Investing for beginners – Dealing with Stock Market Volatility

This post is next in my investing for beginners series (earlier posts include asset allocation, diversification, things to do before you start investing), and for this post I wanted to talk about volatility and dealing with it.

State Bank of India (SBI) is one of the bluer blue chips in India, and a look at its 52 week high / low on BSE reveals that the 52 week low was Rs. 1,863 and 52 week high was Rs. 3,222.

So, what happened in the last year to warrant this? Why did the stock price move up about 70% from 1,863 to the 3,200 it is today?

Did SBI fundamentals change so dramatically that they triggered a 70% jump? Just what exactly did it do to jump that much in a year?

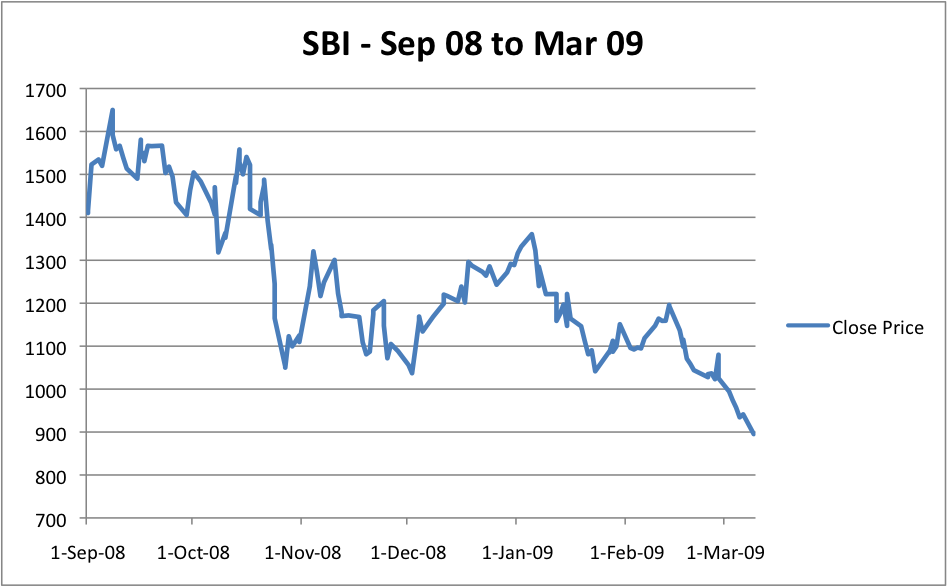

Let’s go back in time to about 2 years ago when the world was falling off a cliff, and see what happened to the price of the SBI stock then.

SBI was Rs. 1,650 on September 8 2008 from where it dropped to Rs. 895 on 09 March 2009. In a six month period the stock dropped about 45%!

The steep drop from 1,650 to 900 or so makes you wonder if a bonus was declared, but I couldn’t find one. But even if SBI is a blue chip, it’s still a stock, so let’s take a look at an Index itself to see if that’s volatile too.

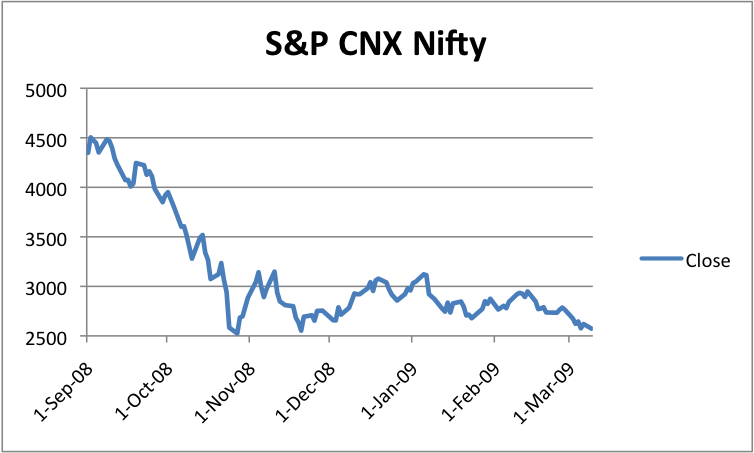

What about the Nifty? How did it perform in the same time period?

From 4,500 it dived to 2500 in a matter of weeks!

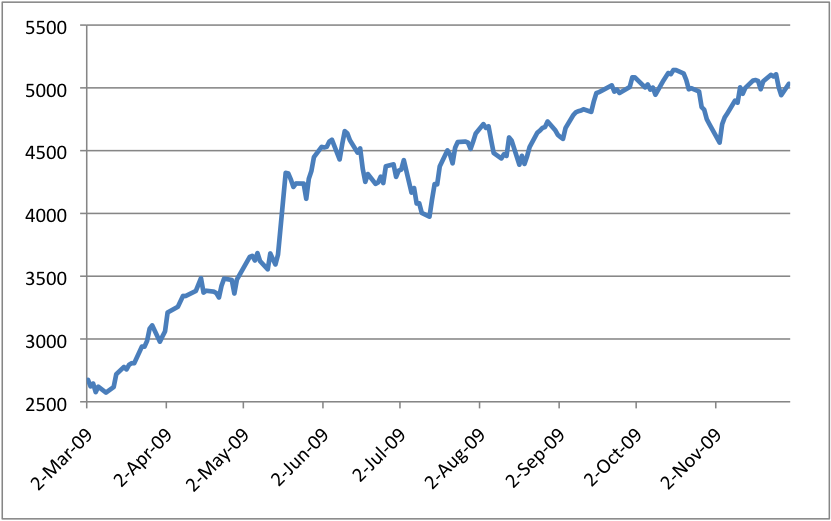

So, what do you think happened in the next six months?

Whoa!

These might seem like crazy moves to you, but they are still better than most because I took a look at a huge stock and an index itself, which are much less volatile than the rest of the market. During the real estate crash or the IT bubble burst – there were several stocks that lost much more than 50% of their value in a much shorter time – frame.

If you’re thinking that this crash was because I’ve taken a time period which saw us having a really bad recession, a quick look through news archives will show you that we’re habitually thinking that the end is near, and crashes are part of life.

You can go take the yearly highs or lows of any stock from an old paper and you will see that there is big gap between the two prices, but there aren’t that many fundamental changes with the company in question. SBI didn’t shut down half of their branches to see the stock plunge that much – that’s the nature of the stock markets.

So, given all this – how do you deal with the volatility in the stock market?

Do you stay completely away from the stock market?

One obvious answer is just stay away from stock markets, and focus on other investments that are not so volatile and which don’t expose you to such huge swings. You could do that, and you should certainly have some allocation towards safer assets but if you stay completely away from the stock market you won’t even be able to beat inflation that runs high in India. So you can diversify in other assets, but for most young people staying away from the market is probably not a practical option.

Do you try to time the market?

All you have to do is buy low and sell high right? That sounds simple enough, but when do you know the market has over-heated or when do you know the bottom has been reached? Timing the market is impossible – no one knows how the market will behave in the short run so you can’t really go all in at one shot or sell everything at another. In fact in October 2008 I wrote a post about not trying to catch falling knives, and how I was gradually accumulating stock even though they were dropping, so while over a period of time it is possible to accumulate stock at lower prices – if you go all in, and the market falls more then you are stuck with it.

Timing doesn’t work for most, so it very likely won’t work for you also, and while increasing your stock purchases when the market crashes and booking profits when the market is at highs might help – if you just decide to catch every top and bottom – that won’t work at all.

Understand that volatility is an inherent part of the market and be ready for it

If you haven’t seen a market crash yet, then brace for it – no one knows when it’ll take place but violent downswings and upswings are just part of the market, and if you know they’re coming – you don’t get scared when you are in the middle of it, and end up selling all your stock at yearly lows.

If you have a diversified portfolio and assets other than stocks then you will have a much easier time dealing with volatility because all your eggs are not in one basket. Sure you stand to lose money, but at the same time some part of your investment is secure and that will give you comfort.

At times such as these don’t let panic set in, but instead continue your SIPs or think about investing in some large blue chip stocks.

Look at it this way – a company like Tata Steel has been around for more than 100 years, and it’s seen a lot more ups and downs than you have, so although there are chances that it may go to zero (remember Lehman?) they are not as high as they would be with a smaller company.

Think about State Bank of India – if SBI goes to 0 then you have much bigger things to worry about than your stock.

It’s really hard to think that the world is not going to end when everyone else around you says that it will. In such times it is really difficult to keep the faith, but if you are well diversified, have bought companies with good fundamentals, and are in it for the long run – you will find the going much easier.

Volatility is part and parcel of the market and the sooner you learn to deal with it the better it is.

This is my first time coming across your site and I am impressed with your content! Keep up the hard work! The stock market is such a fun topic to write about 🙂

Thanks Shane, hope to see you around!

This is not just for beginners.

Even old timies can read it refresh themself 🙂

U can also call it a good refresher for stockies 🙂

I am trying to write about things that I feel will be useful from the perspective of someone starting out, but thinking about topics is not as easy a process as I thought it to be, so if you ever have any suggestions for a topic please feel free to share them with me.

I re-read this today.

*taking a deeeeep breath…*

Thank you.

I see a bit more turmoil in the next few weeks or months, and I think a good way to deal with it is to just tune out most of the news and TV because beyond a point they do more harm than good. Too less information, and too much hype.

Can we invest in share market personally??? Means without any broker or sites like share khan????? How???

can we download part 2,3,4 of the ebook?

Hi

I am really impressed from the content that you provide and in a very understandable manner . I have just started working for a year and I am very keen in investing . Kindly advice me what pattern shall I follow . Shall I take the professional guidance from the initial or shall I study and understand on my own first .

Thanks

Prashant