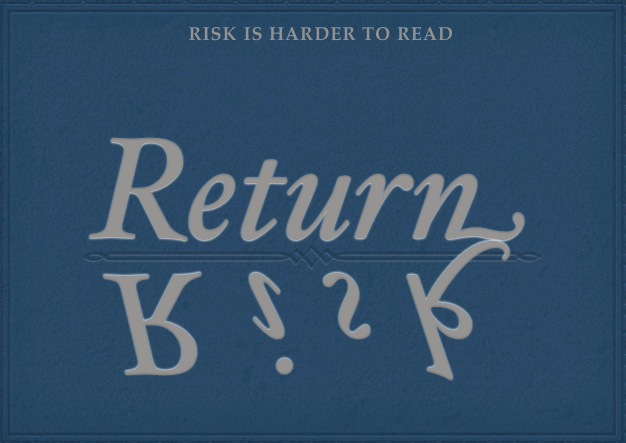

Risk is harder to read

Almost every other day there’s a comment from someone who wants to know what the best investment is – one that will give him the highest return.

There’s no inquiry about risk, and that’s not surprising because people new to investing don’t really understand or even think about risk. It’s only after you’ve burned your fingers a few times that the concept begins to sink in.

Talking about return without talking about risk is meaningless. If you’re going to go after high returns know that you’re taking a greater risk as well.

If you buy debt backed by the US government you will get very little by way of returns but it’s very unlikely that your investment goes to zero.

If you buy a penny stock then it might double next year, but then there’s a very real chance that it halves as well.

So, that’s the simple message I want to convey with this post, and this image which I’ve grown quite fond of in the 15 minutes of its existence.

If you hear someone talk about returns without talking about risk – tell him his folly. And please do share this picture with people new to investing, and others who you think will benefit from the message.

I like the image very much! Conveys the message very appropriately!

A very good message Manshu, this reminds me of a story I read in valueresearch about a small time investor who could only save Rs.1500 per month and was very particular that his money be safe and the investment advisor had to convince him hard to invest in SIPs. After his regular systematic savings, the investment has become substantial. Now, this guy wants to withdraw his nest egg and speculate in silver ETFs. His take is that he missed the initial run on silver and he does not want to miss the rest. So, this proves that irrespective of how much people have or what strata they belong to, greed has no barriers. Once people have money they want to speculate not considering the risks and there are some who want to borrow and speculate even if they dont have the money.

I hope the guy is young because he will need time to re-earn what he’s surely going to lose in all that trading business.

Nice post Manshu! Simple yet effective. While amateurs make an investment thinking about potential returns, professionals make an investment calculating the potential risk.

A point every investor should have in mind at the time of investment. Image you created is very nice I like the most. Thanks for sharing.

very well written. Unfortunately, it seems human brains are not wired to understand risks and probabilities well. I once saw a man riding a bike in the wrong side of the road with no helmet while covering his face with a (dirty) hanky to prevent swine flu. I stopped him and asked him if he knows he is more likely to die of head injury in an accident than catching a swine flu. And he was like “huh”. It took me a long time but with a lot of difficulty, i have managed to learn to ignore any statement that talks about investment returns without the context of risk.

That’s a good example Sumant – thanks for sharing!

Risk is harder to read !

Your pictoral represeantation is simple to understand it’s significance !!

Well I can relate with every iota of this article.

My dad has always been equity averse because all he has see is people losing lots of money. Accoriding to him equity = gamble.

When I started earning my sister introduced me to mutual funds and given my passion for numbers I was obviously interested in going one step further and learn about direct equities.

Given I had no one to guide me, I looked at it as education oppurtunity rather then investment oppurtunity. I set aside fixed amount and told me its my fees for self learning equities.

Though i started in 2007, you bet that I have paid full fees and saved nothing not even a scholarship for being a good student (which I guess I never was). 🙂 But yes I learnt the lesson of risk very well. Now when I see people doing SIPs or buying equities with money meant for short term goals, my heart aches.

On the other hand my personal experience says, own actions will teach better then someone’s else preaching. So I let it be.

I know of a couple, who always stayed away from equities because its way risky. Then 2007 BULL run forced them to change their perspective. In 2008, they did all tax saving through ELSS and need I say more. Few days later, girl told me that she has worked with a broker company for 3-4 years. And couple also sweared that they will never ever get into equities again. I am quite hopeful that they will ( and infact many people like them) will return to equities after another solid BULL run of few months.

I just hope atleast some people who already don’t understand risk quite well get inspired to learn about it after reading your post.

I see that happening quite a bit – people enter the market at peaks, lose money, exit, then enter again at slightly higher levels and bang the market follows its cycle and the same people lose money again. Then they somehow manage to blame investing and think that trading will solve their problems. You know of course how that ends up.

Unfortunately, a lot of people go from one mistake to another without getting direction.

Oh and I just realized my comment size is quite similar to original post size. I am sorry for that.

But your posts always make me write a big comment because they are simple to core and very thought provoking.

You’re one of the long time OM readers and every time I read a comment from you I’m delighted. I feel that you know a little bit more about the evolution of the blog and my personal philosophy to appreciate my thoughts better than new readers and the fact that the site has held your interest for so long is an encouragement for me as well.

Thanks so much for all your lovely comments!

Hi Manshu,

Small post but very important for every investor

Yesterday someone told me that one company recently picked money through corporate FD @ 24% pa.

Few months back Future Venture shares (privately changing hands before IPO) were bought & sold at 40-60 rupees. Promise of doubling the money with IPO listing 🙁

I think clients are clearly at fault in both the cases – they should understand the kind of risk they are taking.

That must be a tricky situation for you to handle esp. with people who haven’t lost money doing this kind of thing yet. What do you do in such situations?

Very creative way of putting the message across. Very often, we meet people who ask us tell us a stock which will double or even triple the investment within a year. And they forget the risk part. Part of the problem lies in they always look at Top Gainers on CNBC or other business news channels. And the images of abnormal gains start to get associated more than the videos of Top Losers.

—

Santosh Navlani

Yeah I hear that quite a bit again these days. People are out of their caves and looking to get adventurous again. I think it’s only a matter of a few more months before these people start giving you tips about stocks that are sure to double in the next six months 🙂