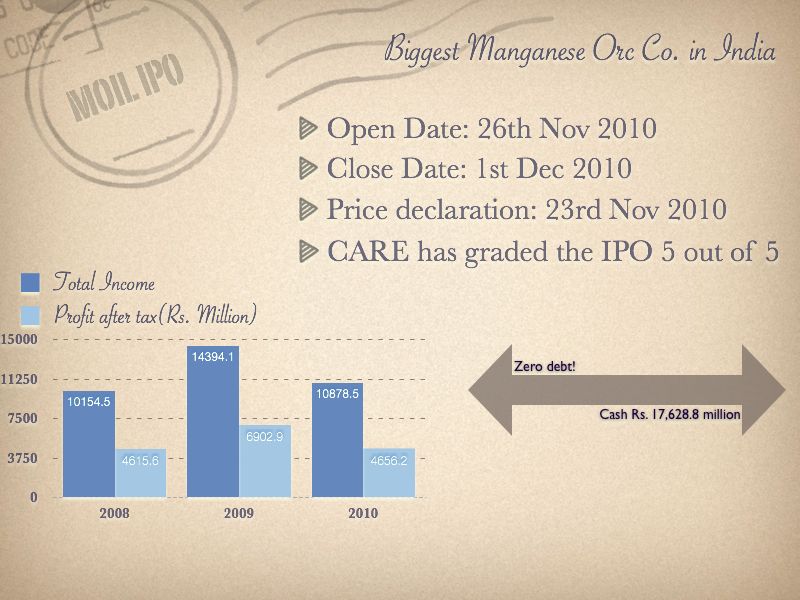

MOIL IPO price band was declared between Rs. 340 – 375, and the IPO will open on November 26th 2010, and close on the December 1st 2010.

MOIL is a Mini – Ratna engaged in mining Manganese ore which is used for desulphurization and strengthening of steel, thus making it closely tied with the steel industry.

Of the total land based manganese ores in the world – South Africa accounts for a whopping 75% followed by Ukraine which has 10%, and then Australia and India which have 3% each.

The Indian manganese reserves are estimated at 378.6 million tonnes and Orissa has the bulk of them with 40% of the reserves, and Karnataka comes second at 22%.

The domestic steel demand has doubled between 2002 and 2010, and CARE research expects it to grow by 9.2% CAGR from the year 2011 – 2015. In fact the demand for manganese ore has turned India into a net importer of the ore in the last 3 years. India is in fact the fifth largest producer of steel in the world, and the need for infrastructure and economic development in the future will only mean that the demand for steel goes up.

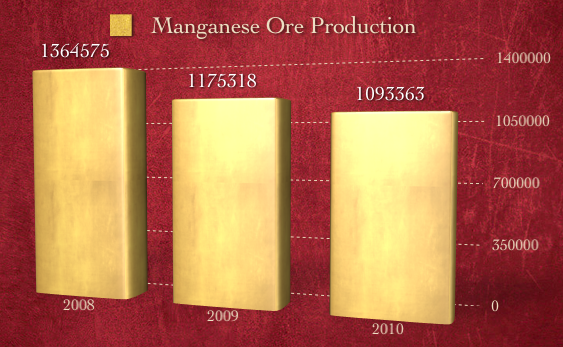

MOIL India is the biggest producer of manganese ore in the country, and produced 1,093,363 tonnes of Manganese ore in 2010. This amounts to about half of the manganese ore production in the country.

They operate 1o mines currently, and a look at the volume of ores mined in the past few years shows a that the numbers have actually declined from 2008 – 2010. In 2008 MOIL mined 1.3 million tonnes of ore, which came down to 1.1 million tonnes in 2009, and 1.09 million tonnes in 2010.

I’m not sure what the cause of this decline is, and I couldn’t find any reference of it anywhere. I wonder if I’m just reading this wrong, so I’m pasting the relevant para from the prospectus here:

We were the largest producer of manganese ore by volume in India in Fiscal 2008 (Source: Indian Bureau of Mines, Indian Mineral Yearbook 2008). We produced 1,364,575 tonnes, 1,175,318 tonnes, 1,093,363 tonnes and 516,749 tonnes of manganese ore in Fiscal 2008, 2009, 2010 and in the six months ended September 30, 2010, respectively.

The company had a total income of Rs. 10,154.5 million, Rs. 14,394.1 million, Rs. 10,878.5 million and Rs. 6,924.9 million in Fiscal 2008, 2009, 2010 and in the six months ended September 30, 2010, respectively.

The profit after tax was Rs. 4,615.6 million, Rs. 6,902.9 million, Rs. 4,656.2 million and Rs. 3,315.0 million in Fiscal 2008, 2009, 2010 and in the six months ended September 30, 2010, respectively, or 45.5%, 48.0%, 42.8% and 47.9% of the total income in those periods.

The EPS for 2010 was Rs. 27.72, which was down from Rs. 41.09 in 2009, and about the same as the Rs. 27.47 EPS earned in 2008. The EPS for the six months of this fiscal was Rs. 19.73. The dip in the EPS is because the number of shares issued, subscribed and paid up increased from 28 million on Sep 30 2009 to 168 millon on Sep 30 2010.

As of September 30, 2010, the cash and bank balances were Rs. 17,628.8 million and they had no debt.

The company has 168 million shares outstanding so cash per share amounts to about Rs. 105.

MOIL Limited has positive cash from operations in each of the last five years, and they even had a positive cash from investing of about Rs. 1 billion in 2010 when they earned Rs. 1.2 billion as interest on fixed deposits!

The total outstanding shares of the company are 168 million, and it is offering 33.6 million shares in this IPO. A lot of you are interested in knowing if the company or the government gets the money in these disinvestments, so let me state that in this particular case there are no fresh shares being issued, and all the money raised from this IPO will go to the state and centre government. The company will not get any money out of this IPO.

The price band of the MOIL IPO is between Rs. 340 – 375, and price will ultimately be finalized using the book – building process.

CARE has assigned a grade of 5 out of 5 to MOIL which indicates strong fundamentals, and finally MOIL Limited is one of the companies in which retail investors will be allowed to invest up to Rs. 200,000 which was recently increased by SEBI.

Also read MOIL IPO Subscription numbers.

Urgent request please !!

Need Min Lot size for MOIL IPO i.e 16 Shares or 17.

application amount will Rs. 375×528 = 198000/- for 33 lots or 375×527 = 197625 for 31 lots.

Please rush on my E mail

17.

The reduction in the mining output for the company for years 2009 and 2010 was directly because of the lower production of iron in India. Globally also, the production of steel was reduced and as you already mentioned, the majority use of the mineral is in the steel industry. However, with the expansion plans of SAIL and other steel majors, the steel production is set to increase (almost double) in the next 2 years.

Thanks for the comment Puneet, so the reduction was due to macro economic conditions, and nothing specific to the company, which is what I was wondering about. Thanks!