This is another post from the Suggest a Topic page, and today we’re going to take a look at the India Infoline Investment Services Ltd. NCD (Non Convertible Debenture), which is going to open shortly.

The first thing to note about this NCD is that it is not the NCD of India Infoline, but of their wholly owned NBFC (Non Banking Financial Company) called India Infoline Investment Services Ltd.

IIFL owns 76.74% in this NBFC, and while India Infoline Investment Services (the NBFC) source a lot of their clients and draw on the goodwill of the parent company, this is a different company from the parent. The remaining stock is also owned by another IIFL subsidiary called India Infoline Marketing Services.

For simplicity sake I’ll use India Infoline to describe the NBFC in this post.

India Infoline is going to issue NCDs worth Rs. 3,750 million, with a green-shoe option of another Rs. 3,750 million, and that makes it a reasonably large NCD issue compared to the size of the company. The issue will open on August 4th 2011, and will close on August 12th 2011.

As a NBFC, their primary business is lending, and their total income for the fiscal 2011 was Rs. 4,697.76 million and profit after tax was Rs. 922.48 million, which is a pretty decent profit margin of 19.2%. 99% of the loans are secured, and they have a CAR (Capital Adequacy Ratio) of 29.95%.

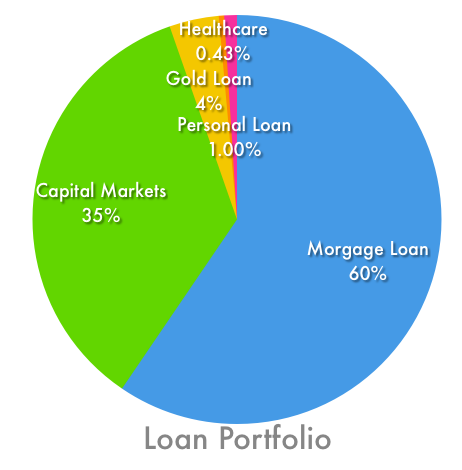

Their primary business is lending in these 4 segments:

- Mortgage loans: Housing loans and loans against property. This forms 60% of their loan book.

- Capital Market Finance: Loans against shares, promoter funding, margin funding IPO financing etc. and this forms 35% of their loan book.

- Gold loans: Loans given against gold jewelery. This is about 4% of their business.

- Healthcare Finance: This is a new segment, and it looks like it doesn’t contribute a lot to their business currently.

Here is a break – up of their total loan book for fiscal 2011.

When you look at these segments you realize that while almost all their loans are secured, they are secured against assets that have volatile prices. Stocks are very volatile, and with the current Greater Noida issue going on – you can’t be too sure of property either.

The issue has been rated AA- or Stable by ICRA, and CARE AA- by CARE.

The prospectus says that while a cover of 1.10 is needed to be made on this issue as this is a secured debt issue, there will be other creditors who will have pari passu charge over the security that they provide. This means that other creditors may also have equal rights on the security provided by the company for this issue, and that’s a definite risk.

So, you see the good thing going on for them are good profit margin and good Capital Adequacy Ratio. What takes away from this is the fact that the sectors that they lend to are inherently volatile and risky.

Now, let’s take a look at the issue itself.

India Infoline NCD Issue

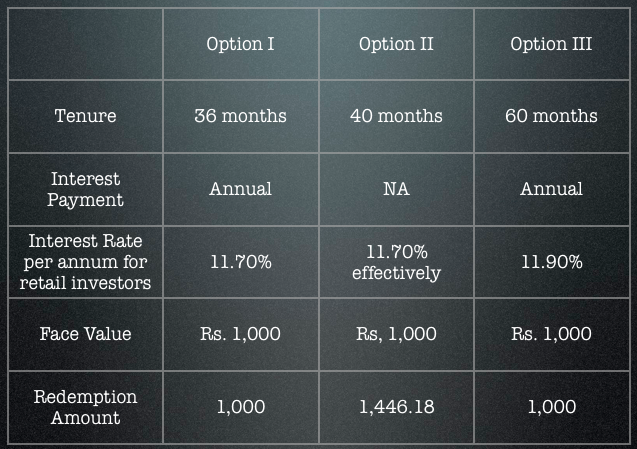

The India Infoline NCD will have three options for investors with different maturities and rate of interests. Two of them will pay interest every year, while a third will pay a lump – sum at the end of the maturity period.

Here are the details of the three options.

All these series will list on NSE, and BSE shortly after the issue is closed, and the allotment will be made on first – come first serve basis.

The last NCD issues have been over subscribed by quite a bit, but they were graded higher by the credit rating agencies, and had more attractive yields as well.

If you look at these yields then they are not that much more than some of the best interest rates given by fixed deposits these days. A lot of banks give within 2% of these yields, and a fixed deposit in a bank is comparatively safer as well. In fact the last big NCD issue – Shriram Transport Finance was giving 11.60% interest, and they were rated CARE AA+ which is higher than this issue.

So overall, while evaluating the issue, you should really consider how much money you are going to put in this, how much extra interest can that earn you, and whether that’s enough for you, or if you’d rather wait for another NCD issue to come because a lot of companies do seem to be interested in issuing them this year.

hi..

I have a query about IIFL NCD which is launching next month that if i invest 1 lac for 36 month mode in between tenure i have a option to surrender my NCD after a six month ? then what will be the charges ?

Hi shriniwas kodam… These NCDs can be sold on the stock exchange(s) on which they are listed. So, you just need to bear the brokerage charges if you sell these NCDs before the maturity. The price you get for these bonds will be market-driven.

i have 100 ncd of india infoline of ipo, but till date I am not received any interest but record date is 23 .03.2012 is record date.

i have 100 ncd of india infoline of ipo, in the account of idbi demat but recently i have opened a new demat account in india info line,can i transfer ncd in my new demat account.

Definitely you can. It is just like transferring money from one Bank A/c. to another.

Any idea why an NCD like India Infoline is quoting at such a steep discount (rs. 925) to its offer price (rs. 1000) giving an yield closer to 15%? Is it worth the risk in investing in them?

Hi,

At current price of 962 and interest due on 1st April the India Infoline NCD looks quite attractive. The yield is 17% and interest rate might go down in next 3 months giving capital gain after receiving 12% return on interest alone in one week.

What is your opinion on this?

Vinod

Hows is Muthood Finance NCD , its giving 13.75 %, how safe are NCD and can we save tax ?

Hi,

At present the Recently issued IIFL NCD is trading at a low price is it better to sell it or continue in the same

Hi,

I have a basic Q abt NCD:

1. If any 12 mnths NCD offers 9.75% rate of interest at matuirity that means we will get exactly 9.75% at matuirity like FD? or there is a chance to get lower matuirity amount?

Thanks & regards,

Sudeepta

Hi Sudeepta,

Yes, the interest you get paid will be exactly as promised.

Dont you think equity market like behaviour (selling NCDs immediately post listing for trading gains) is very opposite to the basic concept of investing in debt instruments (which is fixed income/return realised if held till maturity). I know trading is vital for liquidity in a market, but that does it mean 1 day price behaviour should be benchmark?. Further, this could be a one off case, since market may not perceive IIFL to be a quality issue. Quality issues like Shriram transport may still hold on to stable prices.

IIISL – N4 NCD listing has been very bad as it closed at Rs. 920.76, down about 8%. Its going to impact investors’ sentiment towards NCDs very negatively. Now even those investors, who invest in NCDs regularly, would either stop or definitely hesitate to invest in all these NCDs.

Though thankfully I didnt invest in these issues (after IFCI issue & Shriram Transport issue), I know this kind of negative listing gives a lot of pain and is definitely not in favour of NCD market’s overall development. Though its not as big as Reliance Power IPO, this listing has dented NCD Investors’ confidence very badly. It’ll lead Fixed Income Investors back to FDs.

Now Investors looking to buy good quality issues should invest in SBI Bonds or IFCI Bonds from the secondary markets as these bonds are yielding 9.5%-11%. SBI should be coming with a Retail Bond Issue very soon thanks to the Govt’s delay in its decision on whether to allow SBI’s Rights Issue or not. God knows when these Govts. will start doing something for the betterment of the lousy systems.

This comes as a surprise to me and I would have never expected them to lose so much in the first day. It seems to me that a lot of brokers loaded up on the market who never intended to hold on to this in the long run, and that created some selling pressure on the first day.

Also, since Manappuram came up with a higher yield NCD after them that impacted the price as well.

What do you think Shiv?

Also, what’s the easiest way to check out their prices? I’m using ICICI DIrect but that’s not very easy to do. Can I find this same info on the NSE or BSE website?

Hi Manshu.. I dont think Manappuram offering a higher yield is a valid reason for this huge price correction, as India Infoline is offering 11.90% for 5 years & Manappuram is offering 12.20% for 2 years and probably they’ve reasons to offer higher returns for a shorter duration. I think Interest Rates in India should start falling soon and are not going to remain this high for longer durations.

Also when IIISL issue opened & closed for subscription, Manappuram NCD Issue was not in the picture, probably Shriram City Union Finance NCD Issue was just announced offering 12.10% for 5 years. Moreover, Shriram Transport 11.60% NCD is still trading at a premium.

I think its probably IIISL poor fundamentals which are playing spoilsport here and Brokers/Analysts/HNIs who know the picture inside out are offloading heavily in the markets.

Easiest way to check India Infoline Investment Services Limited (IIISL) 11.90% NCD price on NSE & BSE is to just click these links:

http://www.nseindia.com/live_market/dynaContent/live_watch/get_quote/GetQuote.jsp?symbol=IIISL&series=N4

http://www.bseindia.com/bseplus/StockReach/AdvanceStockReach.aspx?scripcode=934819

Hi Manshu & Shiv…started reading your website, really liked the stuff, very informative. Do you expect similar trading/pricing behaivour for muthoot manappuram ncd’s? Or probably due to their lesser riskiness & shorter tenures, they wud do better post listing?

I for one was totally caught by surprise by the huge discount at the IIISL listing, and haven’t got a clue what will happen with the listing of the other NCDs. Sorry.

Hi ankm83.. I would like to begin answering your question here with what happened today in the Gold Markets and with the Muthoot & Manappuram share prices. Despite markets falling for quite a few days now, Muthoot share price was not falling, in fact it was rising. Gold prices, Muthoot share price & Manappuram share price, all three were down 4-6% in today’s trading.

As I write, Gold prices have fallen about 10% in the last 2-3 days. The basic business of Muthoot & Manappuram is directly affected by the Gold prices. Though many would say their loans are secured as people need to keep Gold as the security but what if I take a loan from them at the peak of Gold prices, Gold prices fall 30-40% in the next 3-4 months after that and I refuse to pay up the loan due to my bad financial condition. What I want to say here is that though their businesses are quite strong at present, they are quite concentrated & hence risky. Moreover, I’m not 100% sure about the quality of their managements.

So, for my personal investments, I would give these issues a miss & probably would invest in IFCI Bonds at 11% yield or SBI Bonds at 9.5% yield from the secondary markets. IFCI Bonds got listed at 4%-5%-6% discount, probably yielding about 12.5%-13%. I wish I could have invested that day.

Hi shiv,

point well taken. But I undertsand that their LTVs are 70% and tenure of loans is short 3-6 months. Besides, avge ticket size being small, probability of a huge default/NPA (i mean probability of large no of customers defaulting together) could be low. Besides, their NIMs are quite robust at 8% odd. While their avge NPA’s to advances ratio is minsicule in past (even vs banks), but those periods gold prices hv been continously rising. So its true, the latter will be tested in a declining scenario.

Hi Ankur.. SKS Microfinance was hailed as the “Next Infosys In The Making” till the AP Govt. started playing with its fortunes. Its NIMs were higher than Manappuram or Muthoot, avg. ticket size & probability of a huge default was lower than these cos. as you must be knowing its business model.

Let the U.S. & Global economies make a turnaround tomorrow, then you will see Gold prices fall below Rs. 20,000 (ruling at around Rs. 26,000 at present), Muthoot share price fall below Rs. 100 (ruling at around Rs. 170) and its NCDs price to fall below Rs. 900 & yield to rise to 14%-15%.

if im correct sks micro’s exposure is unsecured, plus sks didnt have the track record of 70 yrs as muthoot. Long standing presence would enable company to have experience of various cycles (up/down).

Hi Ankur.. Muthoot is in operations for 72 yrs. but Gold financing has become this big commercial business very recently. SKS Microfinance’s business failure is a result of Human Act & not because of Market/Natural Conditions. If people take loan from a Gold financing co. & Indian Govt. asks them not to pay-back these loans, then I would like to see how long that co. survives.

My idea was not to compare these two cos. as such, but making this a point that circumstances change very fast & it can happen more rapidly with cos. of concentrated businesses. Manappuram & Muthoot have concentrated businesses whereas SBI & IFCI have diversified businesses. Moreover there is a natural confidence which comes when the issuer is a Govt. co. as compared to private cos. with unproved management track record. I would prefer SBI Bonds with 9.95% interest & IFCI Bonds with 10.75% interest for my personal investments rather than 12%-13%-14% Manappuram, Muthoot or India Infoline NCDs.

You are probably referring to regulatory risk. I think chances are remote, that is more of an event risk, rather than a genuine business/market related risk. Of course, its no brainer that SBI/IFCI bonds would be safer to invest in. Btw is this the current yield you are referring to on SBI/IFCI?. Do you know if such PSU banks/institutions are coming out with fresh retail bond issues.

9.95% & 10.75% are the coupon rates of SBI Bonds & IFCI Bonds respectively. But these Bonds are still yielding about 9.5% & 10.75% respectively.

In March this year SBI said that its going to come out with Retail Bond Issues every quarter now onwards but yesterday only SBI confirmed that its not going to come with a Retail Bond Issue till the time interest rates moderate. Also SBI Bonds qualify as Tier II Capital whereas it is required to raise Tier I Capital.

IFCI 10.75% Bonds offer was open for 45 days & closed on July 15, 2011. I dont expect IFCI to come for any other bond offer anytime soon. I think IFCI Bonds are the best investment option at this point of time. NHAI is expected to come with Rs. 5000 Crs. Tax-Free Bonds offer next month with 8% as the coupon rate.

Thanks Shiv – that makes sense, so the NCD did recover a bit today didn’t it?

Hi Manshu.. Yes, it closed at Rs. 952.63, up 3.28%. I think, probably in a day or two, it’ll discover & stabilise at its fair price.

Hey Shiv,

Did you ever buy or sell these NCDs on the exchange? I wanted to know if brokers are charging STT on this because that affects long term capital gains on them. I got an email from a reader today saying that since you pay STT on these they should be treated as equity as far as capital gains are concerned.

I’m not quite sure about that and wanted to see if you have any input on that?

Thanks as always!

Hi Manshu

These NCDs wont be considered as ‘Equity’ from Taxation point of view as these NCDs dont attract any STT. When I sold my NCDs, I was charged (i) Service Tax (ii) Cash Turnover Charges & (iii) Stamp Duty, apart from Brokerage. Thats it.

& you are always welcome!!.. 🙂

Thank you so much Shiv – check out today’s post – I wrote about taxation on NCDs, and used your input there.

What does steep discount for IIISL on first trading day indicate: i) good opportunity to buy as yield would be 13-13.5% or ii) quality of NCD is not good, so ppl having apprehensions and hence selling. What does this imply for NCDs of Muthoot and Manappuram? Already heard many ppl stopping their cheque for Muthoot application.

Lists at a discount of 6.3% ????

any idea why?

http://www.bseindia.com/cirbrief/new_notice_detail.asp?icount=20&dt=8/22/2011&totcount=20&flag=0&flag1=N¬iceno=20110822-20

Listing tomorrow. Already in demat accounts…

Hey Neel – thanks for this info – I didn’t know that. Let’s see how the listing goes.

Any ideas when this IIFL NCD is getting listed? and how about allotment?

No, not yet Kapil.

IIFL NCD is Good ?

If i invest Rs 25000 for 60 Months @ 11.90% P.A having Monthly Cummulative interest.

Thus as per my calculation the maturity Amount is Rs: 45120

Assuming Infaltion would be 8%

the Inflation Adjsuted amount @ 8% is= Rs :30707.92

Interest earned during the tenure will be Rs: 20,120

Thus even if we considering Inflation we are getting 20% return on our investment .

Please correct me if i am wrong.

By the way, the issue has been fully oversubscribed and will close today -instead of 12th Aug. Let’s hope for a healthy listing. I will be happy with 1.5%…

Thanks for leaving that comment Neel – I wasn’t aware of that.

Hi everyone,

I have 2 doubts on NCDs.

1. Can NCDs be redeemed before tenure end like our bank FDs. if yes, what is the process?

2. the IIFL NCD option 1 and 2 appear same to me. Apart from term of 36 months and 40 months, what is the other major difference.

which option is better in terms of return on maturity

thanks

Hi Mohit,

1. They can’t be redeemed with the company, but since they are listed on the stock exchange, you can sell them there. You should have a trading account to do that, which is linked to your Demat account.

2. The difference between option 1 and 2 is that in the first option you get annual interest at that rate of 11.70% and in the second option you don’t get any annual interest but get paid a lump sum at the end of the tenure. That’s the big difference, so you need to see if you are okay with getting a lump sum at the end or want a steady stream of annual interest payments.

Hi Mohit,

Also one of the technical differences between Option 1 and Option 2 is your re-investment risk. In other words, is it possible to invest at the same/higher return, your annual interest payments? In option 2, you worry only after 40 months where to invest the amount (which is received in lump sum) to either earn the same interest or higher interest. Whereas, in Option 1, you start thinking every annual payment, where to invest the interest amount received to earn same/higher interest rate.

Good point Aakash – I feel in today’s environment there are a lot of options to get high yields, but people will still have to look for where to put their money and do a bit of work.

Hi Manshu,

Your review is very simple and good

I have a basic doubt on NCD’s, is there any premature withdrawl option

Suppose say have invested in Option I of IIFL NCD for 36 months, and after 12 months as I need cash I am planning to close. So can sell the NCD on equity market when I want or should I wait till 36 months for my money??

Hi Karhikeyan,

You can see the NCD on the stock market. Now the price of the NCD at that time will depend on how interest rates have moved between when it was issued and then, and the NCD may even be trading at a discount to the face value. So, you have to keep in mind that while you could sell the NCD in the open market, the price is not certain.

I think the interest rates have peaked. At most, we will see a 50 bps increase in the next one year. Fuel has fallen and if it falls further, that will help reign in inflation. Also, I don’t think it’s easy to for the industry to borrow at these rates. Builders will not be able to sell more houses. In about a year’s time, the trend should reverse. And the effective yields on NCDs will increase. Let me check if I can get some SBI bonds at an effective yield of 10%. 😉

Thanks for covering the topic.. good insights….

Thanks for your suggestion – you brought it to my notice or else I wouldn’t have known about this.