This is another post from the Suggest a Topic page, and today we’re going to review the recently launched IFCI Tier II Bonds. When I first heard of them I wondered if they had released another tranche of infrastructure bonds for this year, but that’s not the case.

These IFCI bonds don’t offer any tax benefits, and are like the SBI bonds that were issued earlier this year. They have a relatively longer time frame for maturity; will be offered in Demat form, and will trade on BSE thereafter.

I wasn’t able to download the prospectus of the IFCI bonds, so I won’t be able to get into as much detail as I went into with other bond reviews, and will focus on the information available on their website, with some thoughts on them.

The first thing that caught my eye was how high the bar was set on investing in these bonds. The minimum investment is set at Rs. 1 lakh, and that’s a fairly big amount for a retail investor to commit on just one bond issue. I don’t know why they would want to keep the limit so high, and I can only think that they don’t want to have a very large number of investors and feel confident that they will be able to raise funds even with such a high minimum investment amount.

This is a subordinated Tier II unsecured debt issue, and from what I understand these bondholders are the lowest in creditor hierarchy and will be wiped out before all other creditors of the company. This will of course only come in play in dire circumstances, but since there are banks that offer interest rates close to the ones offered by this IFCI bond issue, I don’t see any merit in allocating more than say 5% of your capital in just this issue.

Here are some other important details about the IFCI bond issue.

Open and Close Date of the IFCI Bond Issue

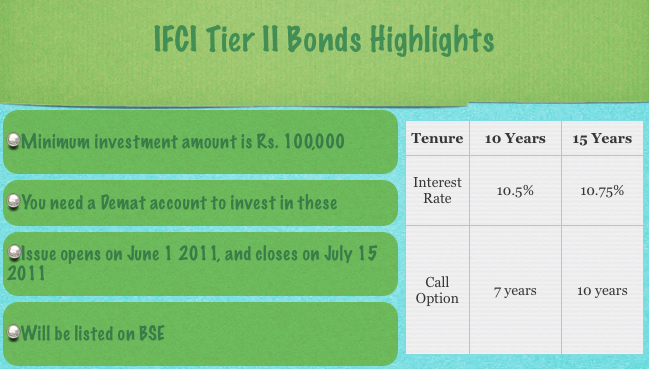

The bond issue opened on June 1 2011, and will close on the July 15 2011.

Minimum Investment and Denomination

The minimum investment needed is Rs. 1 lacs, and one bond is worth Rs. 10,000. Since the bonds will list on BSE shortly after they’re issued, you will be able to buy one bond for Rs. 10,000 from BSE. However, it is quite likely that the bonds trade at a premium at that time, so you will probably have to pay a premium while buying these bonds from BSE.

Interest Rates and Series of IFCI Tier II Bonds

You have 4 options when it comes to these bonds – you can choose the 10 year or the 15 year maturity period, and then within that you can decide whether you want the interest paid to you annually or you want it to accumulate and get it all at the end.

The two series have call options from IFCI – the 10 year one can be called at the end of 7 years, and the 15 year one can be called at the end of 10 years.

What this translates into is that if you chose to take the 10 year bond, and at the end of 7 years IFCI decided that they want to redeem the bonds – they will repay you the money, and not have to wait 3 more years for maturity. Same thing with the 15 year bond.

Since the bonds are traded on the stock exchange – you can sell them at any time at market prices, but there’s no guarantee what the market price will be.

Listing Gains on the IFCI Bond

Some of you will be curious as to what price will the bond list on, and if there’s any opportunity to make listing gains, and make a fast buck on them.

I have absolutely no idea how they’re going to list, and the only input I can offer here is that the SBI issue listed at about a 5% premium. (I have fairly strong views on this topic which can be found here)

How does this issue compare to fixed deposits?

As far as I know – there’s no bank that allows you to lock on to a 10.75% interest rate for 15 years, or even a 10.50% for 10 years.

Karur Vysya is currently giving 10.00% for 1 – 2 years deposit, but as the time frame goes up the interest rate goes down. There must be a few other banks around that range, but I don’t think anyone is promising you this interest rate for such a long period. On the other hand, IFCI’s unsecured Tier II debt, is riskier than a bank fixed deposit.

Plus, the minimum amount will take it out of reach of a lot of retail investors, and this is probably just the beginning of many more bond issues from other companies as well.

Conclusion

Ultimately, you have to see if this fits into your asset allocation and doesn’t expose you too much to just this one asset. Also, think if it makes sense for you to wait for it to list, and then buy it from the secondary market. That way you can invest a smaller amount, but may have to a pay a premium for it.

As always, your comments are welcome, and much appreciated!

Hi Manshu,

Thanks for the prompt response. I feel it really works for guys who want to take advantage of high returns over a long period of time. FD/FMPs have high returns but only for approx 2 years. And the interest will be taxed as per your tax slab .

Only NSD that comes close to this is Mahindra one.

Sriram

Really good discussion around the scheme. I feel its a good option if someone wants to allocate in a debt instrument over a time period. May be for those individuals who have already reached the cap of PF quota ( 70 K per year ). I want to understand the following :-

1) How credible is IFCI ? What is the rating given by agency – AAA,etc ?

2) Is the interest offered locked or will it fluctuate as per the existing interest rate in the market? For instance when the banks reduces their FD’s,etc

3) IFCI has 2 options ( for both 7 yr and 10 yr bond ). It is annual and cumulative. I understand that in annual interest payout would be a, and in cumulative , the entire interest would be given along with principle at the time of maturity. Thereforer, in case of cumulative, would the return become tax exempted under long term gains ? Is that right understanding ?

Hi Sriram,

1. IFCI is a fairly big company, and though this issue is unsecured, in my opinion this bond issue is more secure than some of the other ones being offered by smaller companies right now.

2. Interest rate is locked.

3. You have both options within both time series so you can select the one that you’re interested in.

4. No, the returns will not become exempted from long term capital gains. They will be taxed under the LTCG rules at that time.

Dear Manush,

I wanted to know one thing, that when these bonds will be listed on Stock exchange, will there be a different listing of Cummulative Payout Bonds and the non cumulative bonds.

Since for cumulative bonds the interest component will come to the person who finally get the redemption money and in the non cumulative ones interest will keep coming to the bond holder of the day. ie if i hold the cumulative bond for one year the value will be 11750, however the non cumulative bond will always get his interest in account.

The reason i ask this is because if there will be two seperate types of listing, can there be a benifit to the cumulative bond holder in a sence that, the bond value of the cumulative option will be including the interest and when we see the bond the whole amount in excess of rs 10,000 can be treated as Long term capital gain and there by attracting an interest rate of flat 10%.

Please if you can explain

Dear Vibhor,

Yes, the different series will list differently. Because the prices are different they take into account how much interest has been earned already, and what the value of the bond is at that point of time.

So, simply preferring a cumulative option to annual one will not put you at any sort of advantage, and the reverse will not put you at any disadvantage either.

Any thoughts on Shriram NCD . I think that is a good option.

Very attractive interest rates of upto 11.60% for 5 years and 11.35% for 3 years

In fact, I have a full post here: http://www.onemint.com/2011/06/22/shriram-transport-finance-ncd-review/

Yes, the rates are attractive; I won’t go as far as saying they’re very attractive because they are not that high when compared with the best fixed deposits you get these days 🙂

What will be the Tax implication on the 15 Year Bond with annual coupon interest ? Will there be indexation benefit ?

Hi Krishna,

Interest will be paid annually, and the face value of the bond at maturity will be the same as at the time of issue, so capital gains won’t arise.

So , interest will be clubbed with other income and perhaps be taxable in 30% bracket … in that case are the returns justifiable ?

“Returs Justifiable” or not ??… people have contrasting views on this but I think it scores higher over many Fixed Income products like Post Office Schemes (except PPF, especially in 30% Tax Bracket) & FDs. The effective tax-adjusted return in 30%, 20% & 10% Tax Brackets would be 7.43%, 8.54% & 9.64% respectively.

Yes, it’ll be clubbed.

Hi.. I think there is a possibility of Capital Gains even with “Annual Interest Payment” option, certainly not at the time of maturity but between the “Date of Listing” & the “Date of Maturity”. Gains, if any, made between 1 year of holding and the Date of Maturity would be LTCG & between the “Date of Listing” and 1 year of holding would be STCG.

Taxation:

> LTCG Tax: “10% Without Indexation” or “20% With Indexation”, whichever is ‘Lower’

> STCG Tax: As per the Tax Slab of the Investor

> Tax on Interest Earned: As per the Tax Slab of the Investor

> No TDS

Gains will be made if overall interest rate environment moderates and YTM of these bonds come below 10.75% or 10.50% as the case may be.

Please correct me if something is wrong somewhere in my understanding.

To invest in IFCI Tier II Bonds (10.75% or 10.5%) or for any other info, Contact us at 9811797407 (For Delhi, Gurgaon & Noida)

Hi Shiv,

You’re right on the money. I completely missed that scenario – I’m sorry about that and thanks for bringing that up. I might have to make a small post out of what you said.

Thanks again!!! All your inputs on this forum are much appreciated.

Rs. 1 lacs is not too high a barrier. You could always sell some part on listing. In case you have some spare funds, you can apply for 1 lacs and then sell some of it on listing. You get interest @10.75% for 1 month and then listing premium of say 2-3 % on the amount you sell. Not bad for money you may have lying around in your savings account

Very good information provided and learn lots of from reading a various comments.

Finally please give one answer, Weather to invest in these bonds or not ?

Will bank FD interest rates are going to increse ?

I am poor in financial matters (as being a technocret).

So Please comment on my post.

Thx & redg

Hi Paresh,

Unfortunately, not many people can predict interest rates accurately. I’m certainly not one of them, and if someone else claims that then you’ll be well advised to view their claims skeptically as well.

As for what you should do – that is again an individual decision that you will have to take based on your situation and preferences.

If you are interested, these bonds are now available in IPO section of sharekhan. minimum investment is 1 lakh(10 units of 10000 rs each)

Thanks for that info Mithlesh.

Is there any clarity about the retail reservation any where?

Forgive me if I have asked this question again on another post 🙁

What is the TDS implication for this IFCI bonds ?

No TDS since the bonds would be in Demat form & listed on BSE

strange – there seems to be trouble with date / time on comments. i posted a comment earlier today morning – 7th june and it shows me at least a -12 hours time discrepancy.

It’s showing a time stamp different from where you are Ravi, and probably that’s the reason it looks like there is a discrepancy.

Since most of the readers are from India, my suggestion would be to change the timezone to IST. That you may do in WordPress dashboard > Settings > General, changing the Timezone field to UTC+5:30.

Just a suggestion 🙂

Thanks Subodh – I’ve never thought about that before…..changed it now! Hope it’s working.

My pleasure! New comments are showing timestamp in IST now.

Cheers!

Thanks for discussing the topic. Couldn’t find other useful reviews on the net.

As most of the insights reflected my thought pattern, felt reassured (is that good or bad??)

FYI there is NCD of Muthoot Fincorp open @ 11.75% for 2 years. You may want to have a look.

Also, do you have any posts on geographical diversification in general and investing in foreign currency in particular (not forex trading)

Thanks – Do you have a link to the Muthoot document? I read about this yesterday but couldn’t find one on their website. Maybe I didn’t look hard enough. I have a post on international mutual funds in India, and from time to time I’ve written about international funds that get launched but I don’t remember if there is anything on geographic diversification. Sounds like an interesting topic though.

I think there is huge gap between the Financial Backing of IFCI vis-a-vis that of Muthoot Fincorp.. I would rather prefer SBI Bonds @ 9.95% & then IFCI Bonds @ 10.75% & probably would never invest in Muthoot Fincorp @ 11.75%.. just my thought process & completely with you guys who prefer to invest in these bonds..

I think that’s where diversification comes into play. To me, you could take a small position in them and benefit from the higher yield, but I wouldn’t be comfortable with anything over 5% of my money.

I don’t know about link, I got mails from my broker & other sources. Muthoot website does not seem to reflect the info.

Btw, 5% comfort level for the likes of IFCI or Muthoot?

Totally agree with the financial backing comment of IFCI vs Muthoot, however can you plz comment/compare from the perspective of 1)secure vs non secure, 2)10-15 yrs vs 2 yrs

Yeah, that’s what I found as well.

The 5% was for IFCI. I was actually thinking about a post on these today, so will have something up in a few hours.

Thanks for putting this into onemint.com. Really very good article and good info on that. I believe its like SBI – you cannot apply online… – ?

Thanks Parva – People were able to buy SBI later online, but I don’t know of an online way to get access to these bonds yet.

i dont know what it means to buy online but these (ifci) bonds are available as a buy option on the icicidirect.com site as well as the hdcsec.com site.

Yeah, that’s exactly what I meant and when I checked ICICI Direct on Sunday I couldn’t see that option, looks like they introduced it later on. Great!

Edelweiss also has started taking it online today only.. As its “First Come First Serve” basis, I wonder if its already oversubscribed and that too good enough for the IFCI to even retain the over-subscription.. :-).. There is very little clarity from IFCI..

I think they will issue a press – release once the full amount is reached. They will not that miss that opportunity for some good publicity 🙂

hehe.. ya right.. :-).. but the thing is there is no clarity what % of the issue is reserved for the retail investors (if at all).. if there is no reservation then FIs only could have bid for Rs. 150 Cr. on the first day itself.. then retails investors’ money would remain blocked for one to one & a half months time without interest.. thats the biggest problem with these kind of institutions.. God knows when there managements will become professional.. SBI Bonds Issue was managed quite well & it was impressive from an institution like SBI..

Yeah I totally agree, and the worse part is when people invest in them and don’t get any information and have nowhere to go. Their numbers hardly work, and it is quite a difficult task for ordinary people to figure out what happened to their money. Some of these institutions really need to get their act together.

ya seriously.. their nos. dont work & people come to these blogs & give instructions to Manshu… this is my application no…, this is my cheque no…, this is my Demat No… get my Bond Certificates delivered in the next 48 hours or you will be kidnapped within 5 hours after that.. hehehehe… 😉

hahaha, that’s hilarious!!! in fact once someone did email me to say that if i don’t refund his Tata Motors Fixed Deposit he will take legal action on me 🙂

The IFCI Information memorandum link works now.

Good that they finally fixed it, I’ll take a look later – thanks for the info!

Hi

I think the banks which are offering higher interest rates of 10%+ are doing so for a very short period of time and its because of higher Inflation and RBI tightening. As the things settle down there will be huge demand for products like these which are offering quite attractive interest rates. These products score quite high over FDs in almost each & every aspect of investment comparison. High Interest Rates, No TDS, Easy Liquidity, Indexation Benefits etc. are some of the key features where it scores over FDs.

To invest in IFCI Bonds – Tier II (10.75% or 10.5%) or for any other info you can Call/SMS us at 9811797407 (For Delhi, Gurgaon & Noida).

The big question in my mind is the minimum investment limit of Rs. 1 lacs – any thoughts on why they chose to keep it that high?

Simply because they want to avoid the headache of managing a large no. of very small-small investors. SBI could have come up with its Bonds with a Face Value of Rs. 1000 & also to be the minimum investment but they came out with Rs. 10K Face Value probably in order to avoid this clutter only. The idea behind the SBI Bonds Issue was clearly to encourage Retail Participation in Corporate Bonds and thats why 90% (Rs. 9000 Crores) of the issue was reserved for the retails investors. I’ve seen these cos. encouraging retail participation very recently.

Tata Steel & Tata Power perpetual bond issues had Rs. 10 Lakhs as the Face Value of one bond and were privately placed also. There the idea was not to encourage retail paticipation but some HNIs are still buying the bonds from the WDM segments of BSE/NSE or from the lead managers privately. So I think the minimum investment thing is totally Issuer specific and its requirements specific.

Also the issue is not that big like SBI’s was. IFCI knows garnering Rs. 150 Crores is not that big an issue as it does it quite routinely. Had it been a Rs. 1500-3000 Cr. issue I’m sure IFCI would have allowed Rs. 10K to be the minimum investment.

To invest in IFCI Bonds – Tier II (10.75% or 10.5%) or for any other info you can Call/SMS us at 9811797407 (For Delhi, Gurgaon & Noida).

That’s great info – thank you Shiv!!!

Post office MIS scheme is giving 8% interest for last many years. Assuming that this continues, I have a better suggestion to invest 1 lakh.

Invest 1 lakh in Postal MIS and get the interested credited via ECS to your bank account. Interest will be roughly 666.66. Open a SIP from same bank in any good mutual fund like HDFC equity or HDFC top 200 or Franklin Blue-chip etc in a growth option. These funds have given more than 15% for last 5-8 years and looking at India Inc scenario this can easily continue for next decade. So in effect 8% is guaranteed by Post (in short GOI) and SIP for 10 years (let’s consider 6 years as that is the limit for MIS) can give better or almost equal maturity to this scheme. Even if it is slightly less it has more than 80% guarantee on Principal and interest. No tax benefit in either case, no TDS in either case. But you have a better control on minimum investments plus MIS gives 5 % bonus on principal. This is just an idea but need to be validated by doing some maths in excel. Please share if some financial wizard has already done the maths.

So a new comer in investments or a not so HNI kind of person should stay away from this issue.

Sandeep

Sandeep, Readers have done a lot of this type of calculation on the post about POMIS. I don’t remember if they have done gone as far as taking the PO interest and investing it in a equity mutual fund or not, but there has been discussion along those lines.

My only observation here is that comparing equity mutual funds to a debt instrument is not a fair comparison because the risk is different in these two products. Equity MFs on an average have given the returns you speak about but then they do have this tendency to crash badly every few years 🙂 So, people interested in doing this kind of thing must be cognizant of the additional volatility and risk they take.

I dont think i would do this as investor. If i apply in such bonds, that would be to make up for debt part of my investment. I invest separately in stocks and mutual funds. This seems to be a good idea for an investor who invests lakhs of rupee in post office MIS and then want to get some equity exposure while preserving his capital as well.

Thank you for broad information, but i suggest someone PPF better than this bond. because post tax return lower than PPF and this bond have no tax benefit.

Thanks for that idea Azad – have you done the number crunching somewhere that you could share with us?

Though coupon rates are decent enough but still, Rs 1L in a debt instrument without any tax benefit!

and the link to download application form and information memorandum on their website doesn’t work.

Yeah, the links there don’t work, and I couldn’t find the data on SEBI’s website either. It would’ve been good if their own link worked!

Nice information! Thanks for updating the readers in advance.

Cheers

Atul

Glad you found it useful Atul!

Thanks Manshu for bringing this topic up!! I think minimum investment amount of 1 lakh is too much for retail investors to invest in.

I am planning to stay away from this one at the moment. Also, i was looking at the fixed deposit rates, City union bank is offering 10.40% for 400 days which seems to be a good option for anyone looking for an year kind of fixed income investment.

cheers for the review !!

10.40% for 400 days is amazing Mithlesh – I this this might be the highest any bank is offering right now?

Lakshmi Vilas Bank is offering 10.50% for 1year 1 day 🙂

Wow that’s great! Is that the highest you know of or is there anything higher than that? I know Tamil Nadu Mercantile Bank was also offering some pretty high rates till some time ago.

yeah

Lakshmi vilas bank is giving 10.5% on a deposit of 1-2 years. I wish if there were a platform where we can invest in any bank’s fixed deposits online from one platform!! :)-

That’s a great idea Mithlesh – I wonder if such a product already exists in any country other than India. Let me check that!