It has been over a year since I wrote my best gold ETF in India post, and since then the number of gold ETFs that are present in India have almost doubled.

There are a total of 11 gold ETFs currently present in India, and 4 out of these 11 were launched within the last year. The big change in this space has been the reduction in the expenses that sponsors charge their customers, and now you can see that almost all of them are on the same footing.

You will still see some performance difference in them because every gold ETF holds a small sum of liquid investments other than gold, and that makes a small difference on their returns.

In this post I will look at the performance, volumes, and expense ratios of all the gold ETFs currently traded in India. I couldn’t find the expense ratios of some of these funds, and instead of waiting out I have published this post now, and will update it as and when I find the information.

First up, here are the names, NSE symbols, 1 year returns as on August 12 2011, and their turnover on the same day.

| S.No. | Name | NSE Ticker | 1 Year Return as on Aug 12 2011 | Turnover in Lacs as on Aug 12 2011 |

| 1 | Quantum | QGOLDHALF | 41.07 | 37.11 |

| 2 | UTI | GOLDSHARE | 40.84 | 341.83 |

| 3 | SBI | SBIGETS | 41.26 | 397.37 |

| 4 | Axis | AXISGOLD | – | 15.24 |

| 5 | HDFC | HDFCMFGETF | – | 288.75 |

| 6 | Relianace | RELGOLD | 41.08 | 440.82 |

| 7 | Religare | RELIGAREGO | 41.95 | 9.9 |

| 8 | Benchmark | GOLDBEES | 40.19 | 5,490.42 |

| 9 | ICICI Prudential | IPGETF | – | 14.17 |

| 10 | Kotak | KOTAKGOLD | 40.43 | 1,042.38 |

| 11 | Birla Sunlife | BSLGOLDETF | – | 1.64 |

Regular readers know that every gold ETF in India holds physical gold equivalent to the number of units that are issued in the market, and their price is thus dictated by the price movements of gold.

Since all these ETFs have the same underlying asset, the price movement is also quite similar.

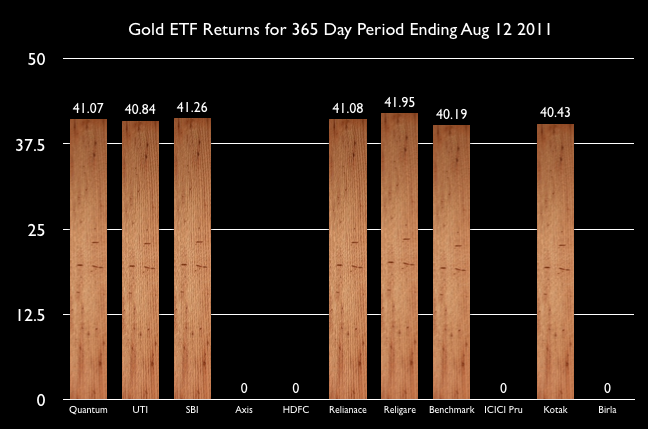

Here is a chart that gives you a better visual of the performance in the last 1 year. Some of these funds are less than a year old, and that’s why you don’t see any corresponding data against their names.

From this chart, you see that the performance are pretty close although Benchmark Gold BeES has done the worst this time period, and Religare has done the best.

When I last looked at this type of data – GoldBeES had done better than all other competitors for a 2 year period, but in the last year everyone else has done better than them.

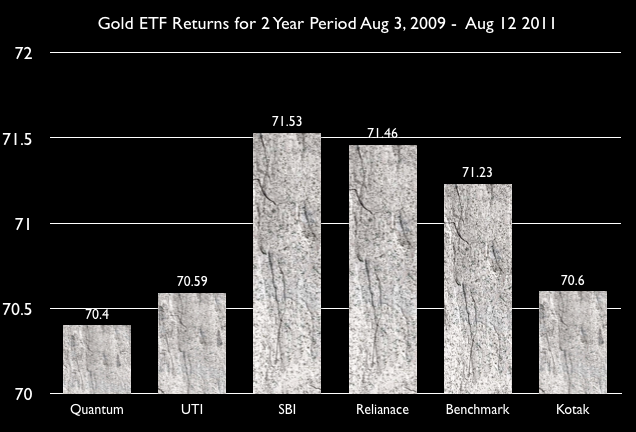

I took a look at the 2 year performance to see if that confirms this or not. Here is how the 2 year returns chart looks like.

This chart shows a different result from the first one, and to my mind – this goes to show that there is very little difference in terms of these funds performance wise.

Next up, I wanted to see what the expense ratios were like, and how much each fund was charging its customers for maintaining the fund. The tricky part here is that each fund lists down the expenses it will charge in its offer document, and then revises these charges periodically. The revised rates should be found on their website because the offer document itself is not revised, and that still contains the old rates.

When you see blanks in this table that means that I couldn’t find the updated expense charges on their website, and didn’t want to use what’s given in the scheme information document.

Here is the chart that shows that information.

| Name | NSE Ticker | Expense Ratio |

| Quantum | QGOLDHALF | Â 1.25% |

| UTI | GOLDSHARE | |

| SBI | SBIGETS | |

| Axis | AXISGOLD | |

| HDFC | HDFCMFGETF | Â 1.00% |

| Relianace | RELGOLD | |

| Religare | RELIGAREGO | Â 1.00% |

| Benchmark | GOLDBEES | Â 1.00% |

| ICICI Prudential | IPGETF | |

| Kotak | KOTAKGOLD | Â 1.00% |

| Birla Sunlife | BSLGOLDETF |

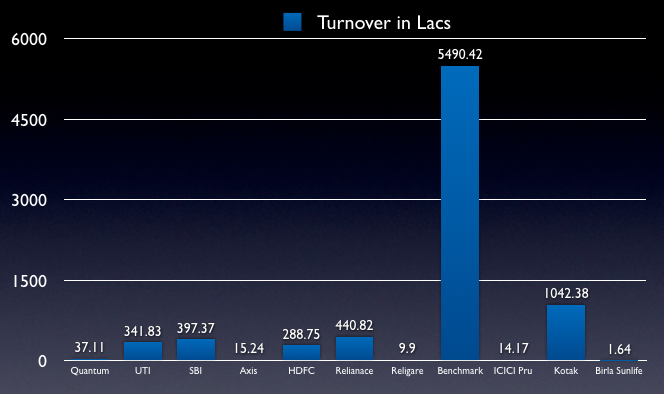

Finally, let’s take a look at the volumes of these gold ETFs because you want your fund to be as liquid as possible so it isn’t impacted by what a few big players may do. The higher the volumes, the better it is.

Here is a chart that shows the turnover of all these funds on August 12 2011.

This is where you see the staggering difference – Benchmark is just way more popular than anyone else, and a lot of that is due to the fact that they were the oldest gold ETF, and even when they had very little competition – they kept their expenses low, and gained in popularity with investors.

Conclusion

It has been interesting to see this space evolve over the years, and see so many competitors come in, which is always good for the customer. I’m fairly certain the expenses wouldn’t have come down to 1.00% without Benchmark setting that precedent and other companies coming into the space and competing. It feels just a matter of time when someone lowers the expenses to less than a percent, and market their fund.

About the choice of funds themselves, although the performance data doesn’t suggest a clear winner – the volume data shows Benchmark and Kotak to be clear leaders of the pack.

Dear manshu,

Nice article and very informative.

Great to hear – thanks!

Dear Manshu,

Iam 49 , have some PF Money , i have no investment made till now , have demat account , would like to know from you where and all for a long term investment i should invest say for 2 to 5 to 10 years .,

i am planning to invest this money in

FD = Laxmivilas bank 1-2 years @10.5%

GOLD BEES some money for a long term say 10 years or so ,

Muthoot finance ncd ,

OR ANY OTHER LONG TERM INVESTMENT YOU SUGGEST ,

i would like to have this money to be a safe yet a good decent return of say around 15% as wt ave Please do suggest thanks

I don’t give any personal recommendations on this blog. Sorry.

Is there any other professional you can recomment

I’m trying to build a directory of advisors here on OneMint based on people who have been answering questions here and are knowledgeable. You can look at that list and see if you want to contact any of them. (There are just 3 people in that list right now)

http://www.onemint.com/category/directory-of-financial-services-providers/

So kind of you thanks

Raman

You’re welcome and I appreciate that you left a follow up comment.

Thanks Manshu and Sridhar – very valuable and practical insights. Will keep watching this space.

Hi Sanal,

Manshu is absolutely right. Timing the prices is not easy.

However, you should invest a small portion of your saving in Gold ETF. This will ensure that even when prices go up or down you are not affected seriously. The biggest advantage of Gold ETF is that you can buy 1 unit/1gm and gradually accumulate instead of investing lump sums.

Like Equities, Gold is also volatile and moves with international market developments, so invest gradually. Most financial experts advice people to invest a small portion in gold – so dont avoid or stay away like Manshu did, instead take small exposure. This is my personal opinion.

Hi Manshu,

Thank you for this article – gained lots of knowledge on GETF and moreover happened to read this at a time when I am thinking of investing in ETF. However with the volatility in the markets and prices slashing drastically (driven by USD hike) whats your say – is this perfect time to invest in gold ?

Thanks,

Sanal

I have no clue whether this is the right time to invest in gold or not – I’ve personally stayed away from it for the last couple of years or so and have been proved wrong, but I’ll continue to stay away from it even in the future.

My being wrong for 2 years and still sticking to my notion should tell you not to seek any directional advice on gold from me 🙂

Hi Manshu,

Going wrong according to me is nothing new. Even the so called Gurus and Experts can go wrong. A balanced Asset allocation according to me can help avoid extreme surprises. (e.g. having equities, gold, debt, etc)

Dear Manshu,

I think this is one of the best articles on GETF that i have come across, written by an individual. I want to personally thank you for the time and effort that you have put in, for getting these valuable information together. I look forward to see more of your expert opinion and guidance. Is there any forum or group that you are part of, which can accomodate others like us ?

Best,

Chandrachur

Dear Chandrachur,

Thank you very much for your kind comments – this is my blog, and I write here very regularly, and answer almost all questions individually, so this is the best place to connect if you so desire.

You can subscribe to the blog on email, reader and through FB. I’m on Twitter as well, and as this is my hobby there isn’t any formal forum or anything that you can become member of.

But there are a lot of regular readers and commenters here, and as you read more you will notice an involved and intelligent community here.

Thanks

Hi Manshu,

First of all thanks for all your helpful advice.

I am planning to start investing in Goldman BEES gold ETF through my broker Angel Broking.

They are giving me delivery brokerage of .03 or 30 paisa in delivery.

which will come some where Rs7.5/- for 1 unit = 2500/-

Is this brokerage OK or i should negotiate with some other broker ?

Thanks

Ankur

Ankur, I haven’t really ever looked at brokerage charges across broker houses, so can’t say if this is the lowest but the range seems about right.

Hi Manshu

It is excellent write-up and everybody has already said the same.

I have to ask a simple suggestion to Ankur through the blogs here with your permission. If you find my question inappropriate please remove the same from the blog.

Hi Ankur,

I am planning to start trading in commodities and have chosen Angel broking firm as my broker. I am yet to give the documents and open an account.

Please let me know how good are the services with respect to commodities. Also let me know how good the dealers response is to our queries.

I am sorry for using this form inappropriatly. But there is simply no-way of finding this information unless I contact other investors/traders like you.

Regards

Dhananjayan

Hi Ankur,

My mail id is tv_dhananajayan@rediffmail.com

Thanks in advance

Dhananjayan

Hi Dhananjayan – Please feel free to share your email – I don’t have an issue with that.

Manshu..Can you please let me know few mock trading site names

Thanks in advance

Try Moneycontrol, Moneysights, Rediff Finance, Google Finance or you could put together a portfolio in Google Spreadsheet and make a tool yourself 🙂

Very much informative for the freshers ..Thanks a lot Manshu

Great to hear that – thanks!

Excellent writing! Thanks so much. I had been thinking about investing in a gold ETF for quite a while now, and had done some reading over the internet. It was this post which VERY clearly and precisely gave me all the data and I have my decision. Hope to read more of your stuff in near future.

That’s great to hear – hope you subscribed to the email, or added the feed to the reader.

Hi Sanket,

You have asked a good question. Gold ETF will give similar returns as physical gold, and variance may be + or – 1%. Gold ETF being a passive fund will only reflect the gold prices and provide equivalent returns. It cannot beat the returns from physical gold, it will only match that closely.

Also remember that Gold ETFs dont track the physical gold prices in India, but it tracks the international gold prices, which get converted to Rs.

ETFs will closely follow international gold prices.

Thanks for the reply Sridhar.

Hi. Will gold ETFs give me better return compared to physical gold? Do they work like mutual funds where a fund can give better returns than the stock market overall?

Hi,

I want to invest in HDFC GOLD ETF .. Is it good? Shall i buy it.. and generally in Gold fund how much return i expect after 1 year.

Hi Manshu

I have read all of ur article in the react months and i learned so many information about GOLD eft from your website.

Thanks for spending your valuable time for publishing you knowledge for us.

i was convinced with all the advantages we have with EFT. When i was about to buy one of eft available i just saw eft unit differs from physical gold price on that day. i was able to observe that when physical gold was decreasing , eft prices were increased.

i just have few doubt abt the eft now.

1 who decides the price of particular etf unit price on particular day ( is that decided based on physical gold)

2) whether the eft unit price changes only according to the buying/selling

Hope my question in clear.

Thanks in advance

Price is decided by trading that is in turn based physical price – you may notice that prices move a little unusually or don’t closely track the price of gold in a short period like a day or two but it smooths out over longer periods and will track the returns of gold prices.

Hi Manshu.

Today just gone through all the information provided by u.

It is very much informative and i m continuously reading Ur articles.

I m a beginner in Gold ETF. From your information above, it is clear that GoldBees is the best ETF.

Today the market is not stabilize. nobody knows that what will happen in next even 4-6 months.

My first direct question is:

Should i go for investment right now?

and others are:

How should i invest in Gold. Please choose the best way: is it Gold Mutul fund(SIP) or Gold ETF?

What is the minimum time i should think to keep investing in anyone?

I will request for direct ans rather diplomatic ans.

Thanks

Pritpal Singh

I’m sorry I don’t give any personal advice on this blog because I really don’t know anything about you, and it takes a lot to find out if this is the right option for you or not, or if you already own too much gold, or if you have credit card debt that you should be paying off first etc. All this can’t be done in the comments section of a blog plus I’m not a financial adviser either so that’s the reason I don’t give any personal recommendations here, and you will see many examples of what I’m saying here.

Thanks for all the useful info Manshu.You are doing a great Job.

Ritu

How nice of you to say so – thank you for your comment!

Hey MANSHU.

I found e-silver from NSEL ( which is again your post ) for investing on Silver,

All those comments are very useful and i got lots of informations.

To get the Demat account we have to approach the members of NSEL like Karvy, right?

Do we open the Demat account with Karvy or with NSEL through Karvy?

What will happen if Karvy closed?

Hi MANSHU,

Thanks for this informative post.

I am new bee for this EFTs / Share market. I am learning slowly.

My Question is, I heard that compare with gold, the people who invested in silver got more benefits in the couple of years. ( if i am wrong please correct me ).

Like Gold ETFs, is there any way to invest in silver.

You can invest in silver using NSEL’s E-Silver series – there is presently no ETF for that. Silver has risen fast, but it has been far more volatile also. On Friday it fell about 13% in one day, so you have to keep all those things in mind.