How much insurance do you need?

One of the questions that came up a few times in the last term insurance post was how much insurance should you get and Hema wrote a comment with a rule of thumb that states you need about 10 times your annual salary.

That sounds reasonable enough to me and I wouldn’t want to get into an analysis paralysis with determining how much insurance I need because term insurance can be bought without spending a lot of money, but I did want to share the way I thought about it, and see what feedback I can get.

Do I Need Insurance?

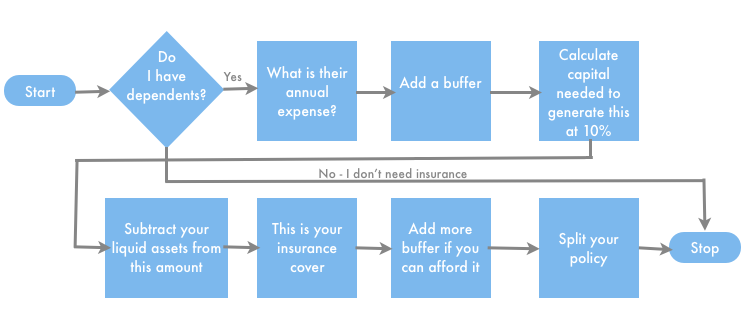

The first thing to do is to determine if you need term insurance at all or not. The answer to that is straightforward – if you have people who are financially dependent on you then you need term insurance, else you don’t.

If your parents are not financially dependent on you, your spouse is working, and you don’t have kids, then I don’t really see a need for insurance.

But, if someone is financially dependent on you then you need to take out insurance.

How Much Insurance Do I Need?

So, once you determine that you need insurance, the next step is to think about how much insurance you need. One way of thinking about that is to think of your dependents and their annual financial needs, then buffer it up by 20% or so.

For example, say you determine that their annual expense will be 5 lacs, so at a 20% buffer you need 6 lacs per annum. To generate 6 lacs per year you need capital of 60 lacs assuming the investment can generate 10%.

Then think about the assets you already own – your savings for retirement, any real estate (apart from the house you live in), jewelery, or whatever you think can be practically cashed in.

Subtract that from the capital amount, and you will get a number that you should have cover for.

I expect that most people will be able to do this calculation mentally and it shouldn’t take more than 5 minutes or so. In my opinion this will be a good ball park in terms of  your term insurance need and can get you started.

This kind of thinking is better than having no framework at all, but the only thing I’d caution you against is that this calculation doesn’t take into account escalating costs.

So, you could say that your family’s expenses will rise significantly once your children start going to school, and this method doesn’t take that into account. Or if inflation continues to be high then this method doesn’t protect your family many years from now as well.

If you feel that’s the case, then get more cover – how much more depends on how much more in premium you’ll be able to afford. No point in talking about cover without thinking about premium – just like risk and return.

One last thing about this is to bring to your notice this insurance calculator I found which allows you to input a lot of parameters and seems quite exhaustive. You can play with it and see if it gives you a reasonable number.

How many insurance policies should I buy?

In my last post I expressed my preference on buying two different insurance policies, as a means to hedge risk and quite a few of you pointed out that it doesn’t make sense because there is no chance of a claim getting rejected if all the information provided upfront is accurate and honest.

I understand this point of view, but would rather stick to two policies because there will always be some things that you don’t know that you don’t know.

There are things that you know you don’t know, and then there are some things that you don’t know you don’t know.

For example – you buy an oil ETF that tracks oil prices by buying future contracts because you are bullish on oil. You know that this ETF will not be able to track oil 100% due to expenses or other tracking errors, so this is a known – unknown, but you don’t know that you don’t know big institutional traders can game the system because they know this ETF has to square off its positions every month end, and that eats your profits big time.

So you are hit by a factor that you didn’t even know existed.

That’s primarily my reason for buying two policies – what if the cheaper company goes bust, who is liable then? What other things don’t I know about this?

Obviously not everyone is so risk – averse (or cynical?), but that’s my rationale for two insurers.

Those were my thoughts on whether you need insurance, how much you need, and how many policies you should buy. Time for your thoughts now.

excellent article.

i prefer assuming a 6 or 7% return on investment rather than 10%, which i feel is too optimistic. More so because it’ll be my spouse who will have to manage money, if i die. And she isn’t very investment savvy.

The formula i have used is this:

Sum assured required = (90% of annual expense / 0.06) + (principal amounts of loan outstanding) – (liquid assets net of taxes)

Thanks for your comment Sumant – that makes a lot of sense – especially the part about adding liabilities – that’s something I completely forgot about.

Thanks!

if you look at the developed nations, the interest rates they have is around 2%. in 30 years from now we’ll be more like Japan, with huge population retiring.

now if you are planning for 30 years, my guess is that we can expect 8% average for 1st 10 years, 6% average for next 10 and 3/4% for last 10. if we consider the term insurance getting triggered 25 years from now, or if you are planning for old age (for 10 years After 25/30 years), we should consider 2% during old age.

this has following implications :

* after 30 years, we can’t have lumpsum and use the interest for daily expenses as a strategy. we may have to use the principal itself. unless we have HUGE lumpsum.

* the money would grow fast in first 10/15 years. which makes it the right window to invest more. thats good – higher returns earlier in cycle is better than higher interest later in cycle.

Manshu, while calculating how much insurance we need another thing which we need to factor in is how much liabilities we have, like Sumant’s formula states. Since if we just calculate our annual exp and arrive at an insurance amount. When something happens to the bread winner, the family ends up giving all the insurance money to pay up the loans etc.

Also, IRDA regulates all insurance cos regarding coverage, riders, investments etc so chances of any insurance co going bust is as much as the other. But then, if you are paranoid enough and want to feel safe get one policy with LIC. LIC is wholly owned by Government of India and was established under LIC Act 1956 according to which Govt of India will be giving sovereign guarantee for the Sum assured and Bonus promised, for the policies sold by LIC. This means that if you buy a LIC policy, there’s 100% assurance that you’ll get whatever minimum benefits guaranteed, even if LIC goes bankrupt, which other cos can’t guarantee.

Yes Hema – that’s a great point that both of you bring in and something that I completely missed!

All these companies publish their balance sheets and their financial health is different from one another. IRDA regulation is not equivalent of solvency. That might be a topic for a future post.

good flowchart manshu. i would also prefer to consider inflation here which may eat sum assured money.

As a buffer, if we can add little more should add mediclaim insurance yearly premium. so incase of hospital exp they would not end spending insurance amount in medicals, which have been only calcualted including their expenses & future responsibilities.

How will you incorporate inflation is the question? Unless you know when you’re going to die, that might be a problem 🙂

manshu i was expecting this query.

How do we consider inflation during our investments, till the end of plan duration. same every insurance policy also has ending term.

is that right my thought ?

Term of the policy can go anywhere from 5 to 35 years or even longer I guess. And usually you do tend to take life insurance for longer durations. So calculating inflation 20 years down the line or 35 years down the line may not be that good an idea.

Personally, I would take a policy based on today’s needs and then re-evaluate that every 5 or 10 years or if a major life event happens. That to me is more practical than trying to incorporate inflation right from the very start.

I’m open to ideas – not analysis – paralysis kind though 🙂

i think…this is a great post….and this helped me to decide my insurance amount….i am going to take term plan and cancel two of my existing LIC policy….beacuse it is simple truth that insurance is not investment…

Thanks Ujjwal – so you had ULIP type insurance from LIC?

Dear Ujjwal according to me term insurance is some kind of fixed investment where you can go for 5 to 35 years.You can go for BIRLA SUN LIFE VISION PLAN which gives you 9% or more interest + Bonus + up to 20Lk coverage.So invest 2ooo p.m. and get more than 66 Lk at the maturity.stop paying premium after maturity still your coverage will be there with you till life time.I will Suggest you that not to go for ULIP plan which includes mutual funds and mutual funds is very risky because it is subject to market risk so you may lose everything.Go for SIP where you will get fixed return.If you want to know more then please contact-9172177038

@Amit

“according to me term insurance is some kind of fixed investment”

You lost me there, mate. Term insurance is risk cover. Just what Insurance is supposed to be.

Repeat after me.

Insurance and investment are two different things.

Insurance and investment are two different things.

Insurance and investment are two different things.

…..

Like chalk and cheese.

As to the Birla plan you are peddling, are you saying that there’s a 9% COMPOUND INTEREST guaranteed on the FULL Premium + bonus + 20Lakh life cover irrespective of age and health conditions ?

And after maturity, this becomes a whole life plan.

I also notice that this product doesn’t invest in the market. So no equity allocation. Means, it is generating this phenomenal guaranteed returns by investing in bond products only!

I doubt any of this is true. But if it is, I’d like to invest all my life’s savings into this plan. This is no bluff.

That was awesome Sumant 🙂 I could’ve never done that!

We reviewed this “Visionary” plan from BSLI… i doubt if this poor agent even knows what he is selling.

The plan sets a “monthly” additional rate. and the product’s T&C says “All terms & conditions are guaranteed throughout the policy term, except for the Monthly Addition Rate which will vary from policy year to policy year depending on prevailing economic conditions.” So while, we do not know where our money is going, it is still mysteriously governed by market conditions…lol

For most consumers, its best they buy a pure term plan and then opt to invest in any asset class ranging from Tax Saving FDs to gold to derivatives depending on how adventurous one is!

One other thing, if investing 2000 per month one can get 66 lacs at maturity, we will need to invest this amount for 36 years at 9%.

We agree with Sumant:

Insurance and Investment are two different things 🙂

Feel free to leave a link to your review in the comments if you feel that it will advance the discussion and be of use to the readers.

Manshu,

I heard that 10 times your annual salary is IRDA limit. is that right? if it is, how is it even possible for an insurance company to know what is the annual salary of an individual?

Aakash – I’ve never heard or read about this limit, and I don’t think it makes any sense for the regulator to impose any insurance limit.

Insurance companies ask for income proof along with the proposal form. I think upto a small amount of life cover, they don’t bother. But the moment, the total life cover exceeds a certain value (may be 3-4 lakh), the insurance company asks for income proof along with the proposal form.

This is part of the “Moral Hazards” guidelines from IRDA. This is not a strict rule. IRDA gives leeway to the insurance companies on the maximum amount of life cover the company would like to provide.

Imagine, a person earns 1 lakh a year. If life insurance company gave him a huge life cover (say 1 crore), he becomes more valuable DEAD than ALIVE to his heirs. And this can be interpreted as a moral hazard.

From the insured person’s point of view, there’s no point taking more life cover than is necessary. It’s a waste of premium. Ten times annual income is a reasonable thumb rule.

In short, there is such a limit. It makes perfect sense both for the insured and the insurer to stay within the limit.

Hi Sumant,

Do you have any link to this IRDA Moral Hazard Guidelines? I’ll be interested to read it.

Hi Manshu,

We have some experience in this space. Our feedback, there is no defined code from the IRDA on the quantum of cover. However, every insurer to back your initial view point has an internal thumb rule of providing not more than 10-20 times your annual CTC as life cover. This can extend marginally higher with high income individuals as in the case of term insurance, premiums are not very expensive.

You can compare on our open platform to get a gist of rates across 10 lacs to 5 crores. The premiums are astounding. For a person who earns say 30 lacs a year in salary at age 30 (implying 2 lacs a month in gross salary), a cover of 5 crore would exceed 10 times salary, however, the premium would be around 40-60,000 per annum!! This is for a 30 year plan.

There is a similar rule followed even in the banking industry where banks disburse loans based on your income. The EMI is typically capped at around 75% of your monthly take home on a total EMI payout basis (so if you already have another loan for a car, personal etc, bank will disburse based on whats left of what they feel you can pay).

To validate all this, insurers and banks ask for income proof, one needs to submit payslips/ ITRs/ etc, to secure the policy, failing to meet this scrutiny, insurers tend to reject the application.

Please note that all this typically comes into picture when the cover exceed 5-10 lacs. At 25 lacs and above it becomes all the more stringent.

Thanks for your comment, 5 cr cover for 40,000 per annum sounds okay to me, does that sound very high to you?

One of the thumb rules for the amount or insurance can be that a particular level of income should be maintained for the family even when its breadwinner is not around. Suppose a family’s present needs are Rs 40,000 p.m. The extent of life insurance for its earning members should be such that interest income from the sum assured can meet the family’s monthly expenses of Rs 40,000. If one also wants to provide for the future fall in the purchasing power of rupee due to inflation, one must necessarily take policies for higher amounts. You also get tax benefit for the premium paid under Section 80C.

Hi, Excellent article but i have done a mistake i think. Some agents approached me with the birla sunlife vision plan and i promised to invest 6999 per month / approx 25 lacs over a period of 30 years. As per the calculations verified 4 times online, on website and with the agents, i calculated an insurance amount of approx 25 lacs with a maturity sum of approx 1.05 crore. I have just subscribed to the policy and i can chose to loose the amount…..Please advise.

Can anyone chalk out how LIC Jeevan Saral Plan is different from regular Recurring Deposit Plan available at any banks.

Dear Sir/Madam,

Right now I am having four different ULIP policies from four different companies. All Policies are more than 5+ years old. The total sum assured of all the policies are 4, 75,000/- and my annual income at present is 9, 00,000/-

Recently I came to know that sum assurance of the policies should not cross 20% of his annual income, for salaried person. Please confirm me.

(1) If the above statement is true, then I crossed the limit, what I have to do.

(2) Due to lack of knowledge I have not disclosed my policy to any other insurance companies, if I want to disclose now, is there any harm for me.

Please clarify

Regards,

Sai Kumar

@SaiKumar

1) Is is the total sum assured or total premium paid?

I m sure the rule is applicable for the yearly premiums and not for sum assured – so you are good to go.

2)not Disclosing is a suppresion of facts and this is a violation according to Insurance Practice.

I m not sure of the implications of disclsoing the details after 5+ years.

Finally why dont you go for a Term insurance ?

Hello Manshu,

Thanks for the excellent article which actually clears some obvious doubts but i am left with one important question. Please do answer.

My question is — if a person have 5 LIC policies (not the term insurance) generating a sum assured of 17 lacs. And now he want to opt for the term insurance of 1 crore. If all the earlier LIC policy details are mentioned at the time of opting for the term insurance then

Final AMOUNT to be given to nominee = (sum assured by term insurance i.e. 1 crore) – (total sum assured by earlier LIC policies other than term policy i.e. 17 lacs) == 83 lacs ??

Is there any impact of SUM assured of other LIC policies on the sum assured of the term insurance?

Thanks in advance for the important answer.

I haven’t encountered this problem in real life and I don’t know this 100% but I think when you declare other policies then the final payout gets added and you get whatever is the sum total. It doesn’t affect other policies.