IFCI Infrastructure Bonds: Tax Saving Bonds under Section 80 CCF

Also read about the REC Infrastructure bonds here or the IDFC Infrastructure Bonds Tranche 2 here.

Update: There has been a change in terms, and you can now invest in these bonds in physical form also. Here is the link to relevant IFCI page.

The issue has been extended till January 12 2011

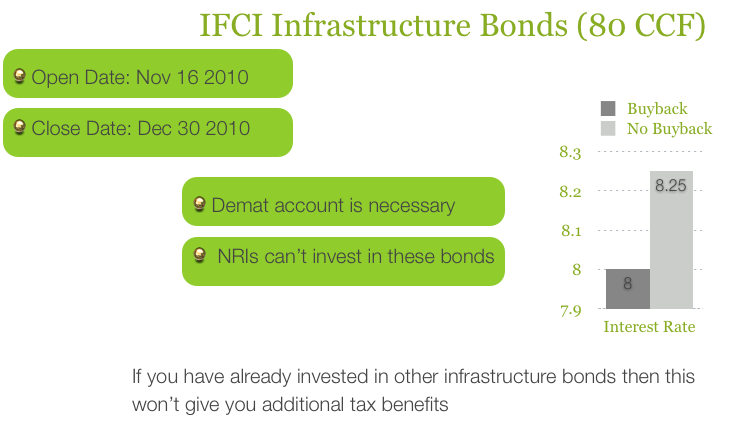

The IFCI Infrastructure bonds are the latest infrastructure bonds to be issued with the 80CCF benefits, and are the second tranche from IFCI, which issued them earlier this year as well.

The IFCI bonds are issued with section 80CCF benefits which means that they will get you a tax benefit of reducing your taxable income over and above the Rs. 100,000 under Section 80C with a cap of Rs.20,000.

The issue has been rated “BWR AA†by “BRICKWORK RATINGS INDIA PVT LIMITED†which means that they are rated as instruments with high credit quality.

Here are some other details about them.

IFCI Infra Bond Options

There are 4 series that you can choose from with a combination of getting interest paid annually, cumulatively, and having a buyback or not.

Here are the details of the 4 series.

| Options | I

Buyback & Non – Cumulative |

II

Buyback & Cumulative |

III

Non Buyback & Non – Cumulative |

IV

Non – Buyback & Cumulative |

| Face Value | Rs. 5,000 | Rs. 5,000 | Rs. 5,000 | Rs. 5,000 |

| Buy Back Option | Yes | Yes | No | No |

| Coupon | 8.00% per annum | 8.00% compounded annually | 8.25% | 8.25% to be compounded annually |

| Redemption Amount | Rs. 5.000 | Rs. 10,795 | Rs. 5,000 | Rs. 11,047 |

| Buyback allowed after | 5 years | 5 years | NA | NA |

As you probably noticed IFCI didn’t show yields in the same manner as L&T and IDFC, where they took the tax benefits based on various slabs and showed yields at different tax slabs and interest payments. This is probably a good idea given the various limitations of the way those yields were calculated.

How does the IFCI infrastructure bond buyback option work?

At the time of selecting a series you have to select either series 1 or series 2, which allow the buyback after 5 years lock in period. To exercise the buyback you have to write to IFCI to request it, and this has to be done in the month of November for the year when you want to exercise the buyback.

Open and Close Date of the IFCI Infra Bond

Opening date of the issue: November 16th, 2010 and Closing date of the Issue: December 31st ,2010. They can close earlier as well if their entire demand is met.

Is a Demat account necessary to apply for the IFCI Infra Bond?

Yes, right now it is necessary to have a demat account to apply for these bonds as they won’t be issued in physical format. Even the IDFC bonds started out as Demat only, and were later on changed to allow physical forms also. The target sum to be raised by IFCI bonds are much lesser than the IDFC ones, so they might not feel the need to change and include the physical format as well.

Will tax be deducted at source from the interest payment?

These IFCI 80CCF bonds will not attract TDS, however the interest itself is taxable at your hands. So, the bonds don’t attract TDS, but it doesn’t mean they are tax free.

Will the bonds list in a stock exchange?

Yes, IFCI plans to list these bonds on the Bombay Stock Exchange (BSE), but from reading the information memorandum it seems to me that you can only sell these bonds after the lock in period of 5 years.

Can NRIs invest in the IFCI Infrastructure bonds?

NRI customers are not eligible to apply for the issue.

What if you have already bought another infrastructure bond?

If you have already bought another infrastructure bond, and exhausted the limit of Rs. 20,000 then you won’t get any further tax benefit by buying this bond. There are also several banks that offer 8% interest for terms less than 5 years, so you won’t get much value out of locking your money in this instrument for 5 years.

How can you buy the IFCI infrastructure bonds?

You can buy these bonds through your broker like ICICI Direct, or can submit an application form in one of the bank branches that are accepting them. The information memorandum lists down a large number of HDFC bank branches so you can go to one near your house, and they might be selling the bonds or can at least tell you where you will get them.

Should you wait for another issue?

This issue is 50 basis points, or half a percentage higher than similar L&T bonds issued earlier, and reader Amit Khandelia actually left a comment about LIC coming up with a future issue, and possibly even offering term insurance free with their offer.

IDFC has also indicated interest in coming up with a future issue, so they might come up with another issue too.

The advantage with waiting is that you may get a slightly higher interest rate, maybe half a percentage or one percentage more, but as I said earlier if you’re able to wait and get a bond which offers a percentage higher, and you invest the maximum Rs. 20,000 in it – that means an additional 200 bucks extra in a year; what is that worth to you? How many hours of Googling and speculating is it really worth?

The advantage of getting it now is that you can get this one thing done with, and have plenty of time to receive the certificates for tax proofs or whatever else you need.

This is a personal decision really, but something worth keeping in mind the next time you speculate on whether you should wait or go ahead with it.

Please leave a comment if you have any questions or observations.

you mentioned that these bonds will be listed on BSE, but can only be sold after 5 years. then, what’s the point of listing these?

If you can sell it on the exchange then you don’t have to wait for November to exercise your buyback, and if the bond price is higher than the exercise price then you’ll benefit. If not, then you can just wait to exercise the buyback.

So, the benefit of listing becomes shows up when you compare it with what would have happened had these bonds not listed at all.

Are Buyback price fixed (inline with interset amount) or decided by them after lockin period?

Can the bond be sold BSE after lockin period, even if we have purchased it in physical form?

Yes Mayank, buyback prices are fixed, and that’s how they tell you indicative yields.

I don’t think you’ll be able to sell them on BSE if they are not dematerialized, but I’m not sure about it.

Hi,

How is IFCI bond, as comparison to bonds issued by IDFC and L&T. I am talking comparison in perspective of rating, company overall, its future plans and projects.

I don’t know how to compare one with the other, but those issues were rated well by the credit agencies, and so is this one.

I have been invested Rs 20000 in your IDFC infra bonds in november 2010. But our company is not accepting 80ccf cliams/deductions. please stop all this type of cheating by IDFC

What exactly did your company say? This is a legitimate tax deduction that they should be able to get you when the tax return is filed.

our company is S C C L

Ask your company account to get his funda right. These bonds are tax exempt as per the Income Tax act. You company CA should clarify to the accounts department.

IFCI Tax Saving Long Term Infrastructure Bonds– SERIES II Save Tax u/s 80CCF — Pune

For More Details and visit on http://www.lifins.in or call on 9822403407 – Lifins Financial, Pune, Maharashtra, India.

can i purchase the IFCI infrastructure bond II on my wife’s dmat account?

I think you’re interested in knowing if you can get a tax exemption, even if the bonds are bought in your wife’s name…is that correct?

I don’t think that’s possible though.

I applied 4 bonds in IFCI TAX EXEMPTION LONG TERM INFRASTRUCTRE BOND – SERIES I on Aug 2010. I am yet to receive bond certificates from IFCI. I applied through ICICI direct. They are saying IFCI will be sending to me for last 2 months. I don’t know when i will receive it. I have send an email to IFCI no response. I need bond certificate for payment of money and tax exemption claim. Please anybody guide on this aspect.

Regards

Sriram

Did you apply for physical bonds or for Demat? If it is for Demat, you won’t receive the physical certificates. You should receive the allotment advice though.

@ Sriram – You should have got the bond certificate by now. Guess you can take a print of your demat statement from ICICI direct and use it for claim till you get the certificate. I’ll check if I can find the point of contact for IFCI bonds and pass on the info as soon as I get it.

If you wish to invest in these bonds please let me or feel free to connect with me.

-Imran

99200-67880

Good information.

My tax liability is 12,000/-. If I purchase 15,000 bonds, will it make my tax liability to nil? Or whether I have to purchase 20,000 bonds?

No Mr. Rao, that’s not how it works. The way this works is that the bond amount will be deducted from your taxable income only, and not your tax paid. So if you are in the 20% slab, and buy bonds worth Rs. 20,000 then that Rs. 20,000 will be deducted from your taxable income, which was going to be taxed at 20%, so you will save Rs. 4,000 if you buy bonds worth Rs. 20,000 if you are in the 20% slab.

If you have not done any other investments under the 80C limit then you can try exploring options like PPF also.

It is understood that for investing in your current infracture bonds, one needs to have a demat a/c. Further, I presume that the bonds will figure in the demat statement, along with shares of different companies, issued periodically by the demat agency. Now, under the buyback option, does one have to approach a share broker to dispose – off the bonds at the end of 5 yrs? If so, does’nt it involve payment of brokarage charges?

From reading through your comment it appears to me that you are mistaking this for the official IFCI website, so let me point out that this is not the IFCI website, but a blog not affiliated to them.

To your question – you don’t need to approach a share broker to exercise the buyback option – you can write to the company, and they will execute the transaction.

Here is the relevant text from the article:

At the time of selecting a series you have to select either series 1 or series 2, which allow the buyback after 5 years lock in period. To exercise the buyback you have to write to IFCI to request it, and this has to be done in the month of November for the year when you want to exercise the buyback.

In case of non buy back and cumulative option, whether tax on interest has to be paid on yearly basis or after the expiry of ten years

Since you won’t get any interest on an annual basis, you won’t have to pay tax on it annually Deepika. At the end of the tenure you will have to pay capital gains taxes, but I’m not entirely certain about how this will work, and what the rates will be.

So this means that amount would be taxable as long term capital gain, so accordingly we will get the benefit of indexation as well?

That’s my understanding, but I’m no tax expert, and since I didn’t find anything about this specifically I am not sure about it.

I looked at icicidirect and the IFCI bonds all have maturity date as 31-jAN -2021 but you have mentioned Series 1 and Series 2 have a buyback option of 5 years. Whats the difference. Also if I opt for cumulative option Series 2 do I have to wait 10 years to get my maturity amount.

How does this work? Quite confusing

Series 1 & 2 have a slightly lower rate of interest, and that’s because they give you an option to sell your bonds back at the end of 5 years.

This is just an option, so if you don’t exercise it, your bonds will mature in ten years as you mention in your comment. In lieu of a lower interest rate you get an option to get your money back faster.

You will have this option if you opt for Series 2 also; the only difference is that you will not be paid interest annually, and of course your maturity amount will depend on how many years have lapsed.

1)What is the maturity amount I would get on an investment of Rs.5,000 with cumulative and buy-back option after 5 years?

2)How to get the Application form for this scheme?

Pl clarify the following points:

What is the maturity amount I would get on an investment of Rs.5,000 with cumulative and buy-back option after 5 years?

How to get the Application form for this scheme?

A C S Kumar

Rs. 7,347 in case of buyback at the end of 5 years.

If you use a broker like ICICI Direct then you can apply through them. Else go to the bottom of this page and you will be able to see links of application forms, and other details:

http://www.ifciltd.com/IFCIBonds/InfrastructureBonds/CurrentIssue/tabid/218/Default.aspx

But it is mentioned redemption amount as Rs.10795 after 5 years as against your figure of Rs.7347 . Which is correct and how ?

Pls clarify

10,795 is the redemption amount, and the redemption will happen at the end of 10 years.

After 5 years, they allow a buy back, and if you exercise the buyback after 5 years then you’ll get 7,347, so that’s the difference VeeTee.

I have a demat account in SBI which I am using for online share transactions.Can I use the same for infrastructure or shuld I create a new account in HDFC .What will be the am ount to start demat account

Yes you can use the same demat account, in fact you shouldn’t spend more money on adding another demat account for anything now. Just one will do for these or any other bonds that come out in the future.

Here is a post about Demat account basics in case you’re interested:

https://www.onemint.com/2010/12/03/what-is-a-demat-account-and-how-can-you-open-one/

Does anyone know if the earlier bonds from L&T and IDFC were sucured? IFCI bonds state that “Unsecured” Bonds.

Even the rating AA- (Investible) is provided by new organisation BRIC work Rating India. Is this a new Rating orgn? Why havent they done by reputed organisations like ICRA / Crisil or any other famous organisations.

Please suggest.

The earlier bonds were also unsecured, and is quite likely that future issues of these type of infrastructure bonds be unsecured as well.

As for the second part of your question – I don’t know the answer to that.

There will be more issues in the future, so you can wait for them if you’re not comfortable with this one.

Suppose I invest on IFCI Tax Saving Long Term Infrastructure Bonds– SERIES II Save Tax u/s 80CCF now, how much time will it require to get the bond to submit to my organisation for tax proof purpose. Or Is there any other way to submit.

I’ve seen that it’s taking about a month or so – the other option is to just buy it in physical form, and use the receipt for tax proof, which you will get immediately. Check with your company accountant if they are going to allow this or not first though.

IFCI infrastructure bond is closing on december 31 2010. It is a very good opportunity to claim tax exemption on additional Rs 20,000. Infra bond is better option than SIP for 5 years.

Hmmm. very very interesting…

Can you be more elaborate Mrs.Nisha???

She was just leaving the same comment on every post, and eventually I had to ban her and mark her as spam.

Do we have any Infrastructure bond having only 3 year lockin period and can the same be purchased without a demat account…

No, SV, the bonds that have come in so far have had 5 year lock in as the lowest – IFCI & IDFC.

reading your blog …very informative for beginners like me

Just wanted to clarify . do i have to purchase such bonds evry year to claim 20k exemption .. is this startegy justified bcoz money gets locked in for such a period .

also the 4 series for the above bonds are little confusing ..which one to chose is difficult .. i think for starters and my understanding from the blog i will go for buyback non cumulative as i can sell them aftr 5 years .

i can use different startegy next year

Yes, every year, assuming that they’re allowed next year as well.

Personally, I like the option of getting some interest paid every year, and having a buyback option even if that means a slightly lower interest (because the amount itself is small) but then that is a personal preference, and you can opt for what suits you the most mrk.

hey thanks for replying ..

i will surely keep that in mind

Just happened to surf up to your site. The information is cogent, well researched and useful. Really wasn’t looking for assistance on the subject but this blog is doing a great service to us whee the tax laws are complicated and understanding very poor.

Do keep up the good work

Amit

Thanks for your kind words Amit – your thoughts are much appreciated.

Hi,

I am planning to invest in IFCI part-2 series Infra bonds up to 20K but my demat account does not allow me to buy bonds online. I have no option but to buy in physical form.

Could you please advice if there is additional tax burden incase we buy in physical form as the correngidum states that TDS will be applicable on interest accured more than INR 2500 in a financial year.

Gaurav – there is no “additional” tax as there is a tax on the demat form as well, but that will not be TDS, just added to income which will be taxed later on. In this case it looks like it will be TDS, though I’m not very sure about this point, as there have been some changes on this point as most issues came with only demat form first, and then opened a physical option as well.

I have invested in IFCI LT infra bonds but yet to receive any communication from IFCI regd the same.

Any idea whom should i contact to get the proof for tax benefits purpose?

This link has got some contact details towards the end of the page which you could try out.

http://www.ifciltd.com/IFCIBonds/InfrastructureBonds/CurrentIssue/tabid/218/Default.aspx

I have been told that it may not be prudent to invest in IFCI bond since its not rated by reputed rating agencies. Is there any risk of not getting even the guaranteed int rate of 8-8.25% since its an unsecured bond? What are the drawbacks/risks that are assoiciated with an unsecured, underrated bond. Please clarify.

Warrier – none of the other infra bonds were secured also, and I don’t think the infra bonds to be issued in the future will be secured either. In case of bankruptcy – shareholders get wiped out first, and then the unsecured debtors, so if it comes to the bankruptcy of IFCI then you can expect some problems in not only getting the interest but your principal as well. How likely that is – I have no idea.

As for the credit rating – the rating itself is good, but the agency Brickwork doesn’t have the kind of name that CRISIL has got.

IF you don’t feel comfortable investing in this then know that there will be more issues in the future that you can wait for, and buy the infra bonds from someone else.

Hi, If i take the IFCI bond from icicidirect 1. Can i get Bond in physical format? 2. For income tax proof submission what i need to submit? 3. Do i get any details or receipt from online application? 4. Which is the best option out of 4 options? I don’t want to keep my bond block more than minimum time period. Thanks in advance….

1. No.

2. They will send an allotment advice.

3. No, I haven’t heard of them giving out anything when you subscribe to it.

4. If you need to select the one with the buyback option, and see if you want to get paid interest every year or would rather have a lump – sum at the end. Keep inflation in mind which is a very real threat, and chips away on your money every year.

Dear sir

I invest Rs.20000/- in IFCI-Infrastructure bond on 31.12.10 for non buyback condition for 10years.

what is the maturity amount i will get at the end of maturity.

Regards

Sanjib Agarwalla

11,047 at the end of 10 years Sanjib.

wrong calculation ,i invest rs 20000.00 and i get only 11047 at the end of 10 years.Please correct and send

The amount I wrote down was for one bond of Rs. 5,000 which is what is shown in the post also, which you somehow failed to see.

How about doing a little due diligence before saying the calculation is wrong?

Hi

I have invested 20,000 in IFCI infrastructure bonds. I have not got the hard copy or allotment advice from IFCI yet. I need to show the hard copy of allotment as proof to get tax exemption. When would i get the hard copy of allotment. Does anybody else has got the hardcopy of bond allotment till now.

Also what is meant by allotment advice

Is the Tax Saving Infrastructure Bond option still alive or closed. I have not invested so far and need to invest Rs 20,000/- before 10th of this month.

Pl confirm.

It’s still available as the date has been extended till 12th January.

I too put money thru icici direct 2 days back. When will I get receipt of the same? My office wil not accept icici direct printout. they need ifci receipt only.

I have invested 20,000 in IFCI infrastructure bonds trough karvy . I have not got the hard copy or allotment advice from IFCI yet. I need to show the hard copy of allotment as proof to get tax exemption. When would i get the hard copy of allotment. Does anybody else has got the hardcopy of bond allotment till now.

Also what is meant by allotment advice

can we show bank statement paid to IFCI infrastructure to get the proof for tax benefits purpose

can i get the hard copy of recipt from icfi if i purchase bond from icici direct for showing proof to get the tax assumption.

can i get the hard copy of recipt from icfi if i purchase bond from icici direct for showing proof to get the tax assumption

They take time to send you that, so you must be prepared to wait and have some good buffer on your last date to submit tax proofs.

Dear Manshu ,

I do not have any demat acoount but my wife has it. She is a housewife and as per office record she is dependent family member. I live in a small city in Punjab where I could not find any agent or institution through which I can purchase Infrastructure bonds in physical form.

Kindly advise:

1) will purchase of bonds in my spouse name thro’ her DP qualify for my tax deduction?

2) In case of guys like me living in cities with less resources , how to purchase physical form of bonds as u mentioned that intercity cheques are not valid?

Request your help. Thanks

I have not seen any evidence that suggests that buying in wife’s name will get you the tax benefit. If anyone else has read something that suggests this is possible then please leave a comment here.

For purchasing the bonds in physical format you do need to submit it at a place accepting them, so I don’t have any idea on how you could tackle this situation.

Hi, The return after 5 yrs is Rs.29,300 for rs 20,000/-. If tax benefit is included for 20% tax bracket, the gain is Rs.13,300/- after 5 yars. Pl clarify,

1. Does one have to pay tax for this amount at the end of 5 yrs.

2. Investing in mutual fund will give far more yeald, in general, right?

I’m not sure how you have arrived at this number Sriram, and what option you’re looking at. As for your questions – Yes, the bond is taxable, and if you take the cumulative option then you will have to pay taxes at the end of 5 years. For the interest income you will have to pay tax every year.

Mutual funds are a different kettle of fish, and especially equity mutual funds which don’t guarantee returns. So, while people might say that equity mutual funds return a higher rate over a longer time frame, they are not debt instruments, and shouldn’t be compared with these bonds.

Tax-Saving or Tax-Declaration season is back. No matter what, January and March are indeed the Tax Saving months and Investors, who either remain busy with their office work, business, families or other daily routines or actually get up late for these important issues in one’s life, flock to the tax saving products like there were no such products available till the start of the new calendar year. In my opinion, every person who has spare money in his/her Savings A/C. or for that matter, in fixed deposits fetching 5%-7%, must go for Tax Savings either u/s. 80C or 80CCF because one’s Bank Savings A/C. takes approx. 8.8 years to earn 30.9% i.e.; 30.9%/3.5%. With these Tax Savings you can save (or actually better to call it earn) 10.3% or 20.6% or 30.9% (depending on your tax bracket) at one go.

IFCI Infra Bonds fetch an interest rate of 8.25% without Buyback option and 8% with Buyback option. Investments can be done through demat accounts and advisable also, if you opt for higher interest rate of 8.25%, in which case you won’t be able to redeem it back to IFCI after a lock-in period of 5 years. In other words, investors going for 8.25% interest option will have to sell these bonds on the exchanges in case they want to get the liquidity for themselves. But I’m not sure who would be interested in buying these bonds after 5 years at Par value, without any tax saving benefit and who would like to sell these bonds at a value below the Par value if actually the bonds trade below it. So, in my opinion, “the most attractive option†is the cumulative scheme with a buyback after five years i.e.; option with 8% interest compounded annually. Investors who choose to exit after five years stand to benefit the most.

To invest in IFCI Infrastructure Bonds/ELSS and save tax u/s. 80CCF/80C — Delhi/NCR (including Gurgaon & Noida), Call/SMS: 9811797407.

Manshu,

Just browsed through your site, and came to know of the wonderful articles you have blogged here, about Tax Saving and necessary instruments to do so.

Enjoyed every bit of it, and I would be visiting more often. It’s long since I participated in any Financial discussions on net, and now I have found a good place to do so.

Keep up the good job.

Wow – thank for your kind words, and I really look forward to more comments and participation from you in the future.

Whether the maturity amount of these bonds will be under EET? whether full maturity amount will be taxed at the time of maturity or only interest earned will be taxed?

regards,

vivek goel

Vivek – if you take the interest option then during redemption you will get the face value (5k) back, and so there will be no additional tax on that.

Wonderful discussions,keep it up. however after lot of in depth study i personally feel that option I is the best because you will keep getting your interest amount every year and you will not burden it at the end of fifth year. With so much inflation what will be the value of interest earned at the end of five years. keep saving and enjoy your money.

Thanks for your opinion Ravi – what you say makes sense to me, but as I’ve repeated countless times, what makes sense for you and me may not make sense for some one else because their situation is different, so they should evaluate these things on their own and take a final decision.

already applied for IFCI and invested 20k , when do i physically receive these bonds for submission

I’ve not heard of any news on when they are going to do so Sridhar.

IFCI bond receipts for ICICIdirect users available on icici direct website.The physical copy for IFCI will be issued after 31-Jan,as per info from ifci representative

Thank you so much for sharing this info dkar – this would help a lot of folks!

I’ve Invested in IFCI Infrastructure bond, amount is deducted on 14th Jan 2011. But i haven’t received physical form of the bond. Please advice me how to proceed with this.

No one has got them yet, so I guess the only thing right now is to wait.

How will they send physical copy of bond allotment? Is it to the present address to which they will sent by post/courier. Can we see the bond online in icici direct or ifci website?

I think the folks who got IDFC got it via registered post, and you can’t see it online yet.

Hi,

I applied for IFCI Infra Bond on 27th Dec. I still dont see it in my demat account nor received any advice that it is allotted or not. Did any of you guys received any correspondence?

Thanks,

Prabhu

Hi, I purchased 4 IFCI infrastructure bonds worth Rs 20000 in December 2010. However, I’m yet to receive the bond (I dont have a demat account). My company needs me to provide a copy of the bond so as to claim the tax benefit.

Let me know when I’ll receive the same so that I can get the tax benefit out of it. My form number is: 2489147

Thanks!

No one has got them yet, so you’ll have to wait longer. I don’t know when they’ll start issuing them but someone will leave a comment here, and you can check this thread or if you get an SMS that’s even better.

i had applied 4 nos bonds for ifci to exempt the income tax, but no reciept or physical recieved copy or no response letter or mail will be delivered to my e-mail ID. please send me the appropriate decision to save the income tax

This much information was available on this blog and I suffered lot. But finally invested on last day thru a local investment house. I have opted for dmat form and given the detail of my Dmat account, I am not sured if the same is processed properly.

What I can do now, should I keep checking my dmat account, email or IFCI website, or I will get some letter by post.

Just wait for it because calling up anyone won’t expedite. Continue checking your account.

I suggest everyone to at least scroll through the discussion forum at least once before posting a question.Physical copy for IFCI is supposed to available only after 31 Jan as per the info received from IFCI representative.

Manshu,really appreciate your tolerance for replying to the same question of “how to claim tax benefit for Infra bond” 10-15 times.

I’d like people to do that very much as it reduces overhead, but it hardly ever happens. As long as people are civil I don’t mind answering. It’s the rude ones and “do the needful” type people who tick me off, and get it from me. Thankfully those are rare, and for some reason are almost always through email.

I have called IFCI – Delhi office for the allocation of Bonds . They said it will get allocated on 7/2/11 . But I don’t know , how to view this in ICICI .Direct, since I will have to show this to my company for tax deduction . Please help me by informing , how to view this in ICICI . Direct .

I had checked with ICICI Customer care.They said once this is allocated then you can see the same in the icici bank site under ur Demat account(in demat holding) i.e The way you see the shares by loging in to icici Bank website. I am waiting for the Bond Allotment too.

Has someone got allotted? It is already over Feb 9th.

Did any one got bond allocation or any communiaction from IFCI . I am getting different feedback from their Delhi office everytime .

I just called them on 011-29961281/2/3 , information given that it will be allocated tomorrow or day after tomorrow.

yet not recived ifci bond certificate of physical form of bond

IFCI bonds are allotted today. You may check your demat account.

Hi

I could see the IFCI bonds under my ICICI Account under DEMAT holding s section.

Will the hardcopy of bond will be sent to us.

Hi

I could see the IFCI bonds under my ICICI Account under DEMAT holdings section.

However i need a hardcopy of the allotment to show as proof for tax exemption.

Will the hardcopy be sent to us.

Also if not, what we will show as proof to get tax exemption

Get a copy of ur demat account statement. and hand it over to your hr person

I had applied the bonds in physical form, but I had also mentioned my demat details in the form. My Demat account does not show these yet.

Has someone received in the physical form also?

I think demat holding statement can be used for tax benefit purpose.

Some other people have also left comments stating that they have been able to do so.

Finally it is showing in my Demat account. 🙂

Hi Gopal

Can u please let me know where exactly in our demat account , this bonds we will be able to see. I have a ICICI direct demat account.

You can see in ICICI bank site demat holding

Hi Anurag,

It will be shown in your demat account in corresponding bank net-banking site. For my case it is HDFC bank, for my brother’s, it is shown in his ICICI demat holding.

I applied for 3 bonds on 19-12-10.

But i have not received the Bonds yet.( physical)

By what time i will get the bonds, may i know?

Hi Priya,

I had also applied for physical only. Haven’t received in physical form yet, but it is now showing in my Demat account. Can you check the demat account that you had provided in the form? It must be there by now. Also, I had applied on last date only. So, if I am allotted, everyone should also be allotted.

Have u got my prev mail…..pl reply soon

HEMENDRA BHIKHALAL JAIN

FORM NO : 2621280

DATE:28/12/2010

APPLICATION FOR 4 BONDS RS.20,000/-

I have neither received bond in physical form nor in Demate Account.

As more than one month is OVER ,please immediately look in the matter and SEND THE CERTIFICATE.

Talk to your agent or whoever sold you instead of wasting time writing comments on blogs.

That is correct. We are also customers just like you. It is better to contact the IFCI on their number.

I already contect them. They just wasted time to transfer the CALL.

Form no: 3279738, applied on 12th Dec, 2010…. didn’t get any response from them. Neither in physical form, nor in demat! Delhi office playing every day. Called 011-41792800 & 26487444… they are saying every day either today or tomorrow! Finally told everything is over… pl call Mr. Sekhar or Namita on: 011-29961281/2/3…. whenever I am calling they are holding the call for 5 mints and saying no body in their seat!!! Don’t know whether my 20K got cheated or not! 🙁

Hello,

i think you need not to worry and no need to panic.

Contcat the registrar of issue with all your details via E-mail.

Form no: 3279738, applied on 12th Dec, 2010…. didn’t get any response from them. Neither in physical form, nor in demat! Delhi office playing every day. Called 011-41792800 & 26487444… they are saying every day either today or tomorrow! Finally told everything is over… pl call Mr. Sekhar or Namita on: 011-29961281/2/3…. whenever I am calling they are holding the call for 5 mints and saying no body in their seat!!! Don’t know whether my 20K got cheated or not! Pl help:(

I dont get any responce from your company even after more then 30 hours.. Is that cheating or what .. I wana reply please..

Hi There,

you can check the status using this link

http://www.beetalfinancial.com/bond.aspx

but not sure about alotment sheet, i need it for IT Proof.

This is really awesome Ravi – thanks a lot for sharing this – there are so many people looking for IFCI information that this will be an extremely useful tool. Thanks a lot – much appreciated!

I got the soft copy of alotment sheet from beetalfinancial. I called them and gave the form number and they sent it with in 1 hour. this sheet is useful for tax proof.

Thanks for that info again Ravi – I created a post out of the info you sent as this is really useful, and will help a lot of people.

Thanks Ravi, the link you posted helped me to check that I have already been alloted and that gives a sense of relief. Thanks very much for your help. I am sure there are many like me who will find your link helpful and breathe relief.

I had applied for 2 (Two) IFCI Tax Saving Long Term Infrastructure Bonds– SERIES II vide Appln. No. 576782 Dt: 30.12.2010, Cheque no.367858 (rs.10,000/-).

No debenture thereof was received in my Demat a/c till date.

My DP is pledging helplessness in the matter.

My DP is pledging helplessness in the matter.

Soma – this links shows that your bonds were allotted so I think you should re-check your Demat account, and see that you’re seeing at the right place.

http://www.beetalfinancial.com/bond.aspx

i SHRIRAM JANARDHAN PAUNIKAR submitted ifci bond application for rs 10000 on dated 08.01.2011 in physical form. my application no. is 52033. i have not got any bond certificate till now. when i will get the bond certificate?

Check your status with this link that Ravi shared earlier, and talk to your agent or banker if you see that the bonds haven’t been allotted.

http://www.beetalfinancial.com/bond.aspx

Check with the agent that helped you buy this bond – also your application number doesn’t seem to be correct based on what others are sending the number is six digits whereas your number is only 5 digits.

My application no is also 5 digit .And I have got the allotmate.

I have applied for physical form.But I have changed my address which I have given in the form.How can I get the Bond sertificates.Please suggest.

Dear ALL,

After posting here on Feb 13th, I wrote to my Dmat provider ICICI with all the details. They answered me immidiately, which I am giving here. Those who didn’t get the demat credit, pl contact your service provider. I am satisfied with the answer from my service provider.

“Dear Customer,

We understand your concerns.

The 4 units of IFCI LIMITED OPT- I 8 LOA 31JN21 FVRS5000 are credited in your Demat Account IN*********** on February 10, 2011.

These units are in Lock in period and you would be unable to view the same under demat allocation at http://www.icicidirect.com. However, you would be able to view your holdings in IDFC bonds by following the below mentioned path:

1. Log in to http://www.icicidirect.com.

2. Click on FD/Savings.

3. Click on hyper link FD/Savings Demat balance.

The security name will be currently displayed as NA as the Bonds are not tradable.

Further, the holding statement for the month of February 2011 will be sent to you by March 05, 2011 which would reflects its credit details. Hence, we request your co-operation in the interim.”

Good luck to all of you! 🙂

Very nice of you to share this piece of info. Thank you.

Great – thanks for sharing!

Hi all,

I have a query.

I appliled for 2 bonds of IFCI in series II option II.Got them allocated in my DP too.

Today when I see my bank account with HDFC it shows a credit of Rs 37 against IFCI infra structure bonds.

If I am right I had opted for cumulative option so no question of interest.

So can anyone tell me if similar thing happened to them too ?

Or what exactly is this amount for.

Any help is highly appreciated.

I have received INR 79 from IFCI. Not sure for what. 🙂

Gopal,

You applied for annual interest option of the cumulative one?

Gopal,

You applied for annual interest option or the cumulative one?

Hey guys ,

I have sorted out the confusion.In the information memorandum available on the link “http://www.ifciltd.com/Portals/0/IFCIInfraBondSeriesII-IMFinal.pdf” on page no 13 it says

“interest on Application Money, to the

extent of allotment of bonds, shall be paid from the date of credit of this money to the bank

account of IFCI to the date immediately preceding the deemed date of allotment at the

respective coupon rates.”

So the amount received in our bank accounts is actually the interest on the application money from the date of applying to 30th jan 2011.

🙂

Thanks people for listening me out…

Great job on solving the mystery Kapil 🙂

Hi,

I checked the allotment status through the URL http://www.beetalfinancial.com/bond.aspx. It says I have been allotted the units but in physical form even though i had applied for demat form. Any idea why? And what Am I supposed to do once the bond matures, i mean how do I encash it?

Hmmm sounds like there was a mistake in filling the form or something. I’m not sure if you have to do anything extra for payment on maturity. From what I remember they will credit the same account that they are paying you interest on at the time of redemption.

Thanks for the reply Manshu but any idea when I will get the physical Bond. I havent received it yet even though the status says the advice already sent.

I really don’t know about that Prabhu.

dear sir,

i had applied for IFCI bond by paying amount 10,000/- chq date 24/12/2010.

my application no 3042186.

till today no allotment had been made.

kindly confirm the allotment

jagdish

hi,

You can actually check the status of your bonds online at http://www.beetalfinancial.com/bond.aspx.

I have not received my bonds yet but it says bonds allotted in physical form. Advice sent.

Thanks for that info Priya.

I have invested Rs.20000/- in IFCI Inf Bond vide Appl No.3010202 dt 30.12.10, but I didn’t receive original bond so far.

I checked status of my application on the http://www.beetalfinancial.com/bond.aspx site; its showing wrong PAN no (one letter incorrect) with successful allotment.

Should I take efforts to correct this or I can live with this as is? Do you foresee any challenges later if not corrected now? If it is better to correct, any clues whom to reach? Beetal? IFCI?

Also status shows “Allotment in physical mode, allotment advice already sent” (I applied for physical mode). Does anyone know how much time allotment advice should take to reach me? Has anyone already received physical bond papers?

I really don’t know enough about this to say if you will have problems or not Sagar, but in general I like to follow the principle of being safe rather than sorry.

Hi,

I also applied for bonds in demat form but the status showing up is “Allotment in physical mode, allotment advice already sent”.

Any idea how much time it will take for the advice/ bonds to reach in physical form?

Sailing on the same boat. let me know if you get any communication from IFCI. And by the way did you check your dp account? How did you apply?

I had applied for the ifci infra bonds in physical mode …..beetal financial website is showing bond allotted…….but till today i have not received the bond………had sum one has received the bond in physical form..?

i check the status of your bonds online at http://www.beetalfinancial.com/bond.aspx.

I have not received my bonds yet

but it says bonds allotted in physical form. Advice sent.

I checked the status on beetalfinancial site, it says bonds allotted in physical form, but i have not yet received any bonds, any idea how much time it will take?

I applied for infra bonds vide application no.3010795& 3010799 no allotment has been received yet

Did any recevie IFCI infrastrycture bonds in physical form ?

Physical alottment along with the cheque ( Interest on Application money) for the time period, money was with IFCI has been received…Its just a letter mentioning that you have been alotted and nothing in addition to same.

All should get by march 11.

Similar letter is also available on beetel financial’s site who is managing this piece.

Vinit

Thanks Vinit.

I think now everyone is waiting to get the physical bonds, if anyone receives it please post the details.

I have received a physical receipt for the bonds. It is just a small 1 page document from IFCI, and I am not sure if this is the actual physical bonds.

P.S. I had been already allotted in my Demat account.

Dear All,

Just spoken to beetal according to them physical bond, we will get this certificate at the end of March 2011.

Thanks for that info Ashfaq – that is useful info, as there are a lot of comments on that.

statement of ifci infra bond required

not showing in demat acct

how to get it

I had deposited on 28-12-2010 Rs 20,000/= at Baroda vide HDFC Bank cheque No 151158 for allotment of physical form of your infrastructure bonds. So far I have not heard anything from you.

Please expedite reply.

Mrs R Ravindran

i have invest in ifci infra bond vide application no:2429436

cheque no:493501 axis bank ltd valsad till date 09/03/2011

i have not recieved the conformation of alloted my bond in my

demet account.

For information of all those who have invested in IFCI Bonds, please note that after accessing the link http://www.beetalfinancial.com/bond.aspx, type out your PAN Card No. and you will come to know whether your investment has been allotted or not. Whether your investment is through the DP route or by physical form, the particulars would be displayed therein. As for the physical forms, the same would be despatched by them only by the end of March, 2011. So please have patience and wait till you get the forms. As far as the IT Return submission is concerned, there is plenty of time till 31-07-2011. To be on the safe side, you may get a copy of the particulars of your investment downloaded from the abovementioned site and use same for attachment to IT Return if necessary.

There is no need to keep sending e-mails about your allotment confirmation.

Mrs R Ravindran

Thank you, thank you, thank you so much!!!

I’ m applay for ifci bond for Rs. 20000 and application no iss 2283394 .please tell me status of allotment

I have applied for IFCI Infrastructure Bond series II in January 2011. My application No: 02365696. I have applied for 4 bonds of Rs. 5000/- each. I have got the allotment advice wherein I found that my name has been mispelt .

My correct name : SISHUTOSH PANIGRAHI

I nominate my wife Mrs MAMATA PANIGRAHI, dATE OF BIRTH: 31.12.1964. aDDRESS: Qr. No Type III/29, Narcotics Colony, 19 mall Road, Morar, Gwalior: 474 006.

Kindly do the needful.

Yours sincerely,

SISHUTOSH PANIGRAHI

This is not the IFCI website – please contact the registrar or IFCI to get this issue resolved. Leaving a comment here won’t get anything done.

Please find out why the infra structure bond in Demat form is still not come to account.

Pls reply in 2 days time.

Already informed earlier.

It shows the customer is not treated will.

When my friend got his Demat a/c updated why this is happening : please note the details of bond applied:

Cheq no 225520 dt 7.1.2011 Rs.20000/-drawn on Axis bank .

Regards,

C.P.Viswanathan

9094783096

The applicatton ser no is 224386 thr kotak securities.

I am yet to receive the bond certificate.My PAN is <--deleted-->.Cheque no. is 78291 dated 06/01/2011.My cheque has been cleared on 14/01/2011.

I have not received hard copy of the bond nor the same is showing in my demat.

My dob is 21/08/1977 and my pan card# is <--deleted-->

I have applied for IFCI INFRA BOND S-II : IFCBON on 30/12/2010 vide application No 3707090 for Rs 20,000/-, I have yet to receive the physical certificate.

i applied for the bond on 30/12/2010but i have not received the physical form of bond till yet and presently my address has been changed kindly look into this matter.

BESSY SAJI

form no.-558881

date-30/12/2010

application for 4bonds Rs-20,000

add. SB-34 SOPHIA APPTS ABHAY KHAND-IV INDIRAPURAM,GZB.

Here is the link to check the status of your applications:

http://www.beetalfinancial.com/bond.aspx

Call Beetal at: 011 – 29961281/82/83

Mail Beetal at: [email protected]

My address with area post office pin code ….. Smt.Rajani Trivedi w/oShailendra kumar Trivedi, ADDRESS-c/o U.N.Tiwari, K-10,KAZIKHEDA,LAL BANGLA,KANPUR.

Pincode-2o8007.(UTTAR PRADESH )

Hi, I have already invested in Infrastructure Bond last year which takes care of tax deduction. Do I need to invest this year as well for benefit?

Yes, the deduction you got was for last year, so if you’re interested in getting a deduction this year you will have to invest again.

pl inform me reg allotment of bond.my applicationno 226383

Sir,

i have applied for IFCI Infracture 2012 bond with application no.1800764 . but till date i have not recive aney commmunication from u

kindely update me

thanks ®ards

dinesh kumar rao

mobile 08298860930

INDIRA GANDHI NATIONAL OPEN UNIVERSITY

PATNA (BIHAR)

I have invested in the IFCI long term Infrastructure Bonds – series II last year 7’th Feb 2011. Shall any one convey that they have paid the annual intrest in what mode?.

Sir,

I have applied for IFCI Infracture 2012 bond with application no.263613 on 02.02.2012 through my d-mat a/c but till date I have niether recieve any commmunication from you nor any proof to submit for income tax rebate.

Kindly update on my e-mail.

Thanks & regards.

Shailendra Kumar Yadav

Mobile.09535303841

I had applied for 12 IFCI Bonds vide application no 1589596, 1580281, 1580377,1589595.

I have not recd the bonds nor any communication in this regard. Pl confirm immediately . what has to be done

I had applied for 04 (Rs 20000) IFCI long term infrastructure Bonds vide application no 52822 by SBI cheque 061949 dated 06 feb 12 from coimbatore I have not recd the bonds nor any communication in this regard. Pl confirm immediately . what has to be done, MY CONTACT NO 8940381920

I had bought a shirt last week which I was not able to return to the store – can you confirm immediately what I should do to get this shirt returned?

I applied IFCI infrastructure bonds series-II in 2011, but bonds were alloted, but till date interest was receive, which mode the interest was sent. The following are the particulars for verification.

client id:10053388

DP no.IN300610.

ISIN NO.INE039A09MU6

I applied IFCI infrastructure bonds series-IIin 2011, but bonds were. . alloted, but till date

interest was not received, which mode the interest will be sending. Please inform the position.

The following are the particulars for verification.

Client id ::10053388.

DP No. IN300610.

ISIN NO.INE039A09MU6.

Please reply immediately.

This is not the website of IFCI….is that too hard to understand? Look at the url of this post, look at the comments that people have posted before you, read the post. Contact your agent or whoever sold you this.

Dear Sir,

Last year I have purchased 04 no ob Infra bonds bearing Application no 357657 & Reference no 143637,ref.ord.no/rRI .No 15211,but date i have received any bond or any papaer from IFCI.

Pls let me where shall I get this paper?

Ganeswar Sahu,

Mob-09049527242,

Mail [email protected]

I HAVE INVESTED Rs 20,000/- IN THE TAX SAVER LONG TERM INFRA STRUCTURE

BOND ON 9TH MARCH 2012 VIDE FORM NO. 1710167, BROKER CODE KISL, SUB BROKER

CODE 902818 ( FOR THE PHYSICAL FORM ) , BUT I HAVE NEITHER RECVD. THE

CERTIFICATE NOR ANY COMMUNICATION . PLEASE UPDATE ON MY E MAIL.

R/sir,

I have invested in ifci infra bonds series II, my id/folio no is 2141810. I want to change my registerd address for the same bond for future correspondence, as I am transferred from Nandgaon Dist; Nashik to Sinnar Dist : Nashik. Please , guide the procedure for change in the address

Thanking You

Yours

V.D.Golesar

sir,

I have invested 20,000/- in ifciltd, on 21/3/2012through sbi ,bheemunipatnam cheque no.020816.but i didnot get any bond and any response .i already gave mail with details. but i didnot get any communication. please inform through mail.

mail id:

[email protected]

What is the date of getting interest payment for this bond?

i have a ifci infrabond 2011-2012,amount 20000/-.i want to know the status of the bond.please reply as early as possible.No is 1724763.

rgds

sridhar

with regards to IFCI 8.25 310121 series IV

Why does the value show as zero in your DP ID? when the paid up value is 5000?

I Bimal Kanti Nath , hold IFCI Infrastructure Bond whose certificate No.0101700 & Folio No. INB 010700 . So far intrest received in 1st year by cheque , now I wish to receive interest through NEFT in my saving A/C. Also send the filledup ECS Form to your Hyderbad offiece on dated 07.05.2013 , till date I have not received any acknowldgement or activated in ECS .

Please inform me .

Bimal Knati nath

if a investor dies then what is the procedure of geting refund of series four bond

hi,

I have bought INFRA BOND on with form no 292206 of 20000rs @9.9%on 2012 with chk no 557753. then I moved from Bombay to hyderabad 2012 dec and ddnt receive any ceritficate or comunication till then. during move I missed the acknowledgement slip so dont even know bond no.

couil you update me iwth the bond no. is it possible to send the certificate to my Hyderabad address?

thanks

I HAVE NOT RECEIVE MY BOND CERTIFICATE. APP.NO.-2124437 PAN NO.-ADAPM0443Q DEMAT NO.-300394-16932939

i had applied the ifci infrabond 2011 but did not got about your corspondence details line your land line or mobile no, …

my mobile no 9493312989 name ashok kumar shukla.

I purchased ifci infra bondseries 5th ?20000 bt till today i haven’t recv detail

Plse reply

I purchased ifci infra bondseries 5th ?20000 bt till today i haven’t recv detail

Plse reply

Sir,

i am very sorry to say you that i had invested the some of rs 20000/- in ifci infra bond in the year 2010. till date i can get regular intrest but therea re no any certificate of letter from you . as i have it quary so please arrange the same for the investment details. my pan no. AFUPP2940M AND INTREST AMOUNT CREDIT IN UNION BANK OF INDIA DHRANGADHRA BRANCH ACCOUNT CNO. 44042070000786 PLEASE ARRANGE FOR THE SAME AS A INVESTMENT CERTIFICATE OF LETTER AND OBLIGE ME

THANKS

BHIKHALAL RAMJIBHAI PARMAR

My application form No. is 816575, dated 23/1/2012, paid Rs. 20,000. I have not received anything from IFCI LIMITED, New Delhi. I have even not getting the status of the same.

Dear Sir,

I have purchased 04 no. of Infra bonds bearing Application no 2198642 Dated 12/01/2011. My other information is as below –

Name – Mahaveer Rayagonda Patil.

E Mail ID.- [email protected]

Mob. No. – 8275258036 , 9881008222.

Folio No./D.P.ID No.2087224.

Old Address – Mahaveer Patil. At & Post Aitawade Budruk Dist Sangli.

New Addrees -Mahaveer Rayagonda Patil. “Veetrag” 8/207,

Opp. Chougule Petrol Pump, Kameri Road, Kisan Nagar,

Islampur-415409, Dist Sangli. (M.S.)

Old Bank A/C. No. 1000135160000172

New Bank A/C. – 1004310030001834.

RBL Bank Ltd. Br.GaonBhag Sangli. IFS code- RATN0000043.

But I have not received any bond/ Certificate from IFCI Ltd. Interest of Rs. 75/- for the period ended 31/01/2011 is received only.

Please change in the address and Bank A/C. No. & send the Bond certificate.

REPLY.

Can anyone kindly tell me how to get the redemption amount of the IFCI tax saving bond 2010 option I , the redemption is due on 15th September 2015.

SIR, GOOD MORNING I HAVE IFCI LTD – OPT – II – TAX SAVINGS SCHEME /31 JAN 16 BONDS (5) IN DEMAT FORMAT. NOW I WANT TO REDEEM THE SAME WHAT SHOULD I DO ALSO I WANT TO UPDATE MY BANK DETAILS KINDLY ADVISE ME THE PROCEDURE. TO WHOM SHALL I SUBMIT THE DOCUMENTS AND WHAT DOCUMENTS AND WHICH FORMATS ETC. MY email address is : [email protected] which may please also be updated at your end. THANKS

I have IFCI bonds in demat form . On maturity , whther it will get automatically credited to the bank account or we will have to apply separately. Please confirm

I have IFCI bonds in demat form . On maturity , whther it will get automatically credited to the bank account or we will have to apply separately. Please confirm

I have IFCI bonds in demat form . On maturity , whther it will get automatically credited to the bank account or we will have to apply separately. Please confirm.

I have IFCI bonds (INE 0139A09MT8)in demat form . On maturity , whther it will get automatically credited to the bank account or we will have to apply separately. Please confirm maturity date also.

I have IFCI bonds 8.0 310121 ( INE 039A09MT8 ) in demat form . On maturity , whther it will get automatically credited to the bank account or we will have to apply separately. Please confirm Maturity date .

I am having 4 IFCI bond series 2011 in (de mat form ) serial no INE039AMU6 my lock period 5years I.e after 31.01.2016. How can I sell .Please reply me on my mail ID [email protected] or mob no 9467109558. Thanks with regards. Sarla Nandwani

I have purchased 4 bonds through ICICI direct.com but till date i have not received interest amount of Rs. 8,000/- which was realised as on 31st Jan., 2016. Please clarify

I purchased 4 IFCI Bonds series 2011 in demat form.I had opted for buy back facility.Will you please advise how and when I can apply for buy back .My email IDis [email protected] My mob no. is 9818268328. Will it be automatically credited to my bank account.Please advise.

I applied the tax saving bond two times Rs 5000-4 nos. each time long back but my amount of Rs 40000.00 not return so far.How to get these amount Pl. guide me. REGARDS.

I invest in the tax saving bond long back for Rs 40000.00 (20000.00 two times) but these amount not refund to me.Pl. guide me how to get these amount. REGARD.

I, Laxman Kumar Ruhela have been received payment of Rs 31,736/- against 04 infrastructure bonds each Rs.5000/- after 05 year i.e Total Rs.20,000/-.

Kindly clarify that interest amount Rs.11736/- is taxable or not,

Rs.31,736/- -Rs.20,000/- = Rs.11736 Interest

My mail ID : [email protected]

Mob:9868134488

Laxman Kumar Ruhela

Hi Mr. Ruhela,

Interest amount of Rs. 11,736 is taxable as Income from Other Sources.

I am having 4 IFCI bond series 2011 in (de mat form ) serial no INE039AMU6 my lock period 5years I.e after 31.01.2016. How can I sell .Please reply me on my mail ID [email protected]

I have purchased 10 IFCI SR I, option II bonds. I tried to sell them online from my demat account. Currently there doesn’t seem to be any trading activity in the bonds. However,I want to know what is the procedure for the company to buy them back at the current market rate which is 18300 per bond.

i sent my original bond along with cancelled cheque on 1 st of nov for redemption/buyback to beetal ..how much time will it take for processing and getting the money into my account .

Sir, I had purchased inf. Bond Series -v of Rs 20,000.00 on 26/06/2012.Now I want to close this. So, what is the procedure.