This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Budget 2016 has proposed a significant change in the taxation laws for National Pension Scheme (NPS). It has been proposed by the finance ministry to make 40% of your lump sum withdrawal to be tax exempt at the time of your retirement i.e. as you attain 60 years of age. But, does it make any sense to invest in NPS post this amendment or should you continue investing in equity mutual funds or PPF for your retirement years?

We all know that our contribution up to Rs. 50,000 in NPS provides us tax deduction under section 80CCD (1B). Unlike investments eligible for tax deduction u/s 80C, 80CCD (1B) provides an exclusive tax benefit for NPS. So, if you do not contribute in NPS, you need to pay tax as per your respective tax slabs. So, should you save tax by investing in NPS or just pay tax and then invest the remaining amount in equity mutual funds, PPF or debt mutual funds for wealth maximisation?

Honestly speaking, it is not an easy decision to take. To come to a conclusion, I’ll do a couple of comparative analysis here – one, comparing an investment in Equity Mutual Funds with NPS and the second one, comparing an investment in PPF with NPS. We will also have to make certain assumptions here based on which this analysis would come to a conclusion and you are most welcome to agree or disagree with my assumptions here because I am as human as you are and that is why there is enough scope of me committing mistakes as bad as anybody else on this earth.

Here are the assumptions I have made in this analysis:

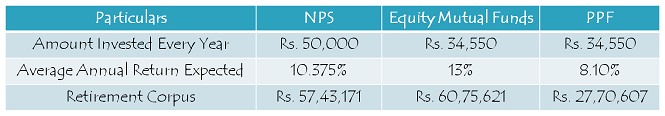

- You are 35 now and would retire after 25 years from now.

- You are in the 30% tax bracket and will have to pay Rs. 15,450 as tax in case you decide not to invest Rs. 50,000 in NPS.

- Equity Mutual Funds would generate on an average 13% annual returns for the next 25 years.

- PPF would generate on an average 8.1% annual returns for the next 25 years.

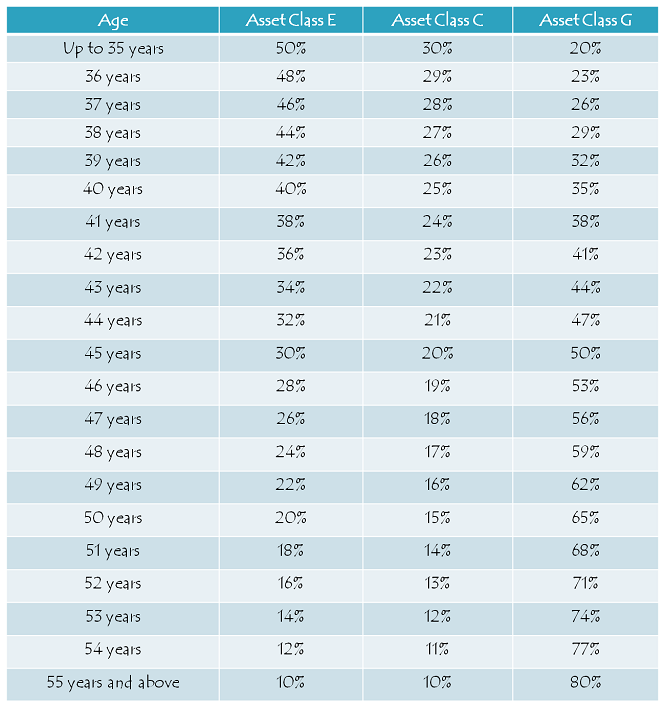

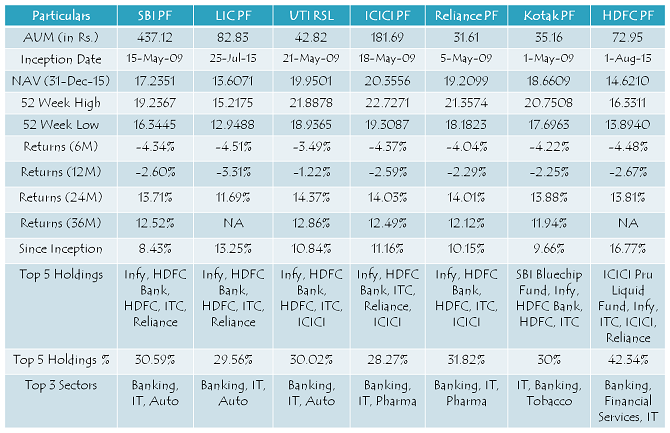

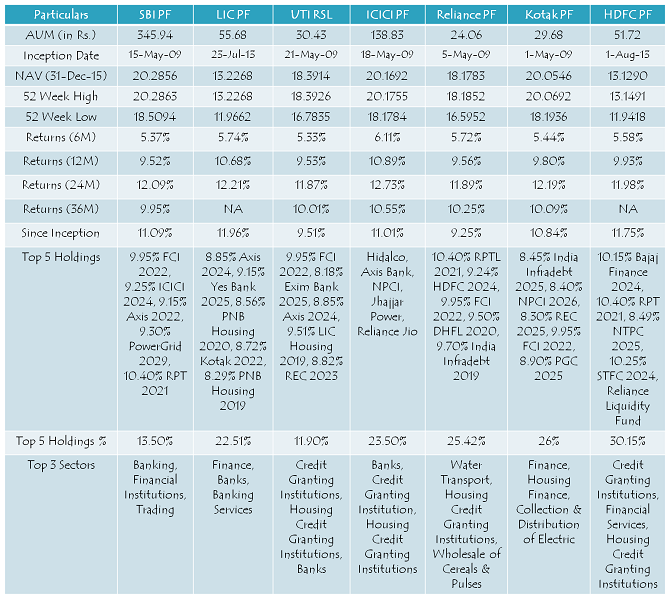

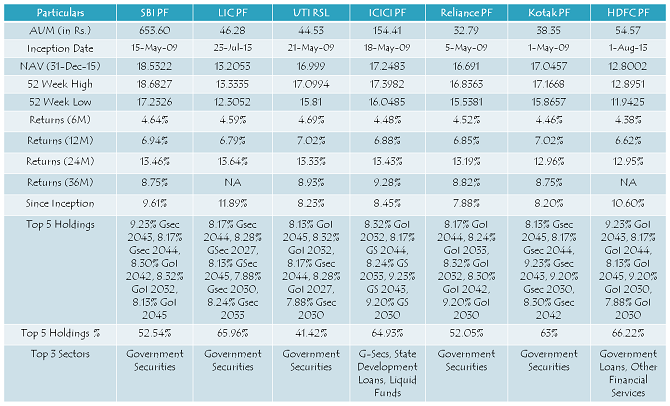

- NPS with 50% contribution towards equity, 25% contribution towards Government Debt and 25% contribution towards Corporate Debt would generate on an average 10.375% annual return for the next 25 years. To provide more clarity here, I have assumed 12% annual returns from equity, 8% annual returns from government debt and 9.50% annual return from corporate debt.

So, should you invest in NPS for saving Rs. 15,450 in tax?

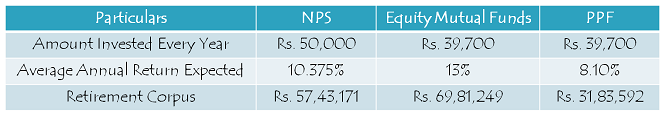

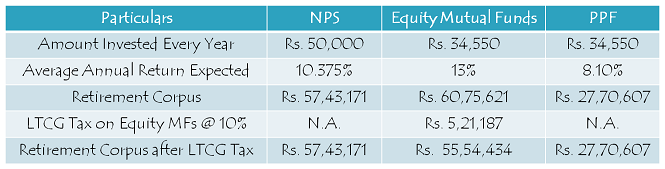

Scenario I – Say No to NPS in the present scenario, as it is not advisable to invest in NPS even with the exclusive tax benefit it enjoys u/s 80CCD (1B). Your investment of Rs. 34,550 in diversified equity funds should result in a higher retirement corpus for you as compared to Rs. 50,000 invested in the NPS. Here is what you’ll have in your retirement corpus at the end of 25 years from now:

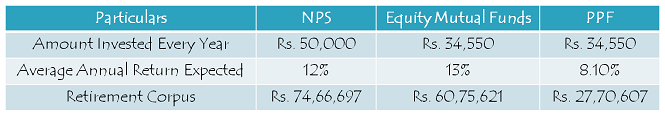

Portfolio I – NPS – 50% of Rs. 50,000 invested in equity index, 25% in Government securities and 25% in corporate debt – Retirement Corpus Rs. 57,43,171

Portfolio II – Equity Mutual Funds – 100% of Rs. 34,550 invested in diversified equity mutual funds – Retirement Corpus Rs. 60,75,621

Portfolio III – PPF – 100% of Rs. 34,550 invested in PPF – Retirement Corpus Rs. 27,70,607

So, the above calculation clearly shows that investing in diversified equity mutual funds would generate the highest retirement corpus for you, even after paying 30% tax + 0.90% education cess on your taxable income over and above Rs. 10 lakh.

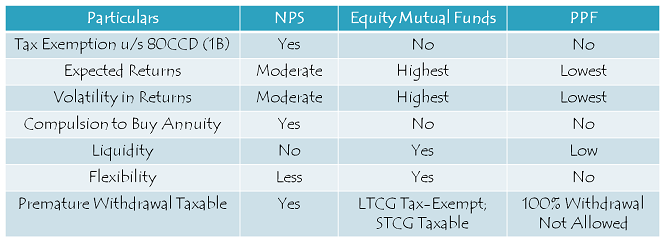

But, there are certain points which you need to keep in mind here which are in favour of NPS. Firstly, from taxation point of view, I think the present situation is not the best one for NPS and it could only improve from hereon. There is still a lot of scope of improvement for making NPS a better product to invest in. Also, I think the present taxation laws are already highly favourable for equity mutual funds. So, let us have a look at some other scenarios and whether it is a ‘Yes’ or a ‘No’ for NPS in those scenarios.

Scenario II – Say No to NPS, if you are in the 20% or lower tax brackets. You should rather invest in equity mutual funds to generate a healthy corpus for your retirement years.

Scenario III – Say No to NPS, even if you think this government or some other government will increase the exempt portion of your lump sum withdrawal in NPS from the current 40% to 100% or any percentage between 40% and 100% during the next 25 years.

Scenario IV – Say Yes to NPS, if you believe in the theory of “one bird in hand is better than two in the bush”. If you decide not to invest in NPS to save Rs. 15,450 today, you’ll have to pay it to the government and you’ll be left with Rs. 34,550 only to invest. With NPS, your first tax outgo will happen when you retire at the age of 60. Then also, if you withdraw 40% of your retirement corpus as lump sum, it is tax-free and invest the remaining 60% for buying an annuity, you are not required to pay any tax on that 60% as well. You’ll be required to pay tax only on the annuity income you would receive on your investment.

On the other hand, if you decide not to invest in the NPS, you’ll have to pay a tax of Rs. 15,450 to the government and your investment of Rs. 34,550 in equity mutual funds will take a long 25 years to beat NPS as far as a higher retirement corpus is concerned.

Scenario V – Say Yes to NPS, if you fall in the 30% tax bracket and you think this government or some other government will make long term capital gains (LTCG) on equity mutual funds taxable anytime during the next 25 years. Even a 10% LTCG tax on equity mutual funds will make NPS a better retirement product to invest in.

Scenario VI – Say Yes to NPS, if you are hopeful that this government or some other government would allow you to invest more than 50% of your Rs. 50,000 in equity portion of NPS. Personally I think there should an option allowing you to invest 100% of your money in equity. That would make NPS an attractive investment for me to save tax.

Scenario VII – Say Yes to NPS, if you are hopeful that this government or some other government would give you the liberty to invest 60% of your lump sum withdrawal anywhere you want and make it tax exempt as well.

Scenario VIII – Say Yes to NPS, if you are a conservative investor and don’t want 100% of your investment to be made in equities. With NPS, even 50% of your investment in equity index would result in a healthy retirement corpus which should be very close to the expected retirement corpus with 100% investment in equity mutual funds.

NPS vs. Equity Mutual Funds vs. PPF – Other Factors

There could be other such scenarios based on which your decision to invest in NPS could change. If you think I have missed any such significant scenario, then please share it here, I’ll incorporate that also to make it an even more comprehensive analysis.