A Look At Citi’s Results to Understand the Current Situation

Citigroup made a loss of 18.71 billion dollars in 2008. In 2007, it had turned a profit of 3.6 billion dollars.

They made these losses because of three reasons:

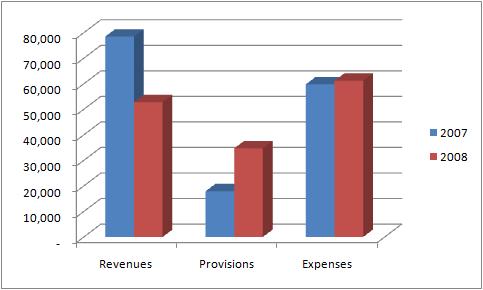

- Total revenues went down from 78.45 billion dollars to 52.79 billion dollars.

- The Provision for Losses had to be increased from 17.91 billion dollars to 34.71 billion dollars.

- The Operating expense went up from 59.8 billion dollars to 61.19 billion dollars.

To put this in context, lets see how these three factors would look like if Citigroup was a regular guy, and not a bank.

The first point is akin to taking a pay cut for a regular person.

The second point is like saying you had a house which you thought was worth 250,000 dollars (and spent accordingly), but when you tried to sell it, it fetched only 50,000 dollars. So you have to provide for a loss of 200,000 dollars.

The third point is like saying your grocery bill rose from 10,000 dollars to 10,400 dollars.

As you can see from the graph – the main problem lies with the – pay cuts and loss provisions; the grocery bill is not too much to worry about.

Citigroup’s Revenue Decline

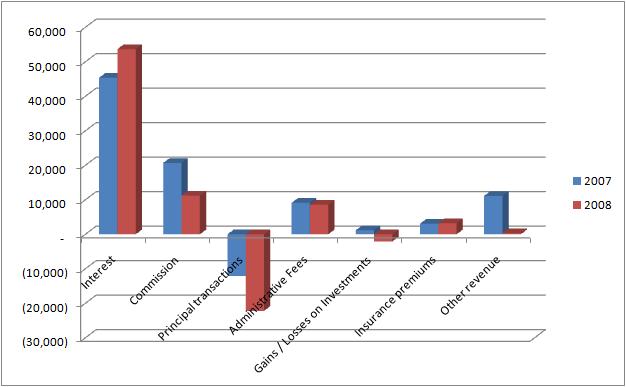

Citi actually earned more interest income in 2008 than it did in 2007. But that’s the only revenue item that increased in 2008. All the other things that Citi made money on – declined in 2008.

The chart below shows the break up of Citi’s revenues in 2007 and 2008.

The key point is that Citi’s 2008 revenue of 52.79 billion dollars can’t even cover its 61.19 billion dollars Operating Expense, let alone the Provision for Reserves.

But the gap is not even 10 billion dollars and if somehow Citi could get rid of those toxic assets on its Balance Sheets, for which it has to carry out these Provisions and incur losses – it could return to profitability.

They Don’t Call it TARP for Nothing

One of the objectives of the Troubled Asset Relief Program (TARP) is to take toxic assets away from the Balance Sheets of Banks, and stop them from bleeding to death.

Citi has a balance sheet worth 1.945 trillion dollars! That means the total value of their assets is 1.945 trillion dollars, but in reality some of these assets are worth much less than that (toxic assets).

The liabilities are worth 1.794 trillion dollars and the remaining 150 billion dollars is the Equity (what belongs to the shareholders).

To make it easier to relate – Think of a person named – Citi – who owns a house worth 500,000 dollars on which he owes 400,000 dollars. The remaining 100,000 dollars is his equity.

Now if the house was worth only 300,000Â dollars – Citi would be insolvent. The amount he owed would be more than his asset’s worth. But, and this is a significant But – if he can continue to make mortgage payments till the situation improves (he starts making more money) – he can be solvent again.

Similarly out of the 1.945 trillion dollars, if there are more than 150 billion dollars worth of toxic assets on Citi’s balance sheets – Citi would be insolvent.

But, and this is a significant – But – a lot of big banks (especially Japanese banks) were able to return to back to solvency after facing a similar situation. This is primarily because banks make more money on their assets than they pay on their liabilities.

So, Citi could bounce back to solvency too. That is certainly what most people are hoping for.

Conclusion

Citi is just an example and a look at any other major bank’s balance sheet and income statement is likely to reveal the same kind of numbers. If that were not so – there would be no need for TARP.

The problem right now is dual in nature and sometimes that is not emphasized enough. There is a recession going on and then there is a financial / credit / banking crisis.

Stimulus packages are being used by the administration to fight the recession. For the banking and financial crisis – bank bailouts, TARP etc. is being used.

I think the bottomline is that all this is part of the economic cycle, so in the time to come – we will come out of this and see better times.

Very informative – thanks for sharing.

Thanks – Richer and Slimmer.