NHPC IPO has been open just one day, and it’s already been oversubscribed three times. But, this headline figure of 3 is a little misguiding, as far as retail investors are concerned.

When a company declares its IPO, it has to declare the number of shares it will issue. Along with this; it also needs to declare the number of shares it will issue within each category of investors.

These are the main categories:

- Qualified Institutional Buyers

- Non Institutional Investors

- Retail Investors

- Employees

People who invest less than 1 lakh (100,000) in an IPO fall under the Retail Investor category, and subscription numbers in this category is the only thing that matters to them.

But, when an over-subscription number is reported, it is normally the sum total of all categories, and is generally misleading.

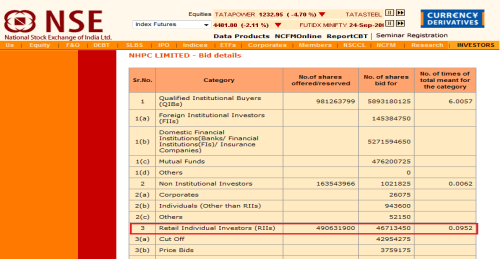

To understand this, take a look at the over-subscription numbers broken down by the different categories for the NHPC IPO.

| Category | Oversubscription |

| Qualified Institutional Buyers | 6.0057 |

| Non Institutional Investors | 0.0062 |

| Retail Individual Investors | 0.0952 |

| Employee Reservation | 0.0002 |

Numbers as at 7th August 2009 from NSE’s Website

If I am going to bid under the retail segment, then I am only concerned with the “Retail Individual Investor†category in this table. That is just at 0.09 times. So, it hasn’t even been subscribed once, let alone thrice! The over-subscription has been driven by the QIBs, but that doesn’t impact my allotment as a retail investor.

But hearing the “three times oversubscribed numberâ€, without telling me what the retail portion is; influences me wrongly in two ways:

- It makes me think that I need to apply for much more than I really want, because the issue has been so much oversubscribed. I think that I will only get pittance, if I don’t apply for a large number of shares.

- If I was going to apply for a small lot, it makes me think that there is no point in applying at all, because my small application won’t get any shares at all.

So, you need to ignore all headline over-subscription numbers, and specifically look for your category to make sense out of this number.

Here is how to do that.

- Go to NSE India’s website.

- In the middle of the page, you will see IPO: NHPC. Click on “NHPCâ€

3. Scroll down the page that opens and you will see a table with the title – “NHPC LIMITED – Bid Detailsâ€.  In this table – “3 Retail Individual Investors (RII) is what you are interested in.

3. Scroll down the page that opens and you will see a table with the title – “NHPC LIMITED – Bid Detailsâ€.  In this table – “3 Retail Individual Investors (RII) is what you are interested in.

You can check this site, and see what the latest numbers are. This is the source of the data, and will help you cut through the noise in the news, and get to the real number you are interested in.

This site has regular features about IPOs, FDs and other investment ideas, if you would like to get that content by email, please click here.

Dear Madem

I am sorry ,I have today readout your querrry.You may be allottted Share from NHPC. All IPO of PSUs remains lower in the begining due to retailers who purchase for short term profit. NHPC IPO is best for long term profit for those who can retained at least upto 2012,at that time NHPC will complete it’s India ‘s largest Hydro Project of 2000 MW Capacity Subansiri Project in Arunachal Project and many more.At that time NHPC share will be gone up to five to six times or dividend will be appreciable.You are advised to purchase from secondary market if you can , but you take your decision and we are not bound for any legal action.

Dear Sir/Mam,

This is to make in the kind notice of yours that i have applied for the shares of your esteemsed Company vide Bid cum Application Form No. : 2880488, but till now i have not got any intimationn regarding the allotment of shares or any refund.

So kindly let me know about the status of my application as earliest possible.

I shall be highly obliged to you.

Waiting for your reply.

Thanks & Regards.

Nirmala Gupta.

NHPC IPO IS LIKE AN INVESTMENT IN REAL ESTATE.

Hi,

this is really very useful for the retail investors.

appreciate ur efforts. Keep it upp….!!!!!

Happy Janmashtmi.

Happy Janmashtmi!

Simple, nice and very useful article. Normal news in the media are really hyped. In the din normal users get really confused.

Very useful info. Keep it up.

You are a star. You have done a wonderful job explaining it.

Regards,

Suresh

Its a very useful info. Thank you.

This is a piece of very useful information.

I have seen a few of these IPO posts now, and you seem very passionate about them. I wish I knew what they were about, or meant…..

Could you do an introductory post, or if you already have, could you let me know the link?

thanks!

you are right, I think I am getting carried away by all these new IPOs that are coming out ,and writing too much 🙂 . Will do an introductory post next week for sure.