Poll Results: Do you hold stocks or MFs as part of your portfolio?

In the last poll I asked if you hold stocks, mutual funds or both as part of your portfolio, and I thought I’d sum up the results in a slightly different manner than usual (my wife did most of the work actually).

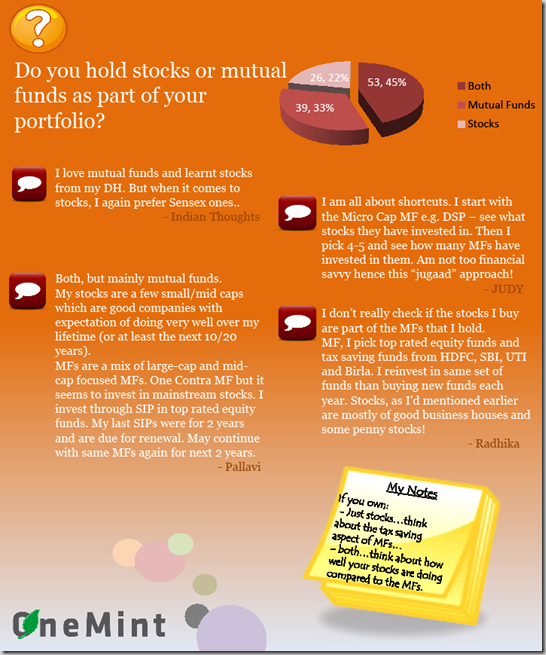

Here is a neat little graphic that shows the breakup of your results, some of the more interesting comments, and then a couple of my notes.

The first note is for people who own just stocks, and if you are salaried and pay taxes, then you are losing out by not investing in tax saving mutual funds.

If you don’t reach the maximum rebate limit through other instruments, and have any meaningful investment in stocks, then do think about the tax saving aspect of such mutual funds, and the effective return you get due to the tax rebate.

The second note, and this is more of a question is for people with both stock and mutual fund investments. Have you ever seen how your own picks compare with the fund returns?

It will be well worth your time to make notes, and compare how well your own stock picks have done when compared with the mutual funds you own. Beating the market is at least quite difficult (if not impossible), and if you find that the mutual funds are doing a lot better than your own stock picks by virtue of being index linked, professionally managed or just because you have a SIP going, then it’s time to rethink this strategy as well.

Thanks to all for voting and leaving comments, and please do leave a comment here as well.

Hi,

I am really very impressed by your mails and the work you carry out. I guess each mail needs a standing ovation. I voted but did not leave comments on the below but would like you to hear a personal story.

I was very confused what were MF’s and what they did and I did not like the stock market. Thsi was way back in 2002. My Dad kept on telling me invest invest but I neither understood nor wanted to loose my money in MF or Stocks. One Day in Jan 2008 when the market was about touch 21,000, my dad caught hold of me and told me to invest 2.5K into 4 mutual funds. Soon in 2 months time the market fell, and I thought I lost all my money.

Sometime in 2010 Feb, I redeemed all my MF’s and was actually very thrilled to see the returns. I started getting interested in how it all works and started reading about it. Soon my wife pestered me and told me to enter stocks as well so I slowly started entering and buying stocks after carefully understanding them and taking some help. This was in May end 2010. Same time also I invested in 2 schemes HDFC TOP 200 and DSP BR Growth 100 with an SIP of Rs 5000 and soon also bought AXIS Income Saver Growth worth value of 1 lakh. 2 months back I added an additional MF to my portfolio IDFC Premier Growth A. Also managed to enter Gold via the ETF way…did a small investment of Rs 10K via HDFC Gold ETF but thru ur site I learnt that the best GOLD ETF is GOLDBEES.

My next step is reading and slowly entering into the new Pension ( NPS) scheme. I could not find a detail write up on your site but I have done enough research and with your permission can share my inputs.

But all thanks to your inputs that I could diversify my portfolio so much within a short span and my knowledge has grown vastly on financial products thanks to your website.

I would say I was zero till March 2010 and now I would rate myself as a 5 on a scale of 10. I still feel there is a long way to go before I touch the 8 and 9 mark and still a lot of learning needs to be done.

Thanks to all your wonderful work. Carry on the good work.

Regards

Thanks for your kind words Gaurav. I feel that there will be a lot of people who will now be entering the market for the first time because its so high, and at least some of them will be disappointed as the market moves up and down like it normally does, and the new folks are caught in it when they started investing at a relatively higher level.

Please do share your NPS stuff also, and I will try and get it in front of a wider audience.

Interesting results to the survey! I believe that a portfolio should include both stocks and mutual funds. The percentage, of course, depends on the financial objectives and risk appetite of individual investors.

A diversified portfolio is the cornerstone of any investment. By creating a portfolio that’s diverse, you can reduce your risk. Just like the old saying that goes you should not put all your eggs in one basket, you should also not invest all your money in just one type of investment instrument.

If it’s essential to hire professionals to create and manage your portfolio, you should just go ahead and do it. In fact, stock broking firm GEPL offers portfolio management services for investors seeking professional management of their investments!

I CAN SAVE MORE THAN 20% FROM MY INCOME AS A SAVINNGS.