A primer on the New Pension Scheme (NPS)

I’ve wanted to write about the New Pension Scheme (NPS) a lot sooner, but never got around to it. Reader Gaurav sent me some great material on it, and got me started.

The stuff that he sent me was an entire post in itself, but I thought I’d add to it, and create a comprehensive post on the New Pension Scheme.

First off, you can call it New Pension Scheme, National Pension System, New Pension System or NPS, anything you like. They’re all the same; I’ve seen different articles call them different names, so that might get a bit confusing, but you’ll soon get used to it.

Next up, some of the things this post will address, are:

- What is the New Pension Scheme?

- What are Tier I and Tier II accounts in the NPS?

- What are the three categories in the NPS?

- Fees and Expenses related to the NPS?

- What is the minimum amount needed to invest in the NPS?

- What are the tax implications of NPS?

- How can I open a NPS account?

- Why hasn’t this become popular?

What is the New Pension Scheme?

The NPS was introduced by the government last year to give people a way to get a pension during their old age. Employees of the government sector already get a pension, so this scheme was introduced as a social security measure that enables people from the unorganized sector to draw a pension as well.

The working mechanism is quite simple – you contribute a certain sum every month during your working years, which is then invested according to your preference. You can then withdraw the money when you retire, which is currently set at 60 years old.

When I say you invest according to your preference, I mean that there are a couple of different options that you need to select from. These options pertain to your preference on withdrawal, and asset allocation.

What are Tier I and Tier II accounts in the NPS?

The NPS is meant to be a pension scheme, so it is geared towards giving you a steady stream of income on your retirement.

That means that NPS makes it difficult to withdraw your money during your working years or till the age of 60 in this case.

Tier I and Tier II are two options under the scheme where you can invest your money, the primary difference between them is how they differ in allowing you to withdraw your money before retirement.

NPS Tier I

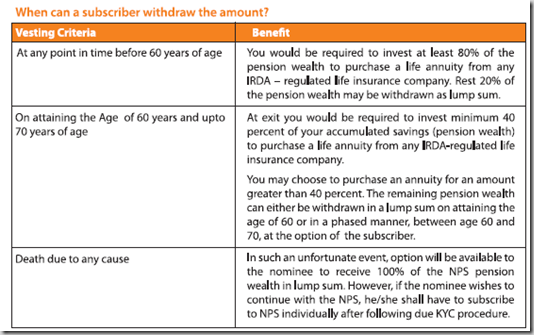

There is severe restriction on withdrawing your money before the age of 60, because it is necessary to invest 80% of your money in an annuity with Insurance Regulatory Development Authority (IRDA) if you withdraw before 60. You can keep the remaining 20% with you.

When you attain the age of 60, you have to invest at least 40% in an annuity with IRDA; the remaining can be withdrawn in lump-sum or in a phased manner.

Here are the details of how your money can be withdrawn in a NPS Tier I account.

Death is another way of getting the money, but that might come in the way of other plans you have.

NPS Tier II Account

The first thing about the NPS Tier II account is that you need to have a Tier I account in order to open a Tier II account.

The Tier II account makes it easy for you to withdraw your money before retirement because there is no limit on the withdrawals you can make from the Tier II account.

You need to maintain a minimum balance of Rs. 2,000, and you can transfer money from the Tier II account to Tier I account, but not the other way around.

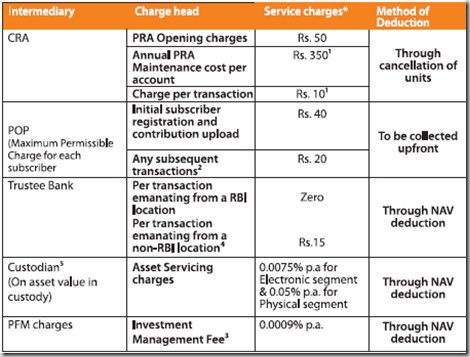

There is a Rs. 350 CRA (Credit Record Keeping Agency) charge which is not present in the Tier II account, but the rest of the fees remain the same.

Asset Allocation and Categories in the NPS

There is an Active Choice option, and an Auto Choice option. If you select Auto Choice then your money is invested in a certain percentage in the various classes based on your age.

Here are the three investment classes:

| Class | Risk Profile | Description |

| G | Ultra Safe | Will only invest in Central and State government bonds. |

| C | Safe | Fixed income securities of entities other than the government |

| E | Medium | Investment in equity related products like index funds that replicate the Sensex. However, equity investment will be restricted to 50% of the portfolio. |

In the Active Choice you can select how much of your money will be invested in the different classes with a cap of 50% in Class E.

Now, there are pension funds that will manage your money, and in either of these options you have to select the fund manager who will manage your fund. So even if you select the Auto Choice, you still have to tell them which fund manager you want to manage your money.

Fees and Costs related to the NPS

I talk about expenses a lot here, and the expenses on the NPS are really low. The annual fund management charge is 0.0009%, which is probably the lowest in the world.

There are some other expenses associated with the NPS, but as you will see all of them are quite low as well. Here is a list of the other expenses.

What is the minimum amount needed to invest in the NPS?

For a Tier I NPS account you need to contribute a minimum of Rs. 6,000 per year, and make at least 4 contributions in a year. The minimum amount per contribution can be Rs. 500.

Minimum amount for opening Tier II account is Rs. 1,000, minimum balance at the end of a year is Rs. 2,000, and you need to make at least 4 contributions in a year.

What are the tax implications of NPS?

The revised Direct Tax Code proposes to make the NPS tax exempt at the time of withdrawal. Initially NPS was going to be taxed at the time of withdrawal, and that had put it at a disadvantage to other products like ULIPs and Mutual Funds. But the revised code proposes it to be exempt from tax, and that really adds to its lure.

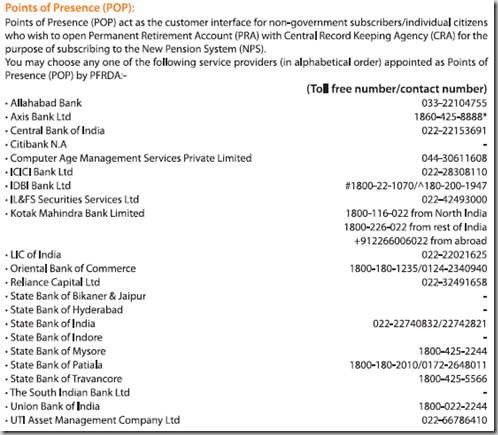

How can I open a NPS account?

You can open a NPS account by going to the bank branches of the banks that are authorized to sell this.

Conclusion

This is quite a good option for people who wish to invest for their retirement, and the government has done good to come up with such an option. It is still early days for the scheme so there are going to be some teething troubles, and I am sure you have come across several articles that write the NPS off completely, or suggest major changes.

While it has not gained in popularity the way you would’ve expected with the low cost structure, a primary reason of that is there is no real incentive for anyone to push this to consumers, so it has not gained any real traction.

That being said, the scheme is a good initiative, and given enough time, the chinks should be ironed out in its favor.

As a final word – a big thank you to Gaurav who sent me all the material, and pushed me to write about the NPS. Thanks Gaurav!

Very useful information indeed, and I think the NPS scheme does have potential and needs to be advertised much better.

However, I think the low fund management charges (0.0009%) is slightly misleading. For a person making minimum investment of Rs 6000, the charges for first year are almost 7% (Rs 50+350). It would be interesting to analyze how this compares with a private mutual fund and at what point the charges balance out. At first look, it definitely seems to me that one is better off investing in a diversified mutual fund for low levels of investment.

Also, it would be useful to get some details on how competently these funds will be managed. Will the equity portion be pretty much passively managed as an index fund, or can we expect better returns that diversified equity funds strive to provide?

Very good points Sandesh.

The equity portion of the funds will be invested in index funds, so the returns will be commensurate with index returns, and not anything over that. There are a few diversified funds in India that have beaten the index in the last 5 years or so, but whether they will continue to do so in the next 30 or 40 years (retirement time-frame) is anybody’s guess.

About the charges, the fund management fee is charged by all mutual funds, which is usually in the 1 – 2.5% range, so that’s the comparison. Your comment made me wonder if the equity part of this fund when it is invested in an index fund, will that pay the fund’s usual expenses….probably not, but I don’t know for sure. Do you know about that?

What do you think?

I believe that the fund management fees for passively managed index funds is typically 1% or lower. For NPS to beat this, the fund value invested in NPS should be larger than Rs 40000. For a smaller investment than this, private index funds seem a better choice. Correct me if I got the math wrong!!

Btw, from what I understand, the fund management expenses under NPS are capped at 0.0009%, no additional fees are payable (other than the fixed charges of Rs 350 p.a.).

There is more to it than meets the eye here, the CRA is the biggest part of the NPS cost at Rs. 350 annually today, but this is going to come down when the number of accounts cross 30 lakhs. At that time this will come down to Rs. 250. The 10 rupee transaction cost will also come down to Rs. 4 at that time.

So, that’s one thing that’s going on here. Secondly, we might be missing the forest for the trees here by focusing too narrowly on the expenses as costs, and by ignoring the tax implication of this, which, at least for now gives them an edge.

Then there is this whole issue of buying a mutual fund or an ETF from a broker where you have to pay distribution and demat account charges which add more to the expense and make it much more than 1%.

So, my take on this is don’t cling to the 40k number, but look at this more holistically, especially with respect to something that provides you a pension, and something you are in for the very long haul.

Of course if you are talking about a bigger investment corpus, and are looking relatively safer investment options, then this is quite good for you. On the other hand if you’re still quite young and want to invest a larger share of your savings in a diversified equity fund, then go for it.

Good discussion Sandesh, thanks for bringing up these points, I might make a mini post out of this.

Dear Sir,

We Are Running Simon Vadana Samaj Seva Sanstha.(N.G.O.) So We Are Thinking To Oppen N. P. S.Agency.

So Pls Give All Detals. Waiting For Your Anser.

My Cont No; 08085558377,8223933140

For info and n.a

Thanks Manshu for the great posting. Once the DTC Kicks in NPS would be eligible for tax saving included in one lakh. So if one invests Rs 18,000 he/she can claim benefit on the amount. The added advantage is obv it will fall under the EEE category wherein the money at the time of withdrawal will also be exempt from tax.

Thanks Gaurav, that’s a great point. I think I need to either update this post with these thoughts, or write another mini post about them as they’re quite important.

I am reading it late… but very informative and useful article.. something thats true for every onemint article infact.

Thanks IT 🙂 very glad to hear that!

Can a person operate the NPS (Tier -1 and Tier- 2 schemes online i.e. without going to any Agent or POP

Devendu,

At present, contributions and other services can only be availed using services of POP.

In future, we will have option of ECS also.

Nice info I could get but the anxiety remains as to “How much monthly pension, one will get after completion of 60 years of age?” Any tabular chart will give an idea as well as clue to the General Public.

Hi,

Currently there is an option of ECS and I have subscribed to it under the same option. It would be very difficult to say how much monthly pension will a person get as it has an equity angle to it…eg I have allocated 45% of my funds to the equity option so it will be difficult to put a figure to it.

I think you can roughly compute the monthly pension by first estimating your total corpus when you are sixty and then calculating the returns you would get from a typical annuity.

e.g. if your total estimated corpus at the age of 60 is 10 lakhs, and you use all of it to buy an immediate annuity (let’s assume Jeevan Akshay from LIC with uniform payout for life option http://www.licindia.in/jeevan_akshay_plan_009_features.htm), you will get an yearly pension of INR 93500 or about INR 7800 per month.

To calculate the corpus, you can use some online calculator and assume a rate of return of 10-12%, which is reasonable for 50% allocation to equity.

http://www.licindia.in/jeevan_akshay_plan_009_features.htm

the correct link for the last comment

Hi,

The Tier 2 account of NPS is one of the Cheapest mutual funds you will ever get to invest in. When I say cheapest, i mean in terms of Management fees, costs and load. Every youngster who has access to open an NPS account should do this ASAP.

Transfer money into the Tier 2 account throug and ECS and beleive me in time you will see great growth and accumulation.

Regards

Venkat

Thanks for your views Venkat.

Hi Manshu

The very purpose that NPS is not well known to many of the investors is because of the low cost and NPS is not attractive for the fund managers. I had to talk to three or four fund managers of NPS and went to their office to open an NPS account whereas for a normal MF, the guys would come home to open the same.

Yeah, that’s right – it’s not really in anyone’s interest to push this product, but with time the pull for it is increasing and as more and more people demand for it, banks and other fin intermediaries will have to carry them and provide info on it.

a) what benefits accrue to the nominee in case of death of customer during the currency of the scheme i.e. when he is still subscribing towards the scheme. It may kindly be clarified whether a nominee will be entitled to any pension and lump-sum payment from the corpus fund accumulated in the name of such deceased customer.

b) It may also be advised if the nominee of a customer wil be entitled to any benefits after death of the subscriber, if such death occurs after the age of 60 years. If so, what are the benefits admissible to nominee. For example, if a subscriber subscribes for 30-35 years and starts getting pension at the age of 60 years but dies at 61, what will happen to the corpus he would have accumulated over 30-35 years? Will his nomees get it?

a) From what I’ve read – the nominee can withdraw 100% of the amount, and if they want to continue with the NPS then they will have to subscribe individually.

b) I couldn’t find any information about the nominee getting a pension. Doesn’t mean that it isn’t there, just that I have not been able to find it.

can I change my tier-1 account of NPS to tier-2 account.

You need to have a Tier 1 account in order to open a Tier 2 account Shylaja, so you will have to keep the Tier 1 account, if you wish you can keep it with the minimum balance though.

After how many days can I withdraw amount from my Tier 2 account and how much percentage

There is no limit on the number or amount of withdrawals.

my question is that govt contribution is also added while calcualting 80C. that is what they are doing in my dept

Hi .. the original blog says “The revised Direct Tax Code proposes to make the NPS tax exempt at the time of withdrawal.” – has the proposal been accepted??

Hi,

Only once the DTC comes into effect will the NPS come under the (EEE) limit

I was appointed as LDC in Central Govt on 22-9-2009, from 1-10-2009 they are deducting Tier.I contribution from my salary. The thing is recently I got another job and I resigned from my previous job on 6-12-2010. Now I want to close my Tier.I account and withdraw my amount . Pleas, let me know the procedure how to withdraw my 15 month contributed amount from my Tier.I account.

I am not to sure as to how can you withdraw the money as money invested in Tier 1 is strictly cannot be withdrawn. According to sources in Govt once the DTC comes into effect they would tweak around the NPS to make it more attractive and bring it on par with PPF and other instruments available currently just to increase the participation of general public. But I am not to sure how you can withdraw the money now. I think you can invest minimum amount of Rs 6000 per year as if the DTC comes into effect this amount will also come under (EEE Category) this will be beneficial in the year end tax claims….Hope this helps…..I am also investing in tier 1 scheme for the moment and not to sure how things will shape up 🙂

Great article, thanks. Any idea about taxation on Tier II ?

I want to know is NPS based on Stock Exchange or not . what is the process to open an NPS account

Shamsher – There is an option that allows you to decide to include shares as a percentage through mutual funds. The best way to open is to go to a bank branch – look at any one listed in this article (in the table with orange header) and get it open from there.

Now, ICICI Direct is providing an option to open NPS account as well, so you can open one from there also if you already have an account.

Explain in detail about NPS

Very lucid. If you can give an example how the money grows and become the big corpus at the age of 60 years. So that each one can plan accordingly.

I actually didn’t understand the question Umesh – I’m sorry about that. Can you give me an example of what you’re looking for please?

I am 57 yrs old. I am left with 3 yrs of service. How much do I contribute per month for 3 yrs to get a pension of say Rs 10,000 pm ? Further I understand Tier I account is a must in NPS. Whether Tier II account opening will be of any use to me? Kindly reply at the earliest

Based on what Sandesh has shared above I see that you need about 10 lakhs to have a 7,800 monthly annuity, so you should aim at getting to a corpus which is higher than that in the 3 years that are left.

Since there isn’t a lot of time till retirement what you already have will play a bigger role rather than the sum contributed in the NPS because it doesn’t have that much time to grow.

I don’t see much merit in getting a Tier 2 account in your case.

Apart from ICICIDirect, is anybody else providing the online opening and maintaining facility

No Chris, not that I’m aware of.

hi sir, this is ravikanth from hyd , iam very much interested in opening the nps account, but most of the banks they are saying that we have not started yet, so pls tell me which bank is gud to open the account, and per annum how much i can invest, iam ready to invest ! one lakh per annum, so please suggest me iam in desperate to open the account, not only me all my family members are ready to open the account.

It’s up to you to see how much you should invest – I can’t comment on that but since ICICI Direct has an online platform I think you will have better luck in trying ICICI Bank.

Yes among all the fund managers ICICI are more proactive and at least they do open the account when asked. The individual need to go to their select branch to open the account. I do have ICICI direct and nowadays I get to see an option to open NPS. This is a good sign.

When I opened the account, ICICI was advising me that for payment into the NPS, everytime I had to visit the branch but it was six months back. Something good is happening.

That’s great – thanks for your comment.

I am still not clear about the payouts. CAn any one explain giving an example

Manika – if you look at the orange table in the post – that explains how you can withdraw the money, and there are no limits on withdrawal on Tier 2.

Is this what you’re not clear about? Or are you not clear on how your money will grow during the time period?

Mr. Manshu – Thanks for the clarification. I am sorry , I am bit late to respond to your clarification. I am not understanding your explanantion “Since there isn’t a lot of time till retirement what you already have will play a bigger role rather than the sum contributed in the NPS because it doesn’t have that much time to grow”. Do you mean to say that what money I get after retirement will fetch me more returns from FD & other investments than investments done now in NPS ? In that case is it worth opening a NPS a/c for me at this stage? Kindly clarify at the earliest.

I was saying that NPS is better for people who have a long way to go for retirement and by saving a little every month can look at building a corpus that can be used for pension at the end of their career.

If I were in your position I’d much rather invest this money elsewhere so that at the end when I get the money I am not restricted by NPS rules on where I can invest the money, and can merge this with whatever other funds I have and invest it somewhere.

I agree with Manshu, that the earlier the better. Regular savings, with consistent upgrades whenever incomes rise, can fetch one a very good pension.

However, keeping in mind that there may be any number of urgent fund requirements for everybody, it would not be prudent to save money meant for pensions in any other savings vehicle, which allow free withdrawals. An element of compulsion goes a long way in ensuring that adequate corpus is created to purchase an annuity at the time of retirement.

I was appointed as LDC in Doordarshan Kendra on 27-02-2004, but our office are deducting CPF No NPS pl suggest me & pl tell me difference of (contributed provident fund & New Pension scheme)

I’m not familiar with the details of CPF so can’t really say – sorry. You can try asking this at the forum and see if someone else answers it.

this is very sad to describe how such good schemes like new pension schemes are out of reach to the people, but one must know why this is not so popular like other investments schemes …the original fact is that government can depute employees even can make bodies but cant put up a proper strategy for development for such welfare plans , because our politicians do not get benefit from such schemes there is no way to have benefit from this schemes otherwise our so mean politicians must have intervene and would have developed a way to have some money from this schemes, no doubt scheme is awful lucrative but when it does not approach to needy people what does it mean whether its a gold or coal . founder of this scheme can derive a product good for people but they cant do it in a manner to be useful for the people because this is not in their nature, they must do something which must be lucrative for them like infrastructure, bridges, dams , tenders .. because it helps them to collect the fund in form of bribes for the approval they provide for contractors. sometimes i think what and how such a huge amount of bribed money would be used by all corrupt politicians, all this must be punished severally and should be hanged perhaps .

Why do you say they’re out of reach of people? They are not as easily accessible as one would like but they are not out of reach of anyone.

I have already opened a nps account with SIB. Can I remit money to this account directly through online. Kindly clarify.

Regards.

Raeba

As far as I know there is ECS facility – how are you making payments right now? Going to the South Indian Bank branch?

yes

I want to join New Pension Scheme (Govt. of India)

In the Almora Uttarakhand district, what is the channel for join to new pension scheme please tell me.

You will have to check with a bank near your place to see how to open an account or if you have an account with ICICI DIrect then you can open that online with them.

i want to open a NPS a/c with SBI , what the proceesure for that , can you give me the details???

Sushama – You will have to go to a SBI branch and get the details from there. I’d like to mention here that awareness is a little low here so you may not get a positive response right away.

i visit d one of the SBI Branch…they are not aware about the NPS…its create a difficulty to open an accout…what should i do????

Sir i want know about nps tier II account.

Sir i serving in BSF my NPS tier I account is already opened and invest monthly amt.as per central govt. Policy but i try to open my NPS TIER II account, but my dept says to me ad all serving person to this scheme therew is no any addprovision to open NPS tier II account.

Sir pse suggest me regaeding this type of account in to my email id.

Sorry not sure about this.

Hi–This is great information indeed. Would you have any updates on the performance of the fund managers? Thanks a lot for your wonderful posts.

No, sorry I haven’t seen this info but it’s a good idea and I’ll see if this is available anywhere.

if i want to discontinue the NPS after 4-5 years from the date of joining NPS the what is the plan of this scheme

You can withdraw money from the Tier 2 account, but there is no provision for that in the Tier 1 account.

i did not got the card of i pin for last 6 years

Can you please elaborate a little?

Dear Manshu

Great Initiatiives and information, i had a big discussion in office on your posts 🙂

Is there any information on the total corpus invested in NPS as of today. Also how transparent these schemes are to the investors in terms fn where they are investing and kind of returns that are generated by them.

WOW – that’s quite incredible Shilpi – I’m really amazed and I think first time I’ve heard about a discussion of OneMint in the offline world 🙂

I don’t know about total corpus or where the fund managers invest the money, but they do publish the NAV regularly, so one can compare from there. That’s actually quite an interesting question – I’ll research that more.

Hi,

Its an informative article. There has not been enough publicity to push this product. Recently I went to one of the PoPs (ICICI Bank) for information and how can I open an account for this. I experienced that the staff is completely unware of this. I did not even a find person who can help me out.

I also called up to LIC Pension Fund office, learned that LIC is no more a fund manager for this scheme.

I find lots of chaos at the moment. A scheme is successful only if it is implemented properly. The scheme deserves lot more attention.

Can any one let me know if you have an NPS account and how did you open.

any one who wants to open can find this link useful just put details online and send adress proof documents to CAMS branches all over india http://www.camsonline.com/PensionSystemServices.aspx

Thanks dr shetti – did you follow this procedure yourself? What happens after one sends the documents?

i have satrted via icici direct its very easy and convnient no need to submit any documents .however one recieved only letter from CRA and not PRAN CARD . with cams they have 194 branches allover india where u can submit documents . in any case CAMS AND ICICI DIRECT are best for NPS

Hi,

I subscribed via ICICIDirect.com ( already had an account for MF/Stock) and found no issues subscribing for the NPS through the same.

-Chris

NPS – ONE OF BEST SCHEMES for those who are working independently/ professionals , enterpruners , jobholdres in private . INindia we dont have govt support in old age and this is only scheme which one can start in india at age of 20 yrs and continue till 60 yrs and is great scheme beacuse WE CANT WITHDRAW . its everyones experiennce that we all invest origianny for retirement but do withdraw for higher education of children, health expences or marraige of kids . NPS invests in equity , corp bonds and g ove sec as per age and hence its ONE OF BEST SCHEMES for everyone . awareness is not much beacuse agents/ bank dont earn anything on this but once people are aware this will pick up

i have opened online today with icicidirect and with 25000 per month contribution i should get 48 to 50 lacks in 10 yrs to take care of me after 60!

Thank you for your comment Dr Shetti.

any one who wants to open can find this link useful just put details online and send adress proof documents to CAMS branches all over india http://www.camsonline.com/PensionSystemServices.aspx

NPS CORPUS CALCULATOR

we can approximately plan a corpus by following following link and putting our figures of contributions

http://www.camsonline.com/PensionSystemServices.aspx

Great – thanks for the link!

Thanks for the link. Though I have one from ICICIDirect, I’m planning to have one for my spouse. Any feedback on CAMS customer service?

plese send information of NPS scheme

VERY USEFULL INFORMATION FOR EVERY ONE,THANKS DR.SHETTY.

is there any change in NPS coz i have heard that what we r giving the money only that will be considered for saving not the same money given by govt.

That doesn’t sound right. There are some additional tax benefits which are good, but what you’re saying about govt.’s part not being considered – that doesn’t sound right, and I haven’t heard anything like that.

hi,

i was having an NPS account in place of my pf account as it was enforced to all the new joinees in india post at the time but i worked there for nearly 5 months and an amount of approximately 1500 rs was deducted every month towards NPS or PF now i have quit that govt job and is working in a private organisation but now that account is not operative and the amount is in pending state so what can be done with that can i continue with that or that money is wasted.

Your money is not lost Sumit. You can continue the account yourself. Actually this scheme is in fact for people who want to invest and save for retirement on their own.

Please can you let me know whether this NPS scheme is allowed for Overseas Citizens of India.

Thanks

NRIs can invest who have Indian passport. I don’t know for sure if people holding OCI cards can invest or not.

Hi,

I am little worried about putting 40% of your corpus, at maturity, in the annuity schemes which gives just 4-5%. Is there any annuity schemes where we can select the funds? Are there any annuity schemes which gives more than 8% returns?

Thanks

There aren’t a lot of great annuity products right now, but given the longish time frame (at least for most people), and the fact that you can open a Tier 2 account without any restriction – you can open a Tier 1 account with a min balance, and establish a Tier 2 account for most of your funds Raj.

Pls. send me more the details for NPS and which bank is better in service.

Based on all the comments here I’d say that ICICI Bank seems to be the one which has better service with respect to this product Vaibhav.

what happen if i stop payment to nps after 5 years

Tier 2 money can be withdrawn, but you’ll have to wait before you get the Tier 1 money.

I would like to join this scheme

You will have to contact a bank or use ICICIDIRECT to enrol in the scheme.

It is a nice write up.

Pl. add to it about govt. contribution to the account. like Amount, %age, Duration, Time of credit, max. / min. limits,etc.

Also add about Return On Investment.

Thanks.

Thanks for your feedback – I’ll incorporate that in a future post I guess. As far as the returns are concerned that depends on how the underlying funds perform, so there is no fixed number for that.

it is good scheme for non govt.employes and i think i will got good plan for future security

I got very useful information about NPS. In some previous comments it was mentioned that the scheme can be made through CAMINDIA. If it is subscribed through them, what are the options to make regular premium payments?. Are they authorized SOP? Is there any other option for NRIs?

Thanks

I guess opening an account through ICICI Direct will be a convenient option for NRIs since it is online.

What is CAMINDIA ?? pl. abbreviate

My date of birth is 12.05.1954. I have joined IIT Roorkee as Assistant Registrar since 13.10.2010 much after attaining the age of 55. Earlier I had worked with a GOI Undertaking and I am also getting pension from EPFO. Can I avail the benefit of NPS.

Sorry I don’t know the answer to that. What account has IIT Roorkee opened for you though? Since NPS is present for new govt. joinees they would have opened one for you if they fall under the government.

And nothing stops you from doing it on your own, but in that case there won’t be a match from your employer which is what I think the implicit question is.

Iam central government employer can i join in the NPS Scheme. please detail me

Yes, in fact for new joinees NPS is compulsory instead of the old PF as far as I know. Have you joined the government service recently or do you already have a PF account going?

Dear Manshu Ji

IIT Roorkee is a Central Govt. Institute giving pension benefits to all its emplopyees at par with Central Govt. Employees. It has also arranged opening of account for new entrants who are below the age of 55.

The question is whether I am entitled for NPS benefits or not as I have joined after the age of 55. IIT has no objection to allow me NPS benefits subject to rule framed under NPS. Please clarify with exact ruling.

Dear Sir – I do not know of an age restriction. Could be that I am not completely aware of some detail, but as far as I know there is no exclusion on the basis of age. You can see this page which has list of exclusions but age is not a factor here.

http://pfrda.org.in/faqdetails.asp?fid=228

I am born in 1958 dec.How much should i invest in nps pa to get 15000 pm.

you are born 1958 and will compleate 60 yrs in 2018 so you have still 7 years of contribution . you need 15000 pm so 180000 per year .

you will have to have a corpus of 18,00,000 with a return of 10% per year

to get 15000 pm so invest 2,57, 000 or 21400 per month for 7 years to accumulate 18 lacs

assuming 10 % is on bit higher side but simple for you to understand . as yo are likely to get around 8 to 9 % (considering some 10 % investment in equity) ALL THE BEST and best part you cant withdraw till 60 yrs

in above reply returns on your contribution for 7 yrs have not been taken into account beacuse period is very short and return may not add much in only 7 yrs

Thanks for taking the trouble to and replying in such a comprehensive manner!

I am 30 yrs old now. Is there any calculator to know how much one need to invest to get amount as pension based on certain assumptions/factors.

Lets say.. I want 50k per month after 30 yrs..so how much I should invest now onwards.

If i were to choose amongst services providers for NPS ..What will be your suggestion amongst , LIC , Kotak , SBI and Reliance Capital and why . It will be great if you can help me to draw comparisions …Regards Avnish

I don’t have any recommendation on that Avnish since I don’t have any special insight on them. They have not been around for long for one to compare the historical record and I’m not aware of any other reasonable way to measure them.

Dear Mr. Manshu

Alongwith you I am also updating my knowledge abourt NPS. The very first thing is that now there is no New Pension Scheme i.e. Now it has become New Pension System as available on the website of Pension Fund Development and Regulatory Authority of India, secondly every body who is below the age of 60, can join NPS. A 14 pages brochure is also available on the website of PFDRA which is quite useful. Also, clarification may be made over phone no.011-26892417 the enquiry counter of PFDRA.

Thanks

V.K. Singh

Dear Mr. Vijay – thank you for your comment – this is certainly new info that I wasn’t aware of. Do you have any personal experience of calling up the helpline?

Mr. Manshu

Yes, that is the help line of PFDRA. You may call them for any clarification.

V.K. Singh

Thank you for your response!

Iam employer of Central government and I have pension in my office . Apart from that I can join NPS SCHEME.

PLEASE REPLY

Acc. to the exclusions on this page you can’t.

http://pfrda.org.in/faqdetails.asp?fid=228

You can also double check by calling the phone number shared on this thread.

is their a pension plan for business man…

please reply……..

Yes Rahul – even businessmen can open a NPS account.

but how we can………

As Dr. Shetti has mentioned in her comments you can find a CAMS branch. OR you can do it through ICICI DIrect if you have an online account with them. The other option would be to check with your regular bank to see if they can allow you to open one.

NPS – The Cheaper Option

Shown below is a projection of how an investment of Rs. 1 lakh per annum would behave over a period of 30 years. This is considering that all three options give similar returns at the rate of 10% p.a. For the sake of this projection we have considered funds that would match the asset allocation pattern followed by the aggressive portfolio under NPS.

NPS

Insurance Pension Plans (ULIP Based)

Mutual Fund Pension Plan

Investment amount per year

NPS 100000

ULIP 100000

MUTUAL FUND100000

Charges per year (Initial period)*

NPS925

ULIP 13200

MF 1250

Charges per year (5 years to 10 years)*

NPS 388

ULIP 6000

MF 1250

Charges per year (11 years to 15 years)*

NPS455

ULIP 3000

MF 1250

Charges per year (16 years+)*

NPS455

ULIP 0

MF 1250

Fund Management

NPS 0.0009%

ULIP1.25%

MF 1.25%

Age limit for annuity

NPS60

ULIP Flexible

MF58

Assume CAGR

NPS 10%

ULIP 10%

MF 10%

Maturity proceeds after 30 years

NPS 1.8 Crore

ULIP1.3 Crore

MF 1.39 Crore

*Premium allocation charge and policy administration charges are calculated at the end of the year. Typically, these charges are computed on premium at the beginning of the year/month. Important Note: The projection shown above takes an investment of Rs 1 lakh every year because this is where the charges under ULIPs based pension policies and MF pension plans are at the lowest.

Superb illustration .. pl. give me links of similar things so that I can enhance knowledge of investment..

sufficiant information

Hi,

I have recently opened the NPS accout with SBI and got the PRAN card lastweek only. Now, how can I make payments to NPS account? Is it possible to do fund transfers from SBI/ICICI banks etc. Could you please let me know the details.

Thanks

Bharat

I think they do have the auto debit facility so you can check with the bank on how to activate that.

i am investing 5000 Rs. per month from the age 55 till 60 . so how much i will get as pension per month from the age of 60?

I am 1958 born. can i contribute to NPS a/c a lumpsum amount , instead over a period of next 7 yrs ? if yes, what would be the one time contribute sum to fetch a monthly pension to the tune of INR 10K ?

NPS puts restriction on where you can invest your money after maturity, and if you are thinking about a lumpsum then I’d say instead of selecting NPS invest that independently so that you have more control on where you can invest the maturity proceeds.

NPS is a good tool for people who have a long way to go and are looking for regular investing.

hi

i want a pension of 50 k per month at the age of 50 , now i am 30 years old . how much i need to invest in this scheme.

akhilesh

Hi,

Now, I am 25 years old. If I invest NPS 5000 yearly from the age of 60 years, After 60 years how much pension I will get every month.

please provide the best pension plan.i’m ready to invest 10 to 15 k annual premimum .

I’ve not done the research on best pension plans, so not in a position to recommend one to you. Sorry.

I am a IT professional and aged of 32. Can i be eligible for NPS.

Yes, you can open one.

Hi,

I am 35 years old , Please let me know if i invest 12K per year , than what will be my pension per month after 60.

Dear,

I suggest if i would get pension after the age of 45 nice because nowdays 60 age very difficult to survive. Whatever food we are geting chemical or poision, air is polluted, then life is full of tension, water is contaminated or chemical used, etc., looking all these is there any gurantee survive till 60 age, as per my concern while living we should enjoy the pension.

Even if person survives at the age of 60, afterthat how many years he will enjoy?.

So please consider this points.

I wanted to open a NPS in any bank in Gurgaon (haryana) . The bank people seem to be unfamiliar on it , although they have heard of it.

Please advise how this can be opened.

Hey Subhrajit – there is this link present in the PFRDA website that lists down locations – I see a SBI branch near Gurgaon – you could check that out. Other option is to do it through ICICI Direct of follow Dr. Shetti’s link that she’s given above.

http://pfrda.org.in/writereaddata/linkimages/POP-SP_Location0502115605373405.xls

I contrbuted to nps I up to mar’07 at gov schedule rate, now i working in different sector. Am i eligeble to getting back my contribution?

As far as I know you can’t withdraw the amount before 60 if its in your Tier 1 account.

Hi,

I have got a few questions on NPS. They are as follows:

1. I am a Private Sector Employee and governed by EPS 95 scheme where out of the Employer’s matching EPF contribution, Rs. 6500 goes to the EPS 95 Account every year.

My question is whether I can open a NPS Account ?

2. In case, I am elligible to open a NPS Account, do I need to open Tier 1 Account first or can I open Tier 2 Account?

3. What is the benefit of opening a Tier 1 and Tier 2 Account both ?

4. As I am not a Govt Employee, would I get a matching contribution from the Government for my contribution in the Tier 1 Account?

Regards

D Ghosh

One of the exclusions listed on the site is as follows:

1. You are already covered by the Employees Provident Fund and Miscellaneous

Provisions Act, 1952 and any other special Acts governing these funds, or

Here is the link to that:

http://pfrda.org.in/faqdetails.asp?fid=228

I don’t know the answer specifically in your case, but I’d recommend calling their helpline and giving it a try. Number given by another reader above.

Manshu – you have got it wrong. What the PRFDA site states is that if you are covered under PF Act 1952, then you are not covered under the NPS scheme. So in such a case you can opt for a personal account under NPS.

Only, there will be no contribution from your employer to NPS. It will be just like a business man who opts to have a NPS account.

You haven’t read my comment Ravi – I’ve said that I don’t know the answer.

The text that I found also talks about any other special acts, and I don’t know what they are or what they’re referring to.

It’s likely that in his case he can open an account, but I’m not the one to say that he surely can.

Hello, still i m 35 years old, if i invest 1000/- per month till the my age 60 means nearabout 25 years (means i will invest total 3 lakh) then how much amount i will get return at the age of 60.

YOU CAN EXPECT total corpus of

Rs 957367 with 8% returns which should be minimum

1129530 with 9%

1337890 at 10%

and 1897635 at 12 % p.a.returns is likely (with 50% equity option )

all depends on how equity / debt perform over 25 yrs term but above is reasonable minimum one may expect anything more will be bonus

Dear Sir

Im working at private company i dont have any pension plans so i would like to join but my job is not like permanent can i join?

and another thing if i joined this scheme if i leave the job shal i get the money which i paid

Yes, you can start it on your own. There are two type of accounts – Tier 1 and Tier 2. You can withdraw money anytime from Tier 2 but only after you’re 60 from Tier 1.

If you think you’ll need to withdraw before 60 years, then you can think of investing the min amount in Tier 1 and the remaining money in Tier 2.

I have heared about the NPS and I want to introduce same for my employees, so please let me know the whole procedure of it & I also want to know that what is contribution to be given by the government ag. this scheme

AS for opening the account you can go to a bank branch and open it for them. Here is a list of branches that can get it done:

http://pfrda.org.in/writereaddata/linkimages/POP-SP_Location0502115605373405.xls

The govt. will contribute Rs.1,000 per year up to 4 years for people in the unorganized sector and who contribute between Rs. 1,000 – Rs. 12,000 themselves in the scheme.

If i want to withdraw my fund at the age of 50 what will be the process? i am ready to contribute 12k per month for nxt 19 yrs.

There are two type of accounts – Tier 1 and Tier 2. You can withdraw money anytime from Tier 2 but only after you’re 60 from Tier 1. If you think you’ll need to withdraw before 60 years, then you can think of investing the min amount in Tier 1 and the remaining money in Tier 2.

i am 36 years old, i would like to get this scheme……… plz give me the hints to help me to get it

Your best bet is to go to a branch near your house or office that is selling this and discuss this with them. The file on this link will show you a list of all the branches and you can select the one near you.

http://pfrda.org.in/writereaddata/linkimages/POP-SP_Location0502115605373405.xls

Dear Sir/ Madam,

I would like to know more about NPS. I am 34 years old and working in a private company . I am getting Rs 23500.00 salary per month therefore interested in NPS. May I get NPS for myself or not , and if yes , what kind of benefits would be given by them?

Please suggest me on my email – [email protected] or call 9898319737

Regards

ajeet

hallo,I liked this scheme but unfortunately even state banks all braches do not have the forms for submitting and getting the NPS.. and many people do not even know about the plan

Dear sir,

What is the interets rate on NPS annualy? and what is the Government contribution

after opening a/c how long I have to deposit money in that a/c, to get pension amount of Rs 5000/pm at the age of 60 yrs age.

I am 33 yrs after opening a/c how long I have to deposit money in that a/c, to get pension amount of Rs 5000/pm at the age of 60 yrs age.

Is it possible to Open the NPS Account by visiting one POP-SP and then after depositing the contribution everytime by different POP-SP?

Thanks in Advance,

Tapan Maru

There is an option of ECS or auto debit so you don’t even need to go to the branch once the account is opened and you opt for that.

I want to join this scheme.Would anyone please help me out.My mobile number is 9937516833.

Ajit – You will have to go to a bank branch and open it. This is like a news website, and can’t open the account for you.

Dear Sir

Im working at private company i dont have any pension plans so i would like to join but my job is not like permanent can i join?

and another thing if i joined this scheme if i leave the job shal i get the money which i paid

sir please provide the toll free no

deepak

ph. 9355531025

Yes, you can join. Yes, you will get the money but only after 60 years of age. The toll free number has been given in a comment earlier. Please browse through the comments and you’ll find them.

Dear sir,

my grandpa wants to upto what age could v contribute under the NPS scheme?

One can contribute up to 60 years.

Dear Sir,

I am born in 2.feb1980 .How much should i invest in nps pa to get 25000 pm?

Sir, if we want 20,000 per month what amount to be invested i am 37 year old now give me the details for these amount also 10,000 per month and 5000 per month.

thanking you

Jithendra N.S.

You can go to this links and use the calculator there to calculate returns. I will write a more detailed post about this later on.

http://www.camsonline.com/PensionSystemServices.aspx

where i can contact for same scheme?

Pawan – this link has all the info about opening an account:

https://www.onemint.com/2011/03/28/how-to-open-a-nps-account/

dear sir

for tier 1 and teir 2 how much we have to invest minimum and maximum it wil count as yearly or monthly payment til how much year we have to invest money

Hi Divya – The min for Tier 1 is 6,000 per year, and you need Tier 1 before you can start a Tier 2.

I Im working at private company i dont have any pension plans so i would like to join,

another thing if i joined this scheme if i leave the job shal i get the money which i paid

and what is intrest rate and how can i get back my money , like in monthly basis or any other type, pls send me detail,i just want know the prosesser.

Veer – You can join the scheme. There are two parts of the scheme – Tier 1 & 2. 1 is necessary for 2, and if you want to withdraw money from tier 1 account before the age of 60 they will make you buy an annuity with 80% of your money which may not be very useful for you. If you foresee a situation where you want the money in the next 4 – 5 years then you may want to avoid this scheme.

i have a nps account with sib. can i transfer money from sbi a/c to nps a/c

Hi

I understand after my repeated visits to SBI that you would have to download the application forms from the internet. Duly fill them and submit it along with your first contribution at SBI branches. Forms would be sent to Mumbai Zonal office for processing ( 10-15 days) then you would receive your NPS Accnt details. Subsequent contributions can be made online or at any SBI brancches quoting the NPS accnt no etc.

Now what the link to download these forms?? Can someone help here…

thanks

services are USLESSS at almost all branches of SBI in india they treat custmer like a dirt so try icici direct thats the best where everything is online nad seamless alternatively follow following link and fill online and take printout and send by courier to any 194 branches of CAMS

CAMS atfollowing link

http://www.camsonline.com/PensionSystemServices.aspx

Why not try another organization which is more responsive. Here is a link that’s got all the options where you can open the account.

https://www.onemint.com/2011/03/28/how-to-open-a-nps-account/

MAINE SUNA HAI KI AGAR HUM HAR MAHINE RS- 1000/- DEPOSIT KARE TO MUJHE GOV. SE KITNA MILEGA PER MONTH.

OR KITNE YEAR TAK ? OR HAME KITNE YEAR TAK MONEY BHARNA RAHEGA?

Aapko paisa milega after 60 years of your age. To kitna milega ye depend karta hai ki abhi aapki age kitni hai.

Paisa invest hoga in safe instruments to 8 ya 9% per year ka return aap assume kar sakte ho.

Is link pe aapko calculator milega which can help you in calculating the return:

http://www.camsonline.com/PensionSystemServices.aspx

sir,

if i want to close my PRAN account what should i do? wheather i need another PRAN for new job? if i quite my present job and can’t afford to maintain my NPS then what will happen .will it lapse itself?

You don’t need another PRAN. Its unique number, even if u change job, place, country. etc.

pl be inform me about age as on to day iam 52 plus how much i invest to get 10000 per month after my retirement 60 yrs and also the place where i open my account

thanks

This post has details on how to open an account:

https://www.onemint.com/2011/03/28/how-to-open-a-nps-account/

NPS doesn’t give out a pension directly but gives you a lump – sum amount at retirement like the provident fund. Then you have to invest this amount (at least 40% in the case of Tier 1) in an annuity and remaining in an instrument of your choice to generate income. Today, banks give out about 10% or even more in some cases to senior citizens, so if you invest 12 lacs in a bank FD you will be able to generate 10K per month which is what your target is.

You can use this corpus calculator to see how much you will need to invest to get there.

http://www.camsonline.com/PensionSystemServices.aspx

I think it’d be about 8500 or so.

You can now days approach a Head Postoffice of your area to open an NPS account.

IN NSP THERE ARE TWO WAYS TO CONTRIBUTE TIER 1 & TIER 2, SO WHETHER RATE OF INTREST SAME OR DIFFERENT ? & NOW MY AGE IS 23 YEAR AND IF I INVEST RS- 1000/- PER MONTH FOR 15 YEAR, AFTER THAT HOW MUCH I CAN GET ? , AFTER 15 YEAR CAN I WITHDRAW MY MONEY ?

It is different based on what plan you select.

Tier 1 money can only be withdrawn after 60 years of age, but you can withdraw Tier 2 money any time.

New pesion system k bare me puri detail janna chahti hun, n uska procedure k kaise usme acount khulwana h or 1000rs kitni bar jma karwana pdega or pension kya har month milegi or kitne sal tak, n kon sa person eligible hoga ye acount khulwane k liye. Wating 4 rply.

Account khulwane ke liye aapko SBI ki branch ya kisi aur bank ki branch pe jaana padega. Is link pe sare banks ka address hai so jo ghar ke paas ho uspe jaake aap inquire kar sakte ho.

http://pfrda.org.in/writereaddata/linkimages/POP-SP_Location0502115605373405.xls

6000 is the minimum every year aur aapko paisa 60 years of age ke baad milega. Ye paisa provident fund ki tarah milta hai matlab aapko ek lump sum amount milega and not pension every mont

You can also approach any Head Post Office of your area to open an NPS account,

You need to invest minimum Rs 500/- per month.

Any person between the age of 15 to 55 years can open an NPS account.

plz send ur office address

http://www.facebook.com/pages/New-Pension-System-India/192694610777605

i also want to detail of nps

I am of 51 years age. If I invest Rs. 1000 per month for 9 years. How much I will get at the age of 60 and how to open account.

Please let me know.

Dear Madam – This site has a calculator that shows you how much money you can get. I calculated using 8.5% return and saw that you will get about 1.6 lacs at the age of 60.

http://www.camsonline.com/PensionSystemServices.aspx

Here is a very detailed post about opening the account that you can read.

https://www.onemint.com/2011/03/28/how-to-open-a-nps-account/

MAINE SUNA HAI KI AGAR HUM HAR MAHINE RS- 1000/- DEPOSIT KARE TO MUJHE GOV. SE KITNA MILEGA PER MONTH.

OR KITNE YEAR TAK ? OR HAME KITNE YEAR TAK MONEY BHARNA RAHEGA?

How much amount is required to invest in this scheme & for how many years.

Alo

9827239867

k

6,000 per year is the minimum for a Tier 1 account, and you can get the money back only at 60 years of age.

my father is a barber (hair saloon), he is 45 years old. if he credited 1000 ropees per month, then how much he get after 60 years old.

how to open the account, & where, i need complete details.

hooping the best.

thank you.

Vijay:

NPS will not pay pension directly. You will invest money regularly, and then they will pay a lump-sum at 60 years. This is more like provident fund payment.

This link has complete details on how you can open the account:

https://www.onemint.com/2011/03/28/how-to-open-a-nps-account/

I want to know about the NPS. my age is 30 years, agar mein aaj invest karta hoon aur har saal 10000 rupees deta hoon till 60 ( 30 years ) so my total invested amount is Rs. 300000 then how much i get pension after 60 years and if any misshapenning with me then how my family get the money back or what is the procedure for it.

Pratush – Please use the calculator on this site to calculate how much money will accumulate at the end of the period:

http://www.camsonline.com/PensionSystemServices.aspx

I joined Kendriya Vidyalaya in 2007 as a PGT Commerce but in 2009 I resigned from the Kendriya Vidyalaya. I was the member of NPS during that period. Can I withdraw the accumulated deposited money in my NPS account .

The restriction on Tier 1 account is that if you withdraw before the age of 60 then they will make you buy an annuity with 80% of your money first, so if you’re okay with that then you could withdraw it or else you will have to maintain the account for longer.

what to do on joining new job.will it continue itself or i have to give my previous details.is my new employer will seek new nps /pran no.?

i am abt 2 join new govt. job after 6 month gap in between my previous one.what should i do?as i don’t want to continue my previous nps a/c or PRAN

can i transfer myNPS/PRAN no. to my relative/dependents?

Hi Manshu,

Please provide me the details of buying 80% of annuity.

If i am wrong, 80% of total money in NPS account will be given as pension and remaining 20% as cash. But they are not providing it.

I have resigned from gov job in Dec,2008. But till now no money is returned to me.

Regs

Avneep

Sorry one typo is there..

pls read “If i am wrong, ” to “If i am not wrong,”

thanks

Hi Avneep,

They don’t get you a pension directly. They ask you invest 80% in an annuity from LIC or someone, and they pay out the rest of it to you as lumpsum. Also, this has to be paid at the time of retirement, and not resignation in the Tier 1 account, so probably that’s why they’re not giving you the money yet.

I had discussed this at CRA customer care. They are saying that policy to pay pension and lumpsum is not defined yet.

Once it will be defined then it will be paid.

Following is the response which I got from CRA:

Dear Subscriber,

This has with reference to your trail e-mail, regarding withdrawal of Tier I account. As per the guidelines for withdrawal stipulated by Pension Fund Regulatory & Development Authority (PFRDA)/Ministry of Finance (MOF), the subscribers can exit form New Pension System (NPS) on his / her retirement, resignation or death. * Retirement: On attaining the age of 60 years, a subscriber would be required to invest minimum 40% of his / her accumulated savings (pension wealth) to purchase a life annuity from any IRDA (Insurance Regulatory and Development Authority) – regulated life insurance company. A subscriber may choose to purchase an annuity for an amount greater than 40%. The remaining pension wealth can either be withdrawn in a lump sum on attaining the age of 60 or in a phased manner, between age 60 and 70, at the option of the subscriber. * Resignation: On resignation of the subscriber, 80% of the corpus has to be annuitized and the subscriber can withdraw remaining wealth. * Death: On death, the entire corpus of the subscriber will be handed over to the nominee of the subscriber.

However, the operational procedures for the withdrawal are yet to be finalized by PFRDA in consultation with MOF. Once they are finalized the offices will be intimated about the same. The withdrawal request should be routed through the associated PAO.

Further, if you are transferring from central government firm to another central government firm or within the same state government, then you have continue with the same PRAN Number. But in case of transfer from central government to state government/private sector or vice versa, you will need to deactivate the existing PRAN number and apply for the new one. For more information, kindly contact your nodal office or PRFDA at http://www.prfra.org.in in this regards.

Thanks & Regards,

Subscriber Care Group

CRA

Devendrappa K Nadavalamani September 28, 2011 at 10:50 pm

Your comment is awaiting moderation.

HI i am working as a probationary sub-registrar in gadag very soon will be posted to some other places, last month i have received my PRAN KIT in which i found my name is incorrect . my correct name is DEVENDRAPPA KARABASAPPA NADAVALAMANI, in pran kit it is written my sur name as NADAVINAMANI WHICH IS WRONG and may lead some problems in future so kindly tell me what is the procedure to rectify the same, and also i want to change nomination … KINDLY LET ME KNOW WHAT TO DO

PLEASE DO THE NEEDFULL IN THIS REGARD

WITH REGARDS

This is not the NPS website and no one can do the needful here – please call up your company to help you get this issue resolved.

can you please provide my the right person and agent who has open my account in state bank of india for NPS.

Anil – this excel sheet has list of banks that can open a NPS account. Please open it and look for one close to where you are located.

http://pfrda.org.in/writereaddata/linkimages/POP-SP_Location0502115605373405.xls

Hi I want to know whole details, i am interested and wnat to know whole the scheme and what amount to be invested per month.

i want know about new pension scheme in detail plz..

Hi, I am working for central govt from 2007, they are deducting Tier.I contribution from my salary but till now they did not give me PRAN NUMBER please tell me the procedure to get the PRAN NUMBER.

I’m sorry Shylaja – but I’m not familiar on how one goes about doing this in a government setup.

Hi.. I am working now in a private sector. My age is 26. I have heard about the NPS . Kindly guide me which one will be better , Tier 1 or 2 . I have an annual income of 3.5lac. I want to start in a monthly basis please inform me how much i should invest ?

Thanks for the info you are providing through this forum. Appreciate it! May I know some examples of annuity investements with IRDA that is being mandated (at least 40% at retirement age)?

The annuities from LIC should be part of this.

I have few questions

1) Is Tier 2 account allowed now or not? I read many articles about this NPS and could not locate any benefit in Tier 1. Obvious choice for anyone is Tier 2. Is it not?

2) I am 34 yrs old, and if i start an NPS account now and contribute till I am in job (say 45 Yrs) !! ….And in my 46th year (without job) if I opt withdraw the accumated amount (Tier 2), what is the tax rate applicable? Pl note now I am in 30% slab, so effectively all my investments will save 30%.

In other case, if only Tier 1 is possible, what is the tax implication for the 20% allowed withdrawal? Please clarify

You need a Tier 1 necessarily in order to open a Tier 2 account, and have to invest a min of 6k per year in the Tier 1 account to maintain it before you can move on to the Tier 2 account. A lot of clarifications are expected with the implementation of DTC in the NPS scheme so if you’re not mandated to invest in it then it’s better to wait for them to come before you make a decision.

D /Sir,

please send me NPS scheme details.

my age is thirty one and if i invest Rs 1000 per month in tier -1 how muuh approx amount i will get on attaining age of 60years and how much pension will i get throughout my lifetime?will i get anything after my death?

Please go through this link to understand how to calculate NPS pension better:

https://www.onemint.com/2011/04/04/how-much-pension-will-i-get-from-the-nps/

It is not a straightforward answer.

Manshu,

Need your take on the following…. as to what would be the strategy to invest in NPS, or one needs to wait for more information…

Clearly Tier2 account is the way to go if all the features like % return, auto active investment options are same as in tier 1 account, not sure whether if i make a premature withdrawl in Tier 2 will i be taxed ? if thats not the case then one can park 6000 minimum in Tier1 and put all funds in tier 2 to get a health govt backed guranteed 9% return….

However i dont like the forced annuity option, of that too of 40% why does the IRDA enforce that on us…. all pension products have that serious limitation… say if i manage to save 10L as corpus at the end of 60 yrs, i will be only entitled to 6L, now in case i am in need of more funds for a major operation that i am going through i will not be able to access that 4 L despite me having the money… i also dont know at what % return will the “forced annuity” give me… if i had access to that 4 L i would have invested in a post office MIS at 8% return and 5%maturity bonus or got a MIP MF, or an FD or a new electric car 😉 for me and wifey…

but alas that wont be possible right…

need your expert inputs….

regards

Sorabh

Yes Sorabh – your analysis is right, and I’d go with waiting if I were in your position. The annuity is forced because they want this to be a pension option for most people and develop a sort of a social security net with people’s money. I’m not an expert on this but I’d be surprised if they make any significant change to that rule. And what you get as an annuity rate 30 years from now is anybody’s guess.

The main advantage of this scheme is the low cost it offers along with the ability of investing in safe instruments, but that won’t be incentive enough for everyone to get in on it, and based on what you’re saying I think it’s not much of an incentive for you too.

Thanks Manshu .. i will wait may be 6 months… as time lost is money lost.. 😛 but i sure will put some funds in this to have a balanced porfolio, for others information the 9th March issue of outlook money has a great article on NPS.

i also would like to hear anyones inputs on pension plans where there is some flexibility with the annuity, i feel the annuity should be optional and should be allowed to be taken out as lump sum if one wants to.

regards

Sorabh

Hi, I want know, whether i have to invest the money the service provider of NPS or do i have the option to invest the money with any of the insurer who provide pension. eg : LIC or HDFC Standard Life or Birla Sunlife Insurance who sell pension fund also

I’m not entirely sure what you’re referring to but if it is the annuity then that has to be one that has been approved by IRDA.

To open an NPS account you just need to visit your nearest Head Postoffice and get the account opened.

I want to join NPS, my dob 4.10.1966, I want to join for next 15 years. How can I open this a/c

MANSU ABHI MERI AGE 31 HAI AUR MAIN NPS SCHEME MAI 20 SAL TAK MONTHLY 500 RS/- JAMA KARANA CHAHATI HOON TO MUZE 20 SAL KE BAD KITNA RETURNS MILEGA? AUR MERI INCOME MONTHLY 4500 HAI TO MUJHE NPS KI KONSI SCHEME NIKALANI CHAHIYE?

THANX W8ING UR RPLY

Sunita – NPS ka final amount kaafi cheezo par depend karta hai & you can’t be sure ki kitna milega. I’d suggest ki aap dusre safe avenues jisme return fixed hai vo try karo like Bank RDs ya Post Office Schemes. Jitna zyada save kar sako utna achcha & be careful agar koi aapko guaranteed return promise kar raha ho. There are many frauds like that.

Sir, mera Name Manish Kumar hai. Meri age abi 25 year ki hai. aur mera NPS mein Rs. 1100/- per month cuta hai. mujhe yeh bataye ki 60 year ki age mein mujhe kitna return milega aur kitni pension mil sakti hai. kya hum NPS mein se withdraw kar k kuch amount nikle sakte hai.

Manish – NPS mein koi guaranteed return nahi hai to tumhe kuch return assume karke calculation karna hoga. You can assume a 10% return and is calculator se dekh lo kitna amount total hoga.

http://www.camsonline.com/PensionSystemServices.aspx

NPS mein 2 part hai – Tier 1 & 2 – 1 se withdraw nahi kar sakte, 2 se kar sakte hai.

Sir , my DOB is 25.04.1963 , we work in a private sector, present salary is about 20K p.m,

we are married , we live with our family (wife,and two children ) in our own house at Haryana and work in Delhi. Both children is study in 2nd class and exam of 10th class in f.y 2010-11 but now result out.

sir, we want minimum received rs 25000/- p.m as a pension

please tell me what amount deposit p.m,/where deposit/ whose a/c, /and if mishapping with me please tell me whose amount withdrawn (due to my wife is housewife)/what amount total withdrawn etc.etc.etc

Thanks

M.G.Gupta

to get monthly pension of 25000 you will require a corpus of about 30 lakhs in year 2023

(which will earn you 10% returns, 10 % is approximate and not guarented) to get 30 lakhs you will have to invest 10800 permonth for next 12 yrs . in case of any mishappenings to you your wife can continue corpus built up in her name till she is alive

Sir,

Thank you for your reply!

Mera NPS Account Office ki taraf se khul gaya hai jiska NPS (A/c No.) Mujhe mil gaya hai. ab mujhe apni NPS Account ki kuch detail check karni ho toh mein kaise check kar sakta hu. aur mujhe apne NPS ka Ref Id aur Password bhi nai pata. plz help me for check my Account Detail for NPS.

Thanks

Manish Kumar

Ye to aapke office vale hi batayenge – I’m sorry I don’t know about this.

whats documents requared for nps a/c opening???

if the popsp lost their password then what can he do? is there any solution

sir,

iam 52 yrs if i want pension 10000 at the age of 62 how much i have to invest now

Here is a post that gives you the details:

https://www.onemint.com/2011/04/04/how-much-pension-will-i-get-from-the-nps/

Sir,

i want to ask about the implication of this payment on my Income Tax.

And also if my employer contribute to my National Pension Scheme, what is the exemption i will get and is the amount paid by him is deductable from his income.

Please reply Fast.

Regards

Manoj

Hi Manshu, i have some question regarding NPS

1- can i access nps a/c online?

2- any tax benefits for tire 1 and tire 2 a/c?

3- any difference between tire 1 and tire 2 a/c , regarding charges and returns?

4- will charges increse in future or its constant for any amount invested?

5- in nps has compounding rate of return?

6-maturity benefit taxable or not ?

7- in tire 2 a/c what nominee will get incase of death?

8- what documents will required for nps a/c opening?

kindly reply as soon as possiable

You will find answers to all these questions in the article or in the 250 odd comments already present in the post. It has been said all too often.

to check you account status online go to https://cra-nsdl.com/CRA/

If you loose your Job or change your Job can this scheme still be continued ??

Is it required that only the employer deposits the money , incase we are not working can we continue the same ?

Yes, you can continue it Shashidhar

i am a central government employee. joint in service on 8/9/2008. i have already PRAN. how can activate tire 2. is it individual risk or government process.

Yes, you will have to open it yourself. Check with wherever you have the account and request them to open it for you Sabiq.

ASSUME THAT AM WORKING{CURRENTLY WORKING} BUT DUE TO SOME CIRCUMSTANCES I LEAVE THE JOB AND START DOING A BUSINESS OR ANY WORK FOR THE SAKE OF MY LIVING,THEN WOULD THIS EFFECT MY NPS.

who is managing the India Cricket team pension fund? may i have their contact details or website

Interesting question – I don’t think there is a pension fund for Indian cricketers, never heard or read such a thing.

if we dont pay money for 2 years what will happen??????????

Please give me some details as to (i) Partial withdrawals after some years; (ii) Death of the subscriber before attaining the age of 60 years.

I’m afraid I don’t have info on that. There was someone who recently faced problems in withdrawing money from NPS, and after that comment I’ve been a bit circumspect on the process of practically getting your money back from the NPS scheme.

Sir,

kiya koyi unemployed log NPS kar sakte hain ? Or iska details kindly sort me batayeinge.

Jishu – A/C to open kar sakte hai but dusre tarikey hai save karne ke jaise RD jama karna ya FD karana jisme zyada control rahega paisey par.

i am central govt servant my account maintain cda nevy mumbai.

appoinment april-01-2004

no pran card and my account details not coming

my officers told coming coming any time told

please my details reply.

Sir,

NPS scheme me retaiment ke bad kitne persent amount cash milta hai or kitne persent amount ki pension banti hai. Kiya NPS scheme me loan ki suvidh hai ?

Dear

PRAN Account open hone per mujhe PRAN Card mila tha jiski sahayta se main apni PRAN account mein login karke invested amount ke bare mein jankari le sakta hun.

Abhi PRAN ka login password bhul gaya hun. mujhe kya karna chahiye ke mera password reset kiya ja sake?

Another Query:

Tier II type ke PRAN amount withdraw kab kar sakte hain aur at that time required documents kya hogi?

Where should I contact to get an NPS scheme in Delhi?

my age 33. If i pay 1000 Rs per month how much i can get at my age of 60?

Unfortunately there are a lot of ifs and buts in that and no straight answer can be given because first of all you don’t know at what rate the money will grow, and secondly you don’t know what annuity rate you will get later on.

hi,

can govt employees invest in NPS. if they can invset which tier ?

Yes, both.

how do applied for pran kit? please details for the new pension schme , then how do you calculation of (% how much percentage)new pension schme ? which is the invested of share markat?

Sir/madam

I am central govt.employee and I am regularly paying my own contribution for NPS from 2005.I want to withdraw some refundable amount for one year from this account .Please tell me can I get it easily.

Hi I am state govt.employee from 2006. If i want quit the job than will i get the full amount that i have saved till now or what ?

I think you won’t get anything till retirement but better make sure by talking to someone at your office who looks after these things.

If i take VRS when can i take

Mere Gross salary income me government contribution jo mere contribution ke baraabar hota hai, add hoga ya nahi? Agar add hoga to uska deduction milega ya nahi? Agar milega to kis section ke tahat milega?

If i take VRS when can i take what is the minmium

Sir,

Which one very beneficial NPS lite or NPS regular?

Rupjyoti…NPS lite is meant for economically disadvantage section of society and is another effort by government on the way of financial inclusion. NPS lite can be subscribed through a specific entities appointed by government termed as aggregators.

So NPS lite is not available to all

hi

i couldn’t get my pran card… employer send me via post but it couldn’t reach at me.. how can i get another one..

Raise the query with employer or call up CRA call centre at 1800222080 , alternatively if you have IPIN allotted you may register your grievance at https://cra-nsdl.com

Dear Sir,

This is inform you that I G Thanigai Selvam have New Pension Scheme account through your service provider(Alankit Assaingnment) at M/s JSW, Bellary. But at present i was resigned the job & Joined TATA Consulting Engineers Ltd. at Jamshedpur. I want to continue the New Pension Scheme so please suggest to me what to do for continue the same without any disturbance. So I kindly request to you, provide any Assignment company address or Contact details for the same or tell me other facilities.

My PRAN NO: 111001169571

You don’t have to do anyting specific, just keep on contributing to the same account. It doesn’t need any kind of transfer and thus operative with the same PRAN all over the country.

NPS is a excellent scheme but what about after maturity??

today LIC is offering pathetic pretax 7% (immidiate annuity jevan akshay)and HDFC 6.5% in immkidiate annuity their annuity plans

although NPS returns may be good later on it just SUCKS your money in sky

and one is left with pathetic returns

THINK TWICE

Nice article Manshu!!!

Am making a presentation on NPS … this has helped a lot!!

Thanks and keep up the good work!!!

Warm Regards,

Schneider

Awesome to hear man – thanks for leaving the comment!

Dear all

I am a pran account holder, which i got when i was working in central govt. Recently I have resigned that job, joined in state govt job. I want to know whether i can transfer or cancel my pran number.I have not changed my job through proper channel.Could some one guide in getting out of that?

dear sreenu

mere sath bhi apki jesi problem h , so plz.. agar aap ko is k bare m kuch jankari h to meri help kare

I don’t understand , what you meant by proper channel. But regarding NPS, PRAN remains same always and does not change with the change of employer. As many state governments also opts for NPS, then i think you just have to inform your accounts department with your current PRAN, and everything else will be taken care by them.

Can Iopen an NPS ac..with the local Post-Office too?Are the PO..not authorised as was earlier claimed?

The employer’s contribution towards NPS was supposed to be non-taxable from 1st Apr 2012 as was announced in the last budget. See link below:

http://articles.economictimes.indiatimes.com/2011-03-07/news/28665804_1_deduction-pension-scheme-nps

I don’t see any mention of it in this budget. Is this proposal still on or has been given a burial ?!

I didn’t see anything either so I guess they didn’t make it non taxable. Will keep you posted if I read otherwise.

My company has given us an option for NPS now.

So this proposal is still on. Probably, your other readers can suggest the same in their companies to reduce the taxable income.

It is true. U/S 80CCD(2) it is applicable wef 1st april 2012.

Thus from this year one may negotiate on the salary break up with employer and reduce the tax outgo.

dear sir,

i just want to know that, i am a Pran card holder…

i just wanted to close the A/c. is it possible??? What are the charges ???

Can i withdraw my Tier-I A/C.

so, need help…

Sorry, there’s no provision to close the account in between.

What is tax rate on widrawal from nps tier 2 at present.

1. applicable to Mutual Gain with indexation benefit

or

2. gain will be added to income

Thanks

Amit

The NPS would follow the EET (Exempt – Exempt – Taxed) regime of taxation.

Means

Investment: Tax-deductible

Accumulation: Tax-free

Withdrawal: Taxed (The monthly pension is taxable)

Hence withdrawal are taxable by adding to your income.