The dates for the Hindustan Copper FPO have been declared recently, and this issue is going to open on 6th December 2010, and close on the 9th December 2010, and I thought I’d do a post with the financials, capital structure, and a brief summary of what it does now, and update the post when pricing is out later.

Like several other disinvestment companies, Hindustan Copper is also the only player in its field and is a commodity company.

Hindustan Copper is the only copper ore producing company in India, and has access to over two – thirds of India’s copper reserves. The company mines copper ore, is engaged in concentration of copper ore into copper concentrate, and also does smelting, refining of copper ore into saleable products like cast wire rods, wire bars, and copper cathodes.

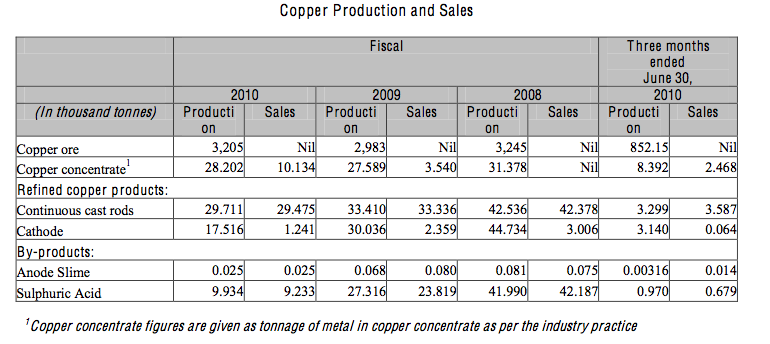

Here is a break up of Hindustan Copper’s key production and sales volume for the last three years from its red herring prospectus.

The prospectus goes on to state that the company’s primary product will be copper concentrate rather than refined copper products in the future as they plan to expand the production capacity from 3.21 MTPA to at least 12.41 MTPA by the end of fiscal 2017.

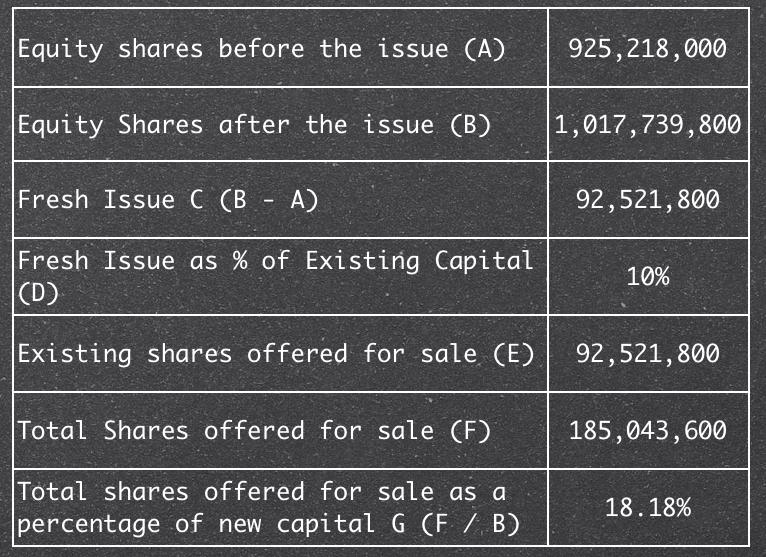

Hindustan Copper FPO Issue Structure

This FPO consists of fresh issue of shares as well as existing shares from the government which means that part of the proceeds will go to the government, and part of them will go to the company.

The way the issue has been structured is that the government is going to sell 10% of the existing capital, and the company will issue new shares which will be equal to 10% of the existing capital. So, half of the money from the proceeds will go to the government, while the other half will go to Hindustan Copper. Here are the details.

Hindustan Copper Financials

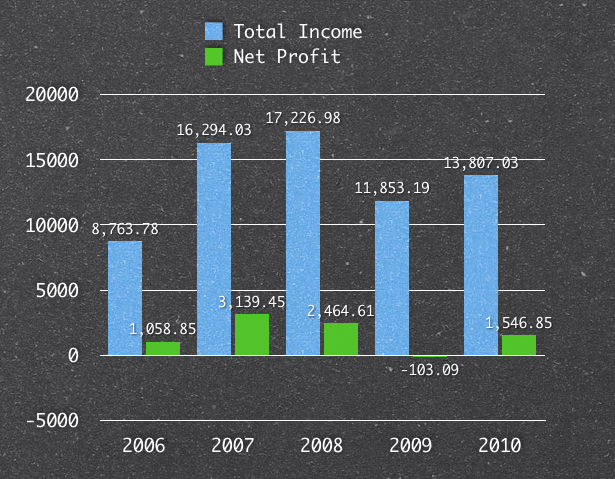

The revenue of the company has grown from Rs. 10,537.59 million in 2006 to Rs. 14,298.48 million in 2010, and the company has been profitable in these years except for 2009 when it had a net loss of Rs. 103.09 million.

Here are the details of revenues and profits in the last few years in Rs. Millions.

The EPS was Rs. 1.89 in 2010, (0.37) in 2009, and Rs. 3.24 in 2008. The stock was traded at Rs. 312.00 in NSE last Friday. The pricing for this issue is not out yet, and I’ll update this post when the pricing of the issue is out.

hey i have a question if someone can answer. why some one will invest in zero coupon bonds when they don’t offer interest on them. i want to know the vision of company behind issuing Zero-coupon bonds.

hey

i have a question in respect to the post of 5th Jan

Dividend Declaration, Ex Dividend and Record Dates.

why’ll the share will lose in value as soon as you hit the Ex Date ???????

what is the reason behind your statement.

Hey, I’m curious to know why you didn’t leave this comment on that post itself? That way others who come across that post will benefit from the discussion.

please reply….

i need ur help…

Is this for an exam or something?

The post is published now, you can see it on the homepage.

hey manshu!

thanx for the reply…..

but it is still not clear…..

How do we come to know about the ex-dividend date of a particular stock. Is there any source for list of ex-dividend dates of different stocks?

Let’s suppose the company is going to payout the interim dividend in Jan or Feb 2011.what would be it’s ex-dividend date?

How much the gap would be in b/w ex-dividend date and announcement date?

Do the ex-dividend date comes after the announcement date or before?

Please explain the whole concept with example.

Ex-Dividend date

Announcement Date

Dividend Payout date

hey buddy!

what is the eligibility criteria for availing dividents in some large cap stocks.

These companies usually pays divident in two phases : interim & final divident.

So my question is …..do i need to hold these stocks for whole year or i can simply enter into these before the expiry period after divident announcement ?

please clarify this?

So the deal with that is Sourabh that there is a date which for recording the dividend and shareholders who own the stock on that particular date get the dividend. After the dividend has been declared, and recorded – the share price goes down with the amount of the dividend and the stock is called Ex-Dividend – you might have heard of that term.

So you don’t need to hold the stock the whole year to get the dividend – only on the dates when the dividend has been declared, but then on the very next day the stock price will decline by that much.

HINDUSTAN COPPER MY BEST STOCK, AFTER THREE YEARS THIS STOCK RS.2000 KE AAS-PAAS HO SAKTA HAI ? AND ANOTHER COMPANY SESA-GOA,STERLTE IND GOOD BUY YOUR ACCOUNT,ANIL AGRAWAL GOOD AND WHAT LARGEST RICHEST MAN. …BHASKAR CHAVDA VAPI GUJ.

STERLTE IND THE DIRECTOR ANIL AGRAWAL JUST TAKE OVER TO HINDUSTAN COPPER(HCL) BUT ANY TIME THE CIMPAMY BUY , HINDUSTAN ZINC + HINDUSTAN COPPER = STERLTE INDUSTRIES. FROM :- ASIF KOTHARI …VAPI..GUJARAT

HINDUSTAN COPPER largest copper mines caompany in the india. after 3 years ago HCL price Rs.2000.

thanks Manshu,

but i think that these banks have no branchs in dubai .

what shall i do ??

Most of these guys have an option of filling up an online form Hossam, so I’d say apply online for two or three banks that you already have some relationship, and have them contact you. Like for HDFC I found this link that you can use to contact them online: http://www.hdfcbank.com/nri_banking/investments/mutual_funds/mutual_funds.htm

I’ve actually not done this myself, so I’m not very clear on the process, but based on the info I see I would go ahead and do this.

thanks very much you where realy so helpful .

You’re welcome Hossam.

hi , i am form dubai UAE and i am thinking of having investments in the indians stock markets as well as in other financial markets (specialy in IPOs and FPOs) but there is always a problem that i face to do such investments which is the lak of information . i spend alot of time searching for the information till the opertunity runs away . ex for the FPO coming for Hindustan cooper i dont know where can i do the supscreptions and how ?? please if you can help me to give me the guidens or the way i can make such investments reply . also i am facing the same problem in other markets like china , europ , and usa . can any one help me .

thanks

Hossam, I think the first step in your case must be to set up an account with someone like HDFC or ICICI or somebody to get started, and open up the necessary accounts – trading & demat, and a bank account linked with them, so that you have the setup ready to invest. That will take a few days, but will ensure that you are ready the next time you see an investment opportunity you’re interested in you have a better chance of getting it.

You could talk to the bank you already have an account with to get started.

The proposed follow-on offer of Hindustan Copper will not hit the market in December. Fresh issue of equity, is likely to happen after January 15, 2011. Anyways i have looked at the graph which is present in the article and came across couple of points…in FY’09 company had a net loss of Rs 103 Cr (probably because of recession) and on top of that for one of the products i.e. Cathode (under refined copper products) sales is 1/8th of the production..this means they may have lot of inventory which can further add burden on their profitability..

Thanks MS, I think that was due to the recession too, and it is after all a commodity company whose fortunes are more closely tied to the economy than others, so that is probably it.

and FPO will give discount for retail.. latest trend.. so was waiting to see what they will put on table 🙂

oh yeah, there is a discount of 5%. Let’s hope for the best.

I am eagerly waiting for this one. Thanks for always collecting all this information. Your blog rocks.

Thanks a lot!

Do you already own some of this stock? Why so eager for this one in particular?

One of the PSUs I wanna have in my portfolio.