Like the IDFC bonds post, there have been several comments and a bit of a discussion going on in the comments section of the SBI Bonds post as well, so I thought I’d take some of those questions and make a SBI bonds FAQ post here.

Listing with a premium

There was this interesting discussion about the bond listing at a premium and I myself know absolutely nothing about this, so I will paste Monu’s original theory and question, and then Arun’s response to it verbatim. Thanks to both of you for bringing this out!

Monu October 15, 2010 at 5:23 am Whether the Bond will list at a premium because as per Bond Valuation theory Bond Value is a function of interest rate. So they are offering 9.5% which is 2% higher than the rate offered on FDs by Banks so we will get 2% higher for 10 years, which if we discount it @7.5% we will see its present value comes to around Rs 14 per 100. So I expect the bond to list @ 14% premium. So can anyone advise me whether I am write or wrong, because I have never invested in Nonds before.

- Arun October 15, 2010 at 7:12 am

Hi Monu,

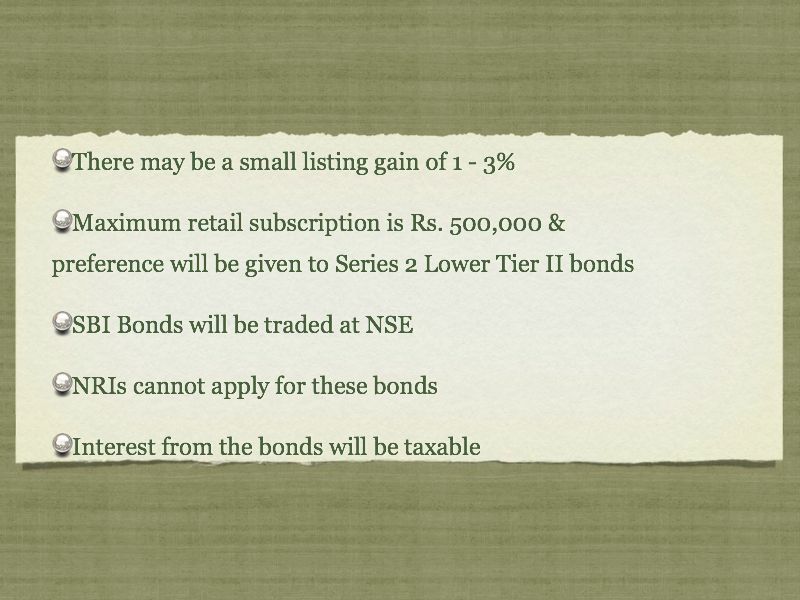

Your basic logic is correct. However FD are covered under deposit insurance while these bonds are not and this makes bonds more risky thus coupon rate has to be higher. In my opinion you will not get more than 2-3% listing gain on these bonds. Same happened with Sriram Transport NCDs (new ones) in May.

Arun

Maximum retail subscription and over – subscription

There is a lot of excitement around these bonds, so I won’t be surprised if they get over-subscribed on the first day itself. So, I thought Sameer asked a very good question about over-subscription. Here is that discussion.

Sameer October 16, 2010 at 3:57 am I understand the retail category applicants can apply for max. Rs 5 lakh. Now if I apply for Rs 5 Lakh on the 1st day , will I qualify for the first come first serve rule to be followed for allotment.

- Manshu October 16, 2010 at 4:23 am

That’s a good point. The bond is reserved 50% for retail, 25% for HNI and 25% for Corporates etc. If one category is left under-subscribed then their quota will be allocated to Retail, HNI and Corporate in that order.

If there is over-subscription – then from the applications received on the day of over-subscription – preference will be given to Series 2 Lower Tier II Bonds on a first come first serve basis, and balance will be allotted on pro-rata basis to Series 1 Lower Tier II bonds.

The relevant part is in page 160, 161 in the prospectus under Basis of Allotment, Issue structure for those of you interested in reading through it. And if anyone else has heard any different then let’s hear it.

Here are some other questions that you may find useful.

Can I trade the SBI bonds on NSE after it lists?

Yes, these can be traded after listing.

Where can I get the application forms, and can I buy the bonds online?

You can get the application from notified branches, and then fill it up there and submit it. To the best of my knowledge, there is no way to invest in them online, but if anyone knows otherwise then please leave a message, and let us know.

Can NRIs apply for these bonds?

NRIs can’t apply for these bonds as they fall under one of the ineligible categories.

Can you take a loan by keeping the SBI bonds as security?

The terms of the issue in the prospectus state that the bank shall not grant any loans against these bonds. Here is what it says:

In accordance with the RBI guidelines applicable to the Bank, it shall not grant loans against the security of the Bonds.

Will the interest from these bonds be taxable?

Yes, the interest income will be taxable.

These were some good points that came out from the comments on the earlier SBI bonds post, and if you have any more questions, then let’s hear them and try to get answers for them.

Click here to read the earlier review of SBI bonds

Click here to read the review of the IDFC bonds

Hi

IFCI Ltd. (BSE:500106 NSE:IFCI) has now come out with its Tier II Bonds Issue fetching 10.75% interest. The issue is quite similar to the SBI Bonds Issue. IFCI Bonds are going to trade on BSE upon listing, so though the duration of 15 years is quite long, liquidity will not be a problem.

Key Points of the Issue are:

> Interest Rate of 10.75% p.a. (15 Years) & 10.5% p.a. (10 Years), which makes the issue quite attractive

> Easy liquidity as the bonds are going to list on BSE

> No TDS

> Issue Size: Rs. 150 Crores with a “green-shoe option†to retain over-subscription

> Bonds will be issued in the Demat mode only

The bonds are most suited to those investors who want to earn better interest on their investments as compared to Bank Fixed Deposits. Issue opens on June 1st & Closes on July 15th but its expected that the issue will get closed much before July 15th as & when IFCI achieves its target.

To invest in IFCI Tier II Bonds (10.75% or 10.5%) or for any other info you can Call/SMS us at 9811797407 (For Delhi, Gurgaon & Noida).

SBI RETAIL BOND ARE EXEMPTED FROM INCOME TAX U/S 80

PC Jha: SBI Retail 15-year bonds DO NOT OFFER any kind of Tax Exemption under any section whatsoever. NO income Tax is deductible at source , ONLY IF, interest accrued during one financial year is less than Rs.2500.

Please see STATEMENT OF TAX BENIFITS(Pg 86-87) of the Shelf Prospectus. Investors are advised to conduct their own research before following any false advice.

For any queries, feel free to contact

Inderjeet Bhatnagar

Goldleaf Investments

(022)6550 4550

Thanks again Inderjeet. And I also want to point out that this post is about the older bond issue.

No, that’s not right as already pointed out.

In case of HDFC Securities, I recieved email saying that I can buy from IPO/FD Section, but same thing, it is now listing there. IDFC and L&T Finance is displayed.

ICICI direct is offering to buy this bond online.

There is a ticker running on ICICI Direct on the top that says that they aren’t able to offer this issue.

Something like: “Due to last minute information from issuer / BRLM, SBI Bonds are not available for sale through internet…”

They are able to offer IDFC and L&T Finance but not this.

where can i get the application forms and where to submit the same for sbi bonds? Can I apply online through ipo sections of online trading plat forms? Pl clarify earliest. Thanks

Satyanarayana cell nr 9845447498

Try your SBI branch, they should have it. I don’t think you can apply online for this.