Also read about the REC Infrastructure bonds here or the IDFC Infrastructure Bonds Tranche 2 here.

The IDFC Infrastructure Bond post has thrown up some interesting questions from readers which were not part of the post itself, and while I am replying to them in comments – I thought I’d do a fresh post with 5 questions that I thought deserved a post of their own.

1. Is opening a demat account compulsory for investing in the IDFC Infrastructure bonds?

No, it is not.

When this scheme opened there was just the option to invest in it if you had a demat account, but some changes have been made (pdf) and opening a demat account is not compulsory now. You can buy them in physical form also. Their website tells you how to do this.

You can also subscribe to the Bonds in physical form by following these simple steps:

- Don’t fill up the demat details in the application form

- Compulsorily provide the following three documents with the application form:

- Self-attested copy of the PAN card;

- Self-attested copy of a cancelled cheque of the bank account to which the amounts pertaining to payment of refunds, interest and redemption, as applicable, should be credited.

- Self-attested copy of the proof of residence. Any of the following documents shall be considered as a verifiable proof of residence:

- Ration card issued by the Government of India; or

- Valid driving license issued by any transport authority of the Republic of India; or

- Electricity bill (not older than 3 months); or

- Landline telephone bill (not older than 3 months); or

- Valid passport issued by the Government of India; or

- Voter’s Identity Card issued by the Government of India; or

- Passbook or latest bank statement issued by a bank operating in India; or

- Leave and license agreement or agreement for sale or rent agreement or flat maintenance bill; or

Letter from a recognized public authority or public servant verifying the identity and residence of the Applicant.

2. Is the interest earned from the IDFC Infrastructure bond tax-free?

While IDFC Infrastructure bonds may not attract TDS – the interest itself is not tax – free. It’s only the Rs. 20,000 you get reduced from your taxable salary that helps save tax.

3. Has the closing date to invest in IDFC Bonds extended?

Yes, the closing date has been extended from 18th October to 22nd October.

4. When do the bonds start trading in the stock exchange?

After the initial lock – in period of 5 years is over, the bonds will list on the NSE and BSE, and start trading there.

5. Which option has the highest yield?

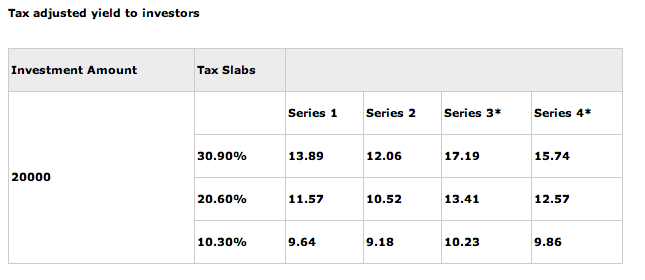

Yield table from the website. Now keep in mind this is just the yield, the lock in periods differ between various series, and that needs to be taken into account while making your decision, however since my earlier post didn’t have this yield table I am including it here.

Click here to read the earlier review of the IDFC Infrastructure Bond.

Hi, I purchased IDFC infrastructure bond last year through sharekhan. I am very new to sharekhna. Ca anyone guide me how to check my bonds on sharekhan side. Thanks in advance

if any body required Infrastructure Bonds processing, please call me at 9241545354 (for bangalore only).

I WANT TO PURCHASE INFRA STRUCTURE BONDS NOW. WHAT TO DO ?

DWARKA,

NEW DELHI

Hi Mr. Anil Kumar

Just approach ING Vysya Bank, Janakpuri Branch for PFC Infra Bonds or contact any Investment Services Provider in Dwarka to apply for Infra Bonds of your choice.. If you can visit our office in Lajpat Nagar or any nearby place we’ll get it done for you.. For more info: # 9811797407

I invested Rs.20k in IDFC Infrastructure bond on 22-Oct-10 & did not receive the bond certificate like many other, who posted their queries here. Through the Karvy site mentioned in the response by a gentlemen I got the details of my allotment, which I have downloaded & will submit to my employer in support of my declaration that I have invested Rs.20k in Infrastructure bond for taking benefit on IT.

On the pdf file which I got after submission of my application number, there is no mention of my address. So what I should do now to obtain the original copy of bond certificate. I have alse mailed to their concerned id, mentioned on their website, but there is no response. Please advise what I should do….

If this is in physical form then you should pursue this and get the address updated correctly. I’m not too sure if it will make a difference if the bonds are in demat form.

I have been allotted four bonds and till date i have not received the Bonds.

The link,

“http://karisma.karvy.com/investor/jsp/IDFC-APP.jsp”

is showing the bonds.

Will the same be considered as Bond or anything else will be posted to the mentioned Address.

I had submitted one application for IDFC Infrastructure Bond valued Rs 20000/- in the month of OCT-10, to ICICI Bank, Vashi. The amount has been debited from my SBI, Konkan Bhavan S/B A/C on 25th Oct,10; however till date i have not received any bond/ certificate from IDFC. Unfortunately i have missed out the application serial no. On checking at ICICI Bank, Vashi, they had informed their position being to be just of a receiver and forwarder, and they are of course right. Meanwhile i have also sent a mail to IDFC Manager, informing my predicament. What can be the pragmatic solution; incidentally also have to deposit copy of bond / certificate to my employer in order to claim the I-T exemption for the amount, which actually is now overdue.

So, is this for Demat or physical copy? In case this is for Demat then you can look at your Demat account and see if it has been credited there.

If it’s for the physical form then that makes it complicated but I think one way of dealing with this is to approach Karvy, and establish communication with them. They might be able to pull it out from your PAN number.

invest in IDFC infrastructure bonds.

interest rate of 8.25%

tax deduction u/s 80 CCF

For details & subscription in PUNE contact me on 9762847432 (Rishiraj)

i have invested in IDFC infra bond in 2/2/11 but i couldn’t get the certificate till now.secondly i am not living at the place which i have mentioned in the application form what should i do in the situation if the certificate return back.please guide me

Do you have the application number Aaakash – you can just download it online if you have that.

Thank you Mansu,

I have downloded the copy from the site as suggegested long ago. Now concern is that after 5 years I may need original one for redeeming the bonds. At that time Photo copy may not be valid.

Do you have any idea?Please let me know.

As KARVY has not sent me the physical bonds, now without my fault I have to go for trouble.

Regards,

Naresh Dholakiya

They should redeem it at the time and credit your bank account (the one in which they pay the interest annually). I’m not sure if you really need the physical certificate for anything at all.

Please check with the Karvy guy to be sure though.

Hi,

I have applied thru Demat 4 earlier transche in oct 2010 and got them in my demat form [sharekhan brkerage]

Now can I convert them into physical form, as 5yrs is too long 4 me to continue my demat acct. Is there any prcedure 2 infrm Karvy/IDFC

Yeah there is an option to rematerialize them and you can go to Karvy to get the necessary paper work done.

Dear All,

See the pathetic face of the KARVY, I have requested trough mail ,lot of times to send me physical cetifcates. They informed that it is sent thtough registred posts, I have checked with PO but PO didnot receive any posts. In this case I have not have certificates nor post offcie have then where it has gone ?.

In registered post if somebody didnot not receive the post will go automatically to the sender, but KARVY didnot have returned post/Certificates.

Afetr so many mails, they sent me format typing information on Rs 100 -Indemnity Bond. Now question is that why should I pay and do these exercise . It is missed by KARVY and not me and KARVY is at fault..

I want to consult the authority which addresses such cases, please advise as I want KARVY should learn a lesson for such misdeed.

Regards,

NARESH

Naresh – do you have your application number? Karvy had this link where you could enter the application and download your allotment advice, so you really don’t have to go through all these hassles if you have that.

Try this link out:

http://karisma.karvy.com/investor/jsp/IDFC-APP.jsp

Manshu- That link does not work for Tranche 2, it seems.

That was originally meant for tranche 1, and I don’t know if they have released something else for Tranche 2 yet.

Manshi, I searched with my Application no, no result after that i tried with my PAN then i got error like “file does not begin with ‘%PDF-‘ “

Thank Manshu, the link is very helful

VMCH VINAYA KUMARI January 28, 2011 at 7:20 am

Dear sir i have invested IDFC infrabonds four numbers vide application no 52593832 vide cheque no 109678 drawn on ICICI bank visakhapatnam branch till date i have not received my bond certificate so i request you to kindly send my bond certificate at an early date.

my address,

VMCH VINAYA KUMARI,

Lecturer-chemistry govt polytechnic NARSIPATNAM,VSP DT,

pin 531116

Manshu do you expect Tranch 3 for IDFC ?

Yeah, I think they I read that they are going to come out with a new issue in March.

if any body required Infra Bonds processing, please call me at 9241545354 (for bangalore only).

Dear sir i have invested IDFC infrabonds four numbers vide application no 52593832 vide cheque no 109678 drawn on ICICI bank visakhapatnam branch till date i have not received my bond certificate so i request you to kindly send my bond certificate at an early date.

my address,

VMCH VINAYA KUMARI,

Lecturer-chemistry govt polytechnic NARSIPATNAM,VSP DT,

pin 531116

You can see the link where you can obtain your statement in comments above. No one here is going to send you the bond certificates. You can use that link to do it yourself.

Not sure about LIC but PFC, IIFCL, IDFC (again in March), probably L&T (again in February) are planning to come up with Infra Bonds in the coming months… So its raining Infra Bonds in the next two months… 🙂

But plz dont remain sleeping till the last time as its not going to help you in any ways. Is it ?? Just get up, do your tax maths now & determine whether you need to invest in these bonds to save tax or not. If you need to, then just go for it as it is a good tax saving investment especially for people falling in 30.9% or 20.6% tax bracket as it adds at least 6.18% p. a. (30.9%/5) or 4.12% p.a. (20.6%/5) to already quoted 8% interest rate. It makes the returns to be over 14% or 12%, but that is before you pay tax on interest earned or Capital Gains Tax to be paid if you sell these bonds on NSE/BSE after 5 years.

For more info about IDFC/REC Infra Bonds, the tax benefits u/s. 80CCF or to invest (Delhi, Gurgaon & Noida) you can call us at 9811797407

Ashok: In the coming months, you can expect bonds from LIC, but then, there has been no announcement on their opening date yet. REC is already open till 28th March and IDFC is supposed to close on 4th Feb.

In my opinion , since LIC , if it does come out with infra bonds will not be offering anything more than the current series of bonds are offering.

i want to invest in infrastructure bonds, guide me, about bonds available in coming months jan/feb 2011

i want to invest in infrastructure bonds, please guide me, and offer available in the month of jan/feb 2011

REC & IDFC Tranche 2 are open, so you can invest in either of them based on your need and availability of these bonds to you.

Dear all,

I have an query:- I have demat accounts in India Bulls and Reliancemoney. My question is weather i can buy these bonds directly through these platforms online without going to the vendor for purchasing these bonds.

Pl suggest

Ram Kumar

Ram – You can directly buy them through ICICI Direct, – I don’t know if India Bulls or Reliance Money provide that feature or not. You can call the helpline and see. If they don’t then you can fill up an application at a bank branch and submit it there. I think by vendor you mean an agent or IFA (Independent Financial Adviser), and buying them through a bank branch will help you do that.

Thanks for your kind reply. I’ ll contact to the service provider then.