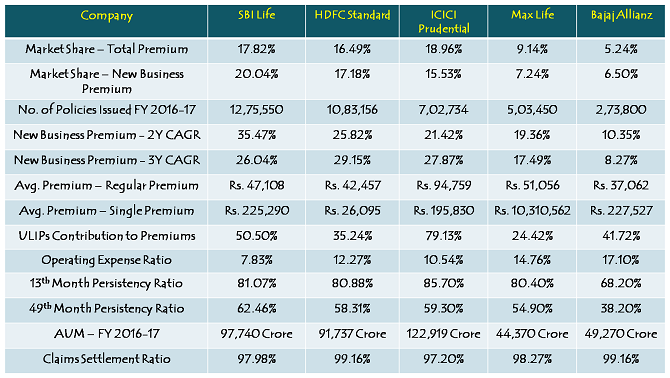

The company reported an EPS of Rs. 36.52 a share as on March 31, 2017 and a net worth of Rs. 234.22 a share as on June 30, 2017, which gives it a multiple of 24.97 times its EPS and 3.89 times its book value. These multiples seem reasonably fair to me as per the current market sentiment. Moreover, recently listed insurance companies, SBI Life, ICICI Lombard and ICICI Prudential, all are trading at multiples higher than that of GIC, but then they are growing at a faster pace as compared to GIC and their growth is relatively consistent as well. So, the premium with which other listed insurance companies are trading relative to GIC seem justified to me.

There are other financials parameters also, which again make it difficult to take a final call to invest in it or not. The company has shown a consistent improvement in its combined ratio, from 108.86% in FY 2014-15 to 98.43% in Q1 of FY 2017-18. However, Solvency Ratio and Return on Net Worth (RoNW) have been on a declining trend during this period, from a high of 3.32 times to 1.83 times as far as Solvency Ratio is concerned, and from 18.97% during FY 2014-15 to 16.09% in FY 2016-17 and 3.12% in Q1 of FY 2017-18.

Finally, investing in this IPO depends on two things – one, what kind of investor you are and two, what is your investment objective with this IPO. I mean if you usually invest in IPOs for making quick listing gains and exit out immediately post listing, then I think this IPO is not for you. I think even in a buoyant market sentiment as it is there in the markets these days, I don’t think GIC should have listing gains of more than 8-10% in this IPO. I think GIC is fairly valued in this price band of Rs. 855-912 and it should consolidate here in the price range of Rs. 800-1000 in the short-term, and should break out of this range only when the company shows some real improvement in its core operating income and profitability.

I think Rs. 45 a share discount is key here and provides a much required margin of safety for the retail investors. Probably in its absence, I would have definitely avoided this IPO. But, its presence has put me in two minds. Still I would skip this IPO and wait for better opportunities to invest in GIC post listing, or pick better companies relatively.