Thoughts on MOIL IPO Subscription Numbers and IPO Investing

The MOIL IPO subscription closed with a bang yesterday, and I think it’s a very good example of why investors should be really careful and skeptical while investing in IPOs, especially if you’re new to the market.

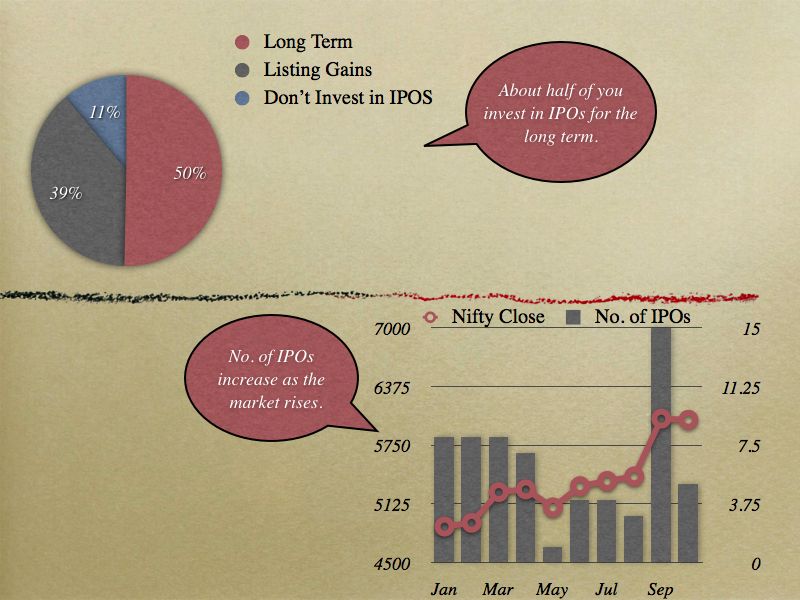

Before I get to the MOIL numbers, let’s revisit a chart I have used here earlier.

The graph on the lower right corner of the image shows you that the number of IPOs rose in September when the market itself was doing quite well.

This makes sense when you think about it because promoters of companies want to sell their stock when the sentiment is up, and when they can extract the maximum price – there’s nothing wrong with that, just the way markets, and people work.

A couple of days ago Khalid posted the returns of IPOs launched in September of this year, and I was amazed to see the number of companies that are currently trading below their offer price.

A quick look at that table shows that only Career Point, VA Tech Wabag, and Tecpro are trading above their listing price! That’s just 3 out of 16!

I think a large part of this can be attributed to pricing the IPOs to the full, and not leaving anything on the table for retail investors, and to that extent it is easy for long term investors to take a look at IPO grades, and decide that the fundamentals don’t excite them, or that the pricing is too high based on comparison with peers, and this way you can avoid most of the high priced IPOs.

But, what when fundamentally good companies that have been decently priced hit the markets?

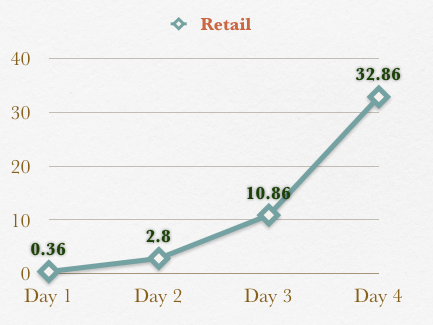

They get oversubscribed to insane levels, and the number of shares that you get allocated is so less that the whole exercise itself doesn’t seem worth it’s time. Here is how MOIL IPO over-subscription looked just for the retail category.

When the IPO is over-subscribed so many times then you hardly get any shares at all.

So, at one hand you have IPOs that are already priced fully, and you’ll probably be able to buy them later at a much cheaper price, and at the other hand you have IPOs that are decently priced, but will get over-subscribed so much that you will not get any significant amount of stock at all.

What does this mean to you?

It means that while there are opportunities to initiate positions in fundamentally good stocks at decent prices, the positions themselves may not be as significant, and in terms of absolute numbers – IPOs can lead to losses much more often than the other way round.

Also, if you are drawn towards the stock market for the first time by IPOs – know that there is a lot of excitement around them, but they may not help you build as much wealth as boring concepts like saving and investing regularly will.

Don’t be turned away from them completely, but don’t be dazzled by them either. They are just one of the many ways of investing in the stock market, and are in no way a sure shot way of making money.

If you’re punting and want to sell to make a quick buck – all the best to you – you will probably lose in the long run because that’s what happens to most retail investors who engage in trading and punting. I understand that you are probably not going to be convinced to stay away from IPO punting because some random blogger on the internet told you so, but I ask you to be cautious because it’s your hard earned money after all.

Hi Manshu,

May be, we can now consider the bids only at cutoff. That makes the subscription 28.02 times for retail 🙂

Regards

Raja

I wonder why those few folks applied below the cut – off. Do you think it was just a lack of awareness, or did they really feel that the 375 is not justified but 340 is?

Good question. But your guess is as good as mine. I would bet on lack of awareness. Because i think people who can talk/evaluate value of an enterprise would sure be practical enough to know that they won’t get them in these kind of markets. Value conscious ones typically wait and don’t waste there time in even applying in such cases below the cut-off 🙂

Regards

Raja

Yeah, true, I hope someone who has applied below the cut – off reads this thread, and leaves their thoughts on why they did apply below the cut-off.

Hi Manshu,

Am trying to build a small blog for promoting(selling) one of our ancient art forms called patachitra. Would request you to have a look at the blog and give few critical comments on what you think is missing and would be critical for the success of such an endeavor.

http://patachitram.wordpress.com

I had earlier sent you an mail, but i think that is lost in your inbox 🙂

Regards

Raja

Hi

One off the track point, you make superb self explanatory graphs.

I think it’s not through excel.

Thanks Sanjay!

Your comment was caught in spam….I don’t know why. This is the second time in two days a legit comment was caught in the spam folder….I think I’ll have to start looking at that every so often too.

No, this is not using Excel. I mean most of them are not anyway. These are using Keynote on Macbook. And even when I use Excel on Macbook, and generate graphs they look slightly better than a PC.

Hi Manshu,

Nice to see my reference here, exactly same view i have that most of the companies even good companies wait for the good market conditions to launch their IPOs. So the retail investors should have to careful and better would be to consider SIP investments in some good companies. 🙂

Regards

Khalid

Hi Khalid,

Only after I saw your post I realized what a huge number of these IPOs completely bomb! I never thought it’d be just 3 out of 13, and even the 3 that are doing well are not all that above from their issue price.

@Raja – I apologize!!! When did you send the email? I don’t recollect seeing it all, so I wonder if it got caught in spam or something! I’m sorry. Please send another email, and we’ll see if I get that or not.

A quick look at your site shows that is actually quite beautiful to look at and easy on the eyes. I’ll get back to you on email, as I don’t think this discussion will be relevant to a lot of other folks here.

Right. I have sent it to onemint at gmail.com now. Confirm if you got it.

It went in the spam folder, but I got it out of there. Will look at the site, think about it a little, and respond to you tomorrow.

Thanks. that would be great!

hi Manshu,

1. I totally agree with you. On 01 December I checked up from NSE website that the MOIL IPO retail portion was subscribed 20 times. So out of the limited amount which I was to block, I would have got almost nil shares. So, I decided not to block my amount, even for a limited period through ASBA.

2. I think raising the retail investor limit to 2 lacs has made the difference. A retail investor can now apply for double the numbers of shares as compared to the previous limit. But the underlying fact is that he is liable to get only half of the number of shares which he would have got as per the earlier limit. So, in my opinion, raising the limit of retail investor to 2 lacs has not actually benefited to the retail investor but in fact harmed him. Unless the retail component of the total IPO/FPO is doubled, doubling the limit has got no value.

I’m really not convinced that doubling the limit is all bad for the small investors. I guess part of it is the belief that there would have been a high demand for this IPO regardless and part of it is the fact that I haven’t looked at the break up of the numbers yet. I guess that will also make an interesting post when i eventually get to the demand break up and see how many bids were made at the top limit and how it affected the overall subscription number

Hi Manshu

I would go with Hemant in the issue of enhancing the limit for RII to 2 lakhs. Since there is a retail discount for PSU offers, I would even suggest reducing the limit for RII to Rs.50000/-.

1. This will increase allotment to RIIs because most RIIs keep off IPOs and FPOs for fear of meagre allotment.

2. Only small investors will apply in the RII category and get the benefit of discount. What happens in issues like MOIL is that even HNIs will apply in retail portion because

a. They get a 5% discount

b. HNI portion is usually hugely oversubscribed and there is no possibility of any large allotment. (eg. in MOIL HNI is oversubscribed at 150x approx. so only one lot will be alloted even for a subscription of 150 lots.)

So HNIs stand to gain at RIIs cost

Hi Hemant and Loney,

In my opinion one critical point is missing from this debate.

i.e., At any point of time there is only a certain number of people (retail participants) who take interest in the IPO.

That number may be influenced by tricks like advertizing, marketing etc.. or for better reasons like quality of IPO, but even then there is a risk that in case of huge IPO’s like say of the size of Coal India the participation may not be enough to cover the issue size. I think this is the primary issue that increase of retail limit tries to address.

In case of smaller IPO’s like MOIL the increased limit doesn’t really affect the allotment %tage anyways specially when the market apetite is so high.

Regards

Raja

I again agree with Raja that at many times, retail investors, who donot know what they are doing are pushed into market products by distributors who have only their commission in mind and they donot take the risk appetite of the customers into mind.

When you increase the retail limit to Rs.2 lakhs, there is a possibility that a person who in his 60’s (say just retired) might be asked to put all his retirement benefits into as IPO with the promise that within 15 days you can earn 40% and so on… We know that for a retired person, capital protection is foremost priority and any market linked instrument is not at all recommended to them. I agree that there might be only a very small percentage of them. But, you should take them also into consideration.

By reducing the limit to Rs.50000/- you are reducing the liability of people who were mis-sold financial products.

I have come across persons in their mid-50s who were mis-sold ULIPs as a single premium product. Unless and until, there is widespread financial literacy, small investors should be protected by such measures as deemed fit.

Hemant

I think you should not have withdrawn the application. You should have applied for the minimum lot of 17 shares. Because, Karvy and NSE which will finalize the allotment has this particular habit of allotting shares even to people who bid for the minimum lot at the expense of people who apply for the maximum lot size within the limit. Therefore there was a probability that you were alloted 17 shares even if you subscribe for just one lot.

Loney,

I was not aware of this. I roughly calculated the proportion which fell below one lot. Anyway, it is a good learning. Thanks.

Hmm.. that’s actually a very interesting point.

It will be a good learning if we can be sure of how it works. although I think allotment shouldn’t be related to lot size. Only the application is related to lot size.

If what Loney says is true then people shouldn’t be blocking 2 lac of rupees to finally get an allotment of 16-17 shares as in case of MOIL. They can just apply for 1 lot, block limited amount and get same level of allocation.

Logically thinking if a person applies for 17 shares and say the issue is oversubscribed by 34 times and the allotment is done proportionately. Then the person can’t be alloted 0.5 shares which is what he deserves. So, his application either has to be rejected or some compromise like giving one share etc.. 😉 But giving 17 share is definitely eating away the share of people who blocked higher amount.

Manshu, any experience on this ?

Regards

Raja

Yup, my exp is the same as Loney’s at lower levels the ratio improves, but of course the absolute number is much lower, so that’s the reason you can’t always do this.

Now that I have warmed up to the topic, i slowly recall what had transpired with me during the Power Grid IPO. I recall that Power Grid had come with newspaper circular explaining the basis of allocation. If my memory serves me right the people who had applied for such minimum lots were alloted full lot’s on the basis of some lottery system. So, what Loney and Manshu are saying is right, but it won’t work for all such applicant’s. I was one of the lucky ones who had got the full allotment on a minimum lot application whereas one of my friend who had applied for equal numbers hadn’t got any.

Regards

Raja

MOIL subscription details are out. I had applied for 1.2 lacs each in 2 diff accounts (me and my wife). Only one of the applications got allotment of 17 shares whereas the other received NIL.

Whereas another friend who had applied for 2 lacs in a single account also got 17 shares.

So, i think probability played out pretty evenly in my case. It would have been bad if both of my applications would have got NIL shares, which was surely was a possibility.

So, i think in future i’ll stick to applying from only 1 account if my total application money is 2 lac.

Regards

Raja

Hi Manshu

That is an article well-written. It takes home the point that investing in an IPO is like buying into a sweep stake. The main problem is with regard to the disclosure. While all listed companies have adequate disclosure norms, those that are on the line donot have. There may be potential ‘satyams’ in the wing. We also donot know the competence of the management.

Take the case of the Claris Life Sciences IPO. This company has many US Regulatory issues and if the company fails to overcome these hurdles, its products may be banned in the US. If US bans them, other nations may follow suit. Claris’s erstwhile promoter and relative of the individual Promoter, Mr. Sushil Kumar Handa, the Ex-Chairman and Managing Director of the erstwhile Core Healthcare Limited, is included in the list of wilful defaulters, in his capacity as a director of such company, maintained by the Credit Information Bureau (India) Limited. Furthermore, there are certain criminal investigations relating to alleged economic offences, which are currently being investigated by the Central Bureau of Investigation and the Anti Corruption Bureau, and offences under the Drugs and Cosmetics Act, 1940, some of which are currently pending against him; and he was declared as a proclaimed offender due to non appearance at hearings in one such instance.

Such instances show that IPO subscription is definitely not on the cards for Retail investors who doesn’t want to lose money unless they are satisfied beyond doubt about the company prospects, ability of the management.

Thanks for that info Loney. I actually didn’t look at this one at all as I’ve been busy with the PSUs, but I think they still managed to get subscribed fully somehow.

I’ve been trying to look up the bid details at various price points, but didn’t find that info yet, if you guys see it anywhere please send it along my way. I think they only reveal it once the allotment is fixed.

The thing is that it looks like what Loney is saying is correct, but that may just be because we’re so close to the MOIL issue closing that our judgment is influenced more than it should be by it. Let’s wait and evaluate a few other issues before coming to a final conclusion. Theoretically and based on practical experience it sounds correct, but let’s see if the numbers corroborate as well.

I appreciate the discussion and insight the three of you have brought to this topic. Thanks!

When there is too much attention on an IPO, even those who have applied for full application( 2 lakhs) wouldnt get a great amount of profit as the allotment ratio is going to be very low.

In investment you always get to gain more by tracking stuff that is ignored by the masses.

Ideasmoney.blogspot.com

I had applied for 289 shares of MOIL but not allotted any

Hi

I don’t think that every body has been alloted as i have applied for 15 lots i.e. 210 shares but not a single lot has been alloted to me 🙁 so best luck to other’s subscriber.

Thanks

Dharmesh

Panjab and Sindh Bank IPO is also likely to be oversubscribed similar to MOIL. Most people are again going to be unhappy as they are either not going to get any shares allotted or only a few – not worth their efforts and money they put in. Can we draw some lessons from MOIL allotment and subscribe P&s Bank IPO more judiciously?

May be we donot subscribe at all or subscribe upto 1 lakh or go all the way upto 2 lakhs?

it is a good issue, difficult to leave!

your expert opinion is appreciated.

thanks

Well my opinion has not changed since I wrote this post, and it still remains that you can use IPOs to initiate positions in fundamentally strong companies, but in this environment there’s not much more to be expected from them.

Hi Ramesh,

Just thought will leave a reply to your point.

In my opinion lot of people are disappointed with the MOIL allotment numbers because of a wrong hypothesis. They think they had applied for 2 lac rs and got shares worth only 6k odd.

I want you to look at the issue from a different perspective.

Most of the retail investor made their application on the last day of subscription. By that time it was very obvious that this issue is going to be hugely oversubscribed and allotment will most probably for 1 lot only. So, effectively their exposure to risk of capital was only to the extent of 6k odd. The rest of the money was any way going to come back safe into their account after 10 odd days.

Now assume the best case, say the issue gains 50% on day of listing and short term player sell their shares. They effectively make 3k odd on an investment of 2 lac rs for a period of 15 days. i.e., 1.5% in 15 days or 36% annualized. If you additionally consider that in this the risk of capital was only 6k and take the opportunity (lost) cost of 8% for keeping the rest of 1.94 lac in FD then the equation is really not that bad.

Worst case scenario is on the opening day the share prices goes below the issue price and there is mayhem and short term players are not able to sell . Well in that case, they can hold it long term. After all it’s a good issue priced reasonably.

If someone wants to increase his odds of getting good allotment in an IPO then there are other issues like that A2Z which just ended and where retail participation is a mere 0.33 percent . Am sure one could have got total allotment of 2 lacs 🙂 So, the risk to the capital is to that extent.

So, the point is when the thing on offer is good we have to share it with all just like Amrit :). Whereas when the thing on offer is bad like Vish every one wants to avoid it. So, i don’t see any reason for disappointment. Rather am happy that i have a fairly good chance of earning a 36% annualized return on my investment of 2 lacs with risk of capital for only 6k. You won’t find many such instruments in the market. If you find any do let me know 🙂

Regards

Raja