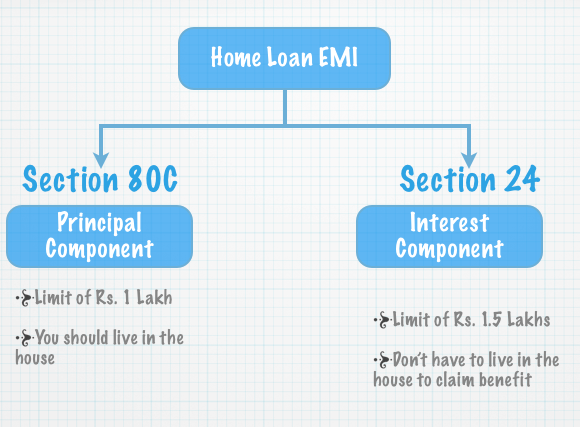

A house loan repayment has two components – principal and interest – and both of these components are treated differently for tax benefit calculation purposes.

The principal amount is covered under Section 80C and has a Rs. 1 lakh limit. In order to claim the tax benefit under 80C the house should already be constructed, and should be a residential property.

Section 24: Tax Benefit on the Interest On Home Loan

The interest on the home loan is treated differently, and Section 24 deals with the tax aspect of the interest on house loan repayment.

The maximum limit under this section is Rs. 1,50,000 and you don’t have to actually live in the house to claim this benefit.

The interest payment is deducted from your taxable income and thus reduces your tax liability. There is no limit on the number of houses you can claim this as well as the location of the houses. The only limit is Rs. 1,50,000 on the whole amount.

There are special conditions like when you get the loan disbursed before the construction of the house and pre – EMI interest and Raag has covered these aspects in a lot of detail in his post about tax benefits of a home loan which you can read if you were interested in those details.

Correction: An earlier version of the article stated that the 80C deduction is only available if you are living in the house. CA Karan Batra notified me that you don’t have to live in the house to claim deduction. Apologies for the mistake.Â

Sir, My first flat is SOP & it is debt free. I have borrowed loan for my second flat Rs, 17,00,000 in Jun 2016. Currently it is under construction. Expected possession is in March 2018, however it may get delayed. How much deduction can I consider now for FY 2017-18 for principal & interest component ?

My employer had not considered interest & principal amount in FY 2016-17 which I had paid till March 2017. Can I claim it now while filing return in Jun 2017 ?

Sir,

I want to know the calculation of perquisite . If value of perquisite is added to the income , then whether we can deduct the value of tax paid on this perquisitite as loss to the income. Specially , in case of housing loan where concessional rate of interest is provided

Dear Sir

I have jointly purchase the flat at Kolkatta. First Name is Mrs. Mahuya Mukherjee & 2nd name is Gautam Mukhopadhyay.

My question is Can I get tax benefit from Hoam Loan

I waiting for your reply.

Hi, I have availed a home loan under my name but purchased property under My Mom. Can someone plz tell me if i can avail tax benefit, if yes then how. Thanks

I have taken a housing loan. There is deduction of Rs.210000 (80C) towards principal in the year. Rs.240000 is allowed accrual interest for the year. My taxable income is Rs.45000. Can I claim Rs.48000 as accrual interest in the current year and remaining claim of accrual interest will intact.

Hi

I have opted for SBI Max Gain. My question –

1. Whether i am eligible for Section 24: Income Tax Benefit on Interest on Home Loan ?

The maximum tax deduction allowed under Section 24 of a self-occupied property is subject to a maximum limit of Rs. 2 Lakhs .

Currently the property is in Under Construction stage.

2. Tax certificate provided by SBI comprises of what all details ?

Kindly suggest what all options are available to me for getting the Tax exemptions ? I have recently bought the first home, loan amount 24 Lakhs, property price-34 lakhs.

Hi,

I have opted for SBI Max Gain. My question –

1. Whether i am eligible for Section 24: Income Tax Benefit on Interest on Home Loan ?

The maximum tax deduction allowed under Section 24 of a self-occupied property is subject to a maximum limit of Rs. 2 Lakhs .

Currently the property is in Under Construction stage.

2. Tax certificate provided by SBI comprises of what all details ?

Kindly suggest what all options are available to me for getting the Tax exemptions ? I have recently bought the first home, loan amount 24 Lakhs, property price-34 lakhs.

Can I Claim the Housing Loan Interest U/s 24 B due to Only Interest Debited During the FY 2015-16 Rs, 99035/- But Amount Paid towards the principal and Interest Rs. NIL.

Timely blog post – I learned a lot from the points . Does someone know where I might obtain a sample a form form to use ?

Sir,

I have purchased 1 flat from greater noida authority as per their emi scheme in this I am paying principle+interest as a emi to authority so now query is that can I take income tax benefit of home loan under section 80c and 24B. Please guide me on this..

Interest paid on Home Loan Top Up . Is rebate available under section 24 ?

Sir,

I have taken personal loan for the purpose of house repair.Can i claim the rebate for the interest amount paid under section 24(b)

I would like to know why ITR 1 meant for e-filing doesn’t include section 24 under deductions? Is there any way of filing gross income from rented house property and deductions under section 24 clearly reflected on the IT document?

sir,

i am a government employee. I have purchased a house in the name of my wife. But i am re paying the loan. Can i claim the exemption for income tax for interest paid on housing loan?

Dear sir,

This is first time i am taking home loan. what are the documents required to show in income tax declariation.

and another one i am the Borrower and my brother is co-borrower how i can show this?

please clarify i am fresh in this………

I am seeking a clarification to a query that remains unresolved till date. If the home loan was disbursed to me in two instalments in two successive years how am I calculate the period of three years for claiming the benefit of 1.5 lakh deduction i.e. from the end of the financial year in which the last instalment was given or the first?

Dear Manish Shah

You can claim interest and priencipal repayment only if the ownership is on your name severally or jointly.

Dear Mukesh

You can claim principal repayment upto Rs. 150,000 u/s 80C

And interest deduction u/s 24 b upto Rs. 200,000 is your house is self occupied.

I have taken loan from bank in which first borrower name is my self and co borrower is my wife and all HOU.loan EMI deduction from my salary can i claim both principal & interest against my income.please answer.

Dear Sir,

with reference to housing loan interest & principal amount .

i have taken loan from bank in which first name of my wife & second name is my name. and all HOU.loan EMI deduction from my salary can i claim both principal & interest against my income.please answer.If any specific propotionate certificate is required or not.