Section 24 Income Tax Benefit of a Housing Loan

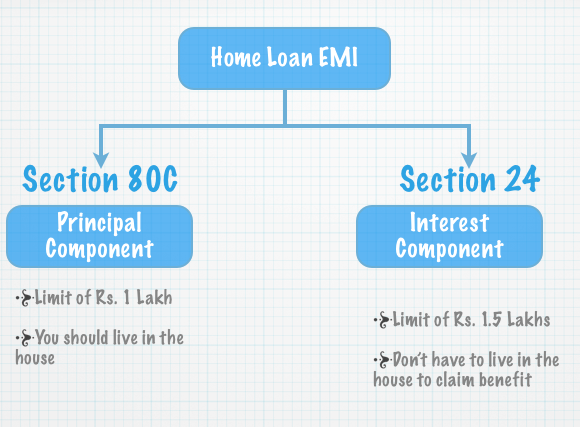

A house loan repayment has two components – principal and interest – and both of these components are treated differently for tax benefit calculation purposes.

The principal amount is covered under Section 80C and has a Rs. 1 lakh limit. In order to claim the tax benefit under 80C the house should already be constructed, and should be a residential property.

Section 24: Tax Benefit on the Interest On Home Loan

The interest on the home loan is treated differently, and Section 24 deals with the tax aspect of the interest on house loan repayment.

The maximum limit under this section is Rs. 1,50,000 and you don’t have to actually live in the house to claim this benefit.

The interest payment is deducted from your taxable income and thus reduces your tax liability. There is no limit on the number of houses you can claim this as well as the location of the houses. The only limit is Rs. 1,50,000 on the whole amount.

There are special conditions like when you get the loan disbursed before the construction of the house and pre – EMI interest and Raag has covered these aspects in a lot of detail in his post about tax benefits of a home loan which you can read if you were interested in those details.

Correction: An earlier version of the article stated that the 80C deduction is only available if you are living in the house. CA Karan Batra notified me that you don’t have to live in the house to claim deduction. Apologies for the mistake.Â

Can anyone explain the exemption part with an example ?

Thanks In Advance.

Rohit – it’s in the post I linked to at the bottom of mine, it has a lot of details and you can go there and check out the examples. I don’t want to duplicate some of the excellent work that Raag has already done in that post.

Rs. 150,000 limit is applicable only in case of self-occupied. If the house is given on rent, limit of Rs. 150,000 is not applicable and can claim any amount as interest

Great – thanks. This and more details are present in the post I linked to so that’s recommended for further reading.

I have only one house and that is let out, so can i claim deduction more than Rs. 1.50 lacs?

An employee can claim maximum Rs. 1,50,000/- tax benefit under section [24b] or which ever is less on self occupied house well if he owns another house and declares rent and has a house loan repayment for the second house also after considering the muncipal taxes paid and a standard deduction of 30% towards repairs and renewals he can claim rebate on the interest repayment which is unlimited but my question to you is, is it over all limit of Rs. 150,000/- for both houses or in addition to this 1,50,000/- for self occupied house can he claim rebate on the second house please clarify.

Dear Sir, Please advice if there’s tax benefit, if i am living in a rental apartment ?

thanks & Regards,

PS: Appreciate your site and the wonderful information you are giving, thanks

I can’t think of anything besides the HRA thing – that you would be aware of I guess.

Cud u please explain HRS ?

thanks

sorry hra…

You probably don’t get HRA as part of your salary and if you do then that’s one thing that automatically leads to some tax reduction. There is no additional investment you have to make. You can read this article here:

https://www.onemint.com/2007/03/21/treatment-of-hra/

There is a section 80GG which gives you deduction on rent paid for residential accomodation if one is not entitled for any HRA benefit from employer or a rent free accomodation.

The deduction is minimum of :

1. Excess of rent paid over 10% of Adjusted Total Income

2. 25% of adjusted total income

3. Rs 2000 p.m.

yeah than Q i have it cleared

than Q?

Whether i can get benifit of 80C for principal value of House loan & 24 for intersest toghether.that means my total tax benifit will be 100000+150000,is it true

Yes ila. You can take both the benefits

I have a home loan account jointly with my wife as co applicant. My wife does not claim any income tax benefit. Shall I get only 50% benefit U/s 24(i).

If your wife is earning and files her income tax return, then yes you can claim only 50% benefit u/s 24(i), but if she’s not working but is only a co applicant as she’s the joint owner of the house, then you can claim 100% benefit.

Hi Sir,

your article is very informative.

I have couple of queries

1. If we are paying an Interest of 2, 80,000.

Can I claim Rs. 15 L income tax benefit and my husband 1.3L tax benefit.

-House is on joint name

-Loan account in joint name

-EMI payment also goes from the joint account.

2. Can house maintenance, house tax paid comes under

Net Income / (Loss) from House Property which includes 1.5L of interest as max.

So income from house property will be the -(sum of interest+ maintenance + house tax)

Please let me know.

Regards,

Seema.

Seema,

Ownership of the house makes one eligible for the tax benefits that can be claimed by an individual but in case you are just a co-borrower and not the co-owner in a joint loan then tax rebates cannot be availed by you. Conversely if the co-borrowers are co-owners of the property then the tax rebate will be available in the proportion of their share in the loan. Hence repayment capacity of each co-borrower should be considered before deciding on the share of a loan. If the co-owners are equal owner of a property but if the share of a loan is 2:1 then the tax benefits will also be availed in the same ratio.

If the person paying extra for repayment excluding EMI, let me know weather this repayment will be deduct from his taxable income.

Yes smita, as paying extra amount reduces the principal amount of loan so this payment comes under the section 80C and you can claim benefit upto the overall limit of Rs 1 lakh.

I have taken home loan of rs 20 lakh in which 5 lakh is margin money.can i get tax rebate for margin money like principle interest?

Can you elaborate what you mean by margin money please?

Amit,

You are referring to downpayment.No you do not get tax benefit on downpayment amount since it is not counted in home loan.

My wife and her widowed mother are co-owners of a property and are co-borrowers as well of the housing loan. However we don’t know what is the share of the loan for each of them. How can I know that?

Further the mother retired in Oct 2010 and since then residing in the said property. All the EMIs till date have been paid by my wife from her account (however a prepayment was made last year by my mother in law). So can my wife claim 100% of tax benefit arising out of the interest paid.

Finally thanks for the very informative post!

The bank should provide that information surely, how else could you find it out? I can’t think of any other way.

hi,

had a query with respect to the interest deduction.

if money is borrowed for construction/purchase of house under construction, is there any deduction for interest during the construction period. or will it be aggregated till finish of construction and then allowed as deduction over the next 5 years?

Sameer,

The deduction of interest payment during construction period is available only after the posession of house in 5 year equal installments.

i have a flat at chenni, and i got retired on 30th sept2011 till retirement i was paying emi instaments from my salary. On retirement with my retirement benefits i have closed my housing loan fully. since i am bank employee i have availed my housing loan on funded interest method(principle paid first and then interest portion). am i eligible the this interst portion under sec 24 of incometax act , (i purchased the flat in the year 1997)and my instalment started in the year 1998 after mortorium period.kindly enlighten me.

Dear Srivatsan,

If you have availed housing loan from a notified institution then you are very well eligible for interest exemption.You can also verify from the institution as every bank.FI which gives housing loan also gives to the buyers interest deduction certificate.

Hi,

I need some explanation on the following.

1. My husband and I have taken a joint loan of 20 lakhs in Aug 2011, we both along with his father is the co owner of the flat. Will Me and my husband can get tax benefit or can only 1 avail of it.

2. Secondly we are paying an high interest rate on 20 lakhs, if we pay 5 lakhs to the bank as prepayment how it work? will it help me in anyways to pay the amts in bits. Total amt that gets deducted every month is 26K out of which 22K goes in Intrest and 4 towards principal

3. Please explain the prepayment procedure or table of home loan. I have to pay prepayment charges o f 2 % to my bank if I prepay the home loan.

Please assist me what can I do??

Tricia,

1. You both can avail the tax benefit in proportion of your ownership

2.Even if you prepay the interest component still remains the same.the strategy is more useful to reduce the EMI burden.

3.The prepayment charges are on the outstanding amount as on date.

Hi ,

I had just gone for a Home Loan of 25 Lakh and flat is under construction.

Could you guide me if I’m eligible for HRA and Interest Rebate(Under Section 24) both.

Or

I’m eligible for one out of two above?

Or

I have to wait for its completion until I can get benefits said above and how it will go then?

Thanks

Puneet

Puneet,

You cannot avail both. Since the flat is under construction you can avail HRA benefit till you get the possession.The interest for construction period you can avail the deduction in five yearly equal installments once after you get the posession of house.

To add further I had purchased this Flat on Down Payment basis means on 95% of payment is down to builder(Mine part and Loan part by bank). Only 5% plus other small charges needs to be paid after possession.

Regards

Punet

If I have already paid the tax for the interset part of housing loan, Can I file a refund latter !?

Fernando,

Yes you can claim refund when you file your ITR.

If an NRI goes for joint homeloan with resident spouse and both are the co-owners of the house, then resident partner can claim tax benefit on the part of EMI and principal amount he has contributed towards repayement of the loan? To claim tax benefit what is the procedure? whether the loan EMI has to be paid through NRO account. What if the loan goe through NRE account and resident partner pays his EMI to NRI spouse by depositing in NRO account.

Awaiting for the reply.

Shakuntala,

Yes Resident partner can claim tax benefit towards repayment in proportion to the share in property. However, it will be good if the loan repayment can be done through partners account and NRI transfer the funds of his share.Otherwise, transferring the payment to other account does not make eligible for claiming housing loan tax benefit.

I will buy a ready to move in flat during April 2012 using 80% home loan and occupy the same by Jul 2012 from currently rented flat. Can I claim HRA deductions till Jul’12 and interest amount rebate on home loan between Jul’12-Mar’13?

shilpi,

You can claim HRA benefit till the time posession of house is not given to you.

Any interest repayment during this period can be claimed in equal installments in subsquent years after the possession of house.

I have purchased the flat in the name of my wife but homeloan is in my name she is house wife

can i will get home loan interest rebate.pl suggest

Rajesh,

You have raised a very interesting question. Under Section 64(i) (iv), the income arising to the spouse of the assessee from assets transferred directly or indirectly to the spouse by such individual otherwise than for adequate consideration is clubbed as the income of that individual. In simple English it means that the income arising out of the house that is purchased from the cash gifted by you shall be taxed as your income.

Hence, tax benefit should be available.

But i am still not clear how you got a loan on any property which is not in your name.?

thank you very much for your comment and I got the loan as she is co applicant I am main applicant loan is taken from HDFC

Dear sir.I would like to ask you that i am having LOAN FREE HOUSE. If i will take loan on this property for reconstruction/ maintenance, THERE IS ANY TAX BENEFITS ??

REGARDS

No sir, it is not second house.I have purchased it in cash.

Now i would like to take loan for maintenance 7 reconstruction.There is any tax benefits ? Regards

Sir Kindly let me know whether IT benefit is available for 2nd housing loan or not?

Kindly let me know.

Is the second loan for a second house? That’s what it looks like – can you detail out your situation please.

No sir It is not second house.We have purchased in cash. Now we are need loan on it for reconstruction & maintenence. There is any tax benefit if i take loan??

Ashok,

If you have already a house and buying any loan on it, then its Loan against property and not a home loan.You do not get any tax deduction in Loan Against property.

I have taken a home loan of 20 lakhs and my EMI starts in April. Me and my wife are co-owners of the apartment and co-applicants in loan. She is a housewife so could i avail of the entire 1 lakh principal + 1.5 lakh interest exemption? Do i need to sign an agreement to show that i would be paying the EMI’s? What all are the legal formalities?

Ratish,

Although the tax benefits are available in the ratio of the share of each individual in the home loan, to avoid future hassles the share of the home loan and other such details should be put on the stamp paper in the beginning only. Also every borrower has to provide a copy of the borrower certificate to claim their respective tax relief. Two separate copies of such certificates along with a copy of the agreement signed between the two co-borrowers would be needed to file for tax benefits. There are chances that either of the borrowers misses on the tax rebate, so in that case one can claim it as a refund at the time of filing tax returns.

In case if you are availing the full deduction then you will have to get a declaration from your wife of not aviling any tax benefits.To show EMI payment,opt for your bank account.

according to the bankstatement i payed 47000/Rs (both principal or interest) during the year 2011-12 does these whole amount calculate income tax rebate ?

Shama,

Yes this amount is fully deductible from your income under two section -80C & Sec 24.

But you need break up of amount within these sections as their deduction heads are different. Also Sec 80 C you might not be able to avail if you have made other investments upto Rs 1 lakh and you have to show both the deductions under seperate heads while filing your returns.

Banks generally give break up also when they send you Tax Deduction Certificate.

please suggest me :I have taken the home loan in my name and i am repaying the loan but the property is in my wife’s name she is not working can i get rebate in income tax.

Rajesh,

If you are not the owner of property then home loan tax benefit is not allowed.

Sir,

I have taken a home lone worth 25 lacs in feb 2011 and satying in same house for long now. Need your expert advise to know that during this current financial year what should I put in my TAX declaration. Should I use HRA as tax saving element as i give 20 k per month to my mother or should I use home loan for tax rebate. my HRA amount is 18892 per month.

Also is it possible for me to claim both.

The house where we live in is in name of myself and my mother and i have a running loan of 25lacs.

Gourav,

You cannot claim for HRA if you have a self occupied house.

Hence, claim for loan benefit.

I have taken a home loan in my wife’s name.I am the co -applicant.We registered the property in my name and in my wife’s name.My wife is working .

Now the questions are

1) Shall I (Co applicant ) avail the 100 % tax benefit?( 1 Lakh and 1.5 Lakhs)

2) Reallhy my wife doesnt want to avail the tax benefit since i am in 30 % tax slab and she is in 10 % tax slab.So how to get 100 % tax benefit for me??

Saranavas,

You can take 100% benefit.In that case your wife will have to give a declaration in writing that she is not taking any benefits from this loan.

Dear sir,

I have taken a housing loan for 50 lacs. How much tax benefit can I expect. I come under 30% tax slab .I have a life insurance for rs.60000. Every month from my salary rs.13360 is being deducted as tax. Please advise as to where all i can invest to avoid this amount getting deducted from my salary every month.

yearly i am paying 90,000 as principal and 4,20,000 as interest.Shall

I claim 45,000 + 1,50,000

Wife – 45,000 + 1,50,000

if we use 50 % + 50 % share.

Please suggest

Saravanan,

Any individual can claim upto maximum limit only i.e. Rs 1 lakh under sec 80C and Rs 1.5 lakh as interest. You cannot claim more than this .

Hence if you utilize your wife share then only you both will be able to claim higher.

dear Sir,

I have purchased one house in my wife’s name, who is house wife,and staying in same house and the house is insured in my name. The EMI is going from my salary, whether I will get in-come tax benefit ? if not then whether i will get HRA benefit?

If your wife is the sole owner and home loan is on your name then you won’t be able to avail tax benefit.You need to be co-owner of property if not the full owner.

HRA benefit also cannot be availed as you are staying in house and Rent to spouse is not considered by income tax.

Hey. I think you can give rent to your wife. But the same has to be reflected in her tax statement. I have read it somewhere. Please correct me if I am wrong.

hi i had a few questions relating to income from house property:

1) for section 24 (b), if i have two houses with one utilised as self occupied and the other as deemed let out, then can the interest on capital borrowed for the self occupied house be used as deduction for the deemed let out house property?

2) if i have a self occupied property, then annual value is nil. in that case can i still deduct interest on borrowed capital to get a negative net annual value, which can be set off against other sourcesof income?

3) does house property also include other commercial property like warehouses, shops, commercial establishments?

thanks in advance

sameer

in case of deemed to be let out property what would be the interest deduction on home loan

u/s 24?

SIR, I PURCHASE FLAT IN JOINT NAME WITH MY WIFE,WIFE IS WORKING IN GENERAL INSURANCE AND I AM WORING IN PVT LTD COMPANY. HOUSING INT AND PRINCIPAL EMI GOES FROM MY SALARY ACCOUNT ONLY, CAN I TAKE ALL THE INCOME TAX BENIFIT AGAING INTEREST AND PRINCIPAL

Girish,

Yes you can take the full deduction.Your wife will have to give a declaration in writing that she is not availing any tax benefit.

sir ,

i have taken home loan for construction purpose from HDFC BANK. The property owner is my mother and i m paying the loan amount . so can i get income tax rebate.?

PLZ REPLY FAST…………..

Deepak,

If mother is owner of your property then you cannot claim the tax benefit on home loan.You need to be co-owner in property to avail the benefit.

thank u sir

sir ,

i want to take home loan for construction purpose from SBI BANK. The property owner is my mother and i m paying the loan amount . so can i get income tax rebate.?

IF NOT THAN SUGGEST ME OTHER OPTION

If mother is owner of your property then you cannot claim the tax benefit on home loan.You need to be co-owner in property to avail the benefit.

Sir,

I have taken a home loan jointly with my wife and purchased a flat (Under construction at that time ) and opt down payment option and paid to the Builder. My wife is also co owner in the property and she is not earning now. I am paying 100% EMI from day 1. Can I take the 100% tax rebate ? Till time registry is pending.

Very Terse and Effective explanation!! Thanks a ton!!

Hi,

I have taken a loan for house purchase from a relative at 12% per anumm. So the interest that i have paid to him is tax free or not. Can anyone please suggest?

If yes then please suggest the section.

Regards,

Rahul Jain

Rahul,

Interest payment to friends and relatives can be claimed u/s 24 but only against a certificate received from them. In the absence of the certificate, you would not be eligible for the deduction. The recipient of interest income who issues the certificate is liable to pay tax on the interest income that he receives. As far as the principal payments are concerned, they would not qualify for tax benefit as loans only from notified institutions and banks are eligible for such deductions.

tahnks for your feedback,

the home is in my wife’s name and EMI is going from my salary, where i am not getting tax benifit, if we will shift to rented home, then can i avail HRA benifit?

Mania,

Both benefits are not allowed simultaneously.

thanks for prompt reply,

sir, i am not getting a single benefit, because the home is in my wife’s name and when we are staying in same room, so HRA is not eligible. my question is that if we will shift to other rented room, whether i will get HRA facility and my wife will do return file, what ever rent she will receive.

And second thing, the home loan is in my name, the bank statement is coming in my name, only registration is done in my wife’s name.

third is what is the process of co-occupier, in co-occupier, can i get tax benefit?

I have only one house and that is let out, so can i eligible for interst deduction for more than Rs. 1,50,000/-

Sumit,

On first house you can claim only upto Rs 1.5 lakh.

Hi Jitendra,

I had read the sec 24 wording but it not specifically written.

Can you throw some light on it?

Thanks

Sumit,

If your property is let out then you can very well claim deduction on interest repayment without any limit. i.e. there is no limit on interest deduction for let out properties.However, your rental income will be taxable.

Hi,

I and my Husband are co -owners and he is the co – applicant of homeloan taken recently.

The EMI will start from next month and EMI will go from my account and he will transfer 50% of the EMI amount to my account every month. In this case can he claim tax benefit upto 50% of the contribution or should he be the joint account holder of the account from which EMI goes out.

Shakuntala,

Wiser choice would be to either have a joint account as transferring funds does not make you eligible for tax benefit.

I co-own a house with my parents but there is no loan. The house has been bought free and clear.

If I buy a second house on loan, would I be eligible to rent it out (really or nominally) and claim rebate on the full interest of the home loan?

Thanks,

Aditya

Aditya,

Yes on second property you can claim the full interest amount for deduction.

Thanks for the prompt reply.

Aditya

Dear Mr. Solanki

sir, i am not getting a single benefit, because the home is in my wife’s name and when we are staying in same room, so HRA is not eligible. my question is that if we will shift to other rented room, whether i will get HRA facility and my wife will do return file, what ever rent she will receive.

And second thing, the home loan is in my name, the bank statement is coming in my name, only registration is done in my wife’s name.

third is what is the process of co-occupier, in co-occupier, can i get tax benefit?

Mania,

Its difficult to get a tax benefit when property is in somebody else name and loan is in your name.If you have made yourself a co-owner during registration of property then you would have availed the benefit.

If you shift to a rented house, you can claim HRA benefit even if you are paying a housing loan.

Dear Sir,

my friend is staying in one house with parents. He booked another house which he will get possession in next 2 years. Now he want to book another house which he will be getting in

next 6 months. Whether we will get benifit for 3rd house ? if Yes , How ?

Regards

Pravin D

Contrary to popular opinion, there is no overall restriction of Rs. 1, 50,000 on the interest payable on a loan taken to acquire/construct a house property or in respect of more than one property. In fact, this deduction is available for any number of properties and is without any limit under specific circumstances.

The calculation of income from house property (which means the rent you earn) has to be done separately for each property owned by a person. Home loan repayments are eligible for deduction for each such property.

Dear Mr. Solanki,

My dad and I jointly own the house and we have jointly opted the home loan. I pay EMI thro’ my account and have submitted NOC (that my dad is not availing any tax benefit from the said property) to my employer. They have considered my entire contribution and same is getting reflected in my Form 16 as well.

For AY 2012-13 when I am filling ITR2, there is a field which asks whether House Property is co-owned? and how much is the contribution? I cannot put 100% contribution in my name, since it is not allowing me. If I put 80:20, still the tax calculation doesn’t change, because I am putting the exact information as per Form 16. Please do let me know, if I am mistaking any bit here?

Thanks in anticipation,

Ankush

Hi Ankush,

Haven’t gone through this information.

Give me a day or two, will reply to your query

Sure, Thaks.

Sir, any further update on my query?

Sir, please respond.

Ankush,

I am still not able to get the query resolved.I have to consult a CA on this matter.Will ensure i reply your query by EOD.

Thanks a ton! Much appreciate this.

If you can answer this as well please?

Is there any provision of tax saving on the second home-loan, where the property is under construction. Also, the first home-loan is still outstanding.

Thanks,

Ankush Jain

In case I am buying a second home ,which i do not plan to rent out. How is the deemed rent calculated? Is there a ready reckoner?

For illustrative purpose, lets say I buy a second home which costs 10LAC and the annal interest on it is 120,000.00. Can i say that the rent income from this property is inr 30,000 per year (at 3% yields as are currently prevalent)?

Thank you,

Akshay,

Generally, the rent is calculated on the basis of annual rental value fixed by the local Municipal authority on basis of which they charge municipal/house taxes. However, if there is a Rent Control act and a standard rent is fixed for any location, then this become the maximum rent one can charge and so will be considered while computing deemed rent.

There is no defined formula and you need to get information on these two aspects.

sir i have two hosing loan from two different bank on same property,kindly tell me can i claim the benefit of 80c on both housing loans

How did you get that? Its illegal to have loan from two banks for the same property. You actually need to submit all property papers to the Bank from which you borrow loan. Obviously, if you take loan from two banks, both the banks will not be able to have all your property papers. Bank obviously will not disburse loan amount unless they have the papers.

sir,

the loan gien by second bank is on the guarantee of first bank.

Ankit,

Are these two loans of same amount for full value of property?

Section 24B is actually dead investment. As per my knowledge, you can even mention loss in share trade in that section. However, I have a question. I have a land loan for which 80c is not applicable. Can I get 24B exemption on this?

Thanks Jitendra for the answer.

I have received a proper certificate from my relative about the interest that i have paid to him. So now i am eligible for tax benefit? Please suggest

Regards,

Rahul jain

I don’t think so. Loan from financial firms (That too only home loans) will be considered for tax rebate. Loan taken from individuals will not count.

Rahul,

Yes you are eligible for the interest you are repaying. As said earlier you cannot clam section 80C under this.

Hi Jitendra,

Do you mean, interest paid on any loan is eligible for IT rebate under 24B? This was my question actually. I have a land loan for which I cannot claim 80C rebate. I am thinking whether it is possible to claim 24B for interest paid!! You have mentioned above that certificate from relative is sufficient for claiming 24B tax rebate. Then I hope it should also allow for other loans – like Personal loan etc. Please clarify.

Regards,

Sudhindra

Sudhindra,

Under section 24 you claim deduction on home loan taken from relatives also.However only the interest is eligible as section 80C is only from a specified institution.

Since, there are no tax benefits provisions on personal loans so you cannot claim it from anywhere.

Sir,

The plot is in my wife’s name and I took a home loan and repaying the EMI. My wife is co-applicant in this home loan. My wife is filing ITR for other sources income only.

Will I get the full Housing Interest Rebate on this house even I don’t have ownership/joint ownership in this house.

Ramesh,

You do not get home loan benefits on buying a plot.Its only the house on which you can claim tax benefits.

Agreed Sir,

I purchased the Plot in my wife’s name but from my income and took home loan from bank for construction. EMI is also paying by me only.

Further my wife is filing ITR for Other Sources income and doesn’t have any other income.

Whether I am eligible for the Rebate of Housing Loan interest, in view of clubbing of income.

Ramesh,

Clubbing of income does not apply in home loan. If property is not on your name then its difficult to claim any tax benefit.You need to be a co-owner in it.

dear Sir,

i donot have the income tax return copies so can i get the home loan still.

my salary is 27k.

kindly advise.

thanks & Regards.

Devendra

i am 3/4th share holder of the property. but i am the only one who is repaying the loan as well as the interest on the same. i get the claim of whole of the interest on this housing loan.

Rajan,

Yes you can claim interest by taking declaration from other holders that they are not claiming any tax benefit.

can i get the claim for whole of the interest.

Allotted flat in December 2006. Construction completed and possession in August 2012. Can I claim tax benfits for the interest on housing loan for the pre construction and post completion period now ? If so what are the limits?

Devarajan,

Yes interest during pre-construction period can be claimed in five equal annual installments once you get the posession.However, it will be under the limit of Rs 1.5 lakh only.

Thank You for the reply. Please note that the first installment of Home loan was taken in December-2006 and last installment in 2010. Period of completion is about six years from first installment and two years from the last installment of home loan. I propose to rent out the home. Please advise accordingly for this type of situation.

URGENT- The house is owned by the father, the housing loan is given in the joint names of father and son considering the income of the son. The son repays the loan. Whether tax benefit can be given to the son eventhough the house is not owned by him but housing loan is opened in the joint names of father and son

Sandhya Someshwar

Sandhya,

No, if the property is not in the name of the son then the assessing officer may not allow the tax benefit as one need to be owner or co-owner in the property.

Is there no tax deduction on loan taken for acquiring land?

No

sir,

Our house is in my dad’s ownership, rules of area are he can not sell or lease for 10 years, now its 6th year. We want to construct first floor, I am working, and want to take loan and claim tax exemption, kindly suggest me what can be done?

Thanking you

Do you have article, how Pre-EMI has to be included in the tax benefit ? Is that something, after construction is over or even before(pre-EMI) has to be claimed. I know, vaguely, it is divided into five equal installments of five financial years. When does it starts ? After the hand-over of home(in that financial year)

Sunder,

Tax benefit starts when you have got the possession of your house.

i have taken a Housing loan of 4000000 for construction of my house for 5 years.i have taken the loan on 05/06/2012 ,am i liable to get tax benefit of 150000 every year till my loan remain as payable ……will i get the deduction of 150000 for 5 years…?

Mavila,

The deduction of R 1.5 lakh is available when your house gets constructed.Any repayment during preconstruction period can be claimed in 5 equal installment when the construction gets completed.However, this benefit is within limit of R 1.5 lakh.

Sir,

We have plot on my Mother name and she is 60+ age, i want to take home loan for it’s construction as i m salried person.

How Can i get the rebate on home loan if i will pay the premium.

Regards,

Anil Gupta

Anil,

You should be a co-owner or owner of the property to claim the tax benefit.

I feel that the Rs.1,50,000 is not the ceiling if Second Housing Loan is taken to purchase a house and the second house is rented out . For the second house , there is no ceiling , even if the interest component goes beyond 1 .5 Lakhs

Yes Mr.S.Antony, on second house one can claim the deduction without any limit.

Dear Sir,

For a financial year , If the total interest payment ie. post possesion period interst and 20% of pre-possession period interst becomes more than Rs 1,50,000 , then whether this amount will be limited to Rs 1,50,000 itself for income deduction purpose?

Yatinder,

Both combine pre and post construction you can claim upto Rs 1.5 lakh.

Hi,

Property is in both wife and husband name. Home loan taken on husband name with wife as co-applicant. Can both avail for tax exemption (50% each of loan interest)?

EMI is deducted from husband’s account, wife transfers 50% of EMI amount before ECS debit date. Is this fine? or should they hold a joint account and transfer the ECS debit to this account?

Regards,

Gauthaman

Gauthaman,

Both can avail the tax exemption in ratio of ownership of property.The best way to claim deduction is from a joint account or distribute EMI payments in case of individual account.

Thanks for your suggestions. Will take the necessary step

Regards

Gauthaman

Gautahaman,

A correction here.

You avail tax benefit in a joint loan in ratio of the loan.So if you have both have a 50% ratio in loan then each of you can claim 50%.

Hello Sir

I am planning to purchase a plot in bangalore. Please advise if i have go for a plot loan or buy the plot and then go for home loan during construction. I also want to know if the tax exemption are available for plot loans.

Harsha,

Tax exemptions are available only for construction of house and not for plot.

My son is working in a govt sector purchased a house on his wife name in the year 2002.Recently he purchased a flat by taking a loan in the bank and paying an EMI of Rs 16,500 pe month.Is he eligble for tax exemption on loan amount.

Thanking you,

S.Babu

Dear Mr S.Babu,

Yes he is eligible for the tax exemption on the loan amount if he has the ownership of the flat.

Dear Sir,

I have a house which is rented out.

thereafter i booked second home for which possession is obtained and i plan to shift in it in coming months. Now Can i treat 2nd house as self owned and notionally rented out, for the purpose of getting IT Tax benefit on home loan interest without any limit ( ofcorse after deducting notional rent income) ?

Yatinder,

Yes you can treat that house as self occupied.

dear sir, i have purchased a flat with my spouse as joint owner. The approx yearly interest component paid on home loan is 4.5 lakh. Whether 1.5 lakh limit shall be applicable individually for both of us or the same shall be divided b/w both of us. please give ur expert advise.

Dear Sumit,

If you have taken a joint home loan then you both can claim Rs 1.5 lakh seperately in proportion of your ownership.

sir,we purchased a flat in joint ownership and paying an interest of 6lakhs an year for the housing loan.whether we can claim both individually 1.5 lakhs each tax exemption.or only 75000 each.please advice us

Jacob,

If its a joint loan then both of you individually can claim upto Rs 1.5 lakh in the ratio of ownership.

Thanks for your reply. I am staying in house property owned in my name which i have let out to my company and getting self-lease every month. For this property balance loan amount was paid in Jan 2012. Recently i have purchased another ready built flat with my spouse as joint owner. which shall be let out on rent. The approx yearly interest component paid on home loan is 4.5 lakh.

1. Wherther 1.5lakh limit is still applicable for both of us or total yearly interest(4.5lakh) shall be divided b/w us in proportion of ownership.

2. Income/loss from house property shall be calculated considering both properties.

3. Please provide any ready-calculation/ article for calculating house income.

dear sir,

ur reply is awaited..

regrds

sumit mishra

Jitendra,

I am confused a bit in e filing the TAX. I have Home loan and got possession now want to get rebate on the interest. Now which sheet should I fill ITR1 or ITR2. ow if it ITR1 then where should I specify the amount over to which I want to file rebate.

Regards,

Prashant

Prashant,

For getting the house loan exemption income from house property need to be calculated.

Consult a CA.

Sir I am paying Income tax on a income of 4 Lakhs after LIC, Ifra bonds, Mediclaim & NPS and I have a housing loan 15 Lakhs paying interest around 2lakhs per year kindly calculate my taxable amount after deduction.

You will have to approach a CA for doing that – there are far too many variables involved in that and it can’t be calculated like this on the comments section of a blog.

Hi ,

I have got married recently and my wife have already bought a apartment with her name in home loan.

She is salaried when purchased the apartment and started claiming the home loan in tax benefits . But she is now planning to quit the job, in this case can i claim the home loan for tax benefits ?

If no is the answer . Are there any suggestions how to claim the tax benefits in my name for home loan.

Home loan details :

Tenure – 15 years ( 2years already completed in repaying EMI)

we are already in possession in the apartment .

Home loan in my wife name .

Rajesh,

you can claim the tax benefit if you are co-owner in the property and jointly taken the loan.

Hi,

I have taken a home loan. The property is in my name. Now can I add my wife as co-applicant and get the home loan transferred. The property is in my name only. Do I have to do something to change the property under both of our names.

Please do help me..

Thanks & Regards,

Senthil

Senthil,

Consult a lawyer in this matter who will be able to gudie you more wisely.

Hi there, If I buy home but still continues to stay in the rented flat, do i get benefits of both ? ie. deduction of 150,000 (interest component) from my taxable income AND at the same time, HRA benefits (house rent allowance) ? Thanks, Jignesh

Shah,

Yes you can claim but there are some conditions attached to this which you need to factor in before claiming for any exemption.

I have taken a housing loan and brought a house and I am living in the same. The housing loan was closed as of last year. I am planning to buy another house in the same city where I have the first house , what are benefits of loan now. My first is obviously comes under self occupied. The second will be rented out. How do i go about declaring this houses in IT.

You advise/suggestion would be highly appreciated.

-Suresh

Suresh,

You can claim tax exemption on loan taken for second house without any limit.The rent received will be included in your income on which you can claim a standard deduction of 30%.

Hi

I have received the form 16 from the employer and missed to delcalre the interest on house loan amount. While filing in the IT returns, is it possible to add the interest amount so that my net taxable income reduces? I didnt find a Section 24 (which is for the interest towards the home loan) in the IT return form.

Please help.

Thanks in advance.

Subrat

Subrat,

Yes you can do it.It is calculated under section “Income from house property” .

Dear Sir,

is offer letter from builder for taking possession of house is sufficent for claiming home loan interest benefit or the date of actual possesion of the house is material to commence the benefit of home loan interest ?

Yatinder,

The actual date of possession is important to claim the tax benefit on housing loan.

Dear Sir,

My wife & my self jointly got an apartment from by a will executed by my deceased father-in-law. We want to sell it and purchase another apartment in the name of my wife. Extra amount needed for new purchase shall be obtained by a Bank/ LIC loan. I shall be the co-applicant and I will repay the loan as my wife is not working. I already own 2 houses in my name and paying EMI for the same. I am an IT asessee and my wife is not, being a house wife. My question is :

1. Whether any capital gains tax is liable to be paid for sale of the house ( either by myself or my wife) .

2. Whether any tax benefit can be availed for the proposed new house ( in the name of my wife) .

Mr>ramana,

Yes, the capital gains arises in case of inheritence also.The cost of acquisition in this case will be taken as the cost at which your father-in-law purchased it.

2.If house is in your wife name you cannot claim exemption unless you are a co-owner in the property.

I and my wife are joint owners of the land and taken a joint house loan from SBI. But the EMI repayment is done fully by me. She is also salaried, but she is not claiming income tax benefit out of this loan. Please let me know whether I can claim full tax benefit out of the interest and principal repayment?

Mr.Mansoor,

Yes, you can claim the fill exemption.Your wife will have to give a declaration in writing that she is not claiming any tax benefit.

Dear Sir,

We are residing in a house from past 21 years without any loans now we need to renovate while staying in house, and i am planning for home loan will i be able to avail tax benefit where 4 of our family members are owners to the property?

ChadrPrakash,

You can claim deduction up to Rs 30000 p.a. on this loan.

I have not shown Housing loan details to my organisation and hence the details are missing in my Form 16. However I’ve all details (especially statement from housing loan provider) now.

I am still eligible to submit these details and re-calculate my taxes during IT filing?

Your response would be of great help.

Regards

Karthik

Karthik,

If you have missed the information in form-16 you can claim it during ITR filing.

I bought plot and constructed house in it now I am getting 150000 tax benefit on interest component. If I construct 1 or 2 house above my home with separate house loan for renting purpose, Will I get tax exemption on the interest paid towards 2nd home loan?

Regards,

Shodhan Kini

Shodhan,

Since the ocnstruction will be on the same property you won’t get full exemption.However, you will be able to claim exemption upto Rs 30000 available for for house repairs /improvement.

Hi,

Just like Karthik I did not show the housing loan details while declaring the income, and now I’ve I quit from the job. I received the Form 16 from my employer and it does not contain the details of housing loan principal repayment. The property is in the name of my father but the loan was granted considering my salary too. The provisional Interest certificate from the Bank includes both of us names. I’ve paid the 70 % of the EMI via cheque or cash payments (not interested in tho’). After I got the SB account number (Father’s) registered online, I’ve transferred it via my salary account. The Housing Loan account number is different from this though both are from the same bank.

Can I show the amount transferred to my father’s name and file the return? If yes, can I submit the monthly statements showing the transferred amount.

Thank you!!

Sunil,

Transferring the money to other account is not granted any tax exemption by the income tax department.Also the loan can be jointly, but if the property is not in your name you won’t be able to claim tax exemption.

Hi Jitendra Ji,

I want tax rebate on house loan interest, (house self occupied) which ITR do I need to fill? ITR-1 or ITR-2? And which section Do I need to fill this in ? Is it income from house property?

Manohar Rawat

Manohar,

You need to fill it under “Income from house property”.If you have only one property then ITR 1 is the right form.

I want tax rebate on house loan interest, (house self occupied) which ITR do I need to fill? ITR-1 or ITR-2? And which section Do I need to fill this in ? Is it income from house property?

Maulik,

You need to fill it under “Income from house propertyâ€.If you have only one property then ITR 1 is the right form.ITR 2 is used for more than one property.

Hi,

I have taken a home loan against a 3 bhk flat around 4 years back.

I bought this flat from builder in pre-launched. Now I have done the entire payment (except stamp duty & registration) of my flat and got the possession.

When I am asking to get home loan rebate (on principle & interest), my employer is asking me to produce registered sale deed agreement.

Since all the flats are not completed yet I am unable to register my flat.

I wanted to know that is it really mandatory to have sale deed agreement in order to get income tax rebate on home loan. if yes do i have any alternate?

FYi. I have all documents except registered sale deed agreement i.e bank loan sanction letter, sale agreement, possession letter, Bank certificate for re-payment.

Many Thanks,

Deepak

Deepak,

The property is not counted in your name till you register it.That’s the reason you are not able to get any tax rebate.

Hence, you will have to first pay the stamp duty, register it and then claim for the tax rebate.

Dear Sir,

I had purchased a house in Sept.2002 after taking loan from Bank. I am getting IT rebate on the loan amount (interest + principal). Around Rs.35,000/- on interest portion.

In 2010, I have purchased a flat after taking loan of Rs.20.0 Lakh from LIC. I have paid Rs.1.65 lakh on interest portion this financial year.

This financial year (2011-12), I have paid around Rs. 2.0 lakh on interest part Housing loan of LIC & Bank.

Now, I am having one house and one flat. One house, I have given on rent basis and getting Rs.25,200/- rent per year.

Sir, Please tell me how much rebate will I get on interest portion of loan Rs.1.5 lakh or more than Rs.1.5 lakh. I have paid more than 2.0 lakh income tax this financial year (2011-12).

Please reply my queries Sir,

Many Many thanks

nk sahu

Sir

I am eagerly awaiting your reply.

Thank you,

nk sahu

NK Sahu,

When you have two houses one is treated as self occupied and you can claim Rs 1.5 lakh interest on it.On second house you can claim housing loan tax exemption without any limit i.e. the entire interest.Hence, you will be able to claim Rs 2 lakh in your case for both the houses.

Sir

I have following queries by seing your blog..

1. If you going to fill your ITR by efiling mode than there is no need togive any documents than how income tax department come know that at what date you got possession with resistration ?

2 I have two houses and both are rented while I am living in govt quarter so do not get HRA in salary. In this situation which ITR form need to be fill for ITR ?

3. One house is with my name and other flat is resistered with name of myself and my spouse. In resistration share of parnership is not defined. Whole EMIs(of both houses) are paid by me. Now My wife has started to work as private teaching but she is earning only 50000 RS per years and she is also going to fill ITR from this assessment year. She will not claim any intrest benifit. Can I get intrest lost benifit for both houses ? Even my wife is co-applicant in one flat, can I claim 100% intrest loss for that property as I am paying 100 % EMI ? What is methord to convey to ITD as I am going to opt effiling process ? Pl suggest best way in which I get maximum benifits.

4. As you know that we could not rented both houses through out 12 month because of 11 month aggement we are generally doing. So practically we got 10 to 11 month rents. How it can be reflected in ITR form ?

5. I requasted to go through the HP(House property) schedule of ITR-2 and suggest how to fill as per my above situation.

6. Can I get benifit intrest loss of 300000 by both ITR(my & my spouse) as per above situation ?

P l reply urgentaly as last date for filling up ITR is 31 July,2012.

Regards

Hi sir,

I am living in Pune whereas my wife and children are living in Bangalore. We have a house at Pune and recently bought a house at Bangalore. Both the houses are reigstered on our names as co-owners. The annual interest paid on Pune home loand is about 1.5 lacks and 6.5 lacks for Bangalore home loan.

On Pune house, I am claiming IT benefit of interest paid on it as owned house.

On Bangalore house, can we both claim income tax benefit on the interest paid? Our share of finance is 70: 30 between myself and my wife.

If yes, can I show Bangalore house as deemed rented house (as I stay at Pune), whereas my wife (who is staying in the house) show it as owned house? In such case, can I be allowed to claim IT benefit on Bangalore house as second house, where as the same is owned house for my wife?

please clarify

thanks

Nagarju,

You can clam tax benefit on second house without any limits.One of your house will be self occupied and other will be deemed rented.However, as co-owners you can claim in the ratio of ownership only.Also, the same house cannot be shown as self occupied by one and deemed rent by other.

Nagarju,

A clerification for you.

Co-borrowers, who are also co-owners, are eligible for tax rebate in the proportion of their share in the loan. So, a couple can be equal owners but if their share of the loan is in the ratio of 60:40 or 70:30, the tax benefits would be shared in that proportion.

Sir/Madam,

I bought a new flat this year and possessed the flat on 1st July, 2012. The flat is regestered. I was planning to buy a 2nd flat. Shall I get tax exemptions on two flats ? What are the options ? If there are two home loans from two different banks are both tax free ?

Abhinash,

On one flat which will be counted as first, you can claim interest deduction of Rs 1.5 lakh only while on second house you can claim without any limit.

After calculation, I get to know that I have to pay tax. So in challan 280, which type of payment should I have to select? ” Self Assesment (300) or Tax Regular ASsessment(400)?

Sir,

pl clarify the followings:

1. I have taken a house in co ownership with wife. First name of my wife and second my name. Ratio of share not deffined in deed.

2.Taken house loan in my account although wife also coborrowers but i am main borrower as i have income.

3. presently i was taking home loan benifit and paying EMI.

4. Now I want that I should pay rent to wife for the same house and claim house rent deduction. Further, my wife will show rent in her return.

5. Wife will pay amt of EMI to me and i will pay tp bank. then whether wife can claim deduction of interest.

6. whether ownership of house can be shown in booksin the name of wife assuming that i home loan was taken for wife.

Kindly suggest.

Thanks in advance

I am staying in house property owned in my name which i have let out to my company and getting self-lease every month. For this property balance loan amount was paid in Jan 2012. The same is free from any loan. Recently i have purchased another ready built flat with my spouse as joint owner. which shall be let out on rent. The approx yearly interest component paid on home loan is 4.5 lakh. Can you please confirm the following.

1. Wherther 1.5lakh limit is still applicable for both of us or total yearly interest(4.5lakh) shall be divided b/w us in proportion of ownership.

2. Income/loss from house property shall be calculated considering both properties.

3. Please provide any ready-calculation/ article for calculating house income.

My father has taken loan for a flat and also flat is in my father and mother’s name, but the EMI is been paid by my brother. now as he is paying EMI he is not able get benefit in Tax.

Can you please suggest what we could do, can we transfer the loan in his name, also if we can transfer the flat in his name but we do not wish to pay huge amount for flat registration.

Thank you

Rinu,

Loan does not get transfer unless the ownership is in his name.In your case, your brother name will ahve to be included to claim tax benefit.

We have a house in the name of my father who was expired few years back. I wanted to buy with the consent of my brothers/sisters. Can I get Home Loan from bank? Can I get benefit in Income tax for Interest on Loan?.

Subha,

Your case i sof succession where you are one of the legal heirs.I do not think you can avail home loan unless you are buying it.For more clarification consult a lawyer.

SIR

I AM CONSTRUCTING HOUSE ON MY WIFES PLOT. I AM THE GUARANTER BECAUSE SHE IS HOUSE WIFE. IHAVE TO PAY FULL EMI. CAN I CLAIM FOR TAX BENEFIT. IF YES PLS TELL THE PROCEDURE OR IF NO HOW TO GET THE BENEFIT

I AM CONSTRUCTING HOUSE ON MY WFES PROPERTY. FOR THAT I HAVE TAKEN LOAN FROM SBI AND I AM PAYING FULL EMI. SHE IS HOUSE WIFE. HER INCOME IS ZERO. SO SBI TAKEN ME AS A GUARANTEER . CAN I GET THE TAX BENEFIT.

Hello

I am planning to buy a flat for 60 L in Bangalore and use it for 10 years and sell the same after 10 years. I am planning to buy this on full bank loan for 10 years. Please reply how do I compare cost of the flat after 10 years and how much loan (interest + principle amount) i will be paying in 10 years in today’s interest rates. These numbers I want to compare with expenses of house rent for 10 years in Bangalore. Please reply and guide me ASAP.

Thanks

Prabhu

Dear sir,

I am taken a home loan for construcion of home on my own name in the month of May2011 and costruction started, mean time i have paid monthly interst without principle amount, and construction complited in the month of May 2012, and given complition certificate to the bank. So i want to known how should i get the tax benifit on interst paid.

Deepak,

Interest paid during pre-construction period can be claimed in five equal installments once you get the possession.So if you have paid interest of Rs 1 Lakh, you can claim Rs 20000 every year fr next five year when the construction gets completed.However do remember that this is within the limit of Rs 1.5 lakh under sec 24.

I have taken residential land purchase loan in July 2011 and started construction on the same in April 2012. Can I calim rebate for interest & principal repayment on resident land purchased ? Please guide me for the same.

Thanks

Naveen,

You cannot claim deduction on purchase of land.

Hello,

I have taken home loan of 915000 and want to avail tax benefit, what are the documents which i need to submit for availing the benefit. I mean do i need to collect bills from the bank to which i am paying the EMI.

Thanks,

Sampath Kumar

Sampath,

You get a provisional certificate at start of financila year and actual certificate at end of the year from the bank to claim Tax Benefit.This certificate gives breakup of principal and interest.If you haven’t received ask from the bank.

Thanks a lot for the info Jitendra

Hi, Can i claim HRA as well as Int on Housing loan uner Sec 24 and Principal under 80 C if i am not staying in the constructed house. But i am staying in a rented house that is close to my office.Both the houses are in the same city.. but because i want to stay near to my office i have let out my constructed/purchased flat and staying near by to office for rent. Please suggest me the solution. I have a ready a case study where this kind was allowed.

clarification awaited….

Nagendar,

Yes you can claim HRA along with Loan Deduction.But there are one conditions which should be fullfilled.

Read my previous comments

During the Form C…i mistake and declared wrong amount in the Form C..and accordingly Form 16 prepared..

So i want to know what is care taken during the Income Tax Return….

Regards,

KC

Kiran,

You can file the correct ITR based on the documents you have.

interest on housing loan to be shown under which head in ITR I while efiling?

Also how does the income tax department verifies the information submitted in e filing of ITR I?

is there any need of attaching form no 16?

Prasad,

This benefit is shown under head “Income from house property” .

No there is no need to submit any documents in e-filing.

Jitendra: If I show under head “Income from house propertyâ€, should i show up the amount in negative like (-150000)? Please confirm… Thanks !!

Hi,

I am a co-borrower with my dad, on a home loan taken from HDFC on Nov 2011. we have started paying the installments, however my dad is paying the monthly installments. The flat is under construction in Allahabad (at my hometown), and I work in Delhi. The property would be ready for the possession by end of the yaear.

Can you please explain me, what amount can I claim for the tax purposes for this assement year ? would be great if you could also explain what can be claimed by my father.

Thanks in advance.

regards,

Abhash

Abhash,

Claim of tax benefits depends on the ownership in property.You both can claim interest deduction in the ratio of ownership.if its 50% then you can claim 50% of the total interest amount as deduction.However, do not that any interest payment during pre-construction period can be claimed only after completion of property.

Hi ,

we are planning to take a flat, we will get its possession after 4 yrs . its cost is 32 lakh. we are planning to take home loan for that . as Banks provide home loan upto 80 % only . i just want to know that how house loan can give me benefit for my Tax rebate.

Guddu,

You can claim for principal repayment upto Rs 1 lakh under section 80C and the interest of Rs 1.5 lakh p.a. under sec 24.

Dear Sir,

Kindly reply to my folloing queries.

I am staying in house property owned in my name which i have let out to my company and getting self-lease every month. For this property balance loan amount was paid in Jan 2012. The same is free from any loan. Recently i have purchased another ready built flat with my spouse as joint owner. which shall be let out on rent. The approx yearly interest component paid on home loan is 4.5 lakh. Can you please confirm the following.

1. Wherther 1.5lakh limit is still applicable for both of us or total yearly interest(4.5lakh) shall be divided b/w us in proportion of ownership.

2. Income/loss from house property shall be calculated considering both properties.

3. Please provide any ready-calculation/ article for calculating house income.

regards,

sumit mishra

Interest on housing loan to be shown under which head in ITR I while efiling? If I show under head “Income from house propertyâ€, should i show up the amount in negative like (-150000)? Please confirm…

Ram,

Yes.The house property income in case of housing loan will come negative if you have self occupied property.

please confirm

Can i get Tax benefit on Pre EMI?

Sunil,

You can avail of tax benefits on the interest component of the pre-EMI only after the construction is completed. But that doesn’t mean you will not get tax benefits on pre-EMIs at all. Once the construction is completed, you can show the pre-EMI interest payment in five equal instalments in subsequent years. For example, if the pre-EMI payments aggregate to Rs 5,00,000, then Rs 1,00,000 each can be shown over a period of five years for tax benefits.

However, you cannot claim any tax exemption on the principal amount, if any paid, in this period

With regards to your example, is this Rs. 1,00,000 apart from the Rs. 1,50,000 that I am can claim for each of those 5 years? In other words, will I get Rs. 2,50,000 exemption for the first five years?

Hi,

One query regarding tax benefit on housing loan under 80c and interest payment.

I have taken home loan on my name and I am paying the EMI of 25000/month for a house but I have made my mother(house wife no source of income) as owner of the property. Tax certificate has both our name but legally she is the owner. Can I take tax benefit under 80c and for interest payment.

Sumeet,

If you are not the owner of the property then you will not be able to claim the tax benefit.

Hi Jit,

Suppose If I have taken house on my spouse name and she is not working. In that case can i avail tax?

There is a provision in income tax for claiming tax benefit in case of spouse as owner.But do consult a CA for clerification on this as most IT officers do not allow it if it is done only for tax benefit purpose.

Sir, I have a housing loan for a housing plot (i havent started the construction yet) hence staying in a rented house, can i claim HRA and loan (principal & interest). Please guide.

Rashmi,

You cannot claim tax benefit on a plot.It has to be a house.

I have 2 home loans out of which, 1 would get fully repaid by end of the next month. I live in the same home.

If I decide to buy third house, by taking a fresh home loan – I will have 1 self occupied property which does not have any home loan on it AND 2 rented properties with home loans on each of them.

How does the taxation happen in this case? Do I get the benefit for (Rent – Corporation Tax – 30% deduction for maintenance – total interest ) for both these properties while computing tax?

And would I be liable to pay the wealth tax on it? If so, how it would be computed?

Umesh,

You need to consult a CA in this case.

I have obtained two different housing loan for purchase and construction on my allowted residential plot in Noida as detail given below :

Bank Loan Amount Remakrs

HFDC, Noida Rs. 3 Lakh Loan was taken for purchase of land from June,

2002 to June, 2010. paid compenent as follows:

Principal Compenent : Rs.2,45,107/-

Interest Compenent : Rs. 1,60,129/-

State Bank of India, New Delhi Rs. 20 Lakh For Construction on my said residential

plot from Sept. , 2010 onward for 20 years.

Interest has been paid to Bank till date :

Principal Compenent : Rs. 94,570/-

Interest Compenent : Rs. 2,37,480/-

The construction work has been completed in June, 2011 and I am living in said constructioed home.

Sofar I have not claimed any tax benefit on the repayment of above loans.

You are requeted to please guide me how I can avail the Tax benefit on my earlier loan inetrest and ongoing current loan. Which type of documents are required to submit for claim.

Please reply

thanks

Daljit Singh

Hello,

My husband and myself has taken a joint Home loan and home is also both are owner of home. We want to claim 50-50% tax benefit. but our office is demanding certificate from bank stating share of each borrower.Bank is not ready to furnish the same. Is it written somewhere in official website of income tax about this rule of tax benefit so that we can show it to our office??

Snehal,

In a joint loan you need to specify the ownership in the property documents itself.It becomes much easier to claim.The reason why office is asking this is that in a joint loan the tax benefit is claimed in ratio of ownership and not loan.

Thank you Sir

Snehal,

A clerification.

The tax benefit is claimed in ratio of the joint loan.This should be specified by the bank in the documents.Generally you should while taking the loan insist on the institution to add this details in loan documents.

Details about claim in joint loan is available on income tax website.

hi,

I have constructed a house. started living in.

The loan amount is 150000/-

Can i claim both Housing Loan repayment of Principal of 1 L and Interest 1.5L (total of 2.5L) tax exemption.

Regards

Arun

Yes you can

sir,

my husband and myself applied for home loan for 1200000/- and repaying monthly 14600/- as the total of principal and interest amount.

my husband is paying the repayment instalments fully through his saving a/c only.

can he claim the tax benefit fully as i am not a tax payer?

total how much he can get tax rebate?

LS Jamuna,

The tax benefit can be claime in ratio of ownership.Your husband can claim th efull by taking a written declaration from you for not deriving any tax benefit.

i have taken a loan of rs 34lacs for purchasing a under construction flat which has been booked in joint ownership of my father and wife.can i claim tax benefit

There is a provision of claiming tax benefit in case of ownership of spouse but not father.You will have to consult a CA for more clerification.

Dear Sir,

i have to purchased a well build house at my village whose cost is near to 300000 (3 Lakh Rupees)

if i taken a loan of 3 lakh to purchase this property then can I able to get ITR (principle 1 L + interest -1.5 L)total 2.5 L tax exemptions

As house is ready with construction.

Ravindra,

Yes you can claim if you are buying a constructed house.

Dear Sir,

I have already one flat bought though loan in 2003 onwards and i repaid all instalments and loan completed. Presently i am staying in that Flat.

I am planned to purchase another one flat by loan in another city (Chennai) which is in construction phase. The Flat expected possession shall be in April 2014. Shall i get IT rebate for the EMI payment. How it can be claimed? What shall be limit for that?

Kindly Reply.

Thanks in Advance.

Ganesan

Ganesan,

Any repayment of loan interest during construction period can be claimed after the completion in 5 equal installment in 5 years.However, the interest claimed is well within limit of Rs 1.5 lakh.You do not get any claim for principal repayment during construction period.

Thank you sir

Hi,

I booked a flat. Registration and formalities are completed.

Now I went to SBI bank and the manager says that there is differencr in Blueprint and description in Agreement.

Actually One of the bedroom was is not shown in Blueprint so bank says I looks like 1 BHK Vs 2 BHK mentioned in Agreement. I already informed the Builder and they are working on this.

Pls suggest if anything to be done from my end ?

Thanks,

Parag

Sorry My mistake in description –

Actually there is a bedroom infront of Kitchen and the front wall facing kitchen is not shown in blueprint for that bedroom …which reflects it as 1 BHK as per bank.

thank you sir

Hi Jitendra Solanki,

I have paid an interest of 1,20,000 in the last financial year towards my Housing loan. I am preparing to file returns towards my income tax. As you’ve mentioned, I will claim this money in 5 equal installments as this was part of pre-occupation interest.

I would like to understand from you as to what documents do I need to submit alongwith my returns so that my claim for interest towards Housing loan is accepted by the IT dept and I get the returns. I have papers related to my flat registration, sale deed copy, Bank Interest certificate. Do I need to submit the copies of these alongwith during the Income tax returns filing process? Please let me know.

Thanks,

Prasad

Prasad,

In e-filing you do not need to send any documents except ITRV which is generated.However, maintain all the records to ensure if any query is raised you have the proof.

I have taken the housing loan for housing plot and constructed only 1 small room. I have got the Bank certificate for Interested paid (mentioned as per IT ACT 1961 you can claim in 8oc and 24 section). I am doubt whether to claim or not as its plot but got the strong certificate from the bank.

Can u help whether I can claim?

Hello,

Would like to seek your views on the pre-emi interest reimbursed by the builder. In case the builder reimburses the pre-emi interest paid to the lender, would such reimbursement can be offset against the interest paid or is the reimbursement is treated as a taxable income?

Thanking you in advance

My father in law have house in his name .He has taken loan from bank ,now he is retired from service and he is not able to pay installments of house loan so his son is paying installments.May his son take the exemption from income tax.

P.N.Malviya,

If he does not have any ownership in property he will not be able to claim any tax benefit.

i have a home loan but i have given that house on rent, so in itr1 form where shoild mention the rent received,kindly help

You iwll ahve to fill ITR2 if you have any income from property.

I have taken loan of Rs.42lacs. Can I avail of the taxbenefits u/s 24 & u/s 80.

I am not living in the same city as my house , due to my employment. I am also getting HRA from my employer. Can I also avail of the theH HRA exemption benefit.

Jaswinder,

yes you can claim both.

I have a flat in Mumbai on which there is no housing loan. The loan was completed 5 years back. I work in Mumbai and stay in my flat there. Now I intend to buy one completed ready to move in flat in Coimbatore. The loan amount will be 35 lakhs. Can I get Income tax benefit on both principal and Interest part? I do not wish to give the new flat on rent. As my child is studying in a residential school in Coimbatore, I wish to stay there on vaccations or on their holidays. What should I do to get maximum tax benefit?

I have taken a home loan. House is complete and is rented out. I am paying the emi which has both principal and interest components. will i get rebate on both principal and interest component to the tune of 100000 and 150000 respectively

sir,

We my wife and i have taken home loan from sbi to construct a home on previously perchased plot. The ownership is in the name of my wife. We have taken a home loan jointly.

my wife also working in state govt. but she is not under the income tax slab.

Can i claim the deduction from house property in my income tax return form.

Reply soon.

Thanking you

vikas meshram

Dear sir,

Regarding hosing loan repayment during construction phase it was told by friend that pre-Emi amount can be considered for income tax exemption. What is Pre-EMI? How it can be availed ? Any restriction for that? If it includes Principal amount or interest.

Please explain to know more

Regards,

Ganesan

pls tell us our employees have taken the loan of housing up to 2.5 lakh , so pls tell me how much rebate will gate on principal and interest.

Regds

B.N.KATORE

Bandu,

On principal Upto Rs 1 lakh can be claimed under section 80C while on interest upto Rs 1.5 lakh can be claimed in a year.

Hi

I have recently purchased a house. It’s under construction and possesion is in next 2 years..Can i claim both HRA and housing loan interest if i am living in same location where i have purchased the new under construction house.

Hi

I have recently purchased a house. It’s under construction and possesion is in next 2 years..Can i claim both HRA and housing loan interest if i am living in same location where i have purchased the new under construction house.

Sunny,

Yes you can claim HRA benefits. However, housing Loan benefits during underconstruction period can nly be claim after you receive the possession and that too only the interest.

We have purchased newly constructed flat & registation is in my wife name but the Home laon from HDFC is joint & i am co-applicant. EMI is being paid from her salary.

Can we claim interst benifit as 50:50. If not, if EMI is paid in ratio of 50:50, can i avail benifit of 50% interest besides property is in wife name?

Dhanjay,

Income tax do have provision of claiming exemption in case property is in spouse name.IF EMI si paid form her account then you might not be able to claim it.Have the repayment from joint account then only you can claim any ratio.

I purchased a flat on August 2012 and I will be getting the possession on December 2014. So does this mean I can claim tax benefit only under section 24 (max of 1,50,000)? Please clarify.

Pradhan,

Any interest you have paid during the period if it was under construction, you can claim it after the possession.

Hello Jitendra,

Thank you for providing this information. So this means until I take possession, I can claim the principal amount (max of 1,50,000) only right?

Pradhan,

You can claim only the interest repayment of underconstruction period.

There is no provision of claiming the principal either during the period or after completion.

Hi

Can the registration charges incured for buying new apartment be declared to avail tax benefit? If so under which section

Siva Prasad

Stamp duty and registration charges paid for transfer of property qualify for deduction under Section 80C.

Nice post..you mentioned there is upper limit of 1.5L on interest deduction. On some online forum, I read that if you give house on rent, then you can show (interest paid – rent earned) as loss, and this entire loss is deducted from your taxable income. And this loss does not have any limit; meaning there is no cap of 1.5L on this loss. Now wondering what is correct information, cap or no cap?

Searching pune home,

Yes you ar eright.

FOR LET OUT PROPERTY, actual interest paid/payable can be claimed as deduction.

Thanks for your prompt reply, Mr Solanki. So for let out property (assume second property) if one takes a loan, and entire interest is deducted from taxable income…would it mean that the person would pay zero income tax? Is this at all possible? I think it still does not make much financial sense, you might be saving 30% on income tax, but you still end up paying interest to the bank.

Hi, We have bought a ready-to-move in home and staying there since May 2012.

House is on name of my husband, while I am co-applicant in home loan. EMI goes from my salary account. So How much we can claim to save IT, and whats best way to save maximum on tax, we both come under 20% bracket and has high basic. Thanks.

Vaishaly,

You are making wrong combinations for claiming income tax benefit.

For claiming any tax benefit you need to be a borrower of property either singly or with some share. If not then you cannot claim any tax benefit.However, income tax have a provision of benefits if property is bought on spouse name.But the taxman shoudl be convinved that thsi is not done only for tax benefit.

You both will be bale to claim your respective share only when you both are paying EMI.If EMI si going from your account then your husband will not be able to claim.Hence, first change your EMI outgo to a joint account.

You will be able to claim tax benefit in ratio of your loan only.So if it is 70:30 then teh tax benefit will eb in same proportion.

I am a salaried employee and taken personal loan from my relative for purchasing a house, can I avail exemption u/s 24, as interest paid on housing loan and also clarify to take deduction u/s 80 c regarding principal payment.

in short, if any body takes loan from his relatives for acquiring home, will he be eligible for taking dedcution u/s 24 & u/s 80 C

Dear Team,

Greetings,

I have taken House Loan of 30 Lakhs of which i will be paying around 3,50,000 per year.

Kindly let me know what is the Maximum amount i can claim tax exception for?

Also Please note that the house loan has been taken for buying a SITE and not building a house.

Please assist..

Dear Jitendra,

I have taken loan of Rs 14,90,000 /- in Indian bank and bought a plot , can i avail the tax benefit for this type of loan ? What documents should i ask from then Bank to submit in my company for IT declaration. Also is it possible to extend the same Loan for construction of House ?

Pls advise.

Thanks in Advance

Benny,

You cannot avail benefit from loan taken on a plot.Its only for construction of house.

Sir,

My form 16 says, Rs.58112 is my interest paid for my housing loan, u/s 24(I) (VI).