Dividend History of the Best Dividend Paying Shares

Dev left a very good comment on yesterday’s post about the best dividend paying stocks which said that while it’s good to have the list of current yields, it’s also important to look at the consistency with which these companies have paid dividends.

That is a very valid point and I took a look at the dividend paying history of all the stocks that I mentioned yesterday plus SCI which has a very good yield, was present in my earlier posts but I somehow missed yesterday. Thanks to Mr. VKD Menon to point that out.

I’ve taken the dividend history data from the NSE website, and right now I think that’s the best source to get this data. You can find calculated dividend yields on other websites, but I’ve found a lot of the numbers to be inaccurate, and that’s primarily the reason I didn’t use any website but rather took the share price and dividend paid and then calculated the numbers myself.

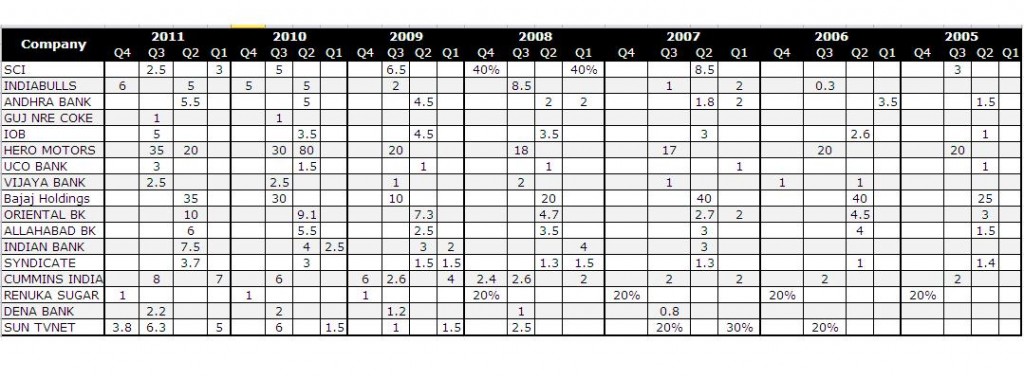

With that said, here is the table that contains the dividend paying histories of some of the best dividend paying companies in India. (Click to enlarge)

The quarters in the above chart are based on calendar years for ease of use, and when I’ve used percentages it’s because there was a share split or bonus in the share and the NSE website listed the dividend as a percentage of face value instead of the amount, and that may be inaccurate.

Looking at this data shows that while most of these companies have been consistent dividend payers – India Bulls and Sun TV has hiked the dividends only recently, and you never know if that will continue or not. Even Cummins India has had a good dividend payout this year but the only other year when the dividends have been these high was 2009.

I don’t notice anything unusual in any of the other stocks, but if you do then please do leave a comment.

Found link Top Dividend Stocks for BSE and NSE on moneycontrol.com with dividend history, One can also view all stocks or filter them according to the group or its sector.

I don’t even recognize a lot of names towards the top of that list. They should probably limit the stocks that feature there by size in order to make the list more useful.

This link Dividend yield on IIFL gives in terms of market-cap but then dividend history is missing..

Oh okay – thanks!

As you have mentioned, split/bonuses make this pure numerical analysis insufficient. One more such instance is corporate restructuring. For example, Bajaj holdings in its earlier avatar was Bajaj auto (currently listed Bajaj auto is a new company !!). So, its data from 2009 is of the holding company while the earlier was Auto+Holding+Insurance+everything. In 2008 or 2009, they split this big Bajaj auto into 4-5 different companies and made this Bajaj holdings as the continuation of earlier Baja auto. So, the comparison with previous years is not right here.

Another point to note here is that we need to see if the dividend will continue/increase at this rate for ever. In most of the cases it is true, particularly in case of PSUs listed in the article. But in some cases it may not be. Here also, Bajaj Holdings is an example. Last two years it gave higher dividend of Rs 30 and Rs 35 primarily by selling non-strategic asset (ex: ICICI shares, Bonds that matured etc) and giving most of it as dividend. But this non-strategic asset is almost over now. So, from this year onwards their primary source of income will be dividend from bajaj auto and interest from FDs/Bonds. I am sure they will bring dividend down to probably Rs 10 or Rs 15 only !!

Deviating from the guideline of this mail, which has rightly looked at reasonably big companies, i must say that there are some good companies with long track records. One should look at that also. Balmer lawrie is one such example. It is a PSU company which was carved out of IBP when it merged with IOC. It gives div yld of 4% or so. Balmer lawrie and Investment, which holds the shares of Balmer lawrie is even better. it has div yld of 7%. Check their track records. It is an impressive growth in last 10 years.

This is an excellent point Bhushan and thanks for mentioning Balmer Lawrie – it probably didn’t figure on the original list due to its size – I think it’s less than a thousand crores worth market cap – please correct me if I’m wrong.

I think I’ll have to do another post with a smaller companies that have a decent track record of dividend payment and that will include companies like Balmer Lawrie.

Another company, manshu would be Smartlink ( the erstwhile D Link). It has been a regular dividend player and last year on sale of its entity it gave a div of 30 Rs on a CMP of 100. In addition, Sonata Software , Helios and Matheson IT have a great dividend history and yield. (Both of course less than a mcap of 1000 crores)

Thanks Harish – Let me take a look at those stocks and see if they have a long enough history to be added here.

Starbucks Corporation is another great American brand with over 16,500 stores in over 50 countries around the world. In the last 10 years, this stock has returned an annualized total return of 34% which is just phenomenal. In fact, had you bought this stock during the 2009 financial crisis, you could have possibly grown your net worth 5 fold. Starbucks yields a decent 1.41% dividend and grew its quarterly distribution from $0.15 per share on August 8th, 2011 to $0.17 per share on November 15th, 2011. The coffee powerhouse can once again increase its dividend this quarter as its dividend payout ratio stands at only 42%. Source: http://www.bestdividend-paying-stocks.com The company generated $1.6 billion in Cash from operating activities in 3rd quarter 2011 and buying back its own shares.

very good effort.

Texient.com provides free dividend alerts, you will get an email alert whenever a company(listed in NSE or BSE) declares dividend.